Global investors are warming up to Chinese equities once again

It has not been uncommon for international investors to be underweight China over the past few years. Evidence signals sentiment is changing.

The shift in sentiment has been due to several factors including the market’s repricing of the probability of a Fed rate cut which has benefited China equities, particularly those with a value style. Despite this shift, China equities valuations remain cheap.

An allocation to China is also important for diversification as investors that ignore China do so at their peril, despite China:

- becoming the largest economy into the rest of the century;

- being positioned differently from other developed market economies therefore providing diversification benefits; and

- being Australia’s largest trading partner.

Putting geopolitical concerns aside, China equities we think, warrant an investment allocation and there are certain sectors that may benefit more moving forward.

The shift in sentiment about Fed cuts has benefited China

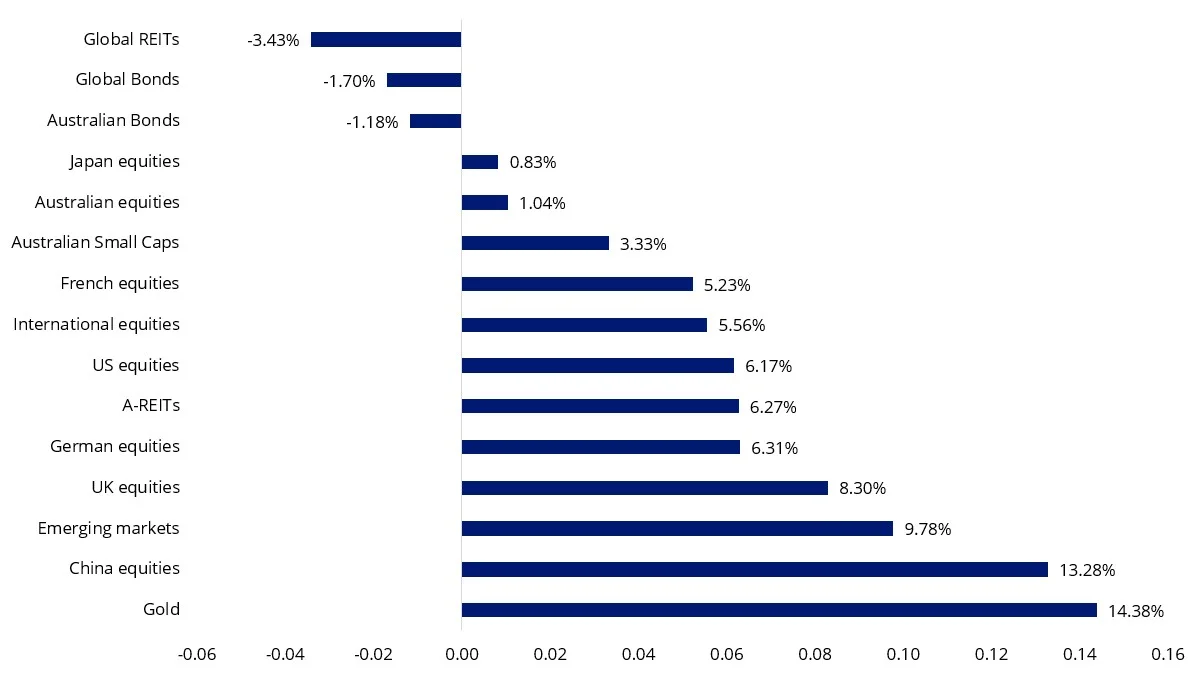

Since the beginning of the year the market has been repricing the probability of a Fed rate cut. The shift has benefited China equities. After Gold, the China equity market has been the best performing asset class of the past three months.

Chart 1: Asset class and equity markets performance for last three months

Source: Morningstar Direct, to 30 April 2024. All returns in Australian dollars. Global REITs is FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged, Global Bonds is Bloomberg Global Aggregate Index Hedged AUD, Australian Bonds is Bloomberg AusBond Composite 0+Y Index, Japan equities is Nikkei 225 Average Total Return Index, Australian Equities is S&P/ASX 200 Index, Australian Small Caps is S&P/ASX Small Ordinaries Index, French equities is Euronext Paris CAC 40 Index, International Equities is MSCI World ex Australia Index, US equities is S&P 500 Index, A-REITs is S&P/ASX 200 A-REIT Index, German equities is FSE DAX Index, UK equities is FTSE 100 Index, Emerging Markets is MSCI Emerging Markets Index, China equities is CSI 300 Index, Gold is LBMA Gold Price PM. You cannot invest in an index. Past performance is not indicative of future performance.

