Why we favour mid-caps, gold miners and consumer discretionary sectors

We’ve entered the final week of Australia’s earnings season. In aggregate, beats have marginally outpaced misses (4:3). The biggest news so far has come from quarterly updates by NAB and Westpac, both of which missed estimates and revealed mounting margin pressure, triggering a significant sell-off across the big banks.

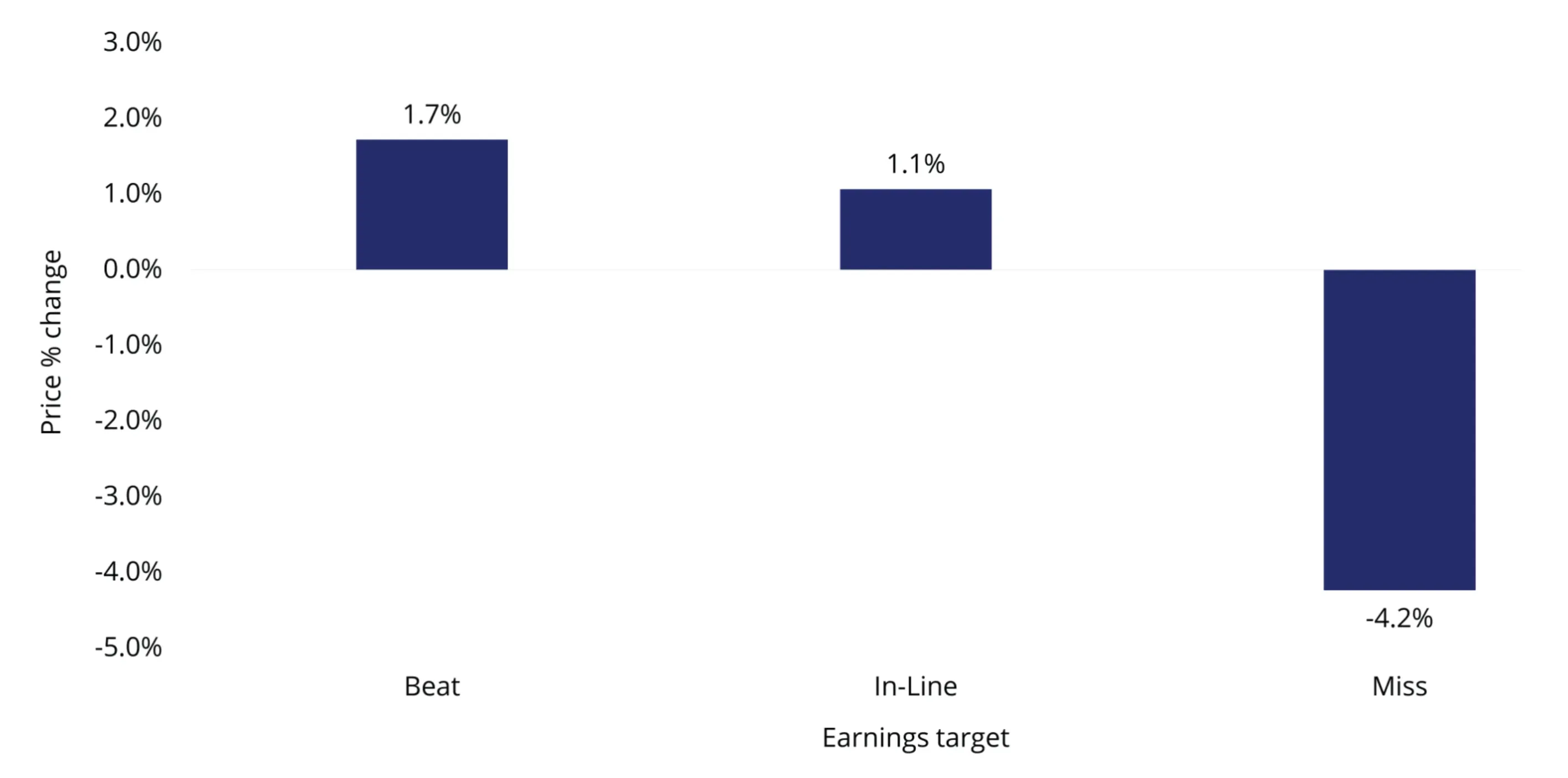

Market reaction to earnings releases highlighted the increased focus on the sustainability of earnings amid elevated valuations. Companies that missed earnings expectations experienced substantial price declines, while those that beat expectations saw only moderate price increases. This suggests that the Australian equity market is shifting into a phase of selective excellence, where performance will be increasingly determined by earnings growth.

