NPC 2025: China’s bold bet on AI, stimulus, and growth

The latest policy announcements are signalling a more measured and well-structured rebound, reinforcing confidence in China’s growth trajectory.

As 2025 unfolds, the sharp rally in Chinese equities has reignited a key question - is this China’s long-awaited economic turning point?

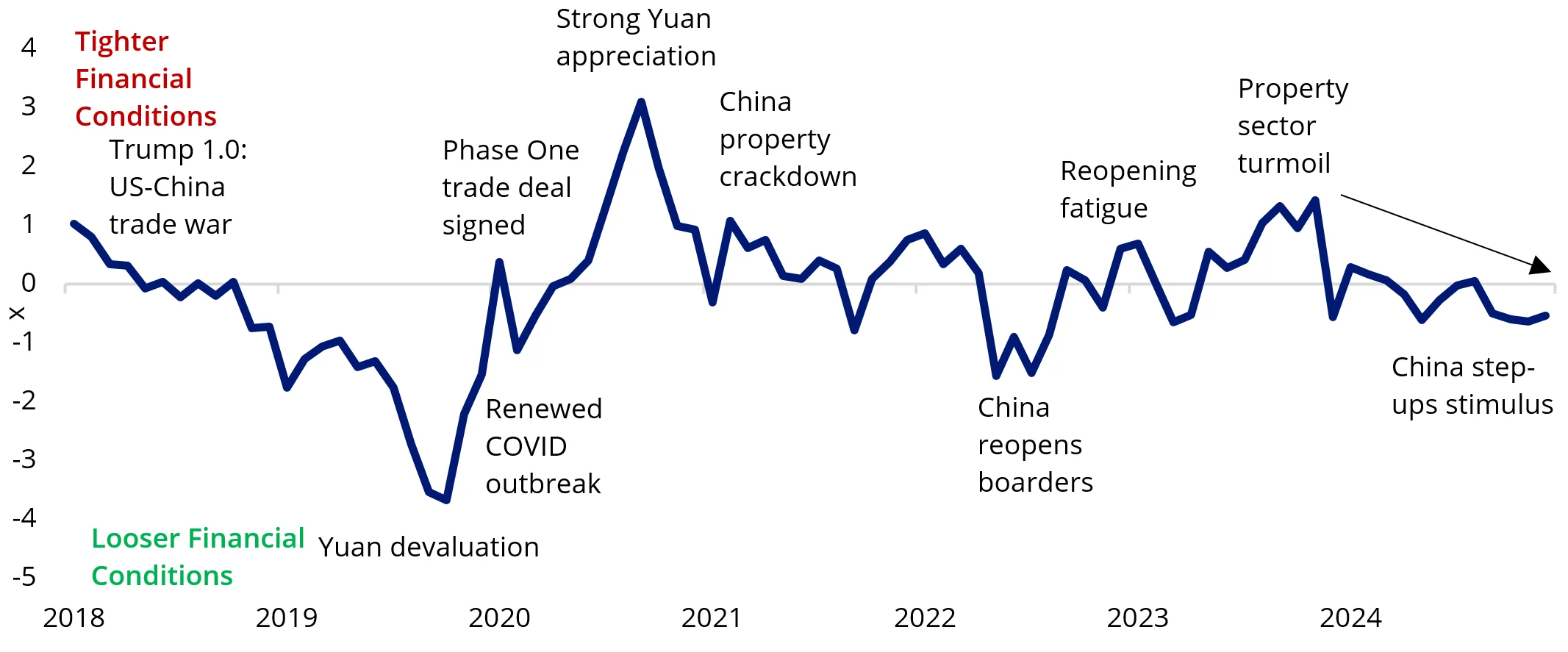

Stepping into the Year of the Snake, a symbol of wisdom, strength, and transformation, investors are watching closely. Years of trade tensions, regulatory shifts and prolonged pandemic disruptions tightened financial conditions, casting a long shadow over China A-shares - the world’s second-largest equity market - and eroding investor confidence.

