The US dollar price is right: Why emerging market equities are appealing now

Last week Goldman Sachs suggested that the US dollar could be closer to peaking than markets think, even as inflation continues and the Fed remains committed to eradicate it. Should the US dollar be nearing its peak, now could be the time to consider emerging market equities. Not all companies in the MSCI Emerging Markets Index however are desirable, from an investment stand point.

We believe, as we may be approaching peak US dollar, this is an attractive entry point for emerging markets equities: valuations are attractive relative to history and to developed markets. In addition to long term tail winds, emerging markets are better positioned than they have been in previous periods of uncertainty. Most emerging markets have lower reliance on foreign borrowing and higher foreign exchange reserves than during previous periods of US monetary tightening, which has been a significant headwind in the past. However not all emerging markets’ companies are desirable from an investment perspective and quantifying factors in emerging markets is near impossible for non-institutional investors.

Last week Goldman Sachs suggested that the US dollar could be closer to peaking than markets think, even as inflation continues and the Fed remains committed to eradicate it. Citing dollar peaks in the 1970s and 1980s, periods that corresponded to high US inflation and weak global growth the note said, "Those parallels suggest it may not be necessary to see the Fed having eased substantially or inflation at the bottom for the Dollar to peak; and that an earlier peak is possible once it is clear US rate hikes may be approaching a pause, or if Fed communication pivots credibly, even if US activity is still slowing."

Emerging markets have been affected by the current rise of the US dollar. Since the beginning of the year emerging markets, as represented by the MSCI Emerging Markets Index, have fallen over 20%.

Should the US dollar be nearing its peak, now could be the time to consider emerging market equities.

Valuations are compelling

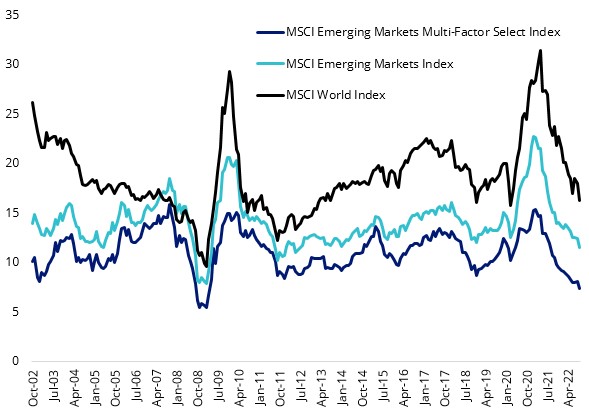

Right now, EM equities look compelling from a valuation standpoint and are trading at their lowest levels in a number of years. EM equities, as represented by the Emerging Markets benchmark are currently trading at 29% and 41% discount on a price-to-earnings (P/E) and a price-to-book (P/B) basis to developed markets respectively. The MSCI Emerging Markets Multi-Factor Select Index, that includes a value consideration is even cheaper, trading at its lowest level since the GFC.

Chart 1: P/E of Developed Markets and Emerging Markets

Source: MSCI, October 2002 to September 2022. You cannot invest in an index.

Chart 2: P/B of Developed Markets and Emerging Markets

Source: MSCI, October 2002 to September 2022. You cannot invest in an index.

Why emerging markets?

For investors, the steep drop in all equity markets so far this year has them wondering where there is value and long-term opportunity. There are a few reasons we believe emerging markets are one of the most mispriced asset classes, with valuations at their lowest levels in some time:

- The mismatch between the size of emerging markets economies and the size of their capital markets creates a long-term opportunity for investors. In addition, these capital markets are evolving, emerging to become as strong and competitive as developed markets in some instances.

- Emerging markets are responsible for over 50% of the world’s GDP, yet their equity markets only represent less than 15% of the market capitalisation of all international equities.

- Demographic and urbanisation trends should provide supportive tailwinds for long-term growth. 87% of the world’s population is in emerging markets, and these populations are younger than developed markets. Over 75% of the world’s population aged between 15 and 24 are living in developing and emerging markets.

We have said this before, but many emerging markets have matured. Traditionally, the investment returns have been closely corelated to the rise and fall of commodities and global growth expectations. Over the past 20 years this has been changing. Many of the world’s leading technology, consumer and healthcare companies are listed on emerging markets exchanges.

Emerging markets themselves are not a monolith. Many have learned from the lessons of the past, and undertaken economic reforms, as a result these economies may be able to achieve a more stable and higher level of growth. Many emerging market economies are better able to implement counter-cyclical fiscal expansion to reignite domestic growth because of their growing foreign reserves, strong budgets and robust balance of payments. This helps the companies in these countries. Additionally, many emerging markets hiked higher and earlier than most developed markets and are not hampered by the after effects of unorthodox monetary policy, therefore many emerging markets companies are coming out the other side of inflationary cost pressures with higher forward earnings growth.

Not all companies in the MSCI Emerging Markets Index however are desirable, from an investment stand point. This is where being selective in emerging markets equities can come to the fore.

Investing in emerging markets is no easy feat

Selective investment in emerging markets has traditionally been the domain of expensive active managers, and returns between them vary significantly from year-to-year. This is because it is almost impossible for active managers to time factors in emerging markets.

The VanEck MSCI Multifactor Emerging Markets Equity ETF (ASX: EMKT) tracks the MSCI Emerging Markets Multi-Factor Select Index (EMKT Index) which includes companies on the basis of four factors: Value, Momentum, Low Size and Quality. The result is a portfolio of 230 companies diversified across 27 countries.

EMKT has outperformed it’s benchmark since it launched on ASX in 2018. As always, this is not indicative of future performance.

Table 1: EMKT performance as at 25 October 2022

Source: VanEck, Morningstar Direct.

#EMKT inception date is 10 April 2018 and a copy of the factsheet is here.

Performance is calculated net of management costs, calculated daily but do not include brokerage costs or buy/sell spreads of investing in EMKT. Past performance is not a reliable indicator of future performance.

The MSCI Emerging Markets Index (“MSCI EMI”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of emerging markets large- and mid-cap companies, weighted by market capitalisation. EMKT’s index measures the performance of emerging markets companies selected on the basis of their exposure to value, momentum, low size and quality factors, while maintaining a total risk profile similar to that of the MSCI EMI, at rebalance. EMKT’s index has fewer companies and different country and industry allocations than MSCI EMI. Click here for more details

EMKT’s performance, to the end of last month, puts it in the top quartile of active peers over one, two and three years.

Chart 3: Performance relative to active emerging market manager peer group

Source: Morningstar, to 30 September 2022. Past performance is not a reliable indicator of future performance. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. Results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads. Returns for periods longer than one year are annualised. Peer group Equity Region Emerging Markets funds invest in companies listed in emerging markets from around the globe. Emerging market securities typically account for at least 75% of the portfolio.

Key risks: An investment in the ETF carries risks associated with: ASX trading time differences, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 03 November 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

View Index provider disclaimers. Index providers for VanEck funds do not sponsor, endorse or promote the funds.