Prosperity, rebirth and good fortune: Four reasons to be optimistic for this Spring Festival

As DeepSeek’s is unleashed, China's capacity to shape its own economic destiny stands out.

Last week China celebrated its New Year. We have entered the Year of the Snake. In Chinese culture the year of the snake is associated with prosperity, rebirth and good fortune.

Just prior to its weeklong celebration, the Chinese AI upstart DeepSeek released its groundbreaking R1 model, sending shockwaves through US equity markets and rattling investors. The R1 model has demonstrated performance comparable to leading AI systems like ChatGPT and Gemini, achieved with only a fraction of the training resources.

Lean, efficient, and unstoppable - like a snake, DeepSeek mirrors the legendary story of the snake in the Jade Emperor’s race, where it outsmarted the odds by hiding in the horse’s hoof and jumping ahead at the finish line.

Similarly, Chinese AI researchers faced steep odds, shackled by US semiconductor restrictions that blocked access to cutting-edge GPUs like Nvidia’s H-100. Yet DeepSeek turned the tables, making ingenious use of the less advanced H-800 to create an AI model that’s faster, cheaper, and more efficient.

This ‘snake-like’ ingenuity is a wake-up call to Western tech giants, who’ve grown almost too comfortable at the top. DeepSeek is more than just a disruptor - it’s proof that technological innovation remains a core driver of growth in China, and one more reason why Chinese equities deserve serious consideration in 2025.

Most investors have been underweight or have maintained zero exposure to China’s equity market since the end of COVID-19. For much of the period, between 2022 and early 2024, it was a challenging environment. During these 25 months, Chinese equities, as measured by the CSI 300 Index, endured 15 months of declines, with an average monthly loss of 7.6%. This was driven by a combination of faltering post-COVID economic recovery, persistent property sector challenges, and geopolitical tensions that eroded investor confidence.

However, periods of sharp gains, such as November 2022 (+28.9%), July 2023 (+9.3%), and September 2024 (+23.1%), underscores how quickly the landscape can change. During these periods, domestic policy stimulus was pivotal to reviving market confidence.

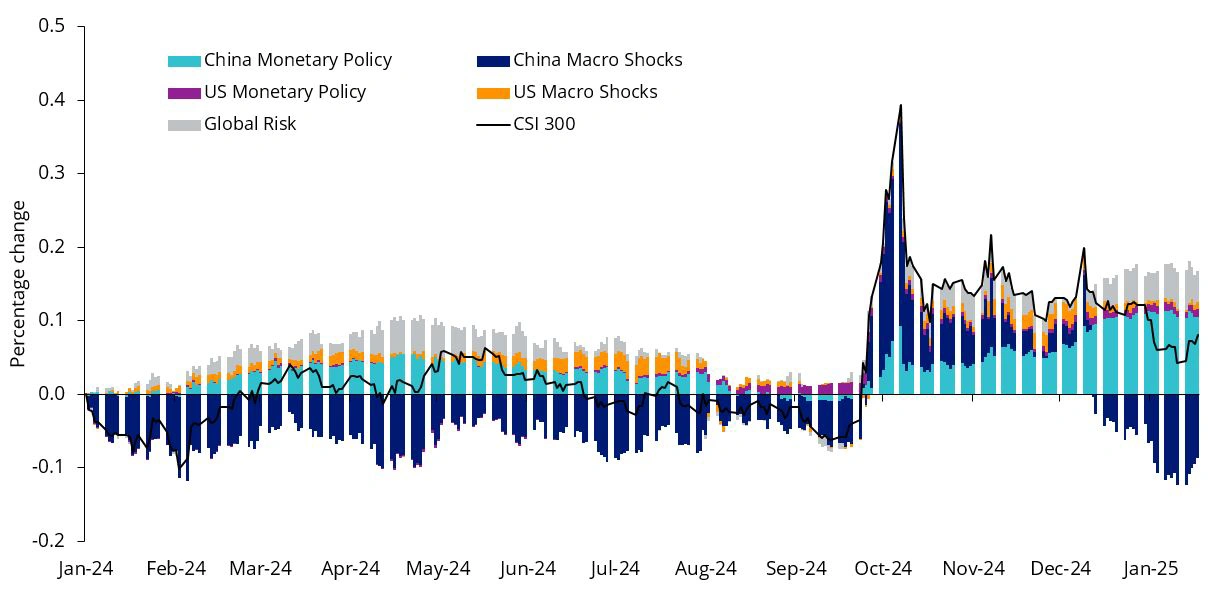

Bloomberg’s economic analysis highlights that domestic monetary policy, and macroeconomic developments exert a greater influence on Chinese equity performance than external factors, such as US monetary policy or global risks. Unlike smaller developed markets, such as Japan and Europe, which are deeply entwined with the Western economic framework, China retains greater autonomy in shaping its economic trajectory. This self-reliance, coupled with the government’s ability to deploy targeted stimulus measures, will be a key determinant of performance in 2025.