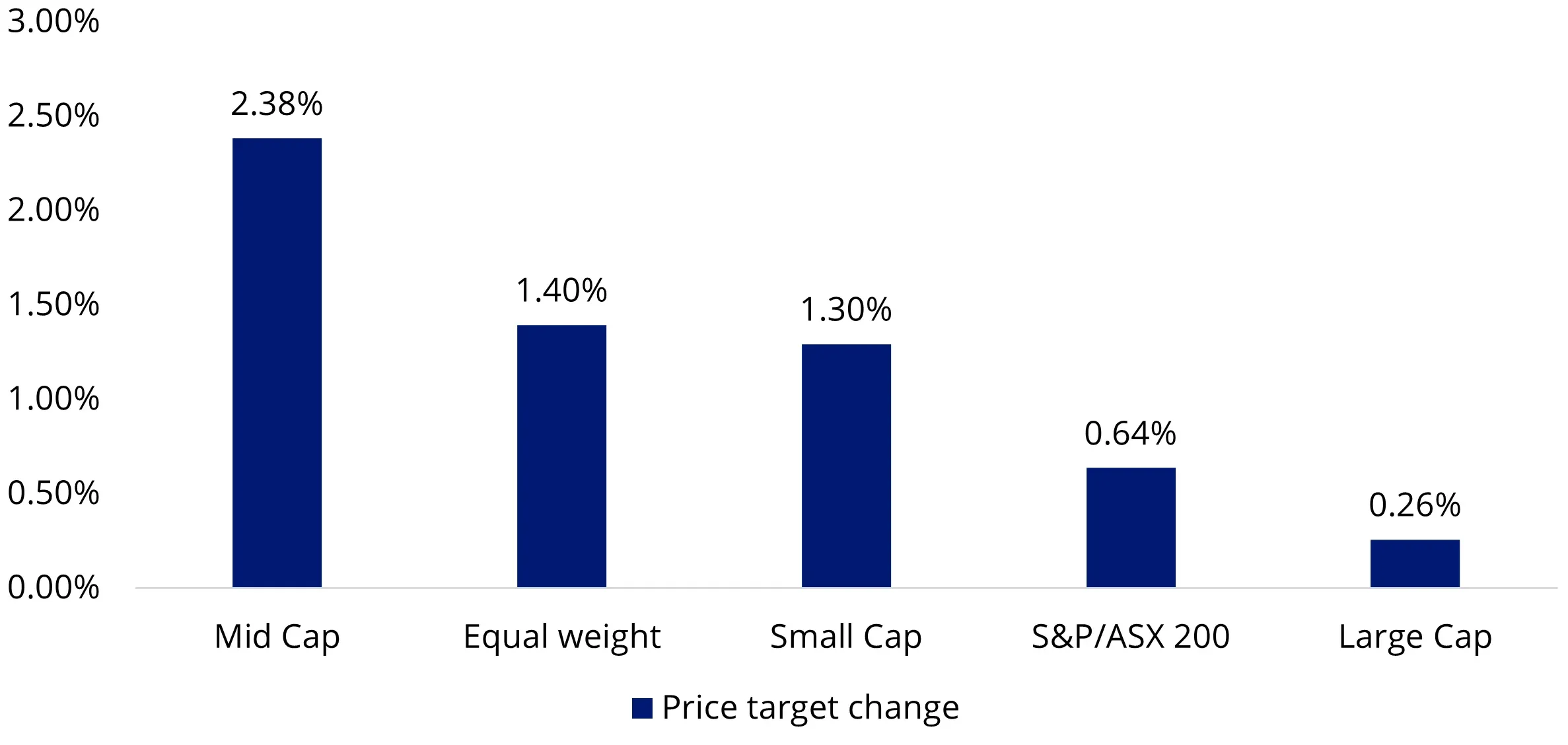

Chart 1: Average one day price reaction post earnings release

Source: Bloomberg. Data as at 20 February 2025.

