The unlikely heroes that won the financial markets in FY24

Uncover the key drivers behind the leading asset classes of FY24. Here are the insights into why alternative assets dominated.

The top-performing investments in the 12 months to 25 June 2024 were alternative asset classes. We explore investing in global private equity, listed private credit and gold.

Besides the hover boards and self-lacing shoes (both of which were subsequently invented in real life), one of the most noteworthy things in the 1989 movie Back to the Future 2 was a sports almanac. The innocuous-looking tome with sports scores from 1950 to 2000 rewrote the destiny of Marty McFly’s arch nemesis Biff, transforming him from a down-on-his luck curmudgeon to the richest and most powerful man in Hill Valley.

Alas, we don’t have a sports almanac to share with you, but we do have information that could potentially improve your lot in life through good old-fashioned smarter investing.

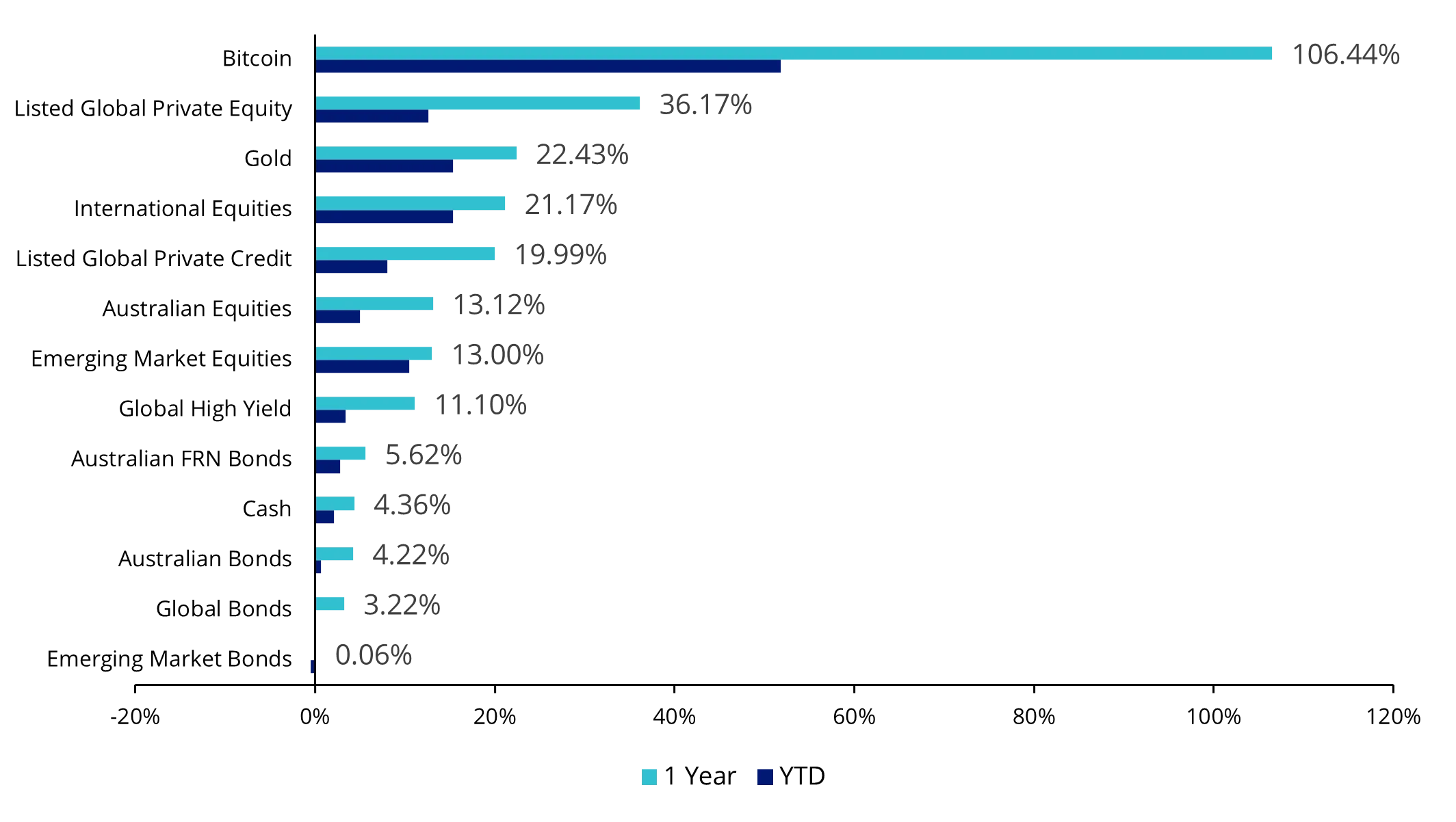

The VanEck 2024 Alternative Assets Outlook is a recent analysis we did on the best-performing asset classes in the 12 months to 25 June 2024. To anyone who follows the markets, it would be no surprise to see bitcoin leading the charge, with a return of 106%. But the asset classes that follow may be somewhat of a surprise.

Watch a 2 min summary of Portfolio Compass:

Listed global private equity had a return of 36.17%, followed by gold at 22.43%, then international equities at 21.17%, followed by listed global private credit at 19.99%.

Again, given we don’t have access to a time machine, past performance is not an indicator of future performance. However, using our deep investment management and capital markets experience, we can provide educated insights how these alternative assets shot to the head of the class, a 12 month outlook, and why they deserve consideration for an allocation in investment portfolios.

Chart 1: Asset class performance as at 25 June 2024

Source: Bloomberg, 25 June 2023 to 25 June 2024, returns in Australian dollars. International Equities is MSCI World ex Australia Index, Australian Equities is S&P/ASX 200 Accumulation Index, Gold is Gold Spot US$/oz, Global Bonds is Bloomberg Global Aggregate Bond Hedged AUD Index, Cash is Bloomberg AusBond Bank Bill Index, Australian Bonds is Bloomberg AusBond Composite 0+ yrs Index, Emerging Market Bonds is 50% J.P. Morgan Emerging Market