Chart 1: Main drivers of performance of Chinese equity markets

Source: VanEck, Bloomberg, January 2025. You cannot invest in an index. Past performance is not indicative of future performance.

Prior to the Chinese Lunar New Year, the Greater China Conference 2025 was held in Shanghai, offering valuable insights into China’s evolving economic landscape. Combined with recent policy announcements, the outcomes of the conference provide several compelling reasons for investor optimism. The Year of the Snake, symbolic of transformation and renewal, could mark a rebirth for China’s equity markets. Here are four reasons to be optimistic:

1. Proactive policy measures from the PBOC

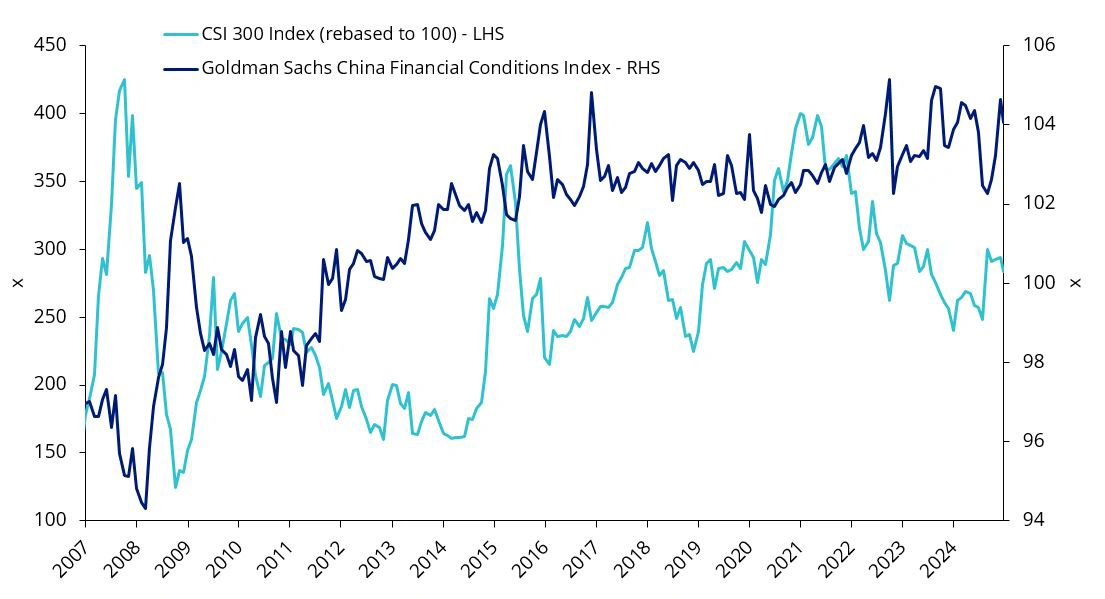

Since China’s top leadership, the Politburo, announced a shift to a “moderately loose” monetary policy for the first time since the Global Financial Crisis (GFC) in December last year, the People’s Bank of China (PBOC) has signalled a more systematic and proactive approach for 2025. This includes actively injecting liquidity into the market to stabilize the yuan and making targeted adjustments to policy rates to ensure financial stability. A more assertive policy stance in 2025, coupled with easing financial conditions, is expected to mitigate recession risks, support corporate earnings, and restore confidence in equity valuations.

Chart 2: Easing financial conditions will likely have a positive impact on equities

Source: VanEck, Bloomberg, January 2025. The Goldman Sachs China Financial Conditions Index is a measure of China’s financial conditions based on the aggregation of several key financial market variables capturing aspects such as credit availability, cost of funding, and currency strength.

