China’s economic recovery - It could be now or never

China appears to be at a defining moment, as targeted measures are set to steer its economy into a new growth phase. Find out why the equity rally could endure.

China equities went on a tear at the end of September following the unexpected announcements aimed at stimulating its stalling economy. Last week, the market was tempered by the lack of the expected fiscal follow-through when the National Development and Reform Commission (NDRC) spoke on Tuesday, this is despite the NDRC not usually delivering fiscal news, that is the prerogative of the Ministry of Finance, which might hold its own briefing in the coming days.

Either way, there has been a shift in sentiment, and China is once again on investors’ radars.

The week before the Golden Week holiday

Chinese equity markets staged a remarkable weekly rally of over 25% before the Golden Week holiday at the beginning of October. The country finally started moving to get back on its feet with the announcement of long-awaited easing packages aimed at stimulating its economy. The stimulus included monetary, fiscal and regulatory policies as well as direct market intervention and these were better received than previous stimulus packages.

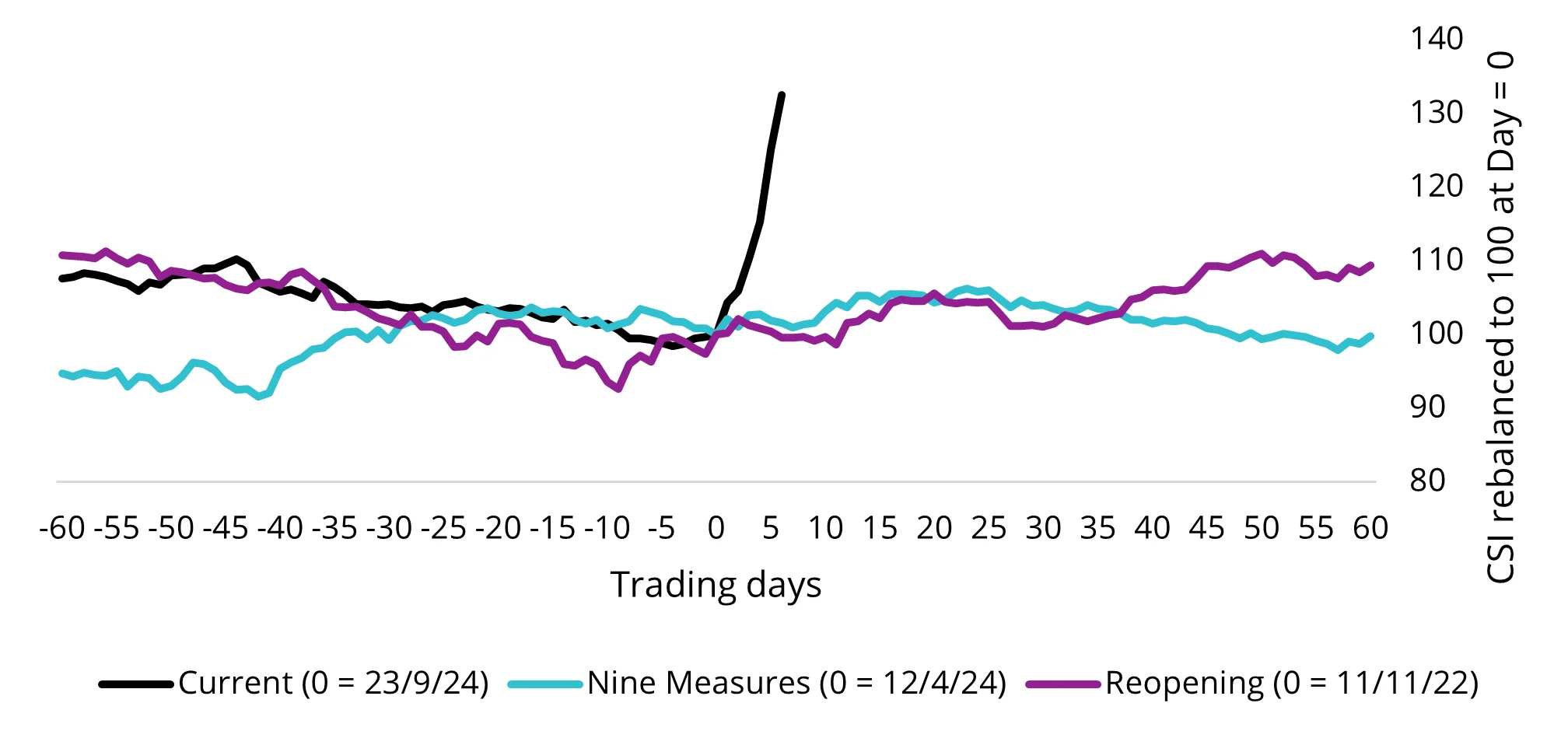

Chart 1: The latest stimulus package has driven a stronger rally than past measures

