China pivots and finally aims stimulus at the source of its economic crisis

Investors should focus less on the magnitude of the measures announced by the government, and more on what they reveal about its intent.

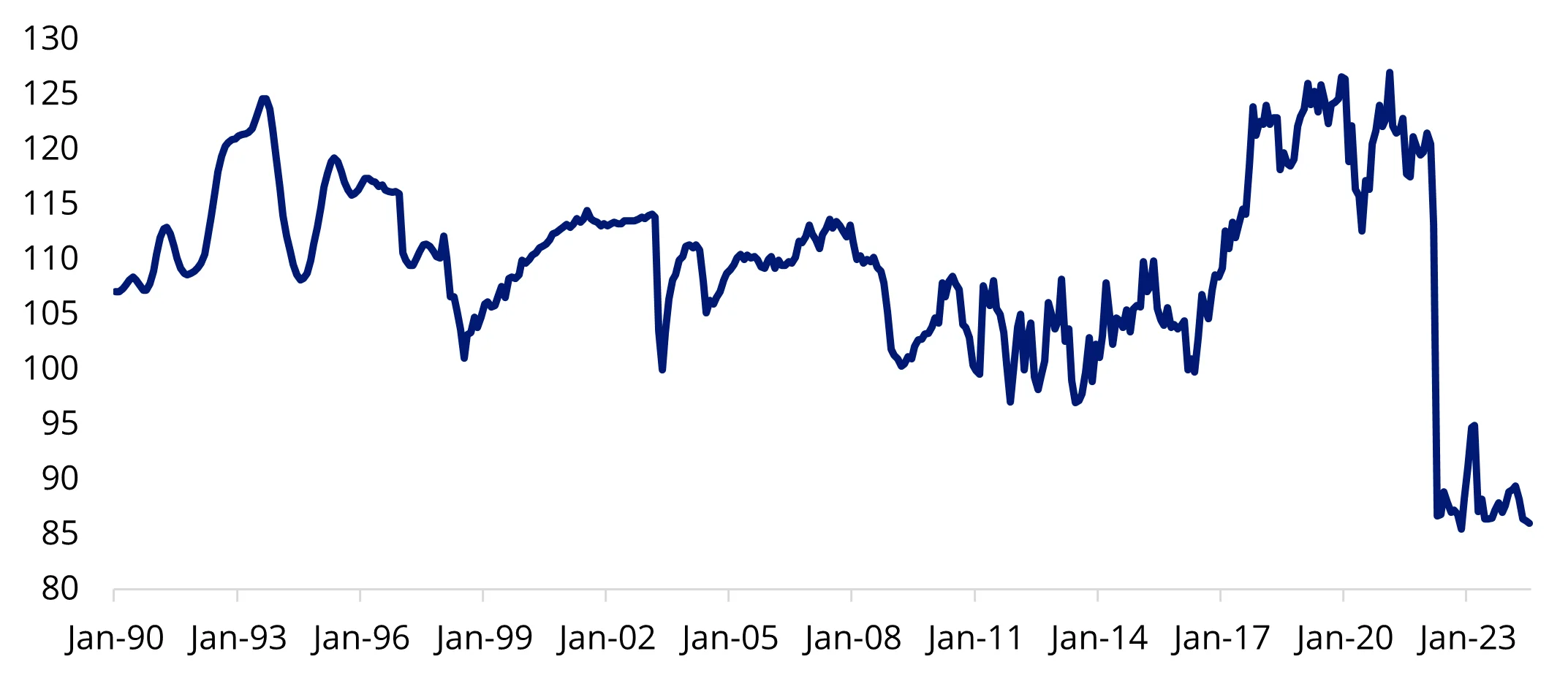

After three years of incremental measures to manage the fallout from its real estate crisis and stimulate the manufacturing and export-oriented sectors of its economy, China’s central government made a hard pivot and finally began to tackle the root cause of its crisis: a historic collapse in consumer confidence that has shown few signs of recovery since the twin shocks of the COVID-induced shutdown of the country in 2020 and the collapse of its real estate market in 2021.

Figure 1. Composite Consumer Confidence for China, Monthly, Seasonally Adjusted 1990-2024

Source: Federal Reserve Bank of St. Louis

While China’s recently announced stimulus measures are categorised into monetary stimulus, real estate sector support, and stock market support, what’s most significant about them is the government’s tacit acknowledgement that a Japan-style deflationary spiral, triggered by excessive leverage in its real estate sector and a collapse in consumer confidence, is a possibility for the country. Most importantly, the government seems to be acknowledging that it needs to lead the effort to mop up the country’s unsold real estate inventory and that, contrary to what President Xi Jinping has stated recently, the stock market does matter and that functioning capital markets are essential for the operation of a market economy.