Investors are starting to take note, with data from the People's Bank of China (PBOC) on net foreign portfolio investment in Chinese equity securities showing that foreign investors bought a net of US$44 bn in February and March 2024, as is expected to be strong in April.

Domestic A-share companies in the consumer, healthcare, and technology-related sectors, which source the bulk of their profits and revenues from the domestic market, have been benefiting from the shift in sentiment with VanEck, China New Economy ETF (CNEW) returning 17.26% over the three months to 30 April 2024 (Source: VanEck – a copy of the factsheet is available here). While we always caution that past performance should not be relied upon for future performance, we think there remains other reasons to be positive about the outlook for China equities.

The return of the Chinese consumer

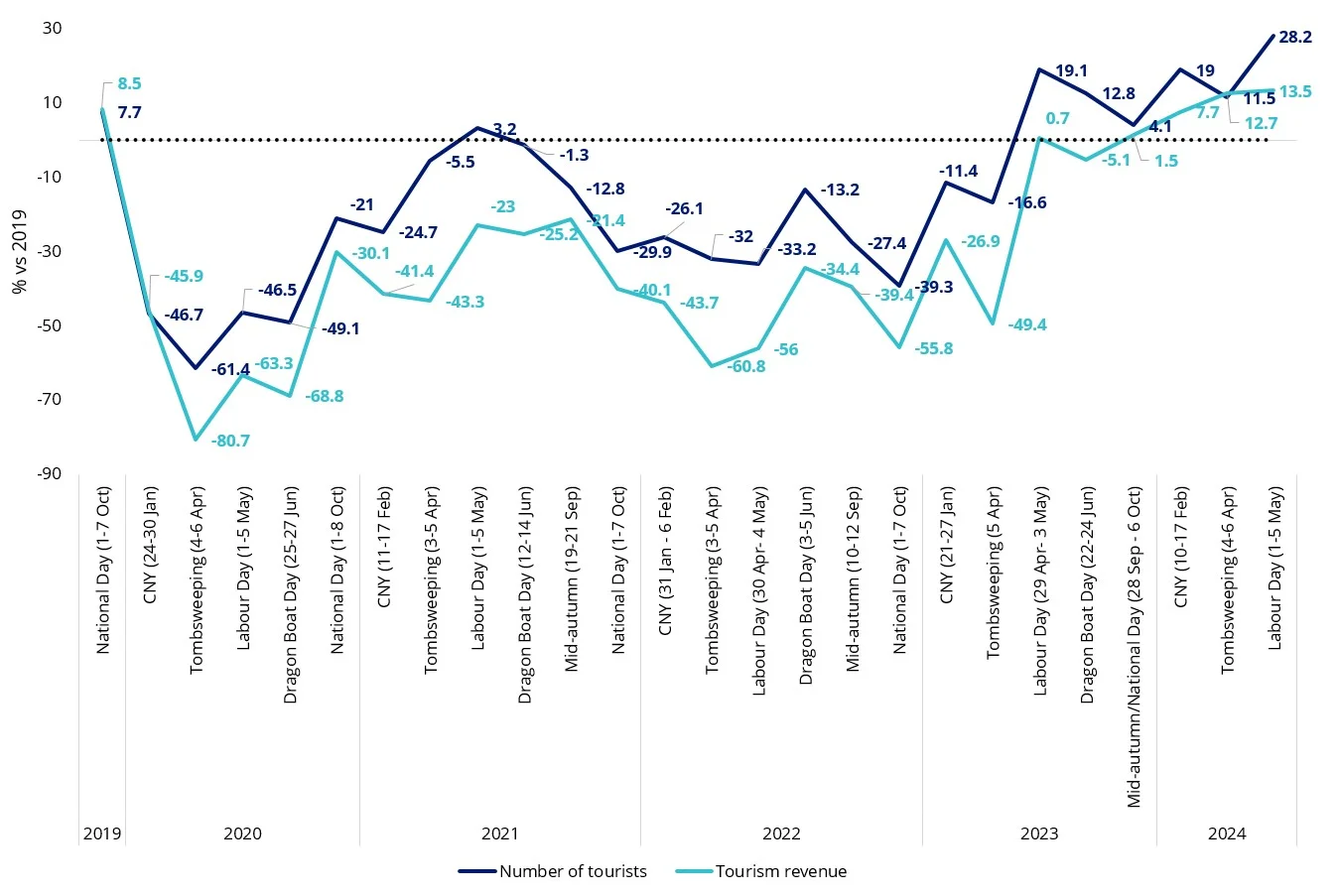

The week-long Labour Day holiday (May 1-5) was another test for the strength of consumer services, and it looks like the domestic tourism has recovered from its COVID doldrums, with levels remaining well above 2019 levels.