Bond Index Global Diversified Hedged AUD and 50% J.P. Morgan Government Bond-Emerging Market Index Global Diversified, Emerging Market Equities is MSCI Emerging Markets Index, Listed Global Private Equity is LPX50 Index, Listed Global Private Equity is LPX Listed Private Credit AUD Hedged Index, Australian FRN Bonds is Bloomberg Ausbond Credit 0+Yr FRN Index, Global High Yield is Bloomberg Global High Yield Index, Bitcoin is MarketVectorTM Bitcoin Benchmark Rate, Past performance is not a reliable indicator of future performance. You cannot invest in an Index.

Listed private equity

Inflation and rising interest rates have seen the number and transaction value of private equity deals decline since the peak in 2021. However, favourable market conditions will see private equity activity accelerate.

According to S&P Global Market Intelligence, private equity deal value climbed 5.1% to US$130.61 billion for the first three months of 2024, compared to the same period in 2023.

We forecast activity in the private equity market will continue to gather pace. Rates should stabilise, improving confidence in the assessment of valuations and therefore investment activity. Central banks cutting rates is typically an environment where private equity outperforms listed equity given the higher levels of leverage and implications on the valuation of future earnings.

Listed private equity has been trading at a discount to book value since 2021 and are unlikely to go on much longer. To capitalise on the discount, we’ve seen private equity managers buying back shares, saying to the market that they perceive listed prices to be undervalued. Double discounting has also played out where private equity firms have sold portfolio companies at a premium to book value. Examples include HgCapital Trust selling GGW Group at a 40% premium and Apax Global selling Healthium Medtech at a 29% premium.

Additionally, private equity companies are under significant pressure to deploy record levels of accumulated capital. We expect to see most of this activity happening across technology, media and telecom (TMT), as companies increasingly seek private equity funding to capitalise on Artificial Intelligence (AI) opportunities. Restructuring distressed assets is another opportunity for private equity firms, with an increasing number of businesses struggling under the burden of a prolonged ‘higher for longer’ rates environment.