However, since late last year, China has decisively pivoted from policy tightening to a more pro-growth stance, extending support to small & medium enterprises (SMEs) and key strategic sectors. These shifts were cemented in the 2025 Two Sessions, China’s most important policy event, comprising the National People’s Congress (NPC) - where top policymakers set the economic, fiscal, and regulatory agenda - and the Chinese People’s Political Consultative Conference (CPPCC), which provides strategic advisory input. Together, these meetings define the nation’s economic direction for the year ahead.

This year’s Two Sessions focused on structural fiscal stimulus, AI-driven industrial transformation, and restoring consumer confidence. The strategic pivot, coupled with breakthroughs in AI such as DeepSeek and Manus (China’s AGI milestone), signals China’s commitment to reigniting the world’s growth engine.

Chart 1: China’s financial conditions steadily loosening

Source: VanEck, Bloomberg. Bloomberg Economics China Financial Conditions Index. Data to 6 March 2025.

Highlights from China’s Two Sessions – what’s different this year

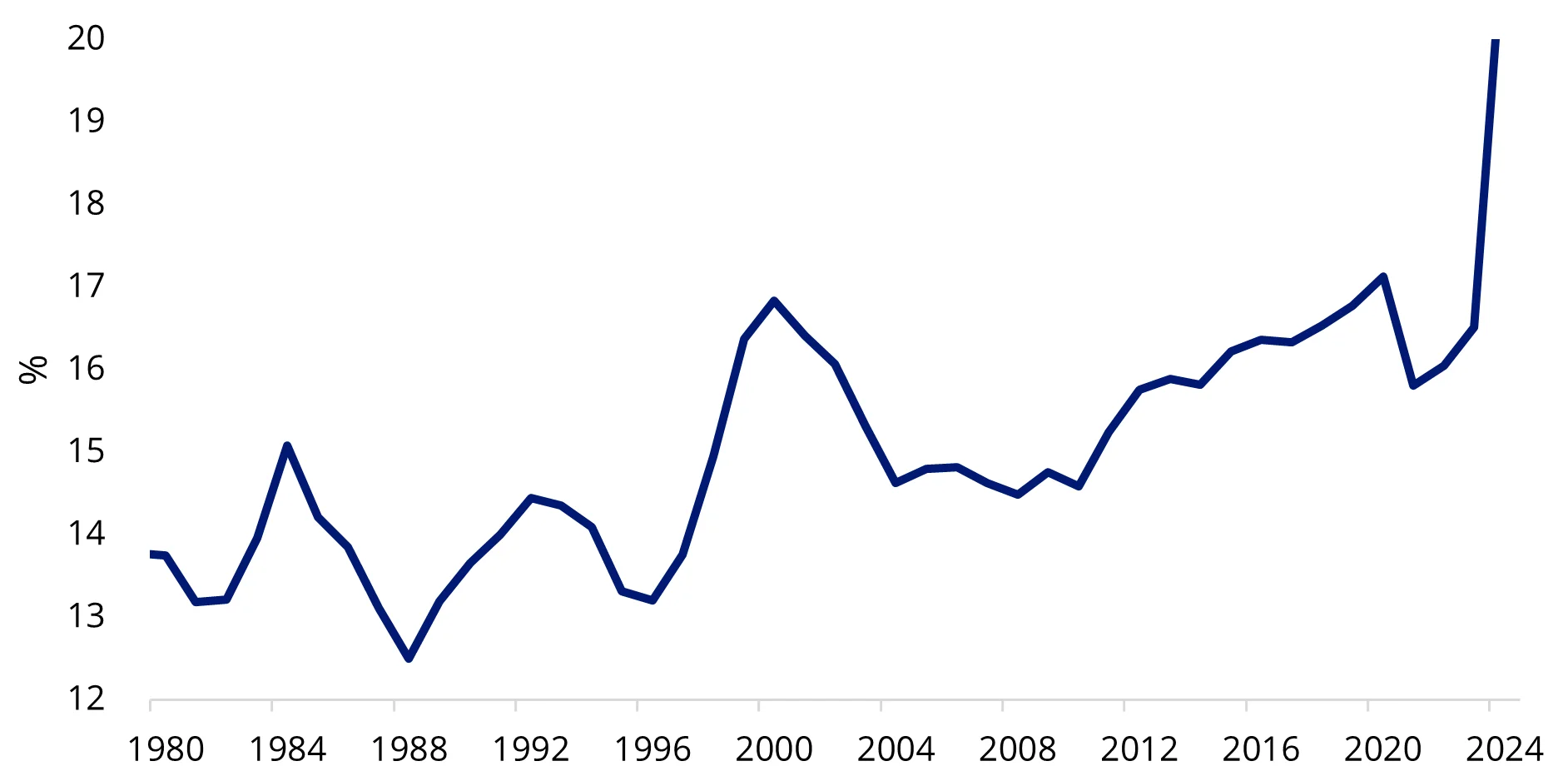

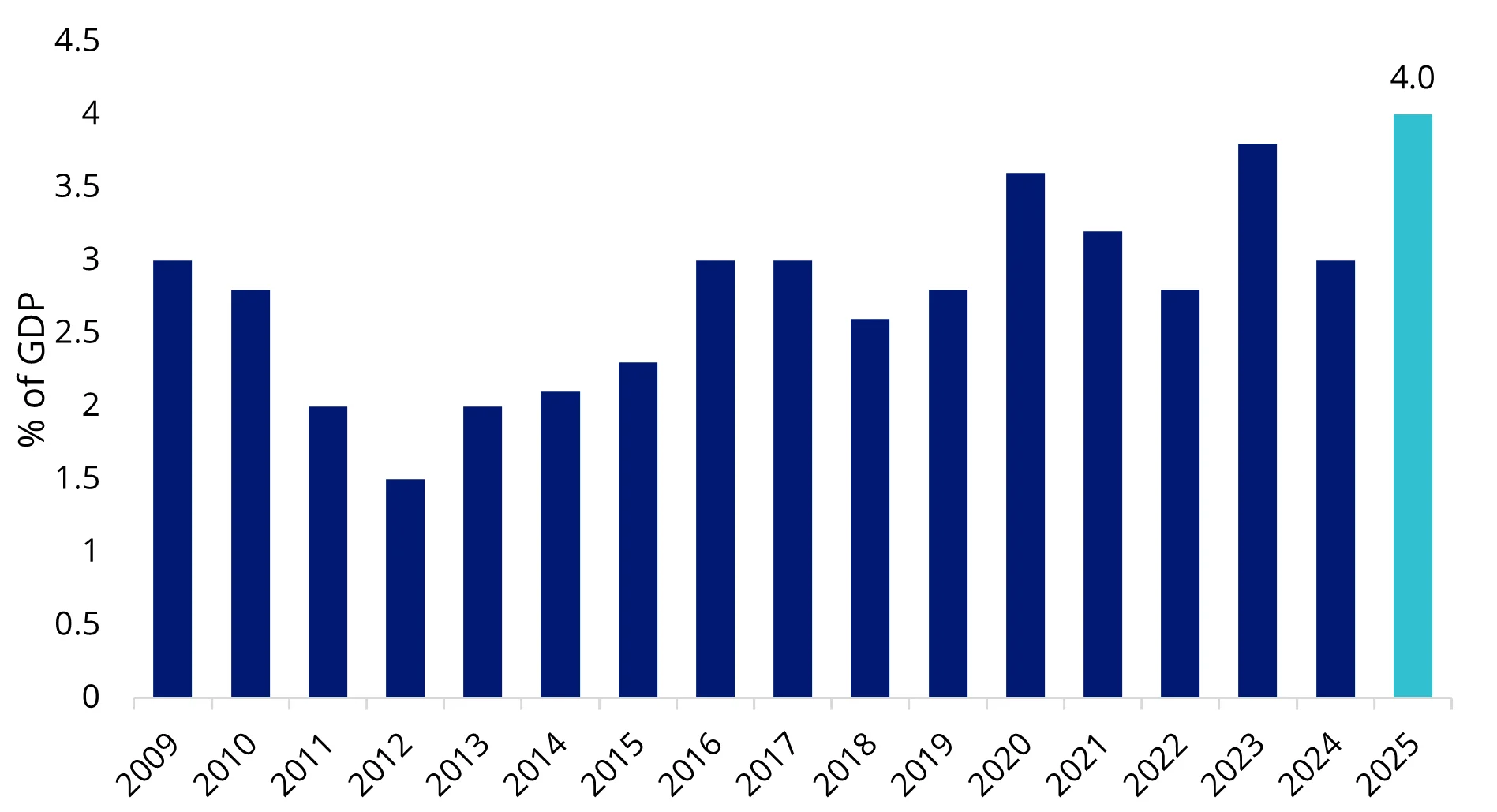