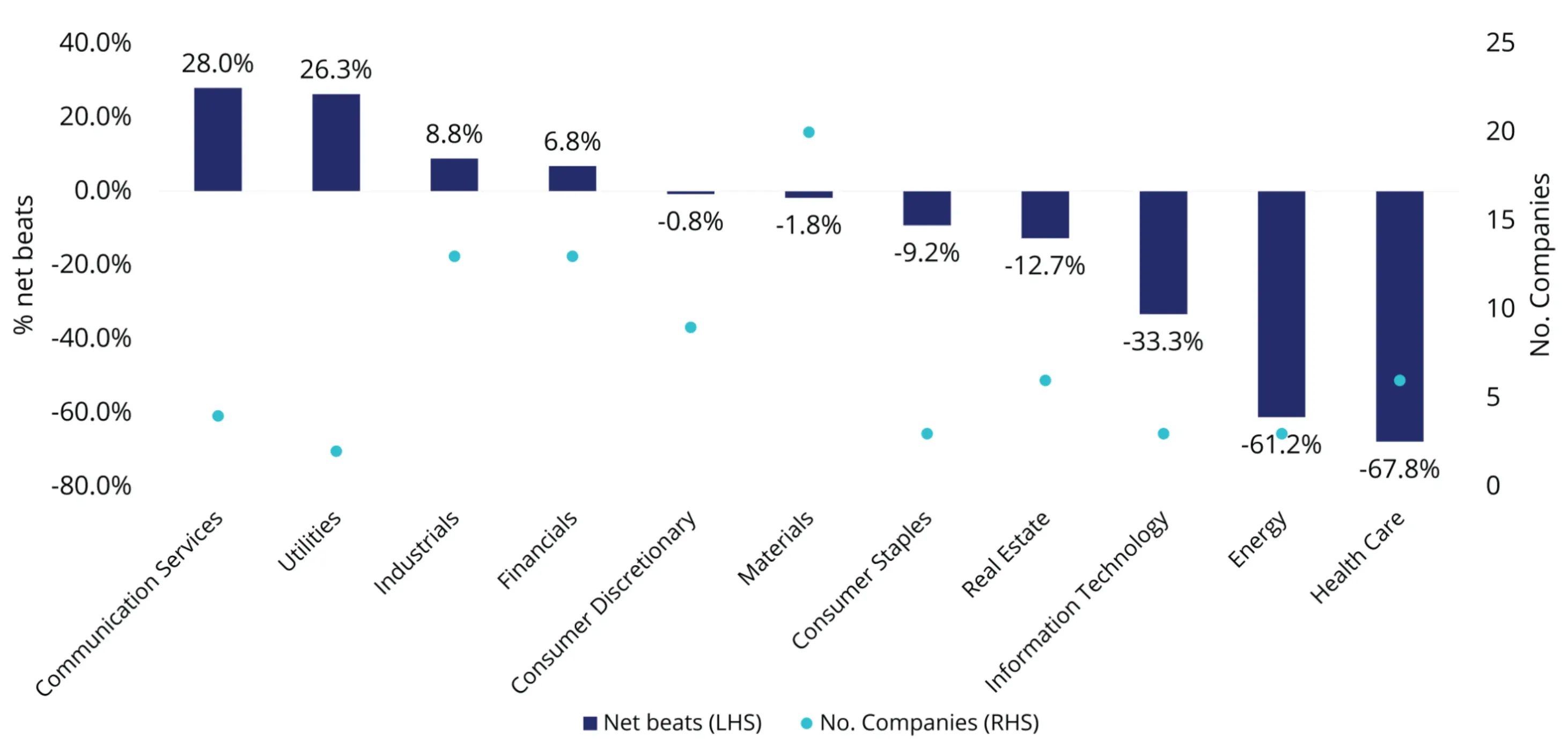

From a sector perspective, communication services and industrials reported the strongest net beats, while healthcare and information technology reported the most misses.

Chart 2: Net beats by sector

Source: Bloomberg. Data as at 20 February 2025.

Looking ahead, we are optimistic about the prospects of Australia’s mid-caps, select consumer discretionary names and gold miners, and we believe an underweight position in banks is prudent.

