What is there to love about emerging markets?

Gain insights into the key factors positioning emerging markets equities as an attractive investment opportunity.

We think emerging markets (EM) equities are poised to outperform developed market equities because:

- Accommodative emerging market policy rates are as close to developed markets as they have ever been;

- Emerging markets has a superior 2024/25 EPS growth outlook;

- When you consider valuations, emerging market equities appear to be at levels not seen on over two decades; and

- The current geopolitical environment favours emerging markets

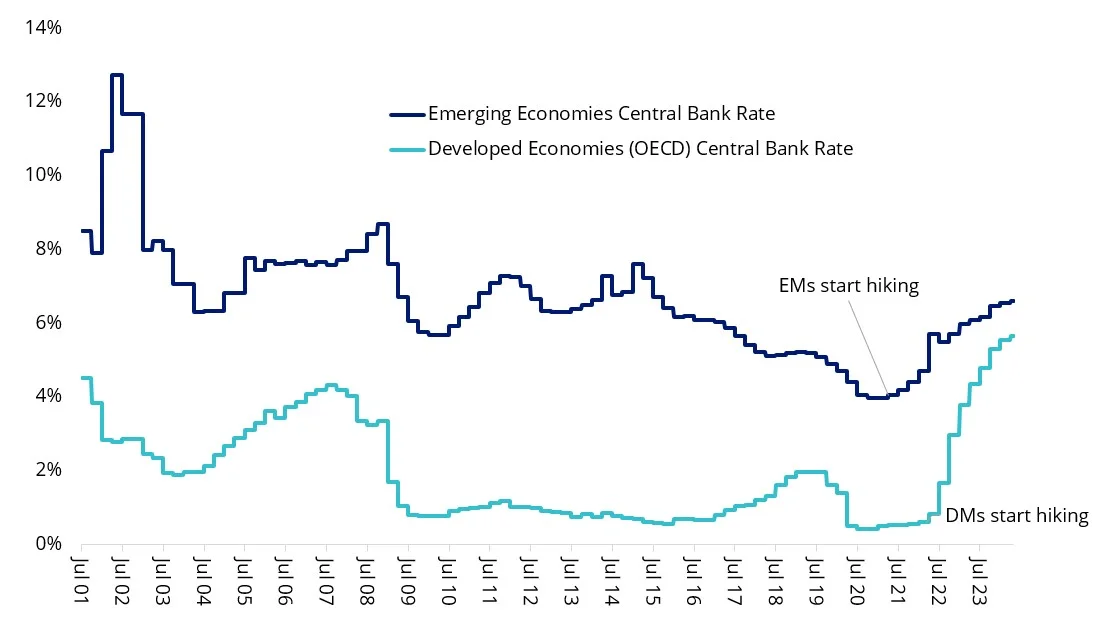

Emerging markets policy rates are converging with developed market rates

Emerging market central banks hiked earlier and faster than developed market central banks as inflation started to heat up during the COVID lockdowns. As a result of this monetary policy prudence many of these economies are experiencing rate cuts. Chile, Brazil and Mexico are among those economies experiencing accommodative rate cuts by their central bank authorities.

Chart 1: Interest rate convergence

Source: Bloomberg

Over the long term, a recent IMF paper found, “In large emerging markets, conservative projections of future demographic and productivity trends suggest a gradual convergence towards advanced economies’ real interest rates.” The lower rates in emerging markets reflect disinflation and policy credibility and this is, in turn, driving capital market demand.

