China at a crossroads following six-month economic roller coaster

Expectations of a sustained recovery were rife after Chinese equities experienced a three-month-rally to the end of April as the strongest performing asset class after gold. Alas, May and June saw the CSI 300 index consolidate. What happened, and what is the outlook for the year ahead?

2024 has seen the trajectory of Chinese equities marked by notable highs and lows, reflecting a volatile yet buoyant market grappling with various economic and geopolitical challenges.

At the end of January, Chinese equities navigated a tumultuous path, initially plunging to a five-year low for the onshore benchmark CSI 300 Index. The downturn prompted swift action from the central government, which deployed approximately 200 billion RMB to bolster sentiment through broad-based index tracking ETF purchases. Subsequently, Chinese stocks emerged as one of the strongest performing asset classes until the end of April.

The consolidation we are now seeing could be attributed to: 1) soft patches in the economy, as shown in the activity data; 2) uncertainties surrounding property funding support; and 3) geopolitical and trade tensions with the US and Europe.

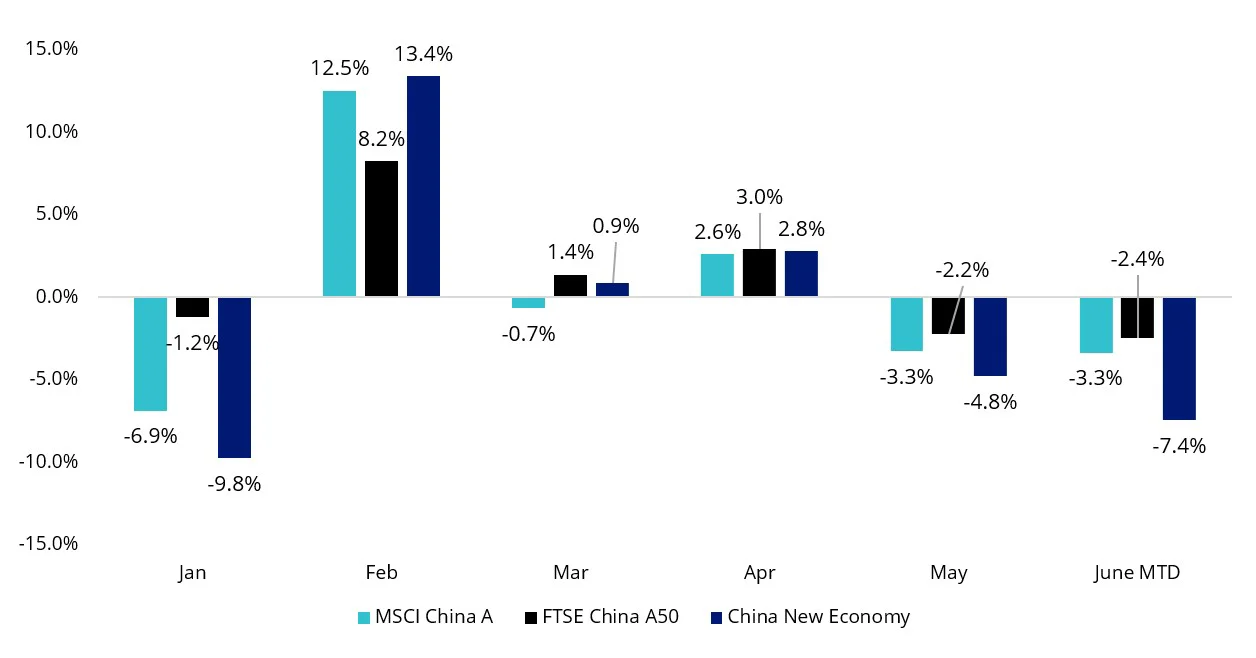

Chart 1: Chinese equity index returns

Source: Bloomberg as at 24 June 2024. MSCI China A is MSCI China A Onshore Net Total Return Index USD. FTSE China A50 is FTSE China A50 Net Tax AUD Index. China New Economy is MarketGrader China New Economy Net Return AUD Index. Past performance is not indicative of future results. Index performance not illustrative of fund performance.