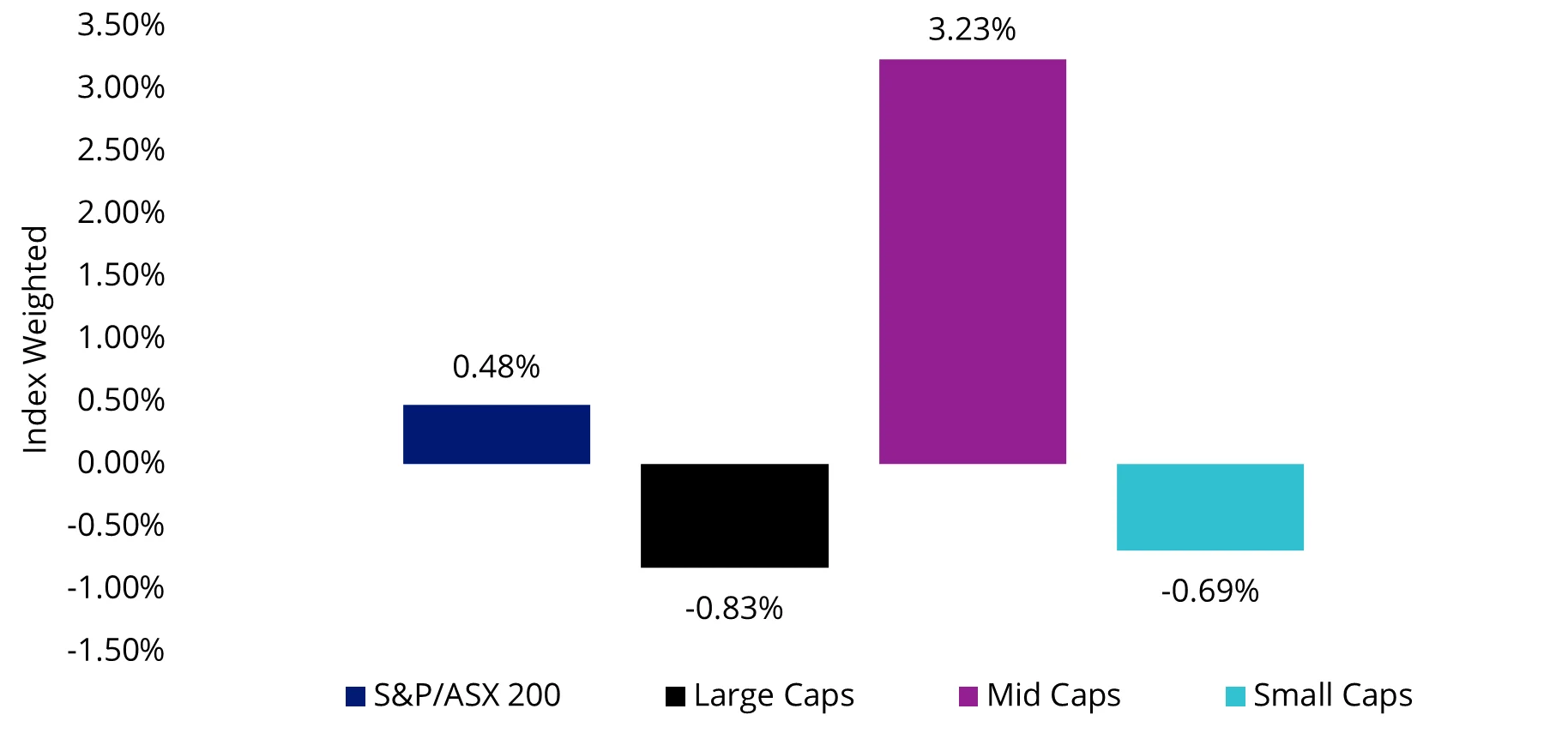

Australian mid-caps continue to lead broader market

Australian mid-caps were the standout in this reporting season, outperforming their large and small cap peers. We observed solid market share gains and the highest upside price target revisions in this part of the equity market. Historically, mid-caps have outperformed prolonged market rallies, and with valuations still attractive and 12-month forward price-to-earnings near their historical average, they continue to offer compelling upside potential.

We like mid-cap industrials SGH Ltd (ASX: SGH), up 9% post-earnings on Boral’s strength, and ALS Ltd (ASX: ALQ), up 34% on strategic acquisitions and solid fundamentals. A2 Milk Co Ltd (ASX: A2M) also remains attractive, benefiting from margin gains and strong China sales outlook.

