Regulatory changes support carbon run in October

Regulatory changes have led to a positive run for carbon markets in October 2024 and are likely to be supportive of prices for the next few years.

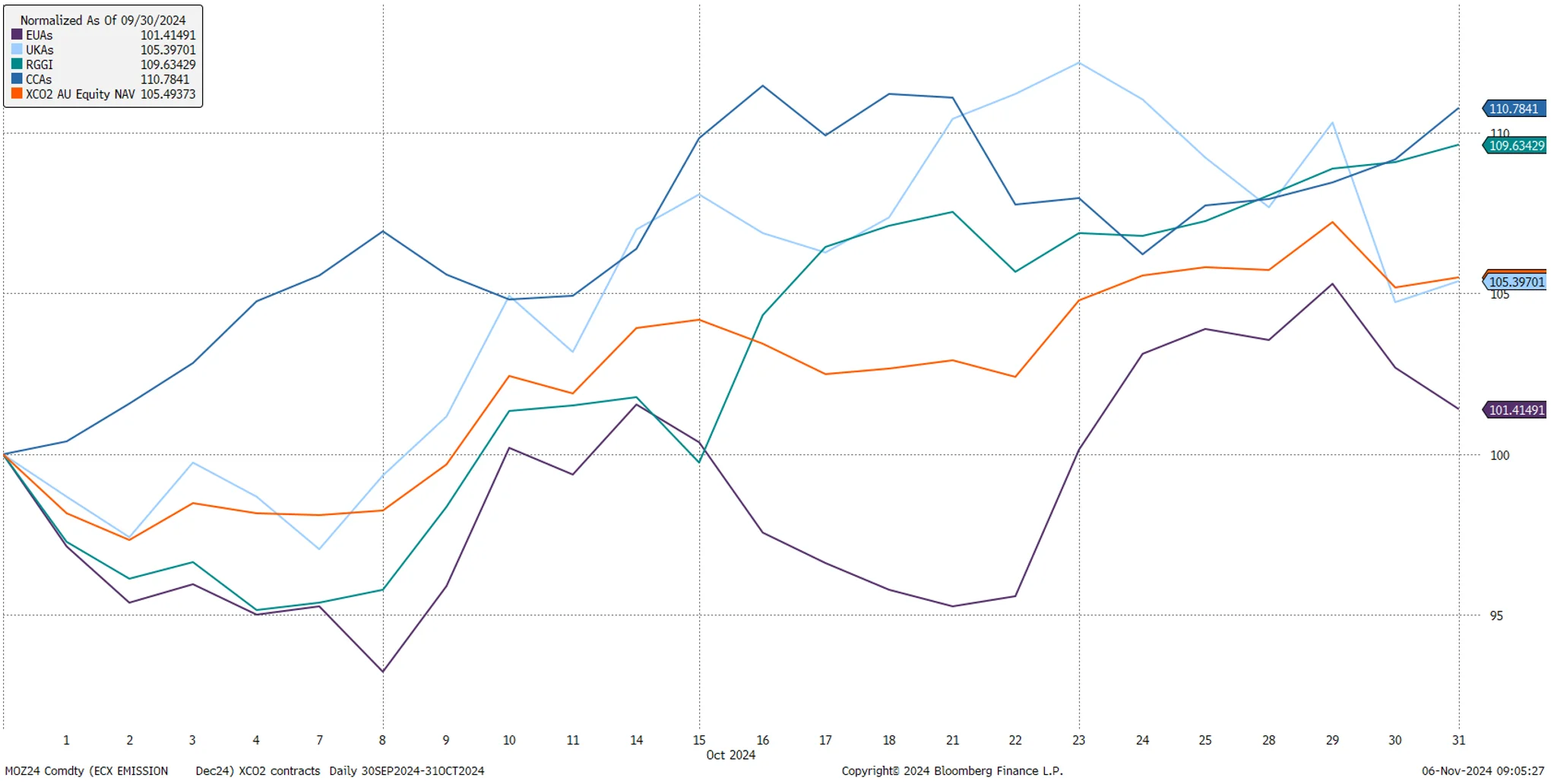

The compliance carbon markets had a positive run in October, propelled by the currency strength of AUD.

VanEck Global Carbon Credits ETF (Synthetic) (XCO2) returned +5.49% for the month of October 2024.

Chart 1: Carbon prices in October 2024 (AUD)

Source: Bloomberg as at 31 October 2024. Abbreviations used: XCO2 = VanEck Global Carbon Credits ETF (Synthetic); RGGI = Regional Greenhouse Gas Initiative; CCA = California Carbon Allowance.

Out of the four regions, California’s CCA Dec 24 contracts saw the largest gains with over 10% in AUD terms. This came off the back of the Scheme’s latest announcement reaffirming the state’s climate determination.

The regulator, California Air Resources Board (CARB), in alliance with Québec, which operate a linked cap-and-trade carbon allowance system, announced the upcoming amendments with a formal proposal for public comment in due course. Since June 2023, several rounds of California-Québec workshops have been held for stakeholder discussions and feedback gathering. The amendments will undergo a thorough rulemaking process, including economic and environmental analysis, and public engagement.

The proposed amendments include:

- Removal of at least 180 million allowances from 2026-2030 and up to 265 million from 2026-2045 to meet updated climate goals.

- A one-time price increase in cost-containment to align with federal carbon cost assessments.

- Updates to corporate association triggers to prevent market manipulation.

- Revisions to offset protocols based on new science.

- Adjustments to allowance allocations for utilities and certain industries.

In July earlier this year, CARB already announced two alternative cap trajectories out to 2045 to achieve carbon neutrality – the long term supply of allowances must reduce significantly in either path.

UK ETS trading has also seen an uptick, with the Dec 24 futures crossing over £40/Mt on 23 October, before trending back down to £37.89/Mt to finish the month. As part of the UK’s Autumn Budget 2024 that took place on 30 October, it was confirmed the UK carbon border adjustment mechanism (CBAM) would be introduced on 1 January 2027.

This mechanism will put an additional carbon price on imported goods sold in the UK across sectors such as aluminium, cement, fertiliser, hydrogen, iron and steel that are at risk of ‘carbon leakage’, which is when manufacturers move capacity from one jurisdiction to another due to different carbon price levels. As opposed to previous announcements, the glass and ceramics sectors will not be in scope of the UK CBAM from 2027, however BloombergNEF estimates the two sectors would account for less than £13 million of tax revenue, out of the total £670 million of revenue each year if free allowance allocation is to be phased out in the future.

Echoing the decarbonisation efforts in Europe, this mechanism can result in a true reduction in global emissions rather than simply displacing carbon emissions overseas.

Key risks

An investment in VanEck Global Carbon Credits ETF (Synthetic) carries risks associated with: ASX trading time differences, market risk, concentration risk, futures strategy risk, cap and trade risk, currency risk, political, regulatory and tax risks, fund operations and tracking an index. See the VanEck Global Carbon Credits ETF (Synthetic) PDS and TMD for more details.

Published: 11 November 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.