RGGI and EUAs energising the carbon market rally

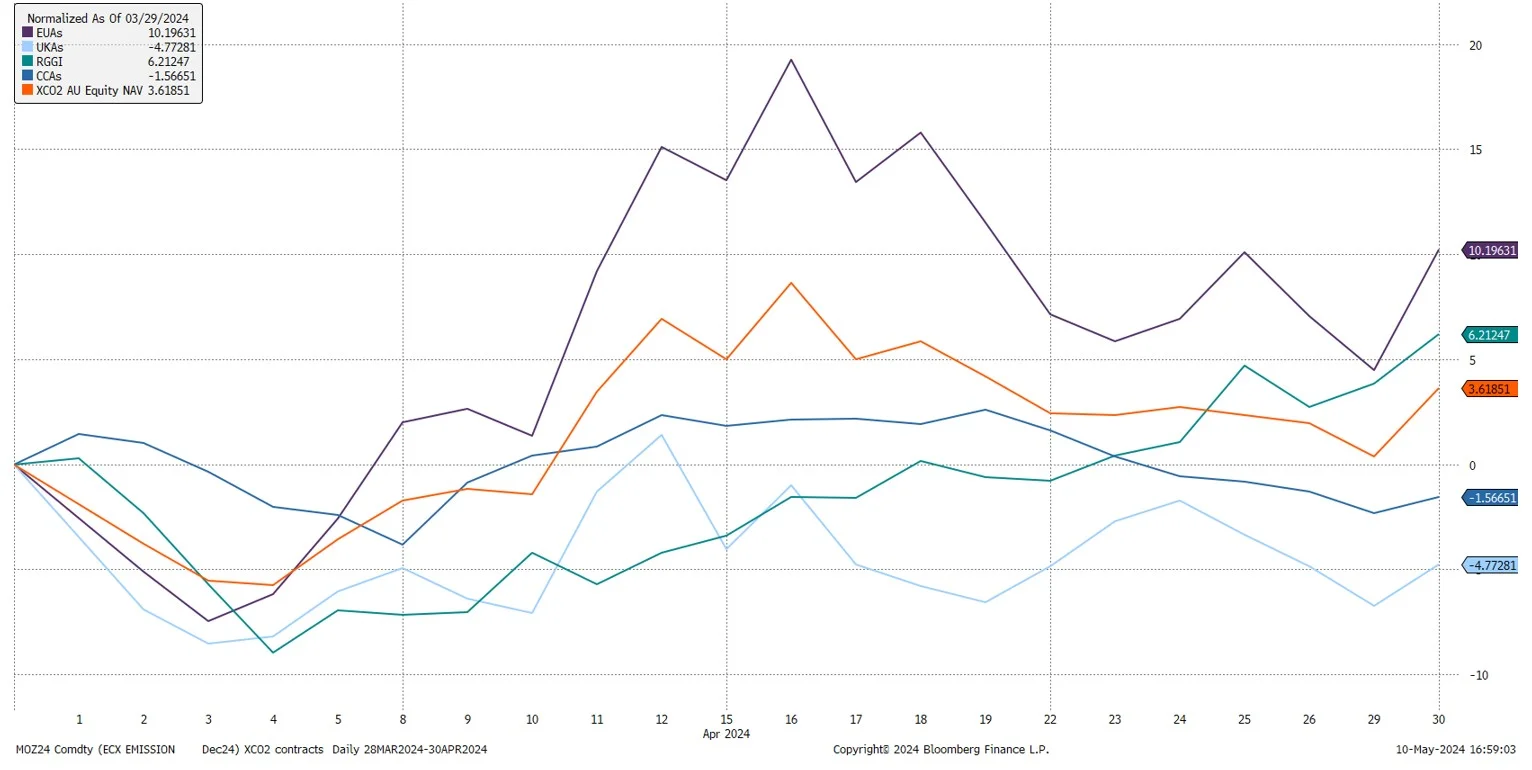

Compliance carbon markets enjoyed further uplift in April overall. RGGI futures hit new highs, marking the fourth straight month of gains, while EUAs returned to €70 on revived activity in the Eurozone.

Regional Greenhouse Gas Initiative

The Regional Greenhouse Gas Initiative (RGGI) – the compliance carbon credits program by the eastern states in the US – continued making strides in sending the right cost signal for decarbonisation. The December 2024 futures price hit a record high again in April at $21.67 per short ton (+6.2% in April in AUD), making it the fourth consecutive month of gain. Carbon Pulse reported a significant 9.1% year-on-year growth in Q1 2024 emissions across almost all RGGI member states, likely motivating polluters to hedge and/or acquire more carbon allowance down the line this year.

California Cap-and-Trade Program

The California Air Resources Board (CARB) which is in charge of the California Carbon Allowance (CCA) program, held a workshop on 10 April concerning the Low Carbon Fuel Standard (LCFS), a key part of programs in the State to cut greenhouse gas emissions and other air pollutants by improving fuel-efficiency technology in vehicles. The results though were somewhat disappointing with the regulator’s proposed 30% carbon intensity reduction target for 2030, while some participants believed more stringent targets were achievable.