Chart 3: 12-month consensus price target return

Source: VanEck, Bloomberg. Data as at 20 February 2025. Mid Cap is represented by S&P/ASX Mid Cap 50 Index, Equal weight as MVIS Australia Equal Weight Index, Small Cap as S&P/ASX Small Ordinaries Index, Large Cap as S&P/ASX 20 Index. You cannot invest in an index.

Chart 4: Market-weighted EPS surprise

Source: Bloomberg. Data as at 20 February 2025. Large Cap is represented by S&P/ASX 20 Index, Mid Caps as S&P/ASX Mid Cap 50 Index, Small Caps as S&P/ASX Small Ordinaries Index, You cannot invest in an index.

Reality check in the banking sector kicks off

Australia’s banks are finally facing reality after an extraordinary run. Disappointing results from NAB and Westpac last week preceded a $26 billion selloff across the big banks. Smaller lenders, including Bendigo & Adelaide Bank, also flagged concerns, while ANZ reported rising impaired assets from mortgage restructures.

Despite last year’s dominance - banks drove 70% of the S&P/ASX 200’s total return - the sector now faces headwinds. The RBA’s rate cut is expected to further compress bank margins, as well as add fuel to an escalating mortgage price war. Valuations remain stretched, making the sector vulnerable to further downside. We think investors should avoid over-concentration in banks, and instead opt for a more diversified, equal-weighted strategy for their Australian equity portfolio.