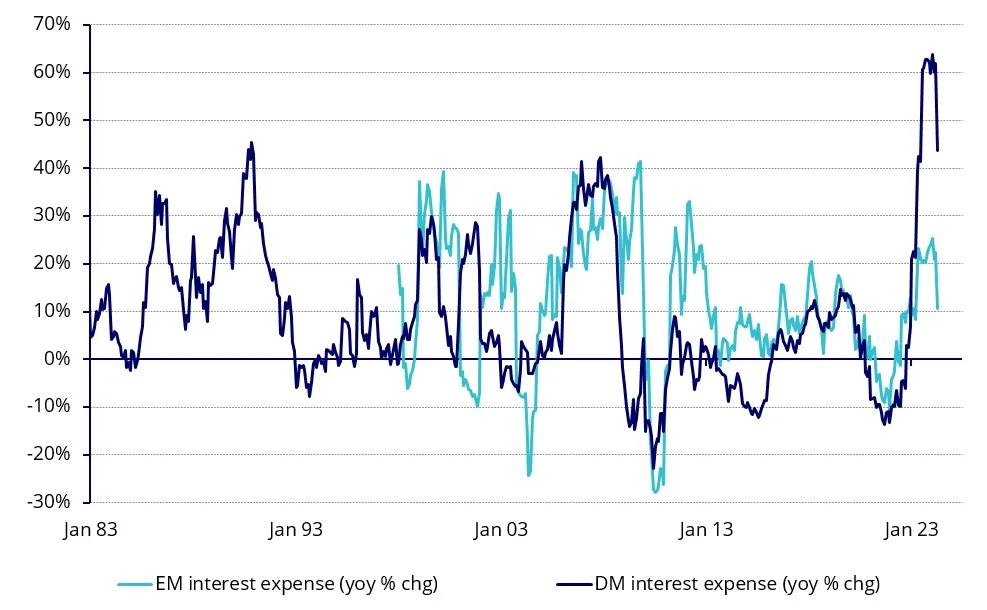

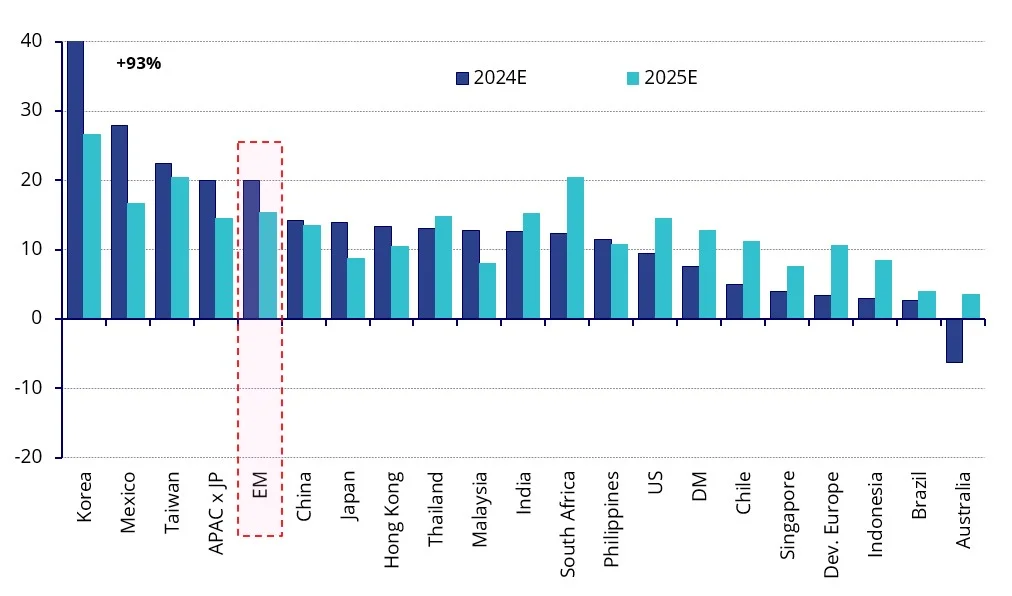

Emerging markets superior 2024/25 EPS growth outlook

This is good for local emerging market companies. You can see this in interest expenses. While developed markets were experiencing year-on-year (yoy) changes in interest costs in excess of 60%, EM’s yoy change peaked at less than half that. This has fed through to earnings with EM growth projections in emerging markets looking for favourable than DM over the next 12 months and 24 months.