Chart 2: Domestic tourism back above pre-COVID levels

Note: Data before 2021 show YoY growth. From 2021 data represents percentage changes from the same holidays in 2019. Source: Ministry of Culture and Tourism of PRC.

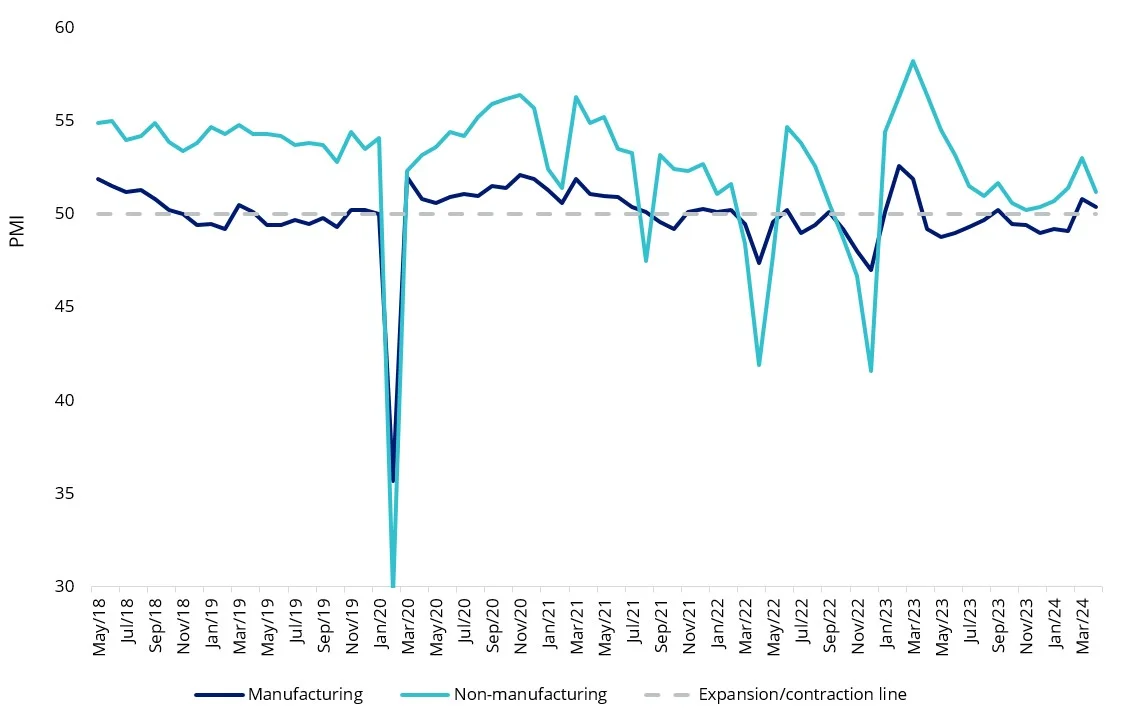

China Purchasing Managers Indices (PMI) indicates that China is in expansion mode again, with manufacturing PMI breaking through 50.

Chart 3: Manufacturing PMI had broken through 50

Source: Bloomberg. Data as of April 2024. Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion and a reading below 50 indicates contraction. Please see important disclosures and definitions at the end of the presentation.

Stepping back, one of the reasons investors diversify globally is to gain exposure to different economic cycles than those experienced domestically. With Australia and the US facing higher rates for longer as central banks manage inflation, China’s economy has different economic fundamentals. The IMF is expecting China’s GDP growth to exceed 4.5%.