- 5% growth target with solid policy backing: In the opening speech at the NPC, Premier Li’s reaffirmed GDP target of about 5% reflects pragmatism rather than mere optimism, acknowledging both external and domestic complexities. This realism was matched by announced decisive fiscal measures, notably increasing deficit spending to 4% of GDP and expanding targeted consumer stimulus. These coordinated efforts aim to not just set a target but to actively achieve it by directly addressing weak domestic demand and anchoring stable economic growth.

- Historic fiscal deficit increase with precise spending focus (4% of GDP): Unlike past stimulus programs that relied on blanket credit expansion, this year's record-high fiscal deficit is strategically designed to achieve concrete economic outcomes. Beyond infrastructure, funds are specifically channelled into stabilising real estate by acquiring unsold properties and idle land, increasing local government special bond issuance by RMB 500 billion to RMB 4.4 trillion, and launching urban village redevelopment schemes targeting 1 million new housing units. These clearly defined commitments represent a deliberate break from prior cycles, moving beyond vague promises to tangible, measurable stimulus.

Chart 2: China Government spending % of GDP

Source: VanEck, the World Bank, National Bureau of Statistics of China. Data to 31 December 2024.

Chart 3: China’s budget deficit as % of GDP

Source: VanEck, Bloomberg, data as at 6 March 2025.

- A shift to moderately accommodative monetary policy: After 14 years of “sound” monetary policy, China has officially pivoted to a “moderately accommodative” stance, marking a significant shift in its economic strategy. Premier Li Qiang stated at the NPC that China is ready to cut policy rates at an appropriate time, reinforcing a more flexible approach to economic management. While monetary policy alone isn’t the primary tool for stimulus – given China’s isn’t suffering from inflation pressures – broader easing measures are already lowering financial barriers to recovery. The People’s Bank of China (PBOC) has reduced the RRR (Required Reserve Ratio), to boost liquidity, while lower business loan rates and MLF (Medium-Term Lending Facility) rate cuts are easing credit access for enterprises. Additionally, adjustments to housing provident fund loan rates aim to support real estate demand, ensuring a balanced recovery across sectors. Policymakers are now prioritising a calculated, long-term recovery over short-lived monetary boosts, signalling a structurally sound and sustainable growth path.

