India joins local emerging markets bond indices

Find out why India’s inclusion into J.P. Morgan's local GBI-EM indices marks an important milestone in its financial history.

At the end of June, Indian government bonds joined J.P. Morgan’s GBI-EM suite of local currency indices in the most significant reconstitution since China’s inclusion in 2020. After several years of discussions with regulators, the index provider and the foreign investor community to address operational issues, approximately US$400 billion worth of bonds were included with a 1% weight, expected to increase by 1% per month until reaching a maximum of 10%. The bonds entering the index are issued by the Reserve Bank of India (RBI) under the Fully Accessible Route (FAR) for non-resident investors, which do not have investment restrictions.

Inclusion may attract a broader base of investors by bringing more attention to the country’s local debt market, and it is estimated to drive approximately US$30 billion worth of passive inflows. This is in addition to about US$11 billion worth of inflows that occurred before index inclusion since the announcement last October. We believe that increased participation of foreign investors may provide additional support to the country’s economic progress.

High growth, but high debt

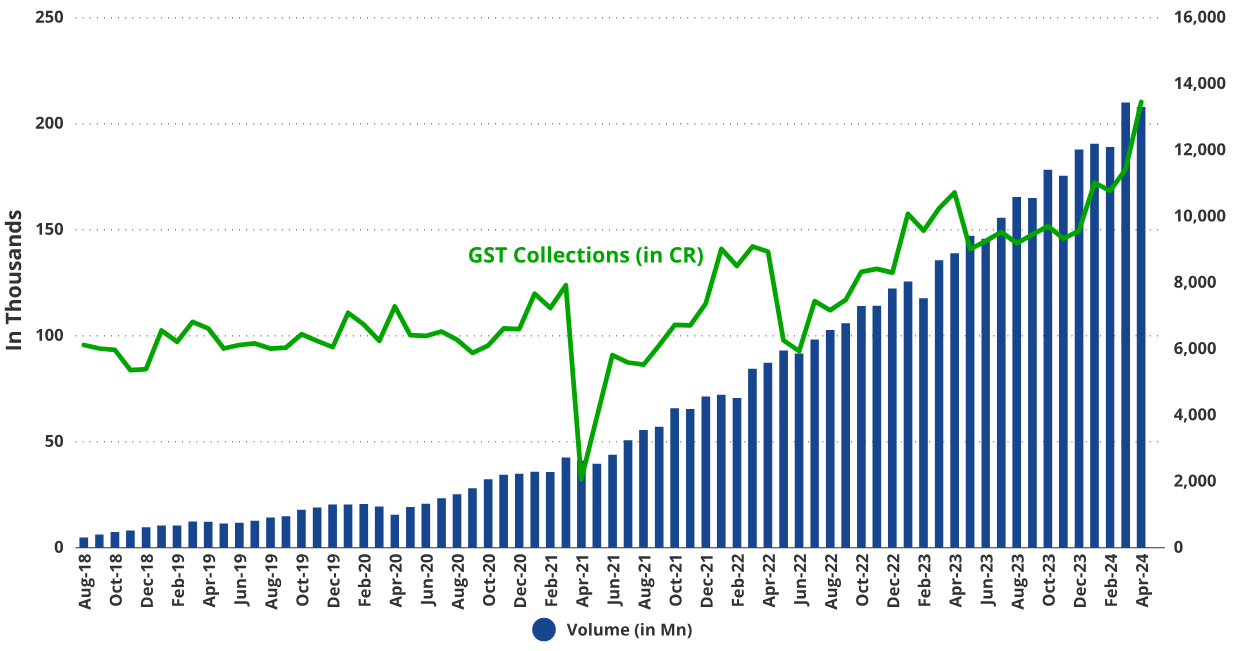

India’s GDP growth has made it a standout in the global economy. At the same time, however, the country has run elevated fiscal deficits and significant accumulated debt. Government spending on subsidies, social welfare programs, infrastructure projects and interest payments on previous borrowing have led to a persistently high deficit. This worsened after the COVID-19 pandemic, driving the deficit to its historical peak. As the pandemic’s impact lessened, economic activity resumed, businesses reopened, and consumer spending increased, the latter of which became a major catalyst for higher Goods and Services Tax (“GST”) collections (more on this later).

Persistent fiscal deficits have led to significant debt issuance. At 82.5% of GDP, India has one of the highest public debt levels among emerging markets. But, one can argue that India’s strong economic growth can support its fiscal spending and high debt levels. Nonetheless, debt investors should continue to monitor the country’s fiscal policies, particularly following President Modi’s narrower-than-expected victory which may impact the potential for reform. Indian bond yields have increased following the election outcome. Meanwhile, S&P Global Ratings raised its rating outlook for India to “positive” from “stable” in May saying they expect growth momentum and fiscal stability to continue regardless of the election outcome, supporting the agency’s positive outlook on India’s credit profile. The increased foreign capital into domestic debt markets may also provide additional flexibility to finance the government’s ongoing fiscal priorities.

A rising digital power

India’s advancements in digital technology have driven impressive levels of financial inclusion (approximately 90% of residents over the age of 18 have accounts with financial institutions vs. 20% a decade ago).1Increased financial participation can positively impact the country’s economic profile by bringing more activity into the formal economy. The Unified Payments Platform (UPI) has been one of the most crucial pillars of India’s digital payments growth, as it has allowed for efficient electronic payments, even for those without a debit or credit card. Amid the COVID-19 pandemic and aided by the Indian government’s push for cashless transactions, UPI transactions surged, boosting economic activity within the country. This has also driven a significant improvement in tax compliance and transparency. It is now easier for the authorities to track and collect taxes since the digital transactions in the system provide a clear economic activity record.

As these digital payments increasingly become a part of people’s lives, economic formalisation continues to benefit from better transparency and a broader tax base. India’s GST collections are expected to grow at more than 7% monthly over the current fiscal year, which provides increased revenue for the continued investment in infrastructure and other projects, as well as support to the country’s credit profile.

Chart 1: India’s goods and services tax collections are surging

Source: India Ministry of Finance, National Payments Corporation of India (NPCI).

Looking ahead

India’s inclusion into J.P. Morgan’s GBI-EM suite marks an important milestone in its financial history by increasing foreign investor participation in the country’s domestic bond market. The country’s advancements in digitalisation have proven effective in increasing financial inclusiveness efforts and tax revenues. The country’s impressive economic growth has supported its ability to maintain its spending and debt levels. However foreign bond investors and rating agencies will continue to monitor the progress achieving the government’s stated goals to narrow its fiscal deficit in coming years.

The VanEck Emerging Income Opportunities Active ETF (Managed Fund) (EBND) has 1.4% of its portfolio in India as of 30 June 2024.

Key risks

An investment in the Fund carries risks associated with: ASX trading time differences, emerging markets bonds and currencies, bond markets generally, interest rate movements, issuer default, currency hedging, credit ratings, country and issuer concentration, liquidity, fund manager and fund operations. See the PDS for details.

Sources1

Nearly 90% adults had accounts with financial institutions in FY21.

Published: 25 July 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.