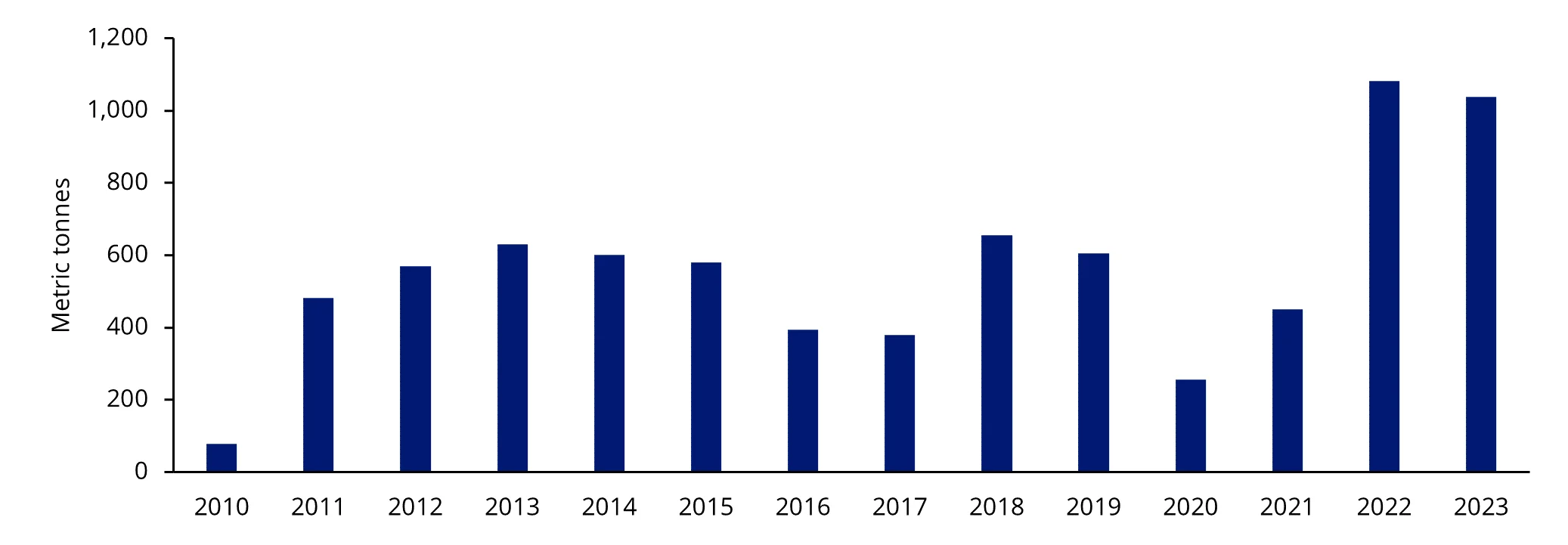

Chart 2: Global private equity dry powder

Source: S&P Global Market Intelligence

Private equity investment has traditionally been available to large institutional investors and high net worth investors only due to the large capital outlays and long lockup periods (among other barriers to entry). Global listed private equity, ie private equity securities listed on exchanges worldwide, makes this asset class more broadly available, providing private equity returns with share market accessibility and liquidity.

The VanEck Global Listed Private Equity ETF (ASX: GPEQ) gives investors a diversified portfolio of the 50 largest and most liquid global listed private equity companies, with a collective portfolio of more than 3,300 private equity direct investments and 350 private funds.

Gold

The gold price has shot up in 2024 following markets ramping up policy rate cut bets in 2024 and increasing central bank buying demand. Since its October 2023 low of US$1,819.45, it is up by about 19%. It’s been a big gain, but there could be more to go.

Central banks have been buying up gold as part of their efforts to diversify reserves. Gold purchases by central banks in 2023 accounted for approximately 20% of the total global gold demand last year.

Chart 3: Central bank gold net purchases

Demand has accelerated over the past 2 years.

Source: Bloomberg, World Gold Council. Past performance is not indicative of future performance.

Persistent inflation, potential bumpy economic path and heightened geo-political tensions could serve as catalysts for a gold rally. With rate cuts on the horizon, even though they have been delayed, real yields have cooled, increasing the relative attractiveness of non-interest-bearing gold.

Now, before you go rushing off to your nearest gold dealer, make sure you choose a reputable seller that is reasonably priced and can verify the authenticity of the gold. You should also make sure you have insurance coverage for wherever you decide to store it.

