A major transformation in global bond markets

Global bond markets reflect developed economies becoming the new emerging markets. While portfolios remain underweight in emerging market bonds, we expect this to shift.

Another developed market, this time Japan, has disrupted global bond markets. Japan is an over-indebted developed market that once led the world in monetary experimentation, and it is now hiking rates despite an economic downturn. This follows market-unsettling elections in France, riots in the UK under a new Prime Minister, and heightened US political uncertainty. Japan’s current dilemma, we think, is consistent with our long-standing ‘fiscal dominance’ thesis.

Once again, a developed market has disrupted global markets

We think the issues arising from Japan’s rate hike and the subsequent market reaction is symptomatic of the premise that developed markets are the new emerging markets.

Early this year we released a white paper titled, Fiscal dominance: Emerging markets' upper-hand. According to the paper, fiscal dominance is an economic condition that arises when debts and deficits are so high that monetary policy loses traction.

A feature of fiscal dominance is government debt. Japan’s public debt is estimated to be more than US$10 trillion, or around 275% of GDP. The US Federal debt hit US$34 trillion dollars of debt this year (124%) while many developed European nations also have debt exceeding 100% of GDP.

Where, 25 years ago fiscal dominance may have characterised emerging market economies, it now appears to characterise developed markets and the shift in this dynamic has been reflected in the performance of bond markets.

Emerging markets bonds have outperformed developed markets bonds over the past 25 years.

This has coincided with the rising incidents of crises stemming from DMs. Since the turn of the century, DMs have been responsible for every major market crises.

Chart 1: Emerging markets and developed markets current account balances, % GDP

Source: Bloomberg, VanEck, August 2024

Japan’s plan to hike interest rates in a declining economy and increase government debt is unsettling. The country reflects the state of over-indebted developed markets governments that co-opted their central banks and are now paying the price. Japan hiked rates to compensate for the feared nominal interest-rate differential with the US. In our view, this is unsustainable. Other developed markets will face the same eventual hard trade-offs.

Our view is that the nominal rate-differential is too narrow and that the fiscal and central bank balance sheet adjustments are the bigger driver, in the long term. The yen’s weakness encouraged carry trades in emerging markets, which experienced washouts when the yen rallied. The short-term hit to carry trades has disappeared for now. What has been interesting is that China has been the key to insulating emerging markets.

China and the Chinese yuan are more influential than the yen in today’s global market environment. The yuan was a flight-to-safety currency during the yen-carry-trade washout, providing stability to other Asian emerging market local currencies. This is evidenced by the Malaysian ringgit’s 5% rally during the yen trade wash-out. However, China is not stepping in to rescue global demand as it did following previous developed market crises such as the GFC and the Covid lockdowns. The yuan and Chinese government bonds have been strong throughout this year’s risk events, despite a tight rate differential with the US. The low inflation in China, relative to its trading partners, has cheapened its real effective exchange rate (REER). Below you can see the REER calculation using manufacturing inflation. The US dollar is at historical highs, while the yuan is near 20-year lows. The yuan is stable and cheap and this insulated the Asian local markets.

Chart 2 – China’s REER vs. US REER (using manufacturing inflation)

Source: BofA Global Research, Bloomberg, Japan Research Institute

The fiscal dominance paper argued that emerging markets, relative to developed markets, will continue to perform well going forward, in particular local currency markets and as you can see this has been playing out in Asia.

And while many fixed income portfolios remain underweight emerging markets, we think it's only a matter of time before more and more investors will start including them in their portfolios.

As with anything – it pays to be selective

When selecting which emerging market bonds to include in your portfolio, it pays to be selective due to the idiosyncrasies between emerging market nations and the nuances between the different types of bonds available.

An active, unconstrained approach, like the one employed by the VanEck Emerging Income Opportunities Active ETF (Managed Fund) (EBND) allows investors to take full advantage of the opportunities within emerging market debt, while avoiding having the highest weighting to indebted, poorly run nations.

Emerging market bonds have significantly outperformed global bonds

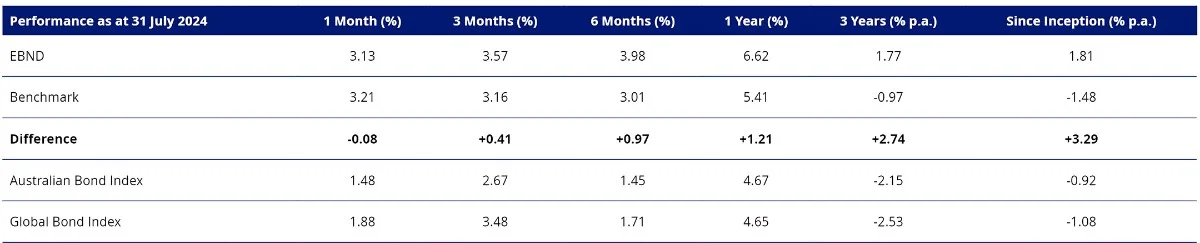

To illustrate the above, Table 1 below demonstrates that VanEck Emerging Income Opportunities Active ETF (Managed Fund) (EBND) has not only outperformed its performance benchmark - the 50% J.P. Morgan Emerging Market Bond Index Global Diversified Hedged AUD and 50% J.P. Morgan Government Bond Emerging Market Index Global Diversified, since its inception, but it has also outperformed broad Australian and global bonds indices. As always, we would say, past performance is not indicative of future performance.

Table 1: Trailing returns

Source: Bloomberg, VanEck. Inception date for EBND is 11 February 2020

Benchmark is 50% J.P. Morgan Emerging Market Bond Index Global Diversified Hedged AUD and 50% J.P. Morgan Government Bond Emerging Market Index Global Diversified. Australian Bond Index is Bloomberg Aus Bond Composite 0+ Years. Global Bond Index is Bloomberg Global Aggregate Index Hedged into AUD. The table above shows past performance of the Fund from its Inception Date. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. Fund results are net of management fees and costs, but before brokerage fees or bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of current or future performance which may be lower or higher.

EBND enables investors to access an actively managed and diversified portfolio of emerging market bonds via a single trade on ASX.

Key risks

An investment in the Fund carries risks associated with: ASX trading time differences, emerging markets bonds and currencies, bond markets generally, interest rate movements, issuer default, currency hedging, credit ratings, country and issuer concentration, liquidity, fund manager and fund operations. See the PDS for details.

Published: 21 August 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.