Source: Bloomberg as at 8 Oct 202

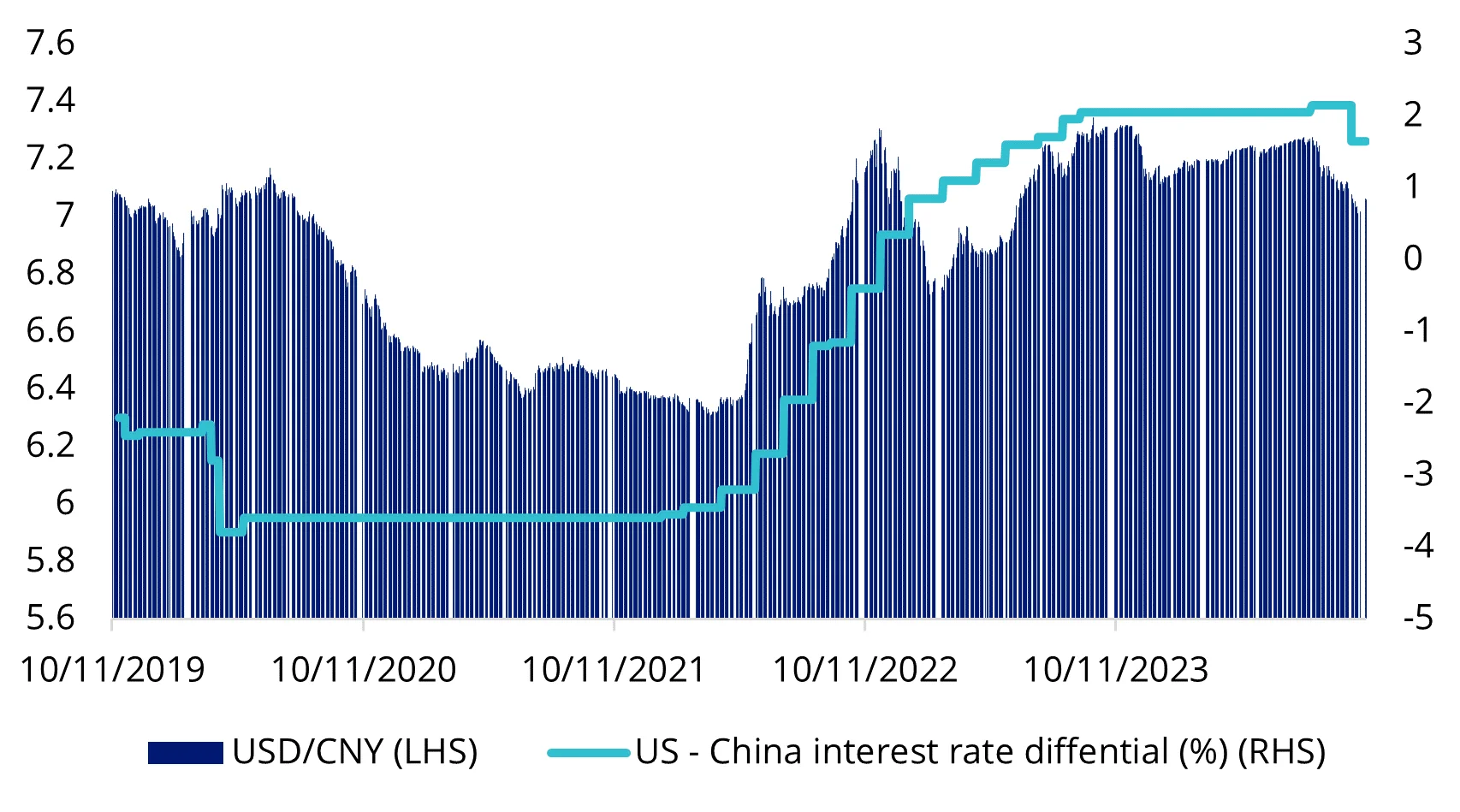

The high-interest-rate environment in other markets has made Chinese policymakers wary of cutting rates too prematurely, given the widening interest rate differential with the US since 2022.

Chart 2: US versus China - interest rates and currency movement

Source: Bloomberg as at 8 Oct 2024

With the US Federal Reserve cutting by 50 basis points (bps) in September, the opportunity presented itself for China’s easing too. China’s central bank, the People’s Bank of China (PBoC) has also hinted that there could be another 25 bps to 50 bps cut of its reserve requirement ratio (RRR) in addition to the 50 bps cut announced in September, which could boost the liquidity in the economy. It is worth noting that previous broad-based RRR cuts have benefitted the onshore equity market more than the offshore counterpart.

