An investment strategy so simple it’s Einstein

Einstein looked for the simple rather than the complex. Applying the same attitude to investing has delivered significant outperformance at low cost.

"Everything should be made as simple as possible, but not simpler." Albert Einstein

The above quote is attributed to Albert Einstein but is probably paraphrased from a lecture he delivered at Oxford in 1933 on 'The Method of Theoretical Physics'. It's very similar to Occam's razor which is a principle stating that among competing hypotheses, the one which makes the fewest assumptions should be selected. Einstein however goes further and warns against too much simplification.

There is no portfolio investment strategy simpler than equal weight. Each stock in the portfolio is held in the same proportion. While simple in concept, in practice equal weighting requires ongoing monitoring and regular rebalancing to retain equal proportions among the components. This results in an inherent contrarian trading strategy, reduced concentration risk and true diversification across the portfolio.

More recently than Einstein, a number of academic studies, including one from Australia's own CSIRO, have concluded that equal weighting is the best performing index strategyi. Given Australia's highly concentrated market, with the top 10 stocks making up more than 50% of the total market capitalisation, it is surprising that there is only one equal weight fund available to investors in Australia. Since its inception this simple strategy has outperformed the market and almost all its more complex competitors at much lower fees.

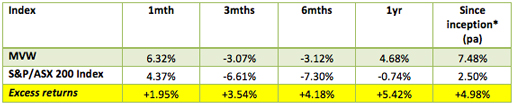

Since its inception on 4 March 2014, the Market Vectors Australian Equal Weight ETF (ASX: MVW) has outperformed the S&P/ASX 200 Accumulation Index by 4.98% pa, returning 7.48% pa to 31 October 2015.

Performance of MVW to 31 October 2015

*Inception Date is 4 March 2014

Source: Morningstar Direct, as at 31 October 2015. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and are net of management costs but do not include brokerage costs of investing in MVW. The above performance information is not a reliable indicator of current or future performance of MVW, which may be lower or higher.

MVW has also demonstrated strong performance compared to its peers. The above performance consistently places MVW in the top 10% of all the funds in Morningstar's Australian equity manager universe.

MVW has been designed per Einstein's maxim not to be simpler than possible. MVW does not equally weight every stock in the Australian market, rather the index MVW tracks is designed to overcome liquidity issues that plague the smaller stocks in the Australian market by applying liquidity and size filters. MVW currently contains only the 72 largest and most liquid stocks on the ASX.

MVW's performance confirms Einstein's approach can also be applied to investing – that keeping it as simple as possible, but not simpler, can deliver outperformance.

Reignite your Australian equity portfolio with MVW, a transparent, low cost, liquid portfolio designed to outperform the S&P/ASX 200 Index.

For more information on MVW click here or call us on 02 8038 3300

IMPORTANT NOTICE: This information is issued by Market Vectors Investments Limited ABN 22 146 596 116 AFSL 416755 as responsible entity ('MVIL') of the Market Vectors Australian Equal Weight ETF ('Fund'). MVIL is a wholly owned subsidiary of Van Eck Associates Corporation based in New York, United States ('Van Eck Global').

This is general information only and not financial advice. It is intended for use by financial services professionals only. It does not take into account any person's individual objectives, financial situation nor needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.marketvectors.com.au or by calling 1300 MV ETFs (1300 68 3837).

The Fund is subject to investment risk, including possible delays in repayment and loss of capital invested. Past performance is not a reliable indicator of current or future performance. No member of the Van Eck Global group of companies guarantees the repayment of capital, the performance, or any particular rate of return from the Fund.

Market Vectors® and Van Eck® are registered trademarks of Van Eck Global.

© 2015 Van Eck Global. All rights reserved.

iCSIRO and Monash Superannuation Research Cluster support equal weighting here

London University's Cass Business school's findings are here

EDHEC Risk Institute findings are here

These all support our own research here

Published: 09 August 2018