How global healthcare can boost portfolio immunity

Healthcare stocks are benefitting from a boom in healthcare spending as populations age around the world. With the covid-19 pandemic too boosting demand for healthcare products and services, investors in the sector will likely reap the benefits of rising demand for healthcare in the long term.

Yet Australian investors are generally underweight healthcare stocks. The local listed company sector is relatively small and dominated by CSL (ASX: CSL) with just a few other stocks from which to choose. An allocation to global healthcare is important to get a diversified exposure to different healthcare subsectors and companies. Otherwise local investors risk missing out on the expected boom in spending.

Global healthcare expenditure accounted for around 10 per cent of the world’s GDP, or US$11 trillion, as at 2018. With global GDP projected to grow to US$137 trillion ($190 trillion) by 2030, and healthcare expenditures forecast to remain at 10 per cent of GDP, this translates into over US$13 trillion in healthcare spending each year by the decade’s end.

Separate forecasts from Deloitte predict global healthcare spending will rise at a compound annual growth rate (CAGR) of 5 per cent from 2019 to 2023. The firm’s Global Health Care Outlook notes that governments worldwide are upping expenditure by adopting universal healthcare coverage.

A separate report from the World Health Organisation notes that the health sector continues to expand faster than the global economy. Between 2000 and 2017, global health spending in real terms grew by 3.9 per cent p.a. while the economy grew 3.0 per cent p.a.

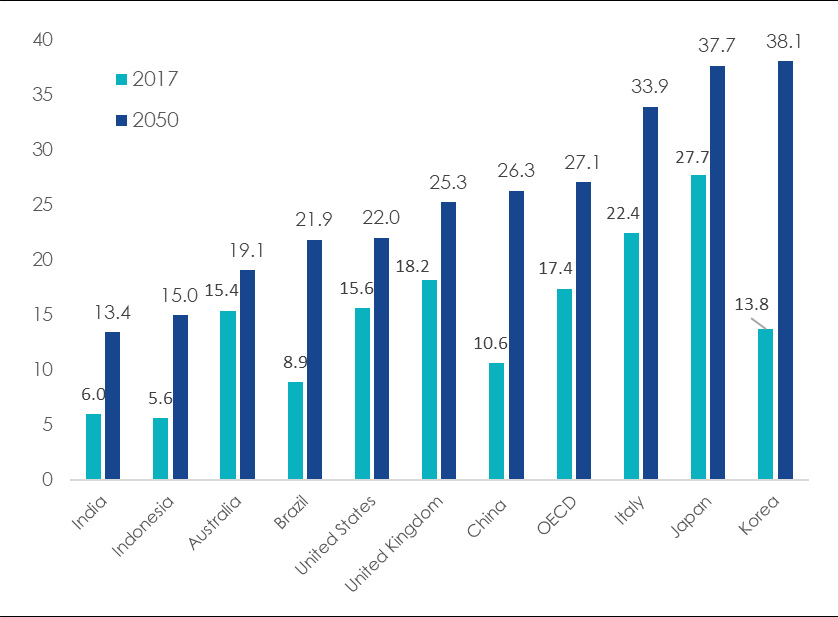

The combination of global population growth, ageing demographics and the prevalence of chronic diseases is driving demand for healthcare. Except for a few large "young" countries such as India and Indonesia, ageing demographics is a global phenomenon. As people age, healthcare spending rises significantly. The chart below shows the expected jump in the proportion of people aged over 65 years by 2050 of the total population.

Source: OECD Health Statistics 2019; OECD Historical Population Data and Projections Database, 2019.

As emerging economies continue to grow faster than developed economies, they will acquire the resources to provide more and better healthcare to their citizens. The gap in healthcare expenditures by emerging nations compared to advanced economies is closing. But emerging economies will need massive levels of healthcare expenditures to catch up.

It is multinational healthcare companies that will mostly meet the demand for products such as medicines and healthcare equipment in these emerging nations and elsewhere. The world’s five most populous countries in 2050 (excluding the US) will be India, China, Nigeria, Pakistan and Indonesia.

Their current average healthcare expenditure as a proportion of GDP in 2017 was 3.7 per cent, compared to an OECD member average of 12.5 per cent and 17 per cent in the US. As part of their catch-up, their healthcare spending as a proportion of GDP will need to increase significantly. This will put huge demand on healthcare providers in developed nations supplying pharmaceuticals and healthcare equipment to emerging nations.

Chronic disease adds to demand

Across the globe, as the population ages, chronic diseases will also drive demand for healthcare and consumption of medicines. People with chronic conditions and diseases are intensive users of health services, and the associated costs of care tend to be much higher. For example, the UK Department of Health and Social Care estimates that 70 per cent of total health funding in England is spent on services for 30 per cent of the population that have long-term conditions.

