The opportunity to beat beta better

We think the Australian equity market is littered with inefficiencies to exploit, and the next evolution in technology and data science is here to help investors access these opportunities.

Shifting global growth expectations, geopolitical tensions and the evolving interest-rate environment are impacting equity markets and this volatility is expected to persist into 2025. Closer to home, style rotations and valuation gaps are presenting short-term opportunities in the Australian market - but adaptability is key.

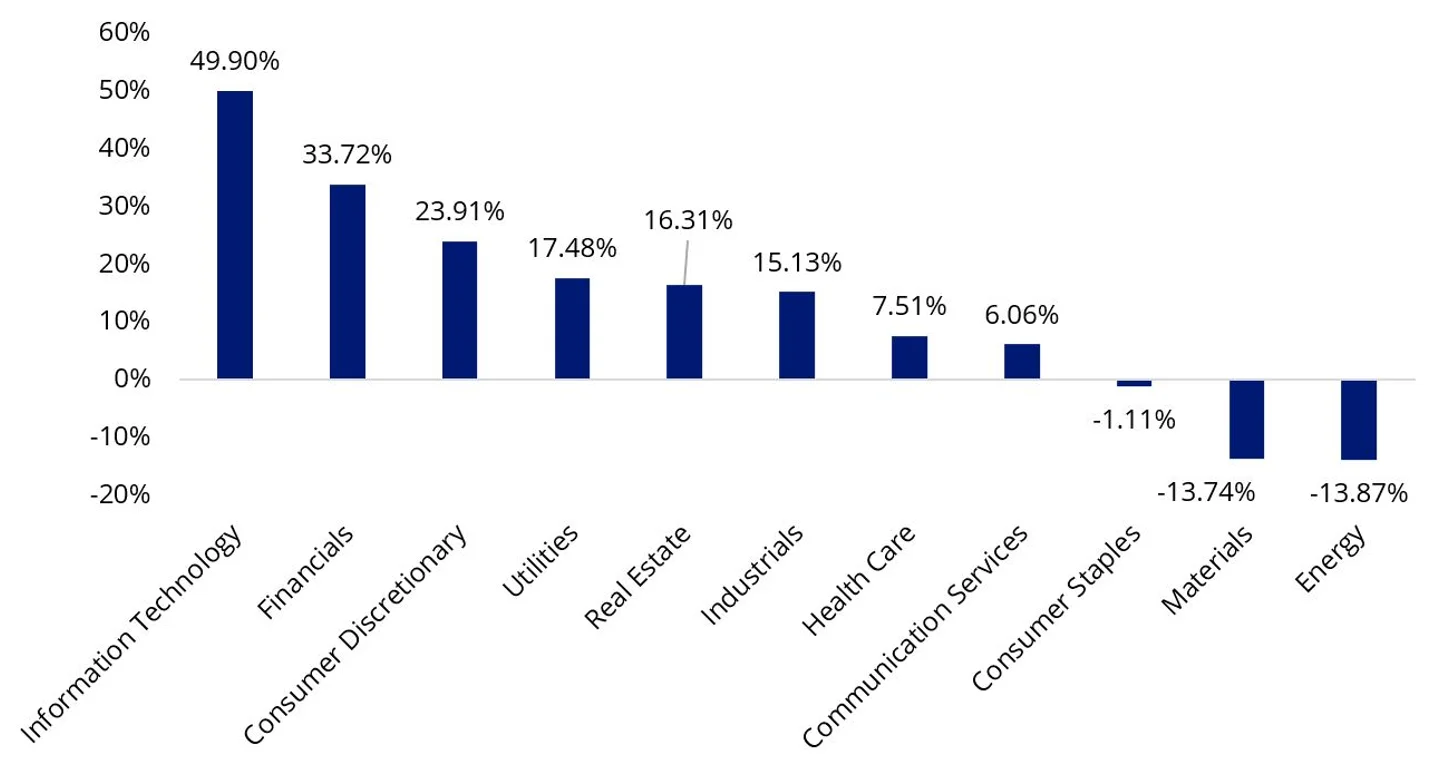

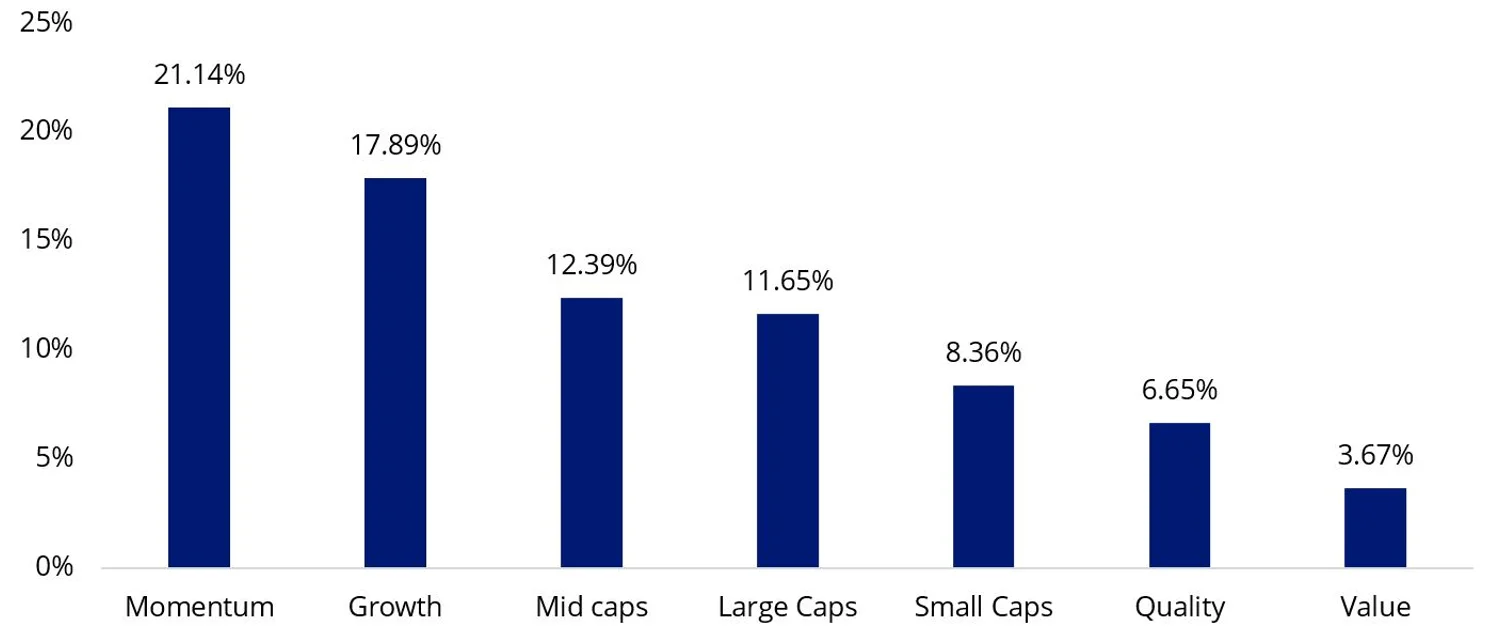

The S&P/ASX 200 Index posted an 11.4% return in 2024, but it was far from a smooth ride. Financials, particularly the big banks and information technology soared, in what was a momentum and growth environment. At the same time, China’s economic woes weighed on resource miners and large caps outperformed smaller sized companies.

