Three reasons to allocate to emerging markets bonds now

1. Emerging markets bonds may help insulate a global bond portfolio from developed markets risks

Developed markets rates have risen sharply since pandemic-era lows, and bond investors in these markets are on track for a third straight year of losses. Central banks have been aggressively hiking rates, after falling behind the curve on inflation. More recently, long term yields have begun to rise to levels not seen in 15 years, as the market begins to price in a “higher for longer” environment amid persistent inflation, still hot economic data and rising fiscal problems. An eventual Fed rate cut would likely occur when recessionary risks are high, which would likely be adverse for developed markets corporate bonds, which are still very tight. In other words, a turn in rates is not the turn in risk. In contrast, emerging market central banks generally got ahead of inflation in the early days following the pandemic. Inflation has been declining, and real rates in many markets remain attractive, which has provided support to local currencies along with rising commodity prices. The lack of irresponsible fiscal policy in emerging markets stands in stark contrast to what is playing out in developed markets.

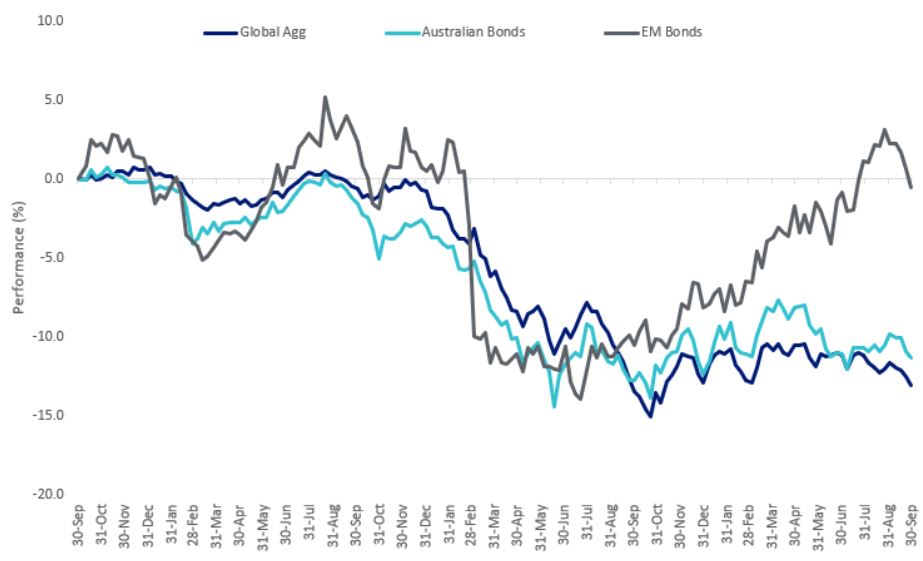

Given these diverging backdrops, it is not surprising that emerging markets bonds have been more resilient compared to both US and global investment grade aggregate bonds given the turmoil in those markets over the past few years. Given the long-term nature of the risks that continue to emanate from developed markets, we believe there is a strong case to allocate to emerging markets bonds to make a bond portfolio more resilient.

Emerging markets bonds have weathered the storm better

Source: Morningstar, as of 9/30/2023. All returns in Australian dollars dollars. Global Agg is represented by the Bloomberg Global Aggregate hedged to AUD Index; Australian Bonds is Bloomberg AusBond Composite 0+ Years; EM Bonds is represented by 50% J.P. Morgan EMBI Global Diversified/50% J.P. Morgan GBI-EM Global Diversified. This index is used to illustrate historical performance of the EM Bond market only. It is not the benchmark that EBND seeks to outperform. You cannot invest in an index. Past performance of the market is not a reliable indicator of future performance of the fund.

2. Emerging markets have lower debt

Notwithstanding China’s more recent policy direction, emerging markets, in general, moved quicker to increase interest rates compared to the US and other developed markets in order to stay ahead of inflation. For investors, this fundamental backdrop means less issuance and rolling over of debt, a favorable supply/demand dynamic that should help support emerging markets bonds. In addition, if needed, emerging marekts central banks can hike interest rates without bankrupting the government (unlike the challenges we saw in the United Kingdom or even the US during its budget showdowns).

Debt levels of emerging markets countries are relatively attractive

General Government Gross Debt, % GDP

Source: VanEck Research; Bloomberg LP. Data as of October 2023. Past performance is not indicative of future results.

3. Emerging markets have independent central banks

The primary focus of emerging markerts central banks is to focus on controlling inflation, and they do this by maintaining high real interest rates. For investors, the result has been not only higher nominal yields but higher real yields. The benefits to emerging markets local currency investors are a more substantial level of income that is not eroded by the loss of purchasing power (through a potentially weaker currency). Additionally, if the central bank's actions are successful in controlling inflation, it can lead to a stronger and more stable economy.

Emerging markets central banks’ focus on inflation means higher income for investors

Real Policy Rates in EM and DM (%), 12m from now if current expectations for rates and inflation materialise

Source: VanEck Research; Bloomberg LP. Data as of October 16, 2023.

Ex-Post Real Policy Rates in EM and DM, (%)

Source: VanEck Research; Bloomberg LP. Data as of October 2023. Past performance is not indicative of future results. Please see important disclosures and definitions at the end of the blog.

To take full advantage of the opportunities within emerging markets debt, we think it is necessary to take an unconstrained active approach, to avoid having the highest weighting to indebted, poorly run nations.

The VanEck Emerging Income Opportunities Active ETF (Managed Fund) (EBND) takes an active, high conviction and benchmark agnostic approach to investing across the EM bond spectrum (the benchmark is 50% J.P. Morgan Emerging Market Bond Index Global Diversified Hedged AUD and 50% J.P. Morgan Government Bond-Emerging Market Index Global Diversified).

Key risks:

An investment in the Fund carries risks associated with: ASX trading time differences, emerging markets bonds and currencies, bond markets generally, interest rate movements, issuer default, currency hedging, credit ratings, country and issuer concentration, liquidity and fund manager and fund operations. See the PDS for details.

Published: 25 October 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.