Expert’s choice: 5 reasons why investors should consider physical gold

Once the basis for the entire global monetary system, gold has been valued for thousands of years as a durable, reliable source of investment which is scarce enough to prevent the market being flooded. With inflation proving to be sticky and fears of a recession rising, astute investors are reconsidering their portfolios and looking at diversifying investments. While gold is one of the oldest investments known to man, its value is often underestimated. But with the current murky economic forecast, it may be worth considering physical gold as an addition to your portfolio.

Once the basis for the entire global monetary system, gold has been valued for thousands of years as a durable, reliable source of investment which is scarce enough to prevent the market being flooded. With inflation proving to be sticky and fears of a recession rising, astute investors are reconsidering their portfolios and looking at diversifying investments. While gold is one of the oldest investments known to man, its value is often underestimated. But with the current murky economic forecast, it may be worth considering physical gold as an addition to your portfolio

The current outlook for gold looks good

In 2022 the yellow metal’s price has been weighed down by the strong US dollar which was supported by the unprecedented pace of the US Federal Reserve’s rate hikes.

Now, according to the World Gold Council (WGC), the impact of further policy rate hike surprises and the US dollar’s safe-haven strength may be fading. Furthermore, in 2022 they pushed negative gold price sentiment to historical extremes, paving the way for a rebound.

Historically, demand for physical gold picks up in Asia and the Middle East when the gold price is weak. The current gold price is no exception, as buyers in China, India, and UAE sense a bargain. According to Bloomberg, gold in Dubai, Istanbul and Shanghai is trading at a premium to spot prices in London. Over 527 tonnes have been moved out of New York and London vaults since April, while Chinese imports reached a four-year high in August.

Another strong indicator, Central Bank demand is also strong, as the World Gold Council reports the banks bought 399 tonnes in the third quarter, the strongest quarter on record. This amount is nearly quadruple the amount of gold that was purchased the same time last year.

Chart 1: Central bank gold demand

Source: World Gold Council. Data as of September 2022.

A recession is also a tailwind for gold. One leading indicator of a recession is, what is called, an inverted yield curve. An inverted yield curve is one when short term rates are higher than long term rates.

Chart 2: Example of a yield curve

For illustrative purpose only.

According to investment bank Morgan Stanley, discussing the US, “the yield curve has firmly inverted (10 year rates having fallen below the 2 year rates) reflecting fears of a possible recession, or perhaps the strong inflation expectations in the near term which are expected to soften in the long term. A yield curve inversion is usually a strong positive signal for the gold price as witnessed in past periods.”

Chart 3: Recession indicator, the current inverted US yield curve

Source: Bloomberg

In Western markets, surging inflation, slowing economic growth and persistent geopolitical concerns continued to support demand for gold bars and coins in quarter 3. The WGC says, as US consumers express increasing pessimism about the state of the US economy amid increasing inflation, investment demand has been supported by gold’s role as an inflation hedge.

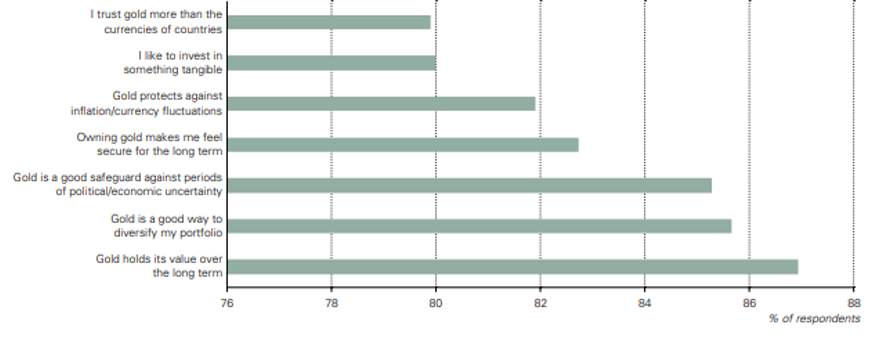

This is reflected by a survey run by the WGC in September of this year:

Chart 4: US retail investors see gold as a safe-haven and source of protection

Note: % of respondents who have invested in gold at some point (base 1,095) who selected either ‘completely agree’ or ‘somewhat agree’ as a response to each statement. Source: Appinom, World Gold Council.