Chart 2: Interest rate convergence

Source CSLA, Datastream - Refinitiv, 1 May 2024

Chart 3: Projected earnings per share (EPS) growth rates

Source: CSLA, IBES.

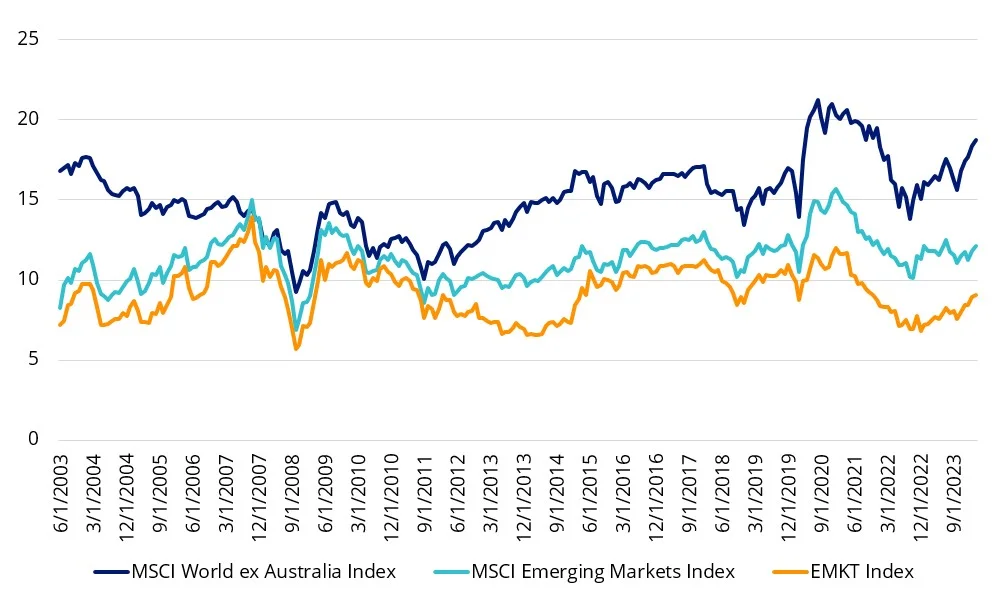

EM hasn’t been this cheap for a long time

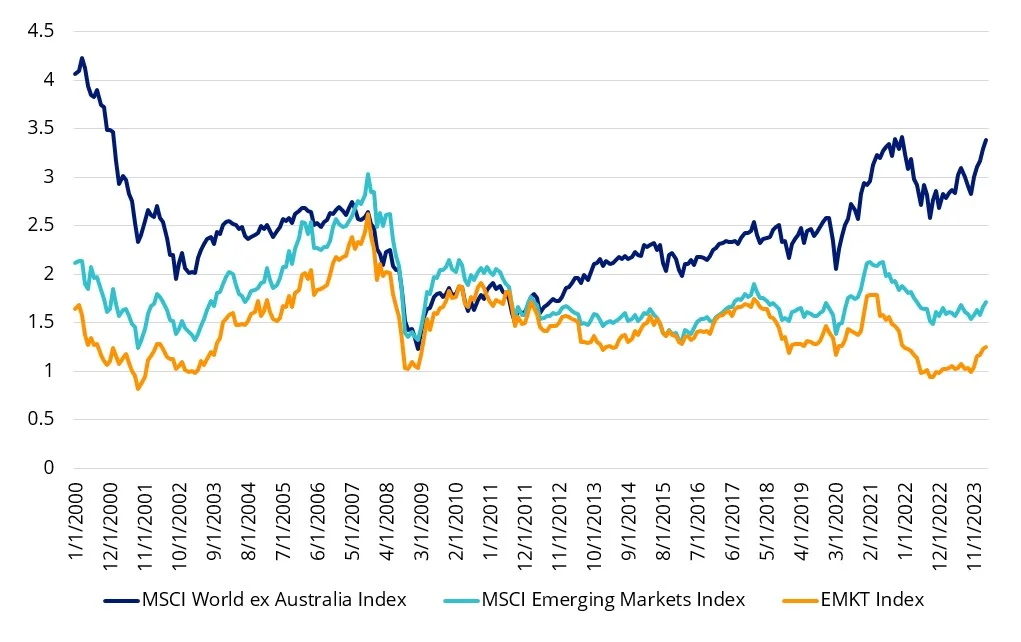

On a valuation basis emerging markets look compelling. While emerging markets have historically always traded at a discount to developed markets, on a forward price to earnings (P/E) basis, emerging markets haven’t been this cheap since the start of 2022.