Highlights of China’s September 2024 Stimulus Measures

Monetary Policy

While helpful at the margins, expect China’s monetary stimulus measures to be the least effective part of the package announced between late September and early October. While the new measures loosen liquidity requirements for Chinese lenders, the country’s problem has been a lack of demand for loans, especially among consumers and home buyers, as opposed to a liquidity crunch caused by tight money. The new monetary stimulus measures included:

- The deposit reserve ratio for financial institutions was lowered by 50 basis points (bps), giving banks greater room for loan originations relative to their asset base.

- The seven-day repurchase rate (repo rate) was cut by 20 bps, while the medium-term lending facility rate was lowered 30 bps to 2%. These two measures are designed to lower the cost of capital to financial institutions and spur them to make loans.

Real Estate Sector Support

While much has been made of the lowering of mortgage rates and the loosening of requirements for the purchase of second homes, the most consequential measure announced by the government was an increase in support for local governments to buy unsold housing inventory and clear the glut that has depressed prices and kept consumers and investors on the sidelines. More specifically, and critically important given the poor state of local government finances across China, the central government has agreed to cover 100% of loans originated by commercial banks earmarked to buy unsold homes from property developers. This measure alone, assuming it is supported with ample capital, has the potential to untie the Gordian Knot that has strangled China’s consumer economy for three years. The new real estate support measures include:

- The central government will cover 100% of “re-lending” loans issued to local governments for the explicit purpose of purchasing unsold housing inventory from property developers. This is up from the 60% coverage that had been announced in May, which means that local governments will no longer have to use their own money to clear up housing inventory that has depressed their local economies. One caveat is that the lending facility authorised to support this program was limited to ¥300 billion (US$42 billion). Expect this to increase significantly.

- The interest rate for existing mortgage loans was lowered by 50 bps, which is expected to benefit 50 million households and lower interest expenses by about ¥150 billion annually (US$21 billion).

- The minimum down payment required for second home loans was lowered from 25% to 15%.

In addition to the specific measures outlined above, the government said it is studying the possibility of allowing policy banks and commercial banks to make loans in support of the acquisition of undeveloped land from property developers, with possible support from the People’s Bank of China. All these measures have the potential to bring housing supply and demand back into balance, but the pool of capital allocated by the government to support its programs needs to be much larger than what has been announced so far.

Stock Market Support

The biggest pivot came in the government’s renewed support for the stock market and public company shareholders, which it has belatedly rediscovered are also consumers. The total support package, which adds up to ¥800 billion (US$112 billion), is explicitly designed to funnel money into public equities at a time Chinese stocks are among the cheapest in the world, in hopes of instilling investor confidence in Chinese markets. The stock market support measures include:

- The creation of a ¥500 billion (US$70 billion) swap facility that allows securities firms, fund managers, insurance companies and other qualified institutions to use bonds, stocks, ETFs and other assets as collateral to borrow from the PBOC at very low rates and buy equities, which are extremely cheap by historical standards. Notably, the swap facility can only be used to invest in the stock market.

- The creation of a ¥300 billion (US$42 billion) refinancing facility for public companies and shareholders to buy back their own stock.

Additionally, regulators suggested that the government is evaluating the creation of a stock stabilisation fund. This could turn what has been implicit support for local equity markets through the government’s “national team” (SOEs the government directs to buy equities to support the market) to an explicit support mechanism, effectively putting a floor under the equity market.

Takeaways

The Chinese government has finally moved forcefully towards a tacit acknowledgement that significant support will be needed to pull its economy out of the malaise in which it finds itself. The specific steps announced are, in our view, just the beginning of what could be a much larger and far-reaching stimulus package than what has been announced so far, especially in terms of the capital allocated to mop up the inventory of unsold homes around the country that is weighing down on consumer confidence. So, rather than focus on the size of the measures announced so far, investors should feel optimistic that much of the ‘scaffolding’ needed to inject direct government support into the economy is being put in place. And most importantly, they should focus on what the nature of the measures says about the government’s acknowledgement of the source of the problem and its determination to do what it takes to correct its course. In the end, Chinese consumers will determine if, and when, the country can return to a sustainable path of economic growth.

Published: 16 October 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.