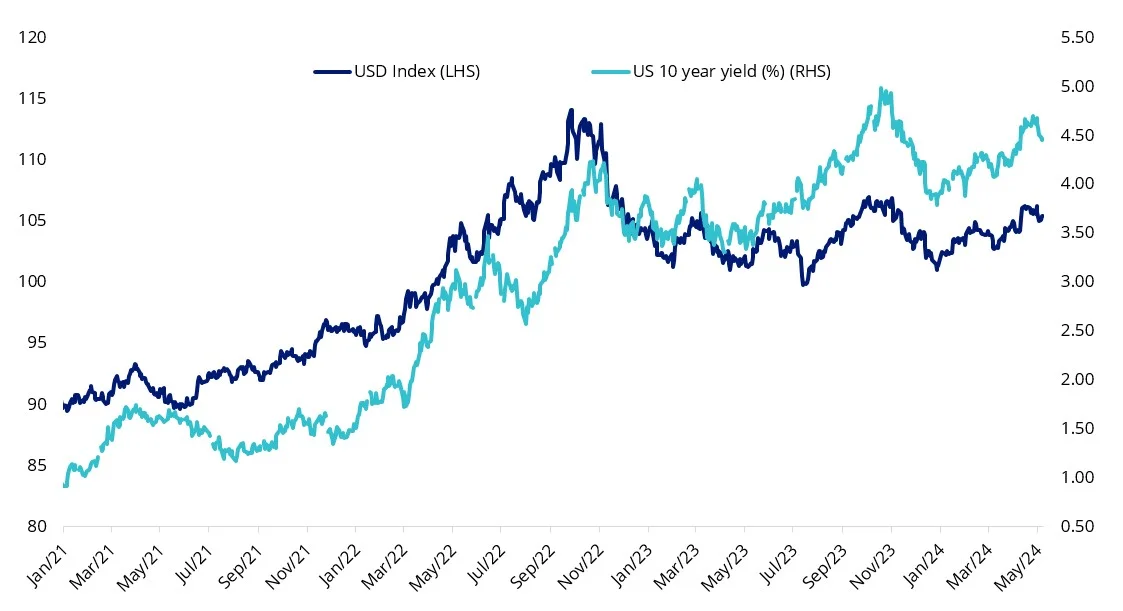

Recently, US dollar and treasury yields have pulled back from April 2024 highs, and they are much lower than October 2023 highs, which is good news for China, as dollar strength has been part of the tightening conditions. Further falls could be good for China's equities.

Chart 4: US dollar Index and US 10-year yields (%) have pulled from highs at the end of April

Source: Bloomberg, 8 May 2024

China is Australia’s largest trading partner, and while recent tensions between the governments have been in the news however investors, irrespective of the geopolitical views, that do not have a China exposure do so at their peril, we think.

As a diversifier and a growth allocation, China equities, we think, warrant an investment allocation. We think the sectors that will benefit more moving forward include the IT and China’s consumer sectors.

There are limited ways through which Australian investors can acquire China A-shares and more specifically, the sectors that are the growth engine of the growing services sector and despite recent price action, we think 2024 represents a compelling reason to consider an entry opportunity.

But it’s important to be selective.

The VanEck China New Economy ETF (CNEW), which tracks the MarketGrader China New Economy Index (CNEW Index) gives Australian investors easy access via an ASX-listed ETF, to China A-shares and the enormous potential growth opportunities in China’s New Economy sectors. CNEW includes 120 China A-shares, equally weighted, from the Healthcare, Consumer Staples, Consumer Discretionary and Technology sectors, all with the best Growth at a Reasonable Price (GARP) attributes. Companies are selected on the basis of the strength of 24 fundamental indicators across four factor categories: Growth, Value; Profitability; and Cash flow.