Chart 4: Forward P/E of emerging markets indices and the developed market index

Source FactSet, MSCI to 31 March 2024. EMKT index is MSCI Emerging Markets Multi-Factor Select Index (AUD).

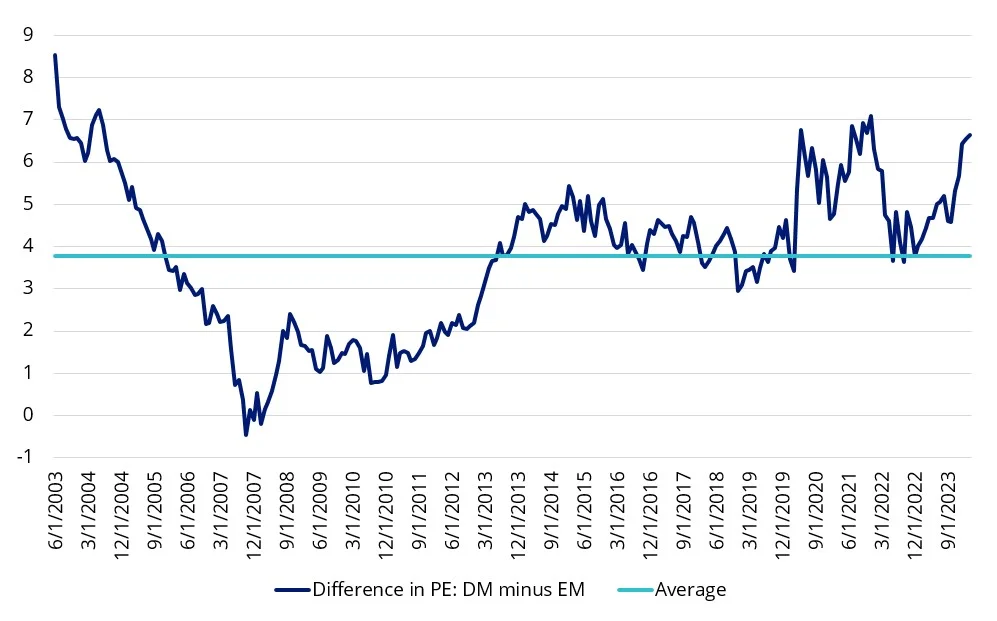

Chart 5: Forward P/E differential between developed markets (DM) and emerging markets (EM)

Source FactSet, MSCI to 31 March 2024. EMKT index is MSCI Emerging Markets Multi-Factor Select Index (AUD). Chart 5 shows the difference between the MSCI World ex Australia Index and the MSCI Emerging Markets Index.