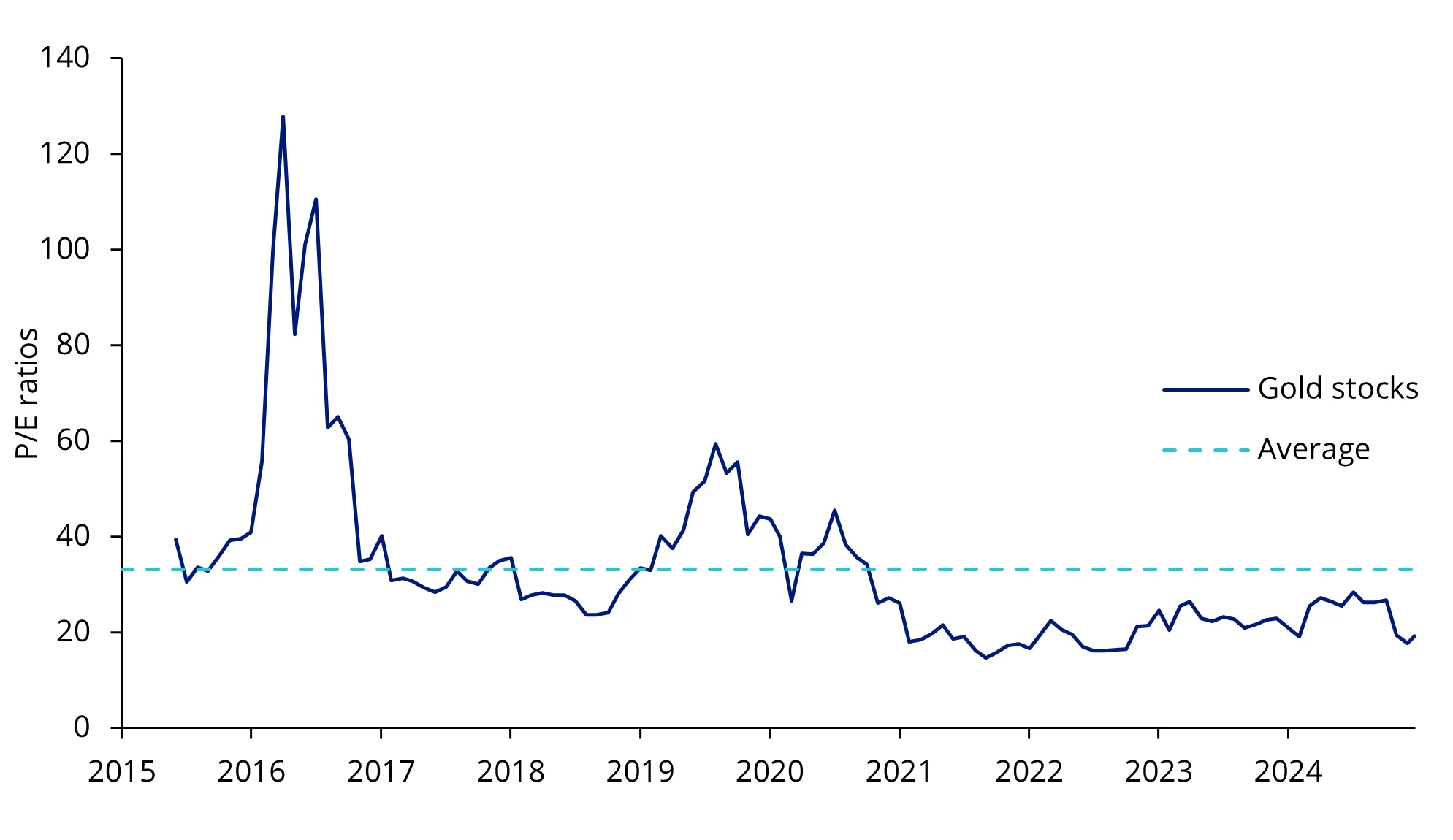

Sector highlight: gold miners

Australia’s gold miners, Evolution Mining (ASX: EVN), Northern Star Resources (ASX: NST), and Newmont Corporation (ASX: NEM), reported record profits. This has been fuelled by a surge in gold prices over the last year – driven by robust central bank demand, heightened geopolitical tensions and a global easing cycle – and moderation in all-in sustaining cost increases.

Gold miners are still trading at a discount to gold bullion, and with attractive fundamentals and continued geopolitical tensions (likely to stay elevated due to tariff threats), we see further potential upside for gold and gold miners.

Chart 5: Gold miners are set to close the gap with spot gold

Source: Bloomberg. Performance data is in USD. Gold stocks/gold miners is the NYSE Arca Gold Miners NTR Index. Index performance is not illustrative of fund performance. You cannot invest in an index. Past performance is not indicative of future results.