Chart 1: S&P/ASX 200 – 2024 GICS Sector performance

Chart 2: Australia size and style performance

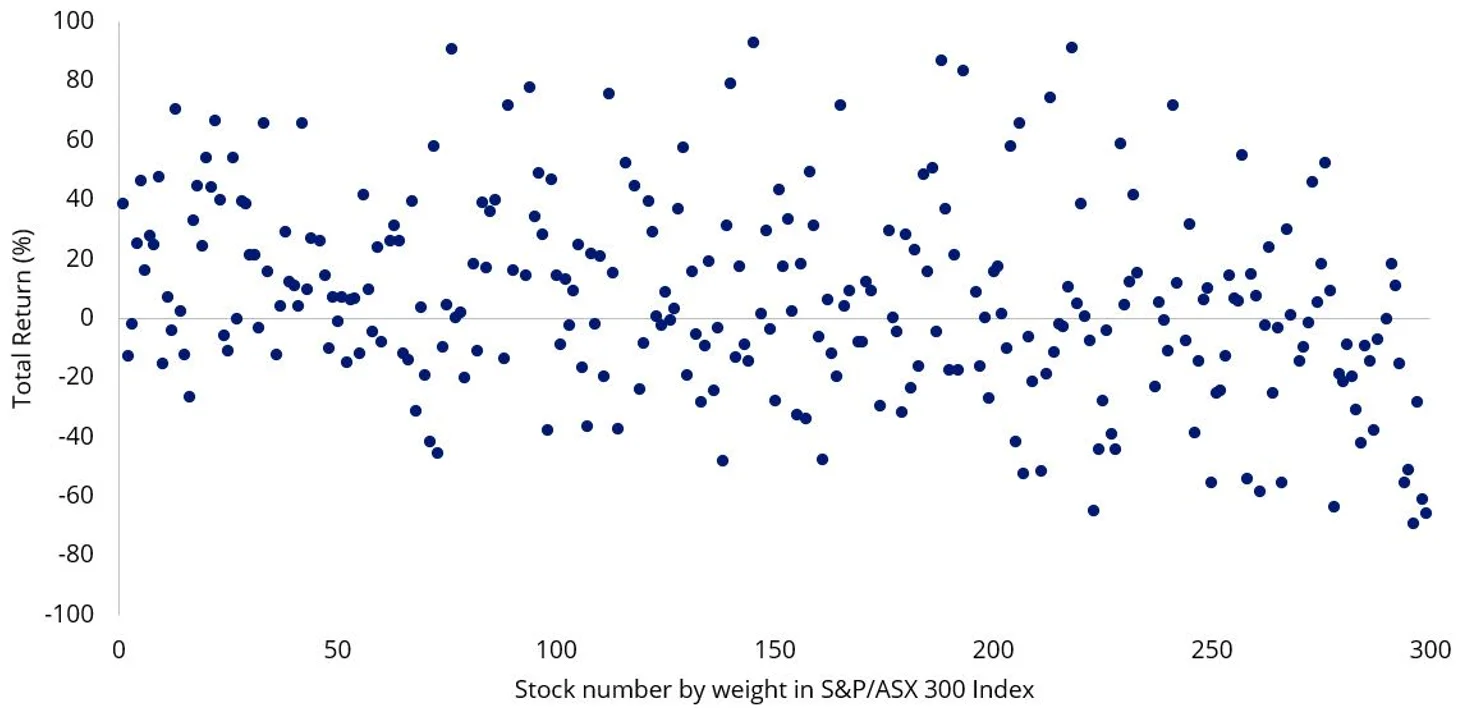

As there was a wide dispersion of returns across the market it was optimal for taking long and short positions, as there were many companies that experienced share price falls (optimal for short positions) and there were many companies that experienced strong gains (ideal for long positions).

Chart 3: S&P/ASX 300 Index - 2024 Stock Returns

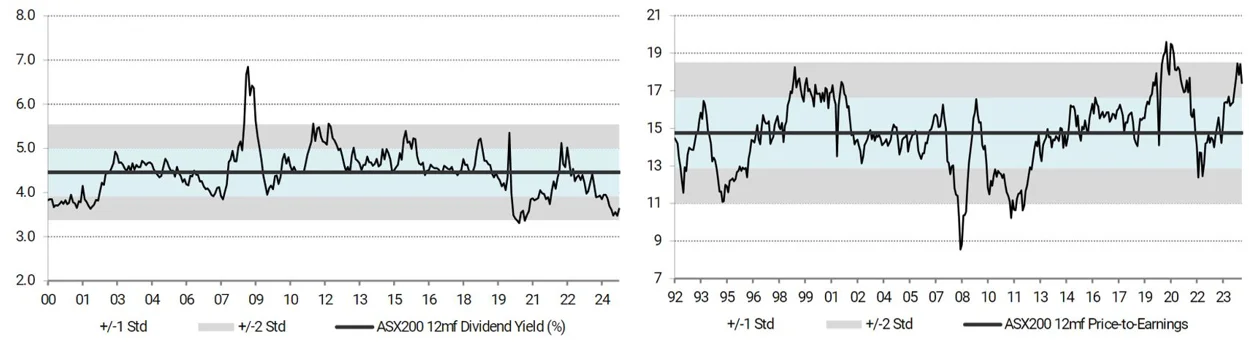

At a broad level, Australian equities look expensive. 12-month forward earnings are +1 standard deviations above average, while the dividend yield is at a 5-year low. This highlights the importance of being selective.

Chart 4 & Chart 5: S&P/ASX 200 12-month forward price to earnings and S&P/ASX 200 Dividend yield

Agile positioning is vital to help navigate 2025

We think the Australian equity market is littered with inefficiencies to exploit because it is hyper-concentrated, over-crowded and lacks persistent ‘factor’ dominance.

With style, sector and size leadership proven to be idiosyncratic, we think this presents an opportunity to exploit the market’s inefficiencies. The recently launched VanEck Australian Long Short Complex ETF (ASX: ALFA) is an actively managed, high-conviction, unconstrained Australian equity portfolio that targets long and short positions which we believe is an ideal consideration in such an environment.

The strategy is systematic and deeply quantitative, analysing over 12,000 potential strategies at any given time, and assessing their efficacy and statistical significance in achieving excess returns. VanEck has a distinguished history of harnessing technological advancement and advanced analysis to identify and unlock opportunities for Australian investors. For over a decade we have pioneered smart beta ETF strategies in Australia, with a vast number of our smart beta ETFs being the first of their kind on the ASX, offering investors the ability to construct portfolios with a targeted outcome in mind.