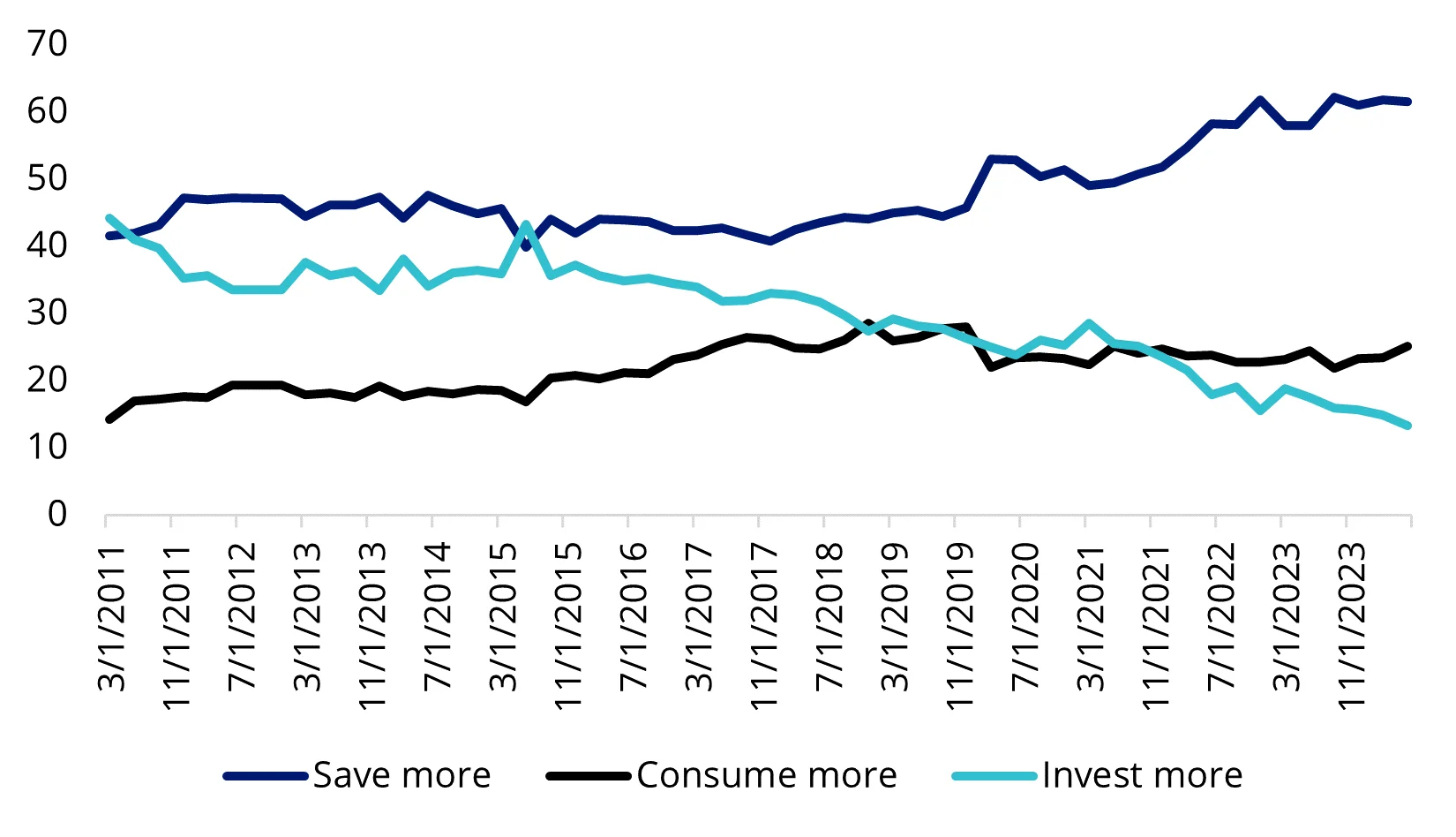

But it’s going to take more than monetary policy, China’s property prices are still dropping, and retail sales are growing at half the pre-pandemic rate, all while saving increase. Chinese authorities need to boost consumer spending.

Chart 3: Need to turn China’s savers into consumers

Source: Bloomberg, PBoC Willingness Survey.