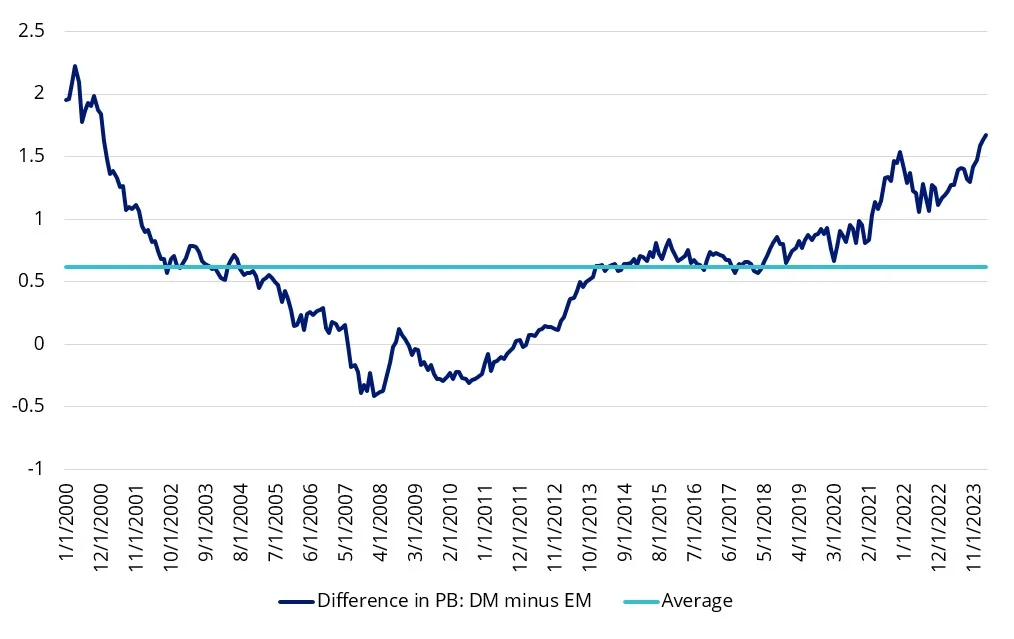

On a price-to-book basis, emerging markets haven’t been this cheap, relative to developed markets, since 2001.

Chart 6: Price to book emerging markets indices and the developed market index

Source: FactSet, MSCI to 31 March 2024. EMKT index is MSCI Emerging Markets Multi-Factor Select Index (AUD).

Chart 7: Price to book differential between developed markets (DM) and emerging markets (EM)

Source: FactSet, MSCI to 31 March 2024. EMKT index is MSCI Emerging Markets Multi-Factor Select Index (AUD). Chart 7 shows the difference between the MSCI World ex Australia Index and the MSCI Emerging Markets Index.

In addition, we would argue that the current geopolitical environment favours EM, as EM economies generally export more than they import, and they also benefit from high commodity prices/energy re-orientation. China’s reopening benefited its close neighbours such as Indonesia, Malaysia and Thailand. Thailand, for example, benefits from Chinese tourism (3% of GDP) and exports to China (24% of GDP).

Being selective in emerging markets

Emerging markets are known to be inefficient, so ripe for active managers to add value. In addition to being expensive, returns among active managers vary significantly from year to year because it is almost impossible for them to time factors in emerging markets. There is another approach.

EMKT tracks the MSCI Emerging Markets Multi-Factor Select Index (EMKT Index) which includes companies on the basis of four factors: Value, Momentum, Low Size and Quality. The four factors combined have demonstrated strong performance relative to the MSCI Emerging Markets Index.

EMKT has outperformed the MSCI Emerging Markets Index (benchmark) by 3.91% so far this year (11.96% versus 8.05%), as at 30 April 2024 and has outperformed on one, three and five years. As always, past performance is not a reliable indicator of future performance.

Emerging markets make up around 12% of MSCI’s All Country World Index, yet most Australians do not have proportionate international equity exposure to this asset class, fearing volatility and geopolitics. A concern for investors considering emerging markets in the past has been costs, with most active managers charging a premium for investing in these ‘exotic’ locations. EMKT’s management fee is just 0.69% p.a., the same as the equivalent EM market beta ETF, but with the potential for active-like returns.

Key risks:

All investments carry risk. An investment in EMKT carries risks associated with ASX trading time differences, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 09 May 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

EMKT is indexed to a MSCI index. EMKT is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to EMKT or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and EMKT.