Using ALFA in a portfolio

We think ALFA complements core exposures such as broad large cap active funds and passive Australian Equity ETFs including smart beta, like our own, VanEck Australian Equal Weight ETF (MVW). Satellite exposures are typically concentrated by sector or by stock and allow investors to tilt their portfolio to access broader opportunities. It is a useful diversification tool.

The advantage that a long short satellite exposure has is that there may be times its returns are not correlated to the broader market it has exposure to. This may be due to its short positions, which will increase in value should the broad equity market fall, and vice versa.

Because ALFA is unconstrained and actively managed, it can sit alongside other satellite positions such as small companies portfolios or direct holdings in favoured mega-caps, with little or no cross-over.

ALFA is designed to be a satellite Australian equities portfolio construction solution that can be deployed as an all-weather equities strategy that aims to outperform across market/economic cycles and style regimes.

Key risks: An investment in the Fund carries risk. The Fund is considered to have a higher investment risk than a comparable fund that does not engage in short selling and leverage. Investors should actively monitor their investment as frequently as daily to ensure it continues to meet their investment objectives. Risks associated with an investment in the fund include those associated with short selling risk, leverage risk, prime broker risk, counterparties risk, concentration risk, operational risk and material portfolio information risk. See the VanEck Australian Long Short Complex ETF PDS and TMD for more details.

Published: 06 February 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.