In the lead-up to the Spring Festival, the Politburo introduced a series of bold measures to inject long-term capital into the market, a strategy reminiscent of Japan's historical efforts to boost market stability. Among the highlights was a requirement for state-owned insurers to allocate 30% of new premiums to equities starting in 2025, an unprecedented step to channel substantial capital into the market. Other policies included increasing mutual fund holdings in A-shares and launching a 100 billion yuan trial for long-term investments. These efforts, complemented by expedited ETF approvals and revised pension fund rules, sparked a brief rally in Chinese equities. While the full impact of these initiatives will take time to materialise, they represent a focused attempt to restore confidence and market stability as China heads into the "Two Sessions" in March.

2. Resilient trade dynamics amid global headwinds

China’s export surplus reached a record $990 billion in Q4 2024, highlighting its resilience and competitiveness amid global challenges. Beyond sheer volume, advancements in AI and advanced manufacturing have transformed China’s export profile, shifting toward higher value-added segments that enhance margins and bolster its global trade influence. These developments underscore China’s pivotal role in global value chains, even as it navigates geopolitical uncertainties.

Meanwhile, Trump’s delay of executive orders on tariffs marks a more measured and pragmatic approach to trade relations between the two superpowers. This move has provided relief by averting disruptions and stabilizing short-term trade dynamics.

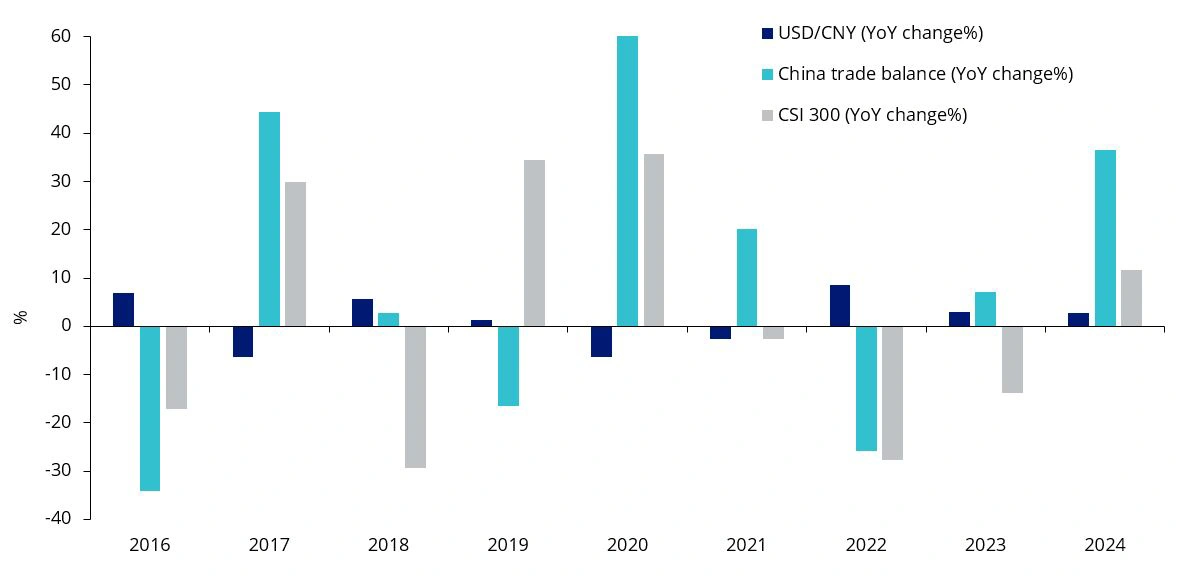

In addition, 2024 presented a unique trend in the relationship between the yuan, trade balance, and market sentiment. A weaker yuan has historically coincided with falling equities and declining trade balances due to feedback loops between currency depreciation, growth expectations, and market sentiment. This past year diverged from that pattern. Strong export performance and growth stimulus measures helped sustain growth expectations, offsetting typical negative impacts. In this environment, a weaker yuan bolstered export competitiveness and cushioned the effects of US tariffs, a dynamic that could extend into 2025 as trade resilience and proactive policies continue to shape economic and market outcomes.

Chart 3: 2024 an exception amid weak Renminbi

Source: Bloomberg, You cannot invest in an index. Past performance is not indicative of future performance.