The housing sector continues to be key to China's economic recovery strategy, where ongoing efforts to alleviate inventory surpluses ("destocking") are expected to have substantial influence over market sentiment and commodity prices. The policy support measures introduced in May were wide-ranging, including removing mortgage rate floors and easing down payment ratios, and were well received by the market with cautious optimism. However, some analysts were expecting a more sizable funding package closer to 1 trillion RMB, rather than 300 billion announced by People’s Bank of China (PBoC).

The counterargument to analysts’ pessimism is that it’s too soon to tell. The measures rolled out in May could just be stage one of a multi-year plan to rescue China’s real estate crisis. We are monitoring the next key policy events, including the Third Plenum (early/mid-July) and the quarterly Politburo meeting in late July, to determine whether further government stimulus is on the horizon.

Looking at China’s broader economic landscape, recent economic indicators paint a mixed picture. Despite increased domestic travel activities in the recent national holidays, consumer confidence has fluctuated within a modest range of 80 to 90 since April 2022, reflecting restrained household spending.

Meanwhile, China Purchasing Managers Index (PMI) figures showed a decline in May, which can be attributed to seasonal factors. More importantly, improved producer and purchasing prices indicate deflationary pressure have eased.

Against the backdrop of escalating trade tensions with the US, China faces critical decisions ahead. Recent tariff hikes by the Biden administration on select Chinese exports highlight a growing rift, particularly in strategic sectors pivotal to China's future economic growth strategy, such as electric vehicles (EVs), lithium batteries, and solar cells.

If trade tensions were to escalate, a few scenarios could take place:

- China may need to digest the loss of exports internationally by increasing domestic consumption. It’s estimated that around 1 trillion RMB fiscal spending would be needed to offset the loss.

- China could retaliate with its own tariffs or restrict US companies from operating in China. The nation could start using alternative countries for imports, particularly agricultural and chemical products.

- China could offshore its value chains to ASEAN and Mexico. CATL, the Chinese top EV lithium battery maker, already has manufacturing capacity in Germany and Hungary, whereas BYD, the leading EV maker in China, has announced plans to build a factory in Mexico. As this scenario is already beginning to materialise, it would be almost impossible to completely cut off exports from China per se.

As China navigates the complexities of global trade dynamics and domestic economic reforms, the resilience of its equity markets continues to be tested. Despite current challenges, there may be opportunities in healthcare on the basis of its compelling valuation (the 12-month forward P/E is one standard deviation below the 5-year average). Some high- dividend-yielding companies are also attracting foreign investor flows, following the Chinese security regulator CSRC recent directing onshore listed companies to increase dividend payouts.

The VanEck China New Economy ETF (CNEW), which tracks the MarketGrader China New Economy Index (CNEW Index) gives Australian investors easy access via an ASX-listed ETF, to China A-shares and the potential growth opportunities in China’s New Economy sectors.

VanEck gives investors unequivocal access to China A-Shares via its RQFII licence, allowing for deeper and broader access and better risk management so that investors can participate in what may be the next growth phase for domestic China investments, beyond limited opportunities in H-shares, Red-chips and NYSE-listed ADRs.

Key risks: An investment in this China equities ETF carries risks associated with: ASX trading time differences, China, financial markets generally, individual company management, industry sectors, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 03 July 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

CNEW tracks the MarketGrader China New Economy Index. "MarketGrader" And “MarketGrader China New Economy Index” are trademarks of MarketGrader.com Corporation. MarketGrader does not sponsor, endorse, sell or promote the Fund and makes no representation regarding the advisability of investing in the Fund. The inclusion of a particular security in the Index does not reflect in any way an opinion of MarketGrader or its affiliates with respect to the investment merits of such security.