Alternatively, investors can use an ETF to access the price of gold. The VanEck Gold Bullion ETF (ASX: NUGG) is an exchange traded fund that offers an investment in Australian-sourced gold. The gold bullion that backs this ETF are only sourced from Australian gold producers whose operations adhere to the LBMA Responsible Gold Guidance. Investors can also get the units converted into physical gold bullion.

Listed private credit

In the wake of the GFC, private credit companies have proliferated as a lending substitute for the increasingly risk-averse traditional banking system. Most recently, private credit has experienced another resurgence with the rise in inflation and interest rates.

Most listed private credit companies are closed-end funds that hold a portfolio of loans.

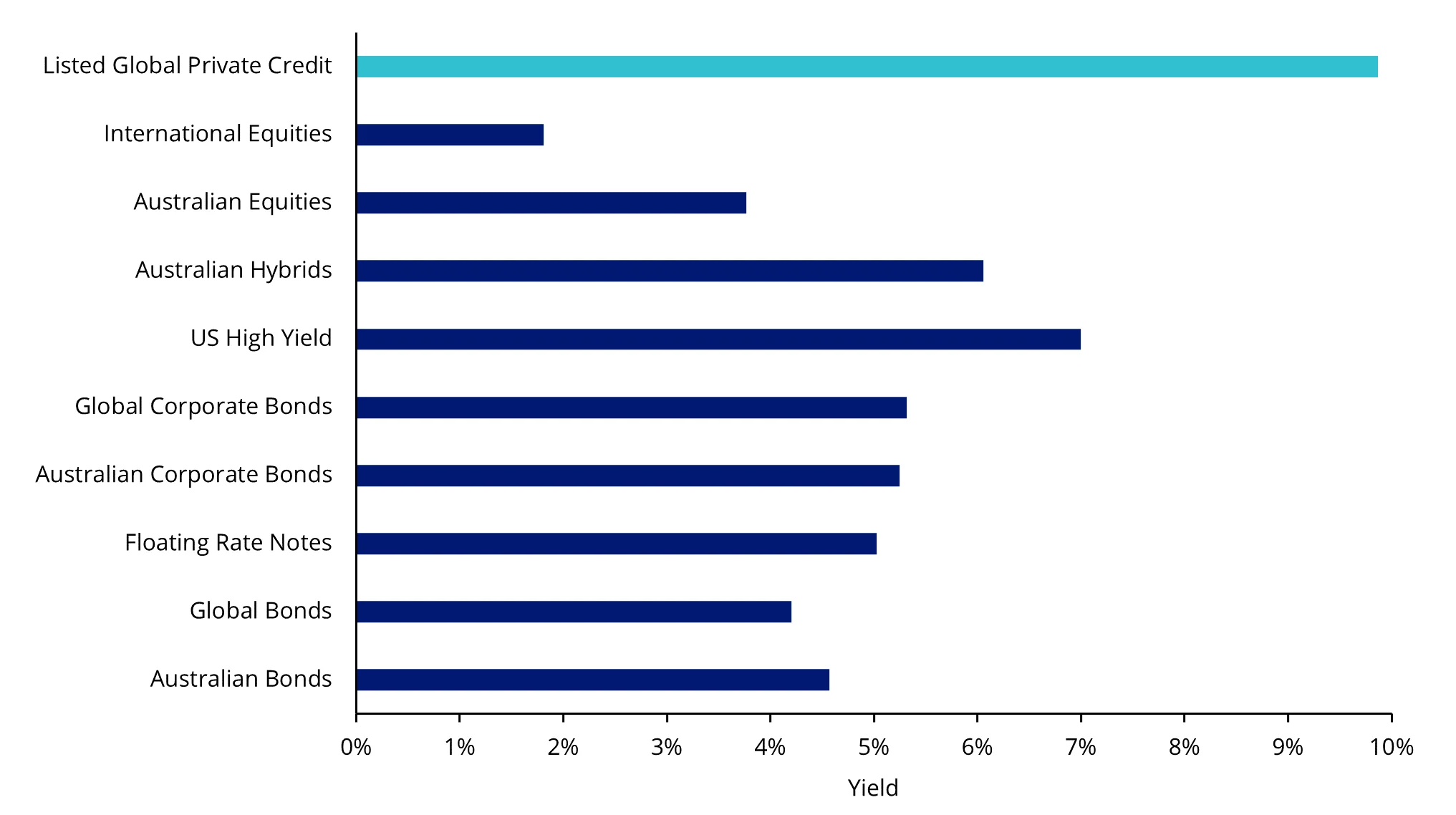

As per the graph below, Global listed private credit offers an attractive opportunity compared to US high yield, providing a yield pickup of approximately 3%. In contrast, the 10-year default rate for US high yield is higher than that of private credit. Additionally, US high yield credit spreads have narrowed significantly over the past 18 months, potentially leaving investors undercompensated for the associated risk. Global listed private credit, on the other hand, has not experienced the same credit spread compression, making it a relative value proposition.

Chart 4: Listed global private credit yield

Source: Bloomberg, IMF, as at 31 May 2024. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Yield is either yield to maturity or dividend yield. Yield to Maturity (YTM) is the estimated annual rate of return that would be received if the fund’s current securities were all held to their maturity and all coupons and principal were made as contracted. YTM does not account for fees or taxes. YTM is not a forecast, and is not a guarantee of, the future return of the fund which will vary from time to time. Dividend Yield is the weighted