European Union Emission Trading System

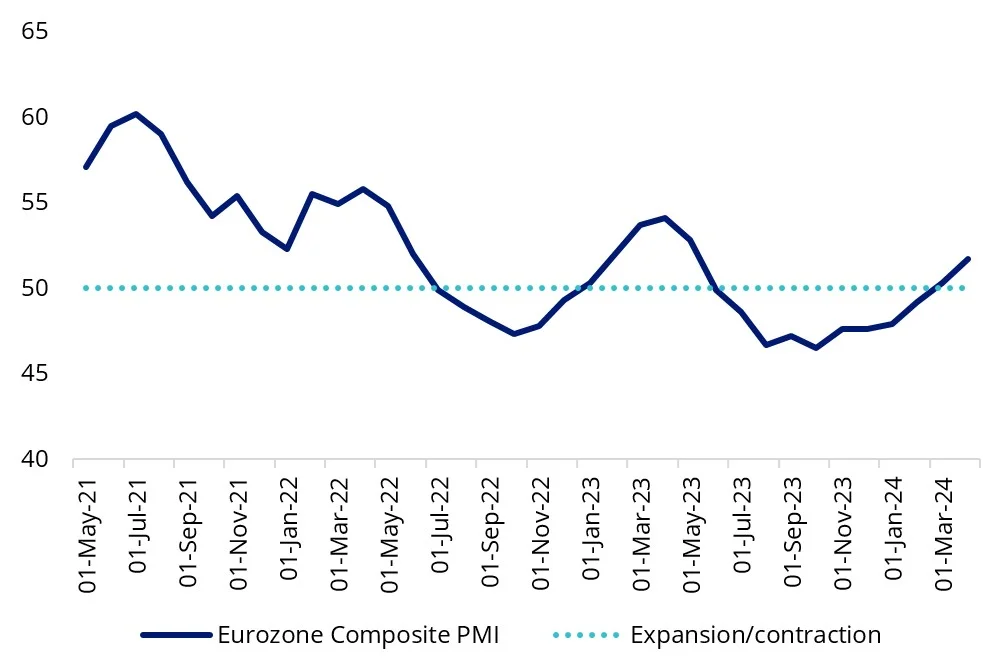

Over in Europe, EUAs’ December 2024 futures returned to €70/MtCO2 mid-month, a level that has not been reached since early January this year. One reason to explain the positive momentum is the recovery of macroeconomic conditions in the Eurozone. The Composite PMI has been in the expansionary territory for two months in a row.

Chart 1: Eurozone Composite PMI in growth mode

Source: Bloomberg as at 30 April 2024

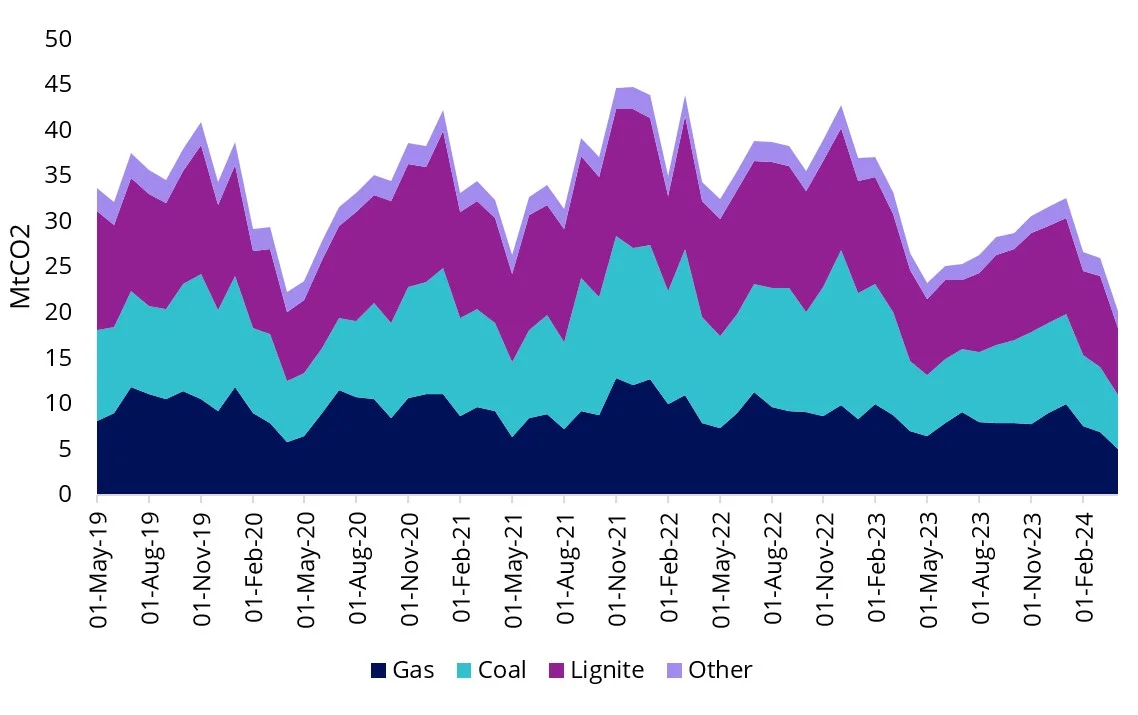

A near-term bearish factor is the reduction of power emissions across various fuel types in the bloc due to increased renewables capacity. As a result, the power sector would have reduced demand for carbon credits and excess allowances in turn would be sold back to the market. However, the EUA’s market stability reserve (MSR) is able to remove excess supply from the market to ensure volatility is reasonably managed if needed.

Chart 2: Europe's power emissions mix

Source: BloombergNEF as at 10 May 2024.

Performance update

VanEck Global Carbon Credits ETF (Synthetic) (ASX: XCO2) returned +3.62% for the month of April 2024.

Chart 3: XCO2 performance in AUD

Source: Bloomberg as at 30 April 2024

Published: 14 May 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.