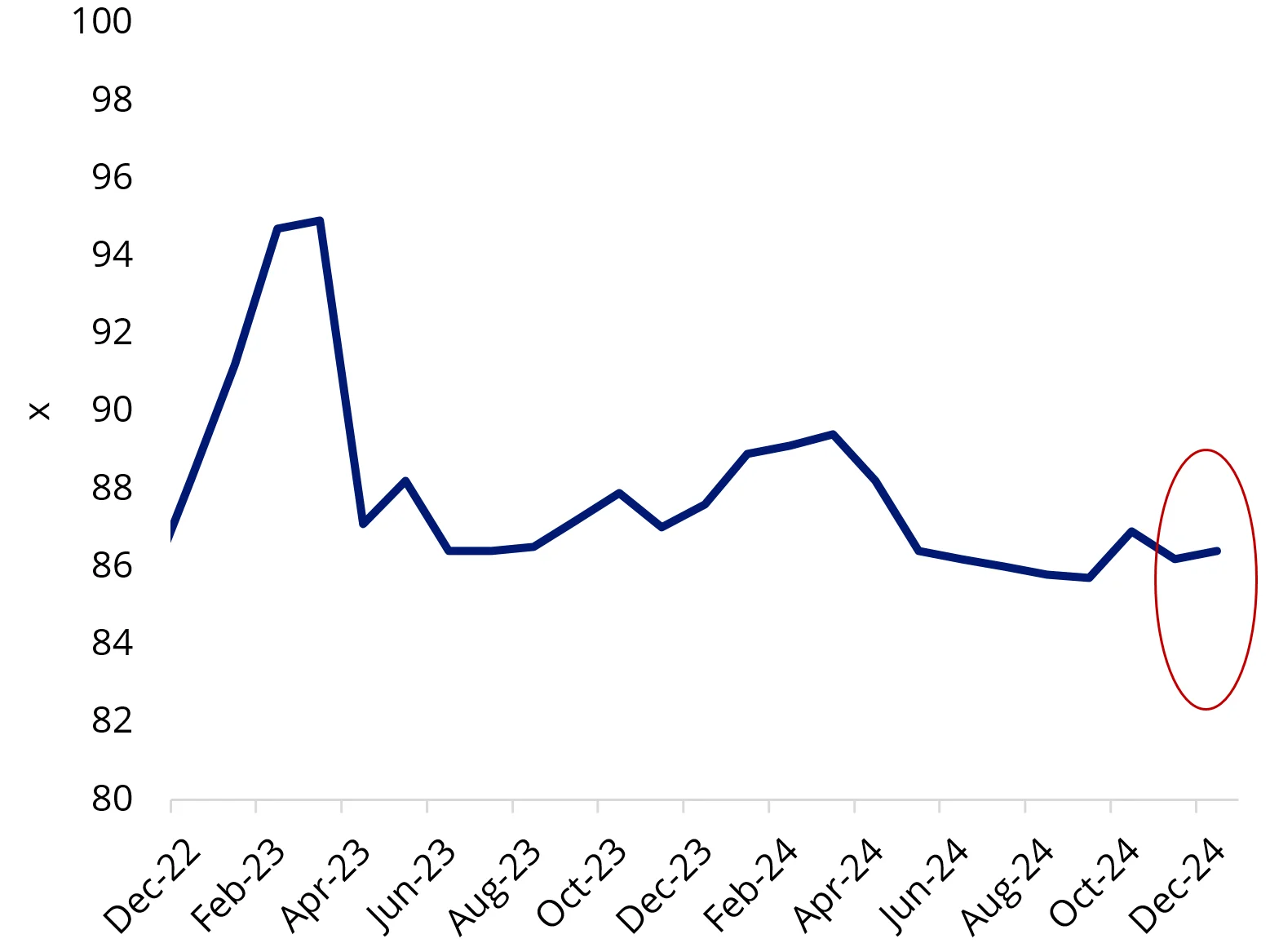

- Reviving consumer confidence through direct stimulus (RMB 300 billion trade-in program): Years of economic uncertainty have pushed Chinese households into a “saving-over-spending” mindset. In a world shaped by trade tensions and geopolitical risks, policymakers now recognise that domestic consumption is not just a pillar of growth - it’s a strategic necessity. To reinvigorate demand, the government has doubled the consumer goods trade-in program to RMB 300 billion, eased regulatory scrutiny on imported entertainment services such as movies and concerts, and allocated RMB 41 billion for pensions and RMB 29 billion for medical insurance to reduce long-term financial anxieties. This time, the focus isn’t just on short-term stimulus - it’s about restoring consumer trust and ensuring domestic demand, China’s most crucial growth engine.

Chart 4: Efforts will be focused on lifting consumer confidence

Source: VanEck. Bloomberg, data to 28 February 2025. Retail Sales MoM% change.

- AI+1as China’s new growth engine: 2025 marks a major milestone in China’s long-term economic restructuring, as AI moves from policy rhetoric to large-scale implementation. Premier Li Qiang underscored this shift in the 2025 Government Work Report, stating that China will "launch an AI Plus initiative and build digital industry clusters with international competitiveness." Backing this commitment with action, China has allocated US$100 billion to AI, semiconductors, and frontier technology, signalling a decisive pivot towards innovation-led growth. Companies like DeepSeek and Manus (China’s AGI leader) exemplify this transformation, as the country moves from a technology adopter to a global innovator. This represents a fundamental realignment of China’s economy towards technology leadership in the global arena, marking a shift away from a real estate-driven model.