People suffering chronic diseases will push up consumption of pharmaceuticals. In OECD countries between 2000 and 2017:

- use of blood pressure drugs increased by an average of 70 per cent;

- consumption of cholesterol lowering drugs increased by a factor of three;

- use of anti-diabetic drugs doubled; and

- anti-depressant usage also doubled.

With the ageing of the population will come more chronic disease requiring intensive treatments. Multinational pharmaceuticals companies are reaping revenues from this increased demand.

Add immunity with healthcare

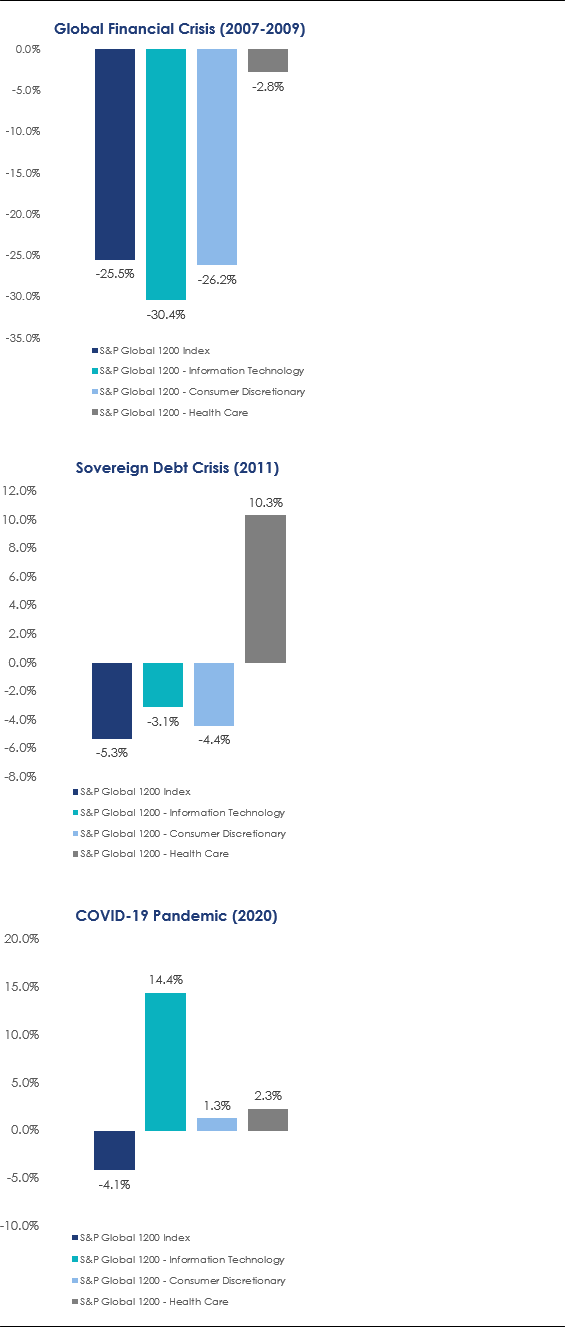

Because of the non-discretionary nature of healthcare spending, it is a relatively defensive investment. Healthcare is a basic need. The current covid-19 pandemic illustrates how important it is for countries to invest in their healthcare systems. Among the three global growth sectors – technology, healthcare and consumer discretionary—healthcare returned 2.3 per cent from 1 January to 30 June and during the pandemic, as the chart below shows, while the overall global share market fell. Healthcare also outperformed technology, consumer discretionary shares and the overall market during the GFC and the sovereign debt crisis, as the charts below show.

Sources: Bloomberg, MarketGrader, 1 Jan 2007 to 31 December 2009, 1 Jan 2011 to 31 December 2011, 1 Jan 2020 to 30 June 2020

In terms of long-term returns, the returns on global healthcare have been very attractive. Only the technology sector has performed better since 2008.

However healthcare is far more defensive than technology; it helps to provide some level of immunity during market sell-offs.

This article was originally published by Morningstar.

Published: 03 September 2020

This information is general in nature and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision investors should read the product disclosure statement and with the assistance of a financial adviser consider if it is appropriate for their circumstances. The PDS has been lodged with ASIC. A copy is currently available from our offices and will be available after the end of the exposure period at www.vaneck.com.au or by calling 1300 68 38 37.

HLTH is subject to investment risk, including possible loss of capital invested. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the fund. HLTH invests in international markets that have heightened risks compared to the typical risks associated with investing in the Australian market. These include foreign currency, ASX trading time differences, country or sector concentration, political, regulatory and tax risks. The PDS details the key risks.