Last week an article in the Australian Financial Review, titled “The key to a golden recovery in 2023” included this prediction, “Bank of America believes the gold price will bottom out early next year before averaging $US2000 an ounce in the third and fourth quarter as the Federal Reserve slows the aggressive pace of interest rate rises.”

Given the positive outlook for gold, below we outline five reasons we think gold has a place in investors’ portfolios.

5 reasons to invest in physical gold:

1. Gold retains its value

As a physical commodity, gold has value outside the banking and economic systems, so it can be used by investors trying to preserve their wealth against future market fluctuations, bank failures or economic recessions. Gold is often viewed as a safe haven investment. Unlike fiat currencies, gold cannot default or go bankrupt.

2. Hedge your portfolio

Many investors hold gold in their portfolios as it provides diversification from other assets. When markets fluctuate, gold will often respond differently to financial events than other assets. As such, investors can reduce their risk exposure to other assets. While not necessarily the first choice for growth of capital, gold offers excellent protection and stability compared to other assets.

The table below shows the correlation of gold bullion compared to other asset classes. In the table, a 1 is perfectly correlated. The lower the number, the lower the correlation. You can see that over 20 years, gold bullion is negatively correlated to Australian equities, international equities, emerging market equities and A-REITs and has a low correlation to Australian and global bonds.

Table 1: Asset class correlations, October 2002 to October 2022

Source: Morningstar Direct, Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. All returns in Australian dollars. Indices used Australian equities – S&P/ASX 200, International equities – MSCI World ex Australia Index, Emerging markets – MSCI Emerging Markets Index, A-REITS – S&P/ASX 200 A-REIT Index, Global bonds – Barclays Global Aggregate Bond Index A$ Hedged, Australian bonds – Bloomberg AusBond Composite 0+ Yr Index, Gold bullion – LBMA Gold Price PM. You cannot invest in an index.

3. Limited supply

Gold is a finite resource. The BBC said, in a recent report, “the below ground stock of gold reserves is currently estimated to be around 50,000 tonnes according to the US Geological Survey. Based on these figures there is around 20% still to be mined although this is a moving target.” Though new gold mines are still being found, discoveries of large deposits are becoming increasingly rare, experts say.

4. Preserves purchasing power

Inflation can have a crippling effect on wealth, diminishing purchasing power. According to the WGC gold can help investors protect against potentially excessive asset price inflation and currency debasement. For example, according to the ABS’s consumer price index data, prices nowadays are about 74% higher than average prices since 2000. In other words, $1.00 in 2000 is equivalent to about $1.74 today.

So, putting this into hypothetical gold terms:

- $100,000 left as cash in the year 2000 would buy roughly $57,500 worth of goods today.

- $100,000 worth of gold in the year 2000 would have retained its purchasing power. That is, it would still buy, at least, $100,000 worth of goods today. It is important to note however that the price of gold does go up an down.

5. Universal currency

Gold is a universal currency that is used and traded around the world.

One way to invest in gold is via an ETF. VanEck recently launched its Gold Bullion ETF (NUGG).

The gold bullion that physically backs NUGG, is held in a vault by The Perth Mint and is sourced from Australian gold producers whose operations adhere to the LBMA Responsible Gold Guidance.

In addition to liquidity on the ASX, NUGG gives investors the option of converting their NUGG holdings into physical gold from The Perth Mint.

A list of the allocated gold bars that make up the Fund’s assets will be made available on our website.

Key risks

An investment in the ETF carries risks associated with: Gold pricing risk, currency risk, custody risk, gold bullion risk, concentration risk, liquidity risk, operational risk and regulatory and tax risk. See the PDS for details.

Published: 15 December 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.