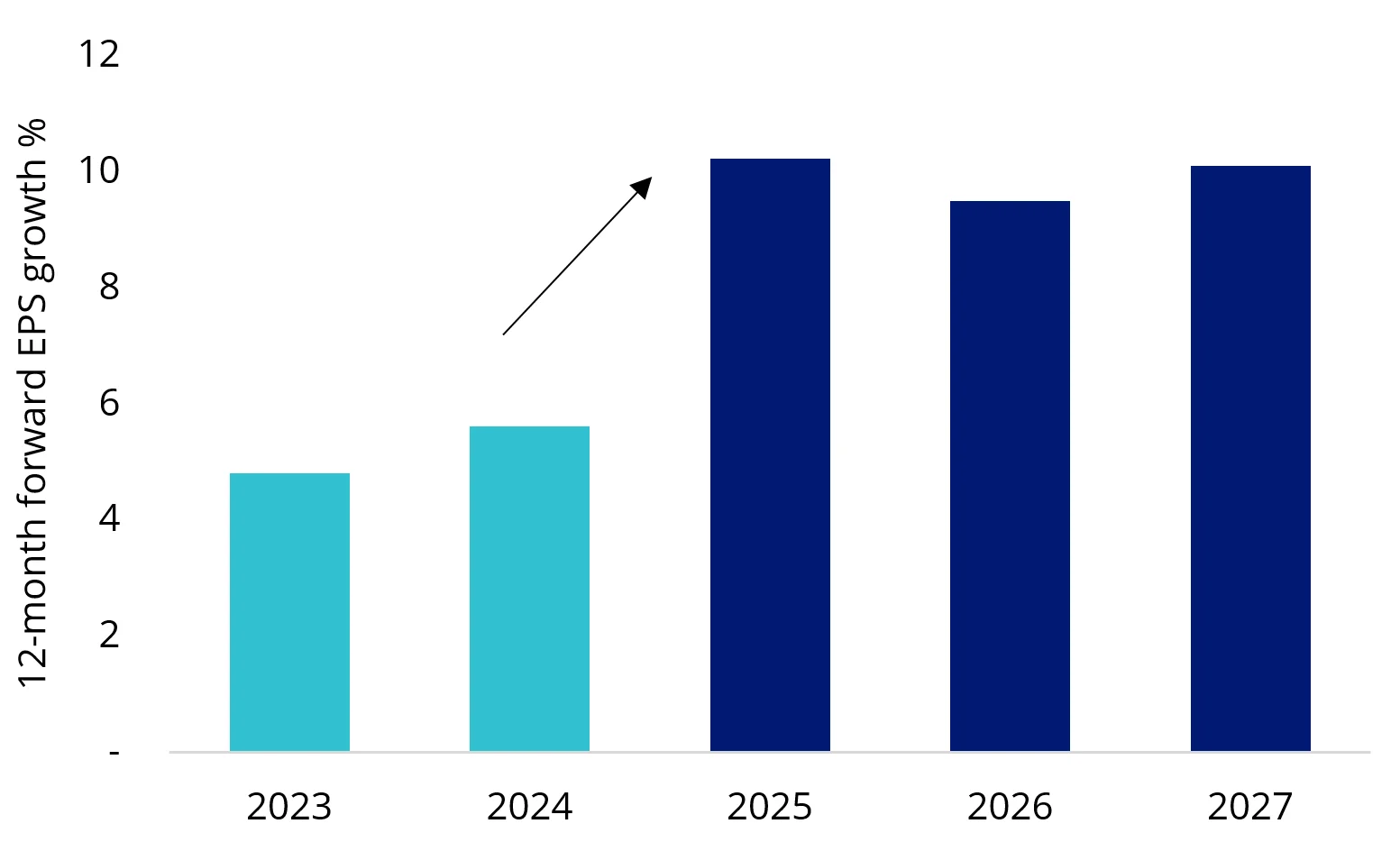

Sector highlight: Consumer discretionary

Consumer discretionary results were mixed amid persistent cost-of-living pressures. We see opportunities in select companies with upgraded earnings guidance and improving sentiment, as these are indicative of attractive entry points.

Cooling inflation, resilient employment, and stabilising economic growth reinforce our positive long-term outlook. Bloomberg’s earnings forecasts indicate a sector-wide EPS uplift from 5.6% to an average ~10% annual growth rate from 2025 to 2027, driven by improving consumer confidence and a gradual recovery in discretionary spending.

Chart 6: Consumer discretionary companies EPS growth uplift

Source: Bloomberg. The S&P/ASX 200 Consumer Discretionary Index used as a proxy for the sector. Data as at 20 February 2025. You cannot invest in an index. Past performance is not indicative of future results.

In the current environment, we favour industry leaders with diversified revenue streams, as this provides resilience against headline shocks such as US tariffs, supply chain disruptions, and shifting consumer trends. Wesfarmers (ASX: WES) posted a 3.6% revenue increase, driven by Bunnings and Kmart’s resilience, while its chemicals, energy and fertilisers subsidiary WesCEF’s achieved sales growth of 9.5% providing a stable earnings base and balancing discretionary weakness.

Entertainment retailer JB Hi-Fi Ltd (ASX: JBH) posted a 9.8% sales increase, fuelled by strong demand for mobile phones and small appliances. Its disciplined cost management and strong brand positioning continue to support profitability and defend market share, outperforming peers facing margin pressure. Additionally, Corporate Travel Management (ASX: CTD) has rebounded notably, benefiting from increased corporate travel budgets and strong leisure demand as international mobility normalises.

Final thoughts

As we move through 2025, selectivity remains crucial in a volatile environment. Investors should focus on fundamentals and avoid over-concentration in expensive market segments, particularly large banks. Instead, a balanced approach - diversifying across sectors with structural growth and seeking under-valued opportunities - offers the best path forward. A mix of capital appreciation and income-generating investments will be key as the market dust settles.

For exposure to Australian mid-caps, explore the VanEck S&P/ASX MidCap ETF: (ASX: MVE).

Key risks

An investment in our mid-caps ETF carries risks associated with: financial markets generally, individual company management, industry sectors, fund operations and tracking an index. See the VanEck S&P/ASX MidCap ETF PDS and TMD for more details.

Published: 25 February 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

The S&P/ASX MidCap Index (the Index”) is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and ASX Limited (“ASX”) and licensed for use by VanEck. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed by VanEck. The Fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or ASX and none of them makes any representation regarding the advisability of investing in the Fund. Such parties do not accept liability for any errors, omissions, or interruptions of the Index and do not give any assurance that the Fund will accurately track the performance of the index or provide positive investment returns. Inclusion of a security within the index or Fund is not a recommendation by any party to buy, sell, or hold such security.