The unexpected home of higher yields

Developed markets are the new emerging markets of global bond markets, and we think the performance is reflecting this shifting dynamic.

Five years ago, just before the nation went into lockdown for the COVID crisis, we launched our first Active ETF, the VanEck Emerging Income Opportunities Active ETF (Managed Fund) (EBND).

This fund had been running as an Active Emerging Market Debt strategy since 2012. In 2020 we decided to make this strategy available to Australian investors, identifying it as an opportunity that was difficult to access and which Australian investors had little to no exposure, despite its appealing risk/return characteristics.

Beyond this, the appeal of the asset class is:

- Diversification; and

- Potentially higher income

Ahead of launching EBND, Australian and global developed market (DM) bond yields were extremely low. The higher yields available on emerging market (EM) debt, we thought, could provide investors with the potential for higher income without adding significant risks. An active approach, unconstrained by indices, such as the approach used by VanEck, allows for consideration of all of the opportunities within emerging market debt, while managing risk. You don’t, for instance, want to have the highest weighting to the most indebted, poorly run nations.

The launch of EBND, coincided with members of VanEck’s active emerging markets bond team visiting Australia for a roadshow. It also coincided with the first reported COVID cases in Australia.

On 27 February 2020, the Prime Minister activated the Australian Health Sector Emergency Response Plan as the rapid spread of the virus outside of China prompted the government to elevate its response. This led to lockdowns and equity market turmoil.

The EBND roadshow was cut short, and our visiting portfolio managers were on the last few commercial flights out of Australia.

Throughout this turmoil, our head of emerging market debt, Eric Fine, was confident that emerging markets bonds were going to weather this storm as well as, if not better than, they had in 2008 after the GFC.

Was he correct? Now EBND has been running for five years, we have an opportunity to review its medium-term performance.

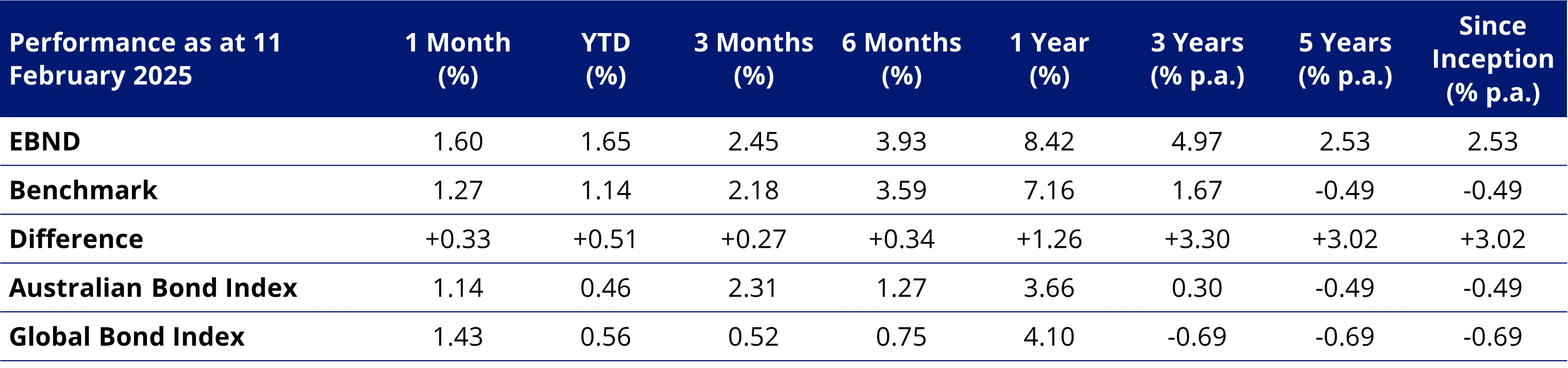

Stellar performance: Emerging market bonds have significantly outperformed global bonds

EBND has not only outperformed its performance benchmark, it has also outperformed the Bloomberg AusBond Composite Bond 0+ Yr Index and the Bloomberg Global Aggregate Index Hedged into AUD index. As always, we would say, past performance is not indicative of future performance.

Table 1: Trailing returns

Source: Bloomberg, VanEck. Inception date for EBND is 11 February 2020. Benchmark is 50% J.P. Morgan Emerging Market Bond Index Global Diversified Hedged AUD and 50% J.P. Morgan Government Bond Emerging Market Index Global Diversified. Australian Bond Index is Bloomberg Aus Bond Composite 0+ Years. Global Bond Index is Bloomberg Global Aggregate Index Hedged into AUD. The table above shows past performance of the Fund from its Inception Date. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. Fund results are net of management fees and costs, but before brokerage fees or bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of current or future performance which may be lower or higher.