- Sector specific initiatives: Authorities announced a series of targeted sector-specific initiatives, which were met with a positive response from the markets.

Table 1: Key sector beneficiaries

|

Sector |

Stimulus announced in the Two Sessions |

Immediate market reaction |

|

Technology/AI+ (e.g. Healthcare) |

• Major funding for AI, semiconductors, and advanced computing. • ¥0.80T (~$0.11T) ultra-long bonds for AI, quantum computing. • Major AI & semiconductor R&D funding; national data infrastructure. • Support for "AI+” industrial applications, AI-driven manufacturing. |

o Alibaba: +8.4% o Kingnet Network: +7.6% o Naura Technology Group: +6.9% |

|

Infrastructure & Defense |

• ¥735B (~$103B) central government investment in key infrastructure projects. • ¥4.40T (~$0.62T) local govt bonds will be used by local governments for land acquisition, transport, housing. • Defence budget +7.2%, focus on AI-driven military tech, cybersecurity. |

o AECC Aviation Power: +5.1% o Jonhon Optronic Technology: +4.0% |

|

Industrials & Property |

• ¥1.2T (~$168B) special-purpose bonds for land reserves, housing stock purchases. • Mortgage rates lowered by 50bps, down payments cut to 15% (from 20%). |

o Shenzhen Sinexcel Electric Co: +6.8% o China Vanke: +3.2% o Country Garden: +5.2% |

|

Consumption & Domestic Demand |

• Strategic emphasis of ‘China will make a major push to boost consumption.’ • ¥300B (~$42B) ultra-long bonds for consumer goods trade-in (appliances, EVs). This marks a 50% increase of last year’s amount. |

o Qingdao Kutesmart Co: +19.1% o Seres Group: +5.8% |

Source: VanEck, Bloomberg, Report on the Implementation of the 2024 Plan for National Economic and Social Development and on the 2025 Draft Plan For National Economic and Social Development, March 2025. AECC Aviation and Jonhon Optronic performance as at 6 March 2025, all other performance as at 5 March 2025.

What does this mean for China’s equity markets?

With China’s push for economic recovery, a wave of pro-consumption policies, and a strong commitment to AI and technological breakthroughs, its equity markets have impressed investors with a strong rally since the last quarter of 2024.

FTSE China A50 Index and China’s New Economy sectors, as represented by the MarketGrader China New Economy Index, are up 28.9% and 43.8% over the last six months respectively, making them clear standouts among global equity markets.