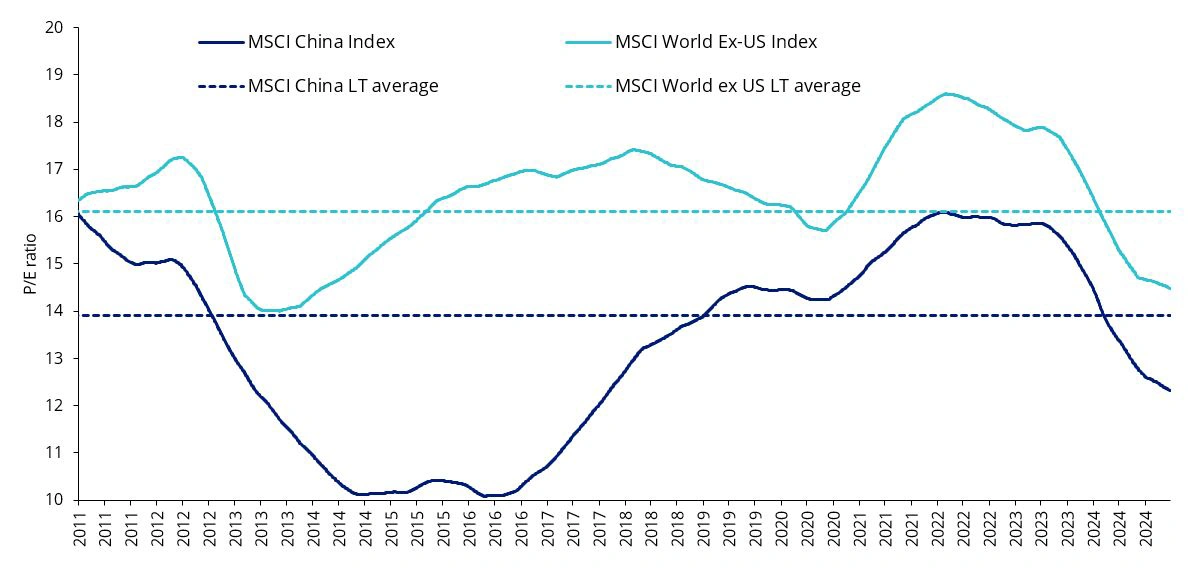

3. Attractive valuations for investors seeking deep value

From a valuation standpoint, Chinese equities are currently trading at historically discounted levels, excluding extraordinary periods such as the GFC and the COVID-19 pandemic. The rolling three-year P/E ratios remain well below their long-term averages, underscoring the market's attractive valuation backdrop. On a global scale, comparing to other ex-US markets, which are discounted relative to the US, Chinese stocks are particularly appealing.

Chart 4: Valuations at historical lows - China equities versus rest of the world ex US

Source: VanEck, MSCI, Bloomberg, January 2025.

For investors seeking dislocation opportunities, sectors tied to government spending, such as infrastructure and advanced manufacturing, present upside potential. Similarly, technology-related industries, especially those aligned with AI and semiconductor self-reliance, are well-positioned for growth in 2025, underpinned by resilient corporate fundamentals and a supportive policy environment.

4. Technological advancements as a pillar of growth

China’s rapid progress in technology, particularly in artificial intelligence, remains a standout theme. Bolstered by ambitious government initiatives to achieve AI leadership by 2030, the country’s tech giants are developing cutting-edge innovations that rival global leaders. A recent breakthrough by DeepSeek, an AI-powered biotech platform, exemplifies this trend. The platform’s advanced data analytics capabilities are revolutionising drug discovery and diagnostics, highlighting the intersection of AI innovation in China. Despite external challenges, China’s unparalleled data resources and deep AI talent pool provide a strong foundation for sustained growth in this critical sector.

While the path ahead is uncertain, the Year of the Snake may still bring opportunities for patient investors, supported by measured policy actions and selective market resilience.

As the world’s second-largest economy, China continues to captivate investors with its potential for growth and resilience amid challenges. But investors generally remain underweight China equities.

We think this could change in 2025. While uncertainties remain, such as execution risks and external pressures, China’s ability to chart its own economic course through domestic initiatives should not be overlooked.

Overall, we remain optimistic about China in the long-term, given the mainland’s strong fundamentals. Accessing China’s mainland equity market can be difficult. There are limited ways through which Australian investors can acquire China A-shares. VanEck has two ETFs that provide investors a way to participate in what may be the next growth phase for A-share investments: VanEck FTSE China A50 ETF (CETF) and the VanEck China New Economy ETF (CNEW).

CETF is a broad market capitalisation ETF, while CNEW is a smart beta approach providing targeted exposure to companies within the technology, health care, consumer staples and consumer discretionary sectors.

Patience and a long-term perspective may be rewarded as the Year of the Snake unfolds.

Key risks: An investment in CETF or CNEW carries risks associated with: China, financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 31 January 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.