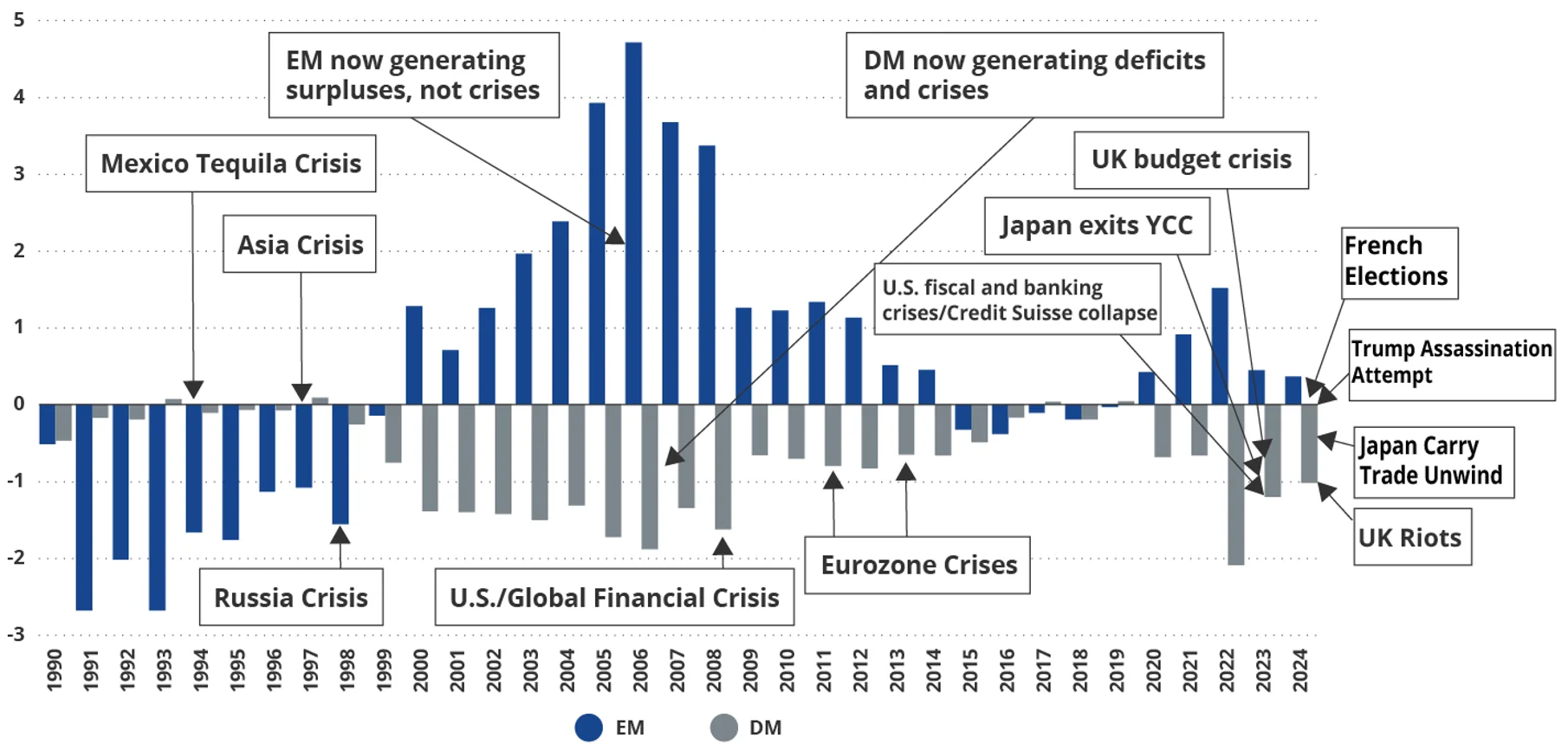

EM is the new DM

Last year typified the issues in developed market bond markets. When Japan’s central bank started hiking, the subsequent market reaction was symptomatic of the premise that developed markets are the new emerging markets. Japan’s dilemma, like the UK’s before it, was too much debt. This is consistent with our long-standing ‘fiscal dominance’ thesis. Fiscal dominance is an economic condition that arises when debts and deficits are so high that monetary policy loses traction.

Last year we released a white paper titled, Fiscal dominance: Emerging markets' upper-hand.

Japan’s public debt is estimated to be more than US$10 trillion, or around 275% of GDP. The US Federal debt hit US$36 trillion dollars in 2024 (124% of GDP), while many developed European nations also have debt exceeding 100% of GDP.