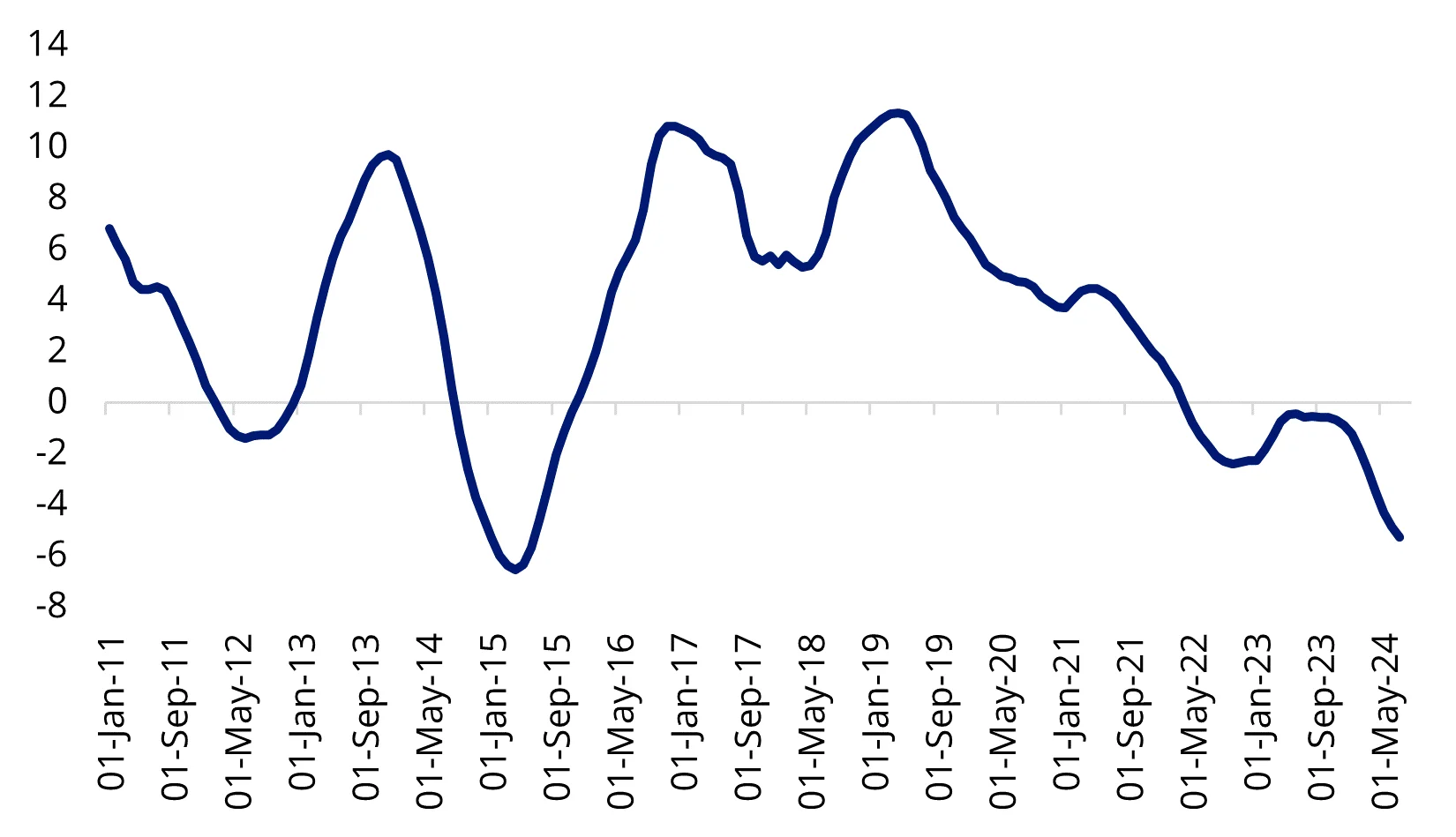

Chart 4: Needing to turn, China house prices year-on-year % change - 70 cities

Source: Bloomberg as at 8 Oct 2024

That is why the fiscal stimulus announcements were so important. We are most excited about the consumption vouchers which we think should support local consumers, as well as the employment support also announced. The measures directed to the property market (cuts for downpayments, lowering of funding costs for destocking re-lending program, relaxation of banking regulations and the extension of loan issuance rules) also ultimately benefit the consumer and consumer confidence. These are more effective and forceful for China right now than rate cuts alone because they address the demand side’s weakness.

Why the rally could extend beyond golden week

Non-bank financials are now allowed to tap into PBoC’s funding for stock purchases in the form of swaps, while listed companies are also encouraged to engage in stock buybacks, to preserve stock prices, which will be funded by the PBoC’s re-lending facility totalling 300 billion renminbi (~A$63 billion). These direct intervention measures in the equity market are another reason why we think the rally in equities can be sustained this time.

Chinese equities experienced the largest single day of buying on 24 September 2024 and our view is that the pickup in the onshore equity margin buying and trading activities in the Hong Kong Stock Exchange is just a start. Retail investors appear to be back and the apparent, consistent policy action this time may be sufficient to bring back foreign investors who have been underweight China over the recent past.

We have been calling out the critical role consumption plays in economic recovery, and we are seeing policymakers working towards that goal, such as the latest consumption voucher program totalling 500 million renminbi (~A$105 million) for Shanghai residents to spend on catering and entertainment. During the recent week-long Golden Week holiday, the total number of trips taken rose by 10.2 per cent, while total spending rose by 7.9 per cent compared to the 2019 level. While per capita spending dropped, we think consumer sentiment will gradually improve with the stabilisation of the property market.