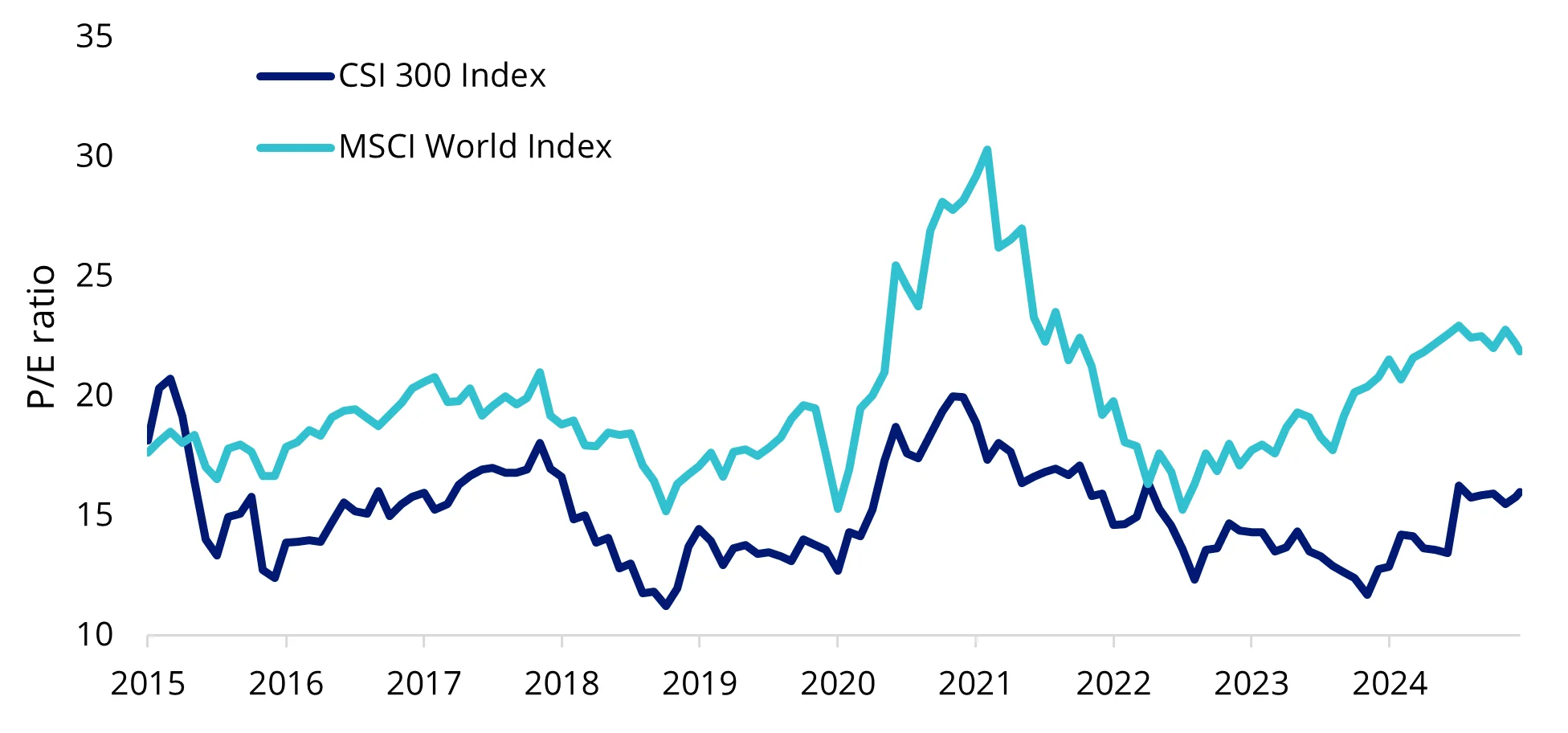

Provided economic stimulus carries through 2025 and considering the compelling valuations of Chinese equities – one of the few asset classes with price-to-12-month-forward earnings near its historical average – this rally could potentially have further momentum.

Chart 5: Chinese equities on sale versus rest of the world

Source: VanEck, Bloomberg. Performance in AUD. Data to 6 March 2025. You cannot invest in an index. Past performance is not indicative of future performance.

Accessing China's recovery

VanEck offers three ETFs that provide exposure to Chinese equities:

- China New Economy ETF (CNEW): Invests in 120 fundamentally sound and attractively valued companies with growth prospects in China's New Economy, targeting technology, healthcare, and consumer staples and consumer discretionary sectors.

- FTSE China A50 ETF (CETF): Invests in a diversified portfolio comprising the 50 largest companies in the mainland (A-shares) Chinese market which currently includes the likes of EV car manufacturer BYD.

- MSCI Multifactor Emerging Markets Equity ETF (EMKT): Invests in a diversified portfolio of Emerging Market companies with value, low size, momentum and quality characteristics. ~30% of the fund is currently allocated to Chinese companies including the likes of Alibaba and Tencent.

In conclusion, China’s proactive stance, combined with historical resilience and targeted investment strategies presents a compelling opportunity for forward-thinking investors in 2025.

Key risks:

An investment in CETF, CNEW or EMKT carries risks associated with: ASX trading time differences, China, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the relevant PDS and TMD for more details.

Sources

The term "AI+" in the 2025 NPC (Two Sessions) represents China’s strategic push to integrate artificial intelligence (AI) into key industries to drive economic transformation.

Published: 19 March 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.