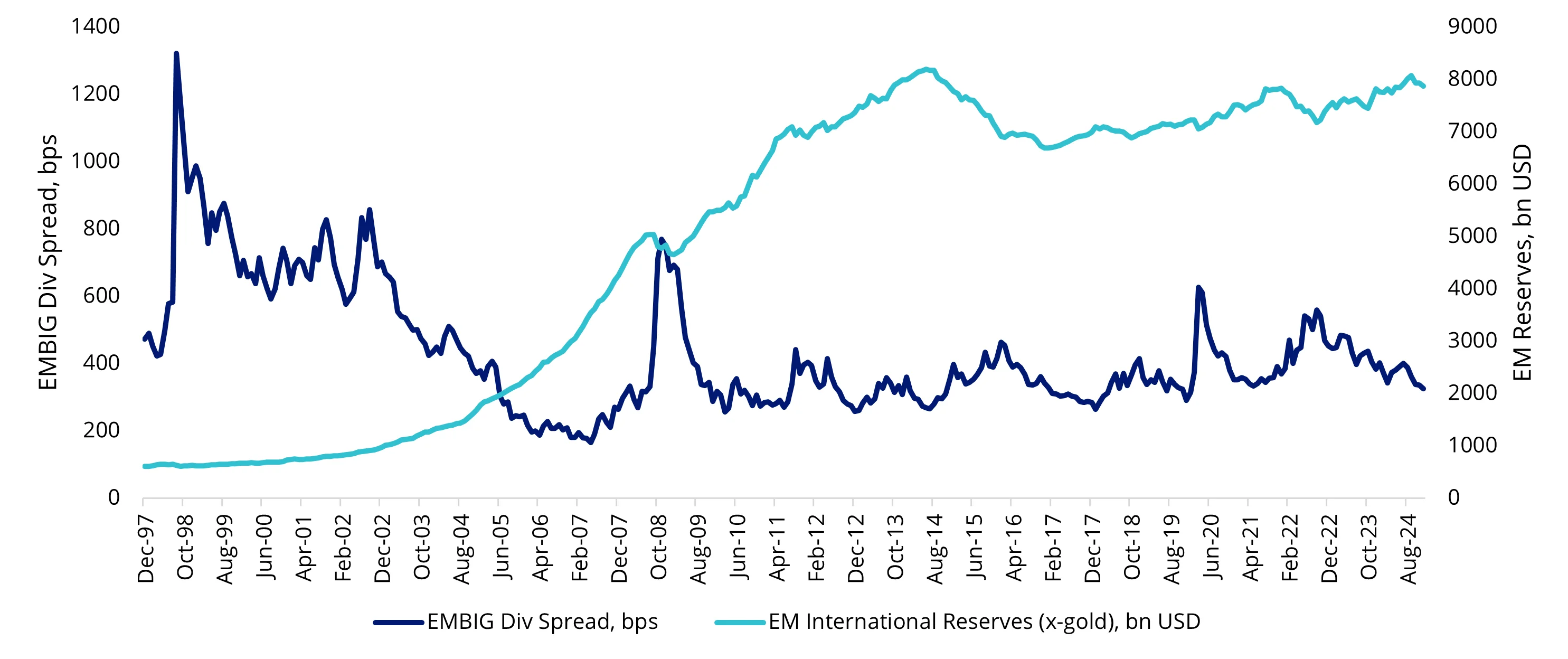

Where, 25 years ago fiscal dominance may have characterised emerging market economies, it now appears to characterise developed markets. The shift in this dynamic has been reflected in the performance of bond markets, with spreads tightening on emerging markets since the EM crises at the end of last century.

Chart 1: Emerging market reserves and spreads

Source: Bloomberg LP, as of December 2024.

Many emerging market economies are as structurally sound and well managed as developed market economies, and in many cases better. Current accounts and government budgets are largely in check. Policymakers, appealing to ever-growing and better-educated middle classes, are encouraging savings and pension reforms, which is driving capital investment. Because of past crises, many emerging markets were forced to be fully transparent with their data to garner support from foreign investors and global monetary funds, often for the first time. As a result, many are now structurally stronger than their developed market counterparts that have not had such discipline.

Emerging market bonds have outperformed developed market bonds over the past 25 years.

This has also coincided with the rising incidents of crises stemming from developed markets. Since the turn of the century, developed markets have been responsible for every major market crisis.

Chart 2: Emerging markets and developed markets current account balances, % GDP

Source: Bloomberg, VanEck, August 2024

The fiscal dominance paper argued that emerging markets, relative to developed markets, will continue to perform well going forward, in particular in local currency markets, and we have seen this playing out in Asia.

And, while many fixed-income portfolios remain underweight emerging markets, we think it's only a matter of time before more and more investors start including them in their portfolios.

Because of the idiosyncrasies between the nations included in the emerging markets universe and the nuances between the different types of bonds available, we think an active, unconstrained approach, like the one employed by EBND, is an ideal way for investors to access this important asset class.

Table 2: EBND statistics

Source: Bloomberg, VanEck. ^yield measures are not a guarantee of future dividend income from the funds.

Key risks

An investment in the Fund carries risks associated with: ASX trading time differences, emerging markets bonds and currencies, bond markets generally, interest rate movements, issuer default, currency hedging, credit ratings, country and issuer concentration, liquidity, fund manager and fund operations. See the PDS for details.

Published: 18 February 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.