average of each portfolio security’s distributed income during the prior twelve months before management costs. If applicable it does not include franking credits. Indices used: Global Bonds – Barclays Global Aggregate Bond Index A$ Hedged; Australian Bonds – Bloomberg AusBond Composite 0+ Yr Index; Floating Rate Notes - Bloomberg AusBond Credit FRN 0+ Yr Index; International Equities – MSCI World ex Australia Index; US High Yield – Bloomberg US High Yield (AUD Hedged); Australian Equities – S&P/ASX 200 Accumulation Index; Australian Hybrids is Solactive Australian Hybrid Securities Index, Global Listed Private Credit – LPX Listed Private Credit Index AUD Hedged, Australian Corporate Bonds – Bloomberg AusBond Credit 0+ Yr Index, Global Corporate Bonds - Bloomberg Global Aggregate Corporate Bond Index (AUD Hedged).

Private credit’s high returns versus risk profile has proven irresistible to institutional asset owners such as pension funds and insurance companies, who have seen their private credit AUM increase six-fold over the last seven years. More than a third of outstanding private credit (35%) is held by these asset owners.

As most private credit loans are floating rate (unlike bonds, which typically have fixed rate coupons), they can also be a hedge against inflation and rising interest rates.

Private credit has traditionally been an illiquid, opaque asset class limited to institutional investors and high-net-worths, however listed private credit companies and listed investment trusts have made the asset class available on the sharemarket.

The VanEck Global Listed Private Credit (AUD Hedged) ETF (ASX: LEND) is the first and only exchange traded fund that provides Australian investors with access to a diversified portfolio of 25 of the largest listed companies involved in private credit. Unlike Australian listed investment trusts, which tend to have a high exposure to real estate, LEND is diversified across both individual companies and sectors.