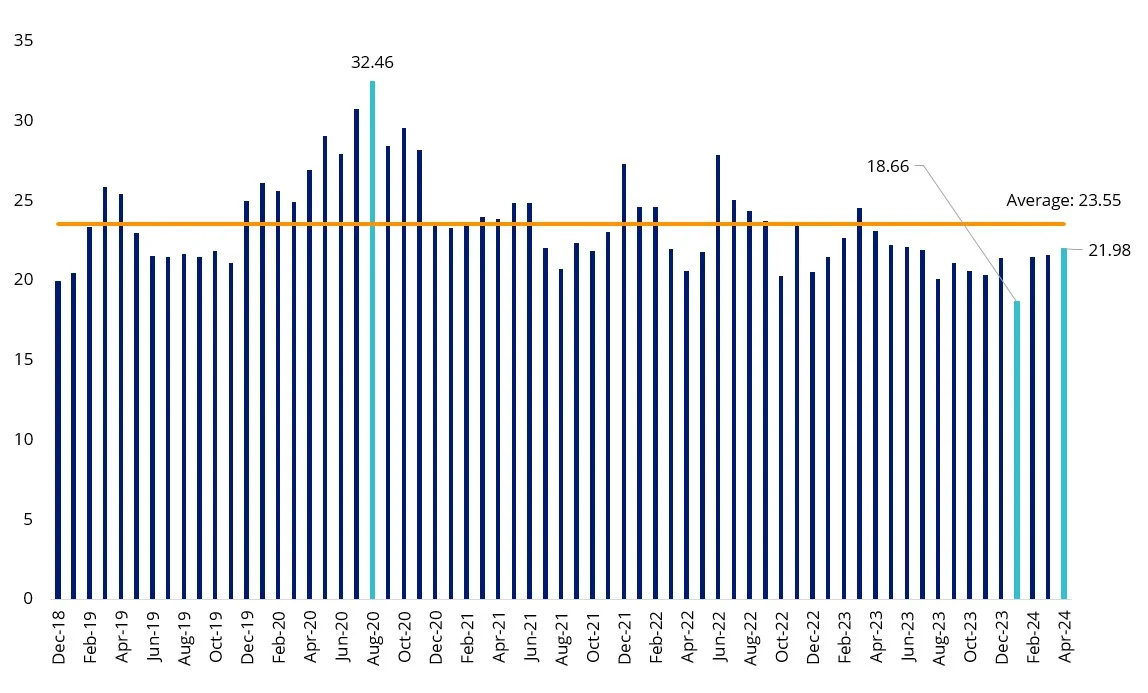

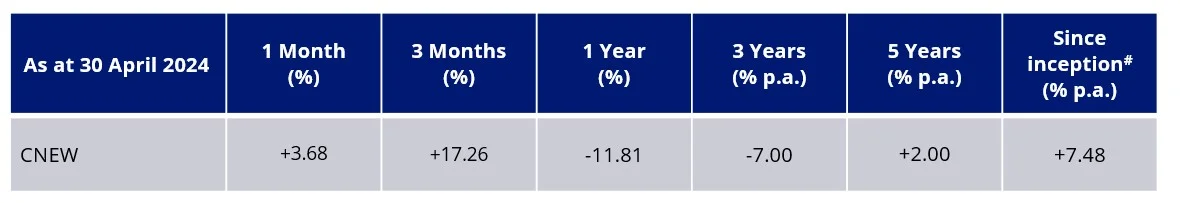

Valuations

Following the recent run, the constituents of CNEW traded at a median trailing P/E of 21.98x at the end of April, below its average, since CNEW’s inception and up from its historic low in January 2024. The current valuation represents a 32% discount to CNEW’s valuation in August 2020, when it peaked following a massive post-COVID run-up, as illustrated in Chart 5.

Chart 5: Median trailing price to equity (P/E) for CNEW since inception

Sources: MarketGrader, FactSet, 30 April 2024.

It is worth noting, that despite the many gyrations of the China equity market over the past six years, CNEW is still up 7.48% p.a. since November 2018 when it launched. Noting that this past performance is by no means indicative of future performance.

VanEck China New Economy ETF performance since inception

#CNEW inception date is 8 November 2018 and a copy of the factsheet is here.

Source: VanEck, Morningstar Direct. Performance is in Australian dollars. Results are calculated daily and assume immediate reinvestment of all dividends. CNEW performance includes management fees and other costs incurred in the fund but excludes broker fees and buy/sell spreads associated with investing in CNEW. Past performance is not a reliable indicator of future performance of CNEW.

VanEck gives investors unequivocal access to China A-Shares via its RQFII licence, allowing for deeper and broader access and better risk management so that investors can participate in what may be the next growth phase for domestic China investments, beyond limited opportunities in H-shares, Red-chips and NYSE-listed ADRs.

Key risks: An investment in this China equities ETF carries risks associated with: ASX trading time differences, China, financial markets generally, individual company management, industry sectors, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 13 May 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

CNEW tracks the MarketGrader China New Economy Index. "MarketGrader" And “MarketGrader China New Economy Index” are trademarks of MarketGrader.com Corporation. MarketGrader does not sponsor, endorse, sell or promote the Fund and makes no representation regarding the advisability of investing in the Fund. The inclusion of a particular security in the Index does not reflect in any way an opinion of MarketGrader or its affiliates with respect to the investment merits of such security.