Valuations remain compelling

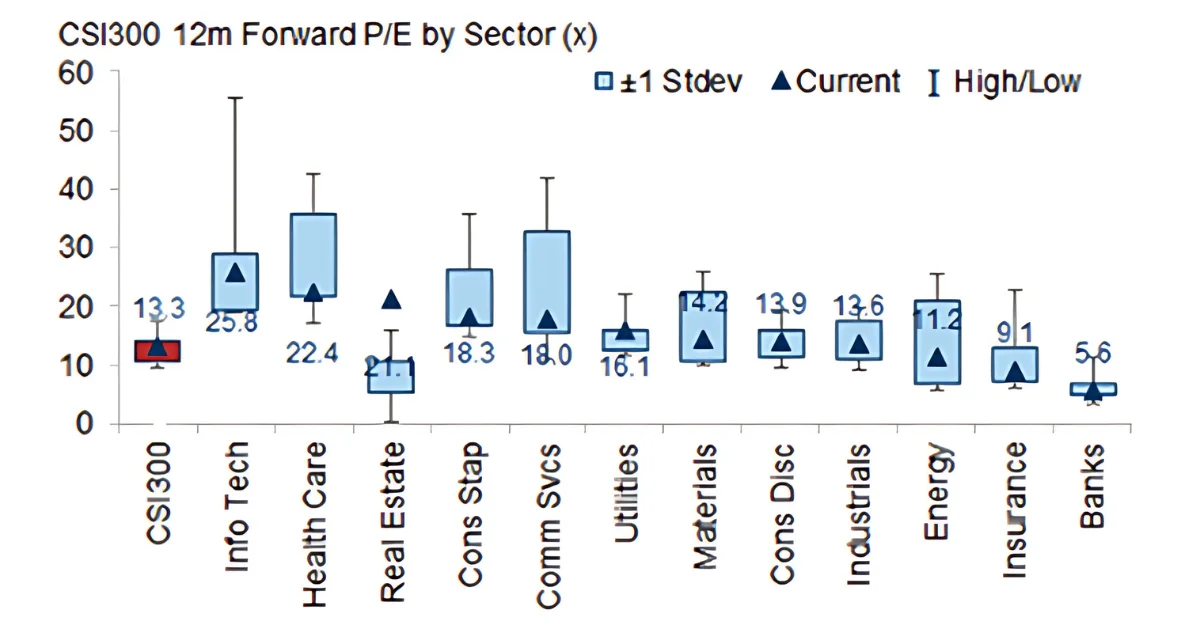

Consumer staples and health care currently have a 12-month forward P/E of 18.3x and 22.4x respectively, considerably cheaper compared to the 5-year average.

Chart 5: Current 12-month forward P/E versus 5 year range, based on CSI300 Index

Source: FactSet I/B/E/S, CSI

It could be now or never for Chinese equities. In addition to looking for a lift in consumer sentiment, we expect greater policy detail and action to follow over the coming weeks and months. The market was disappointed during the past week after China’s NDRC Press Conference. It will be interesting to see how markets react to the Ministry of Finance’s announcement on Saturday. Either way, how the money will be spent is looming as the most important issue, efforts to boost consumption and address unresolved housing issues, especially unfinished homes, should have a longer-lasting positive impact on growth.

Accessing China mainland

There are limited ways though in which Australian investors can acquire mainland China A-shares. VanEck has two ETFs that provide investors a way to participate in what may be the next growth phase for A-share investments.

- VanEck FTSE China A50 ETF (CETF) - Australia's only dedicated China A-shares market benchmark exposure. It is the most cost effective beta ETF exposure to China A-shares in the Asian region. CETF is diversified across companies and sectors, comprising the largest and most liquid mainland China companies considered leaders in their sectors and pillars of the Chinese economy.

- VanEck China New Economy ETF (CNEW) - a portfolio of up to 120 of the most fundamentally sound companies with the best growth prospects at the forefront of China’s ‘New Economy’. These sectors are:

- Technology;

- Healthcare;

- Consumer discretionary; and

- Consumer staples.

It is also worth noting that VanEck gives investors unequivocal access to China A-Shares via its RQFII licence, allowing for deeper and broader access and better risk management and this came to the fore during the last week of September. Due to trading volumes, many A-share companies could not be readily bought via Hong Kong Stock Connect, however, as we have an RQFII license, we can buy and sell on China’s mainland exchanges, so we are not affected by any stock connect quotas.

Key risks: An investment in CETF or CNEW carries risks associated with: China, financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.Published: 15 October 2024

IMPORTANT NOTICE

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.