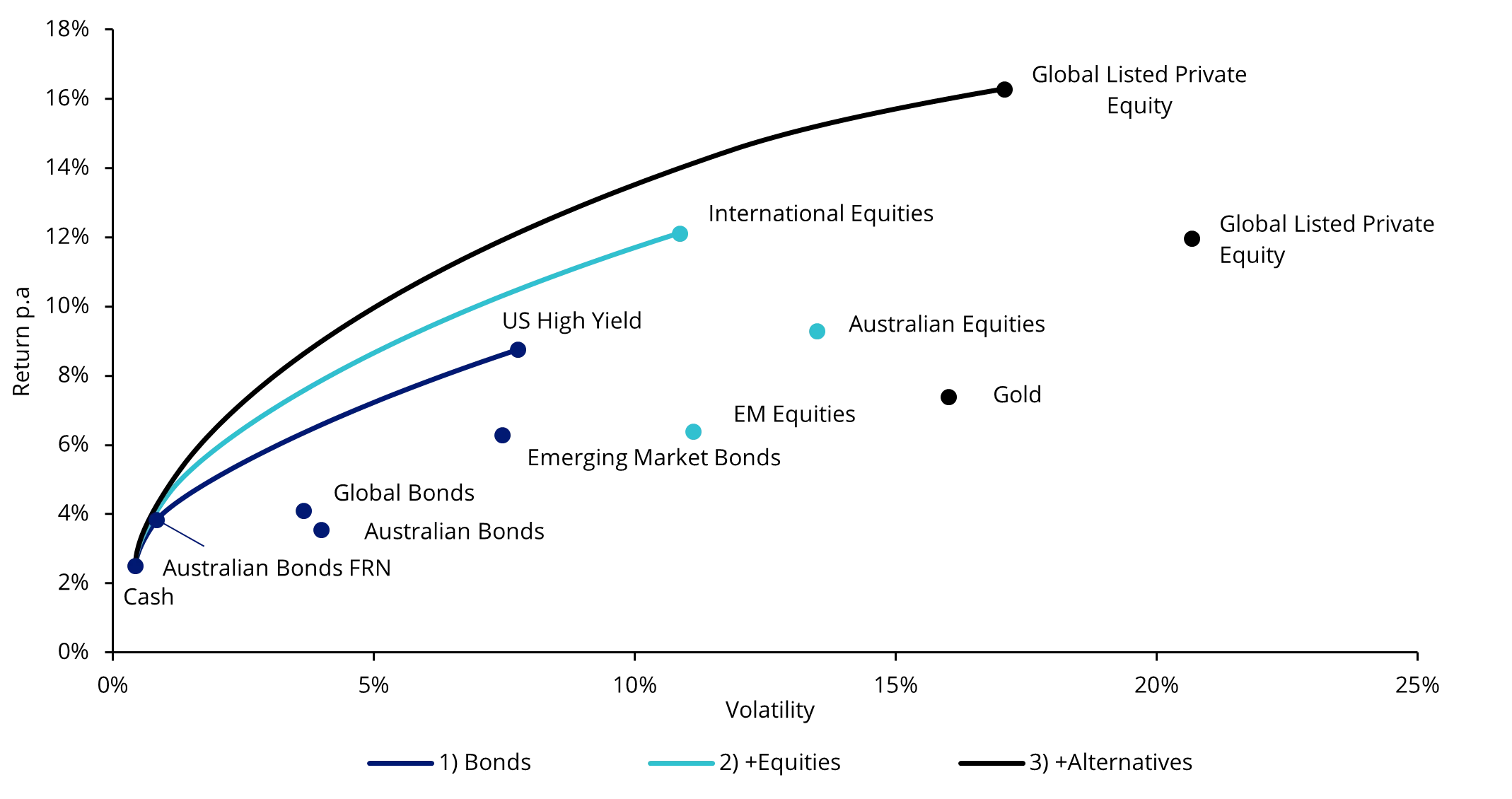

Potential for higher returns without greater risk

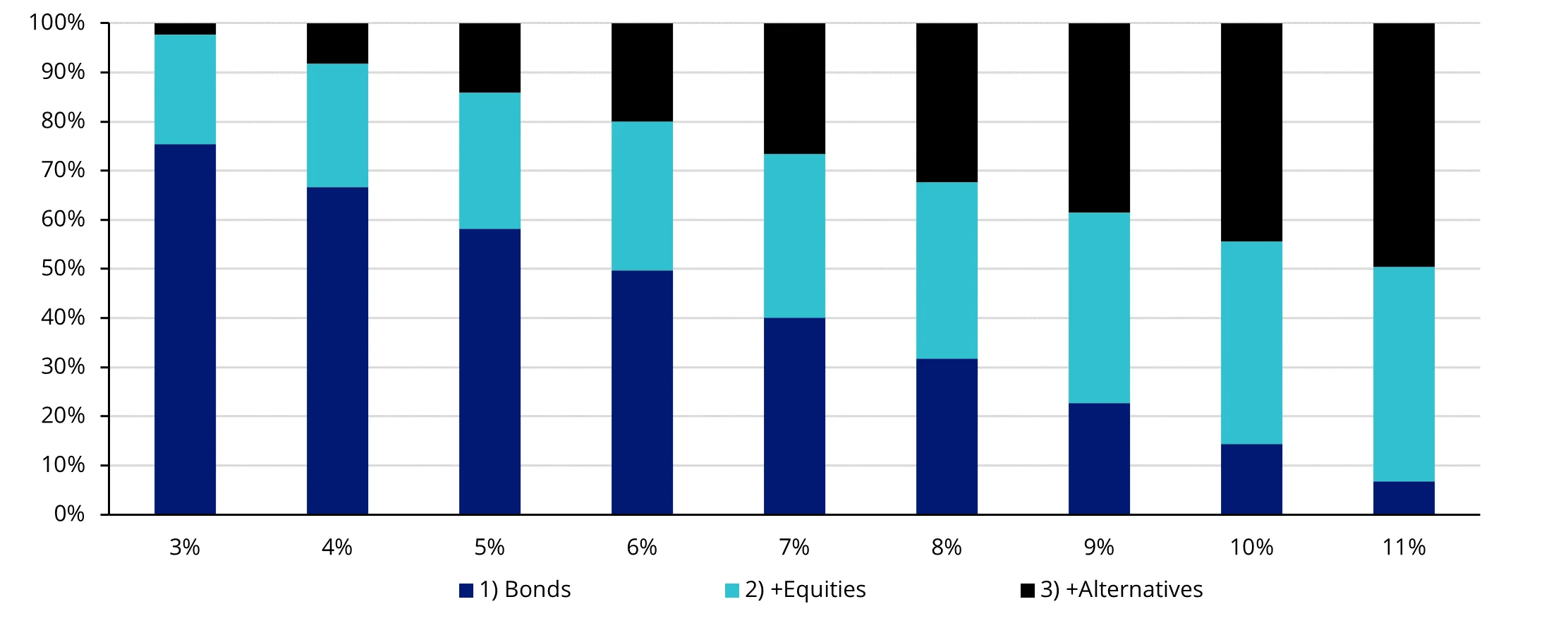

Our efficient frontier modelling over 15 years shows an optimal allocation to listed private equity, listed private debt or gold has historically enhanced returns without changing the target risk profile when added to a traditional equity and bonds portfolio.

Chart 5: Efficient frontier portfolio: 15 years

Chart 6: Allocation by target volatility

Source: Bloomberg, 1 January 2009 to 31 December 2023. returns in Australian dollars. International Equities is MSCI World ex Australia Index, Australian Equities is S&P/ASX 200 Accumulation Index, Gold is Gold Spot US$/oz, Global Bonds is Bloomberg Global Aggregate Bond Hedged AUD Index, Cash is Bloomberg AusBond Bank Bill Index, Australian Bonds is Bloomberg AusBond Composite 0+ yrs Index, Emerging Market Bonds is 50% J.P. Morgan Emerging Market Bond Index Global Diversified Hedged AUD and 50% J.P. Morgan Government Bond-Emerging Market Index Global Diversified, Emerging Market Equities is MSCI Emerging Markets Index, Listed Global Private Equity is LPX50 Index, Listed Global Private Credit is LPX Listed Private Credit AUD Hedged Index, Australian FRN Bonds is Bloomberg Ausbond Credit 0+Yr FRN Index, Global High Yield is Bloomberg Global High Yield Index. Past performance is not a reliable indicator of future performance. You cannot invest in an index

Looking at gold specifically, our analysis shows that gold inclusion in a traditional bond and equity investment portfolio has historically enhanced returns by up to 0.5% p.a. for the same level of risk, based on efficient frontier portfolio modelling over 15 years.

As always, we recommend speaking to your financial advisor or broker to determine which investments are best suited to your individual needs.

Key risks

An investment in GPEQ, NUGG or LEND, carries risks associated with listed private equity, listed private credit, interest rates, credit/default, currency hedging, gold pricing risk, custody risk, Australian origin gold bullion, ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for more details on risk.

Related Insights

Published: 09 July 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (‘VanEck’) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au.

LPX and LPX50 are registered trademarks of LPX AG, Zurich, Switzerland. The LPX50 Index is owned and published by LPX AG. Any commercial use of the LPX trademarks and/or LPX indices without a valid license agreement is not permitted. Financial instruments based on the index are in no way sponsored, endorsed, sold or promoted by LPX AG and/or its licensors and neither LPX AG nor its licensors shall have any liability with respect thereto.