Riding the gold wave: Record prices, strategic mergers and miners’ resilience

Equity turbulence boosts gold’s shine

US equity markets experienced significant declines during the month of March. Driven by concerns over new tariff implementations and their potential impact on the global economy, both the S&P 500 and the Nasdaq Composite entered correction territory on 13 March, after dropping more than 10% from their 19 February peak. The unpredictability of economic policies and heightened market volatility bolstered gold's appeal, reaffirming its role as the preferred safe-haven asset during times of global uncertainty. The spot gold price recorded new all-time highs during the month, surpassing the US$3,000 per ounce mark on 14 March and closing at a record price of US$3,123.57 on 31 March, a 9.30% (US$265.73) monthly gain.

Gold miners outperform amid market weakness

The gold miners, as represented by the NYSE Arca Gold Miners Index, outperformed gold’s price rise (up 15.16% during the month) showcasing, not only their leverage to the gold price, but also their attractive valuations relative to the broader equity markets. It also highlights gold miner’s role as an effective portfolio diversifier due to their lower correlation with most other asset classes. The S&P 500 ended the month down 5.87%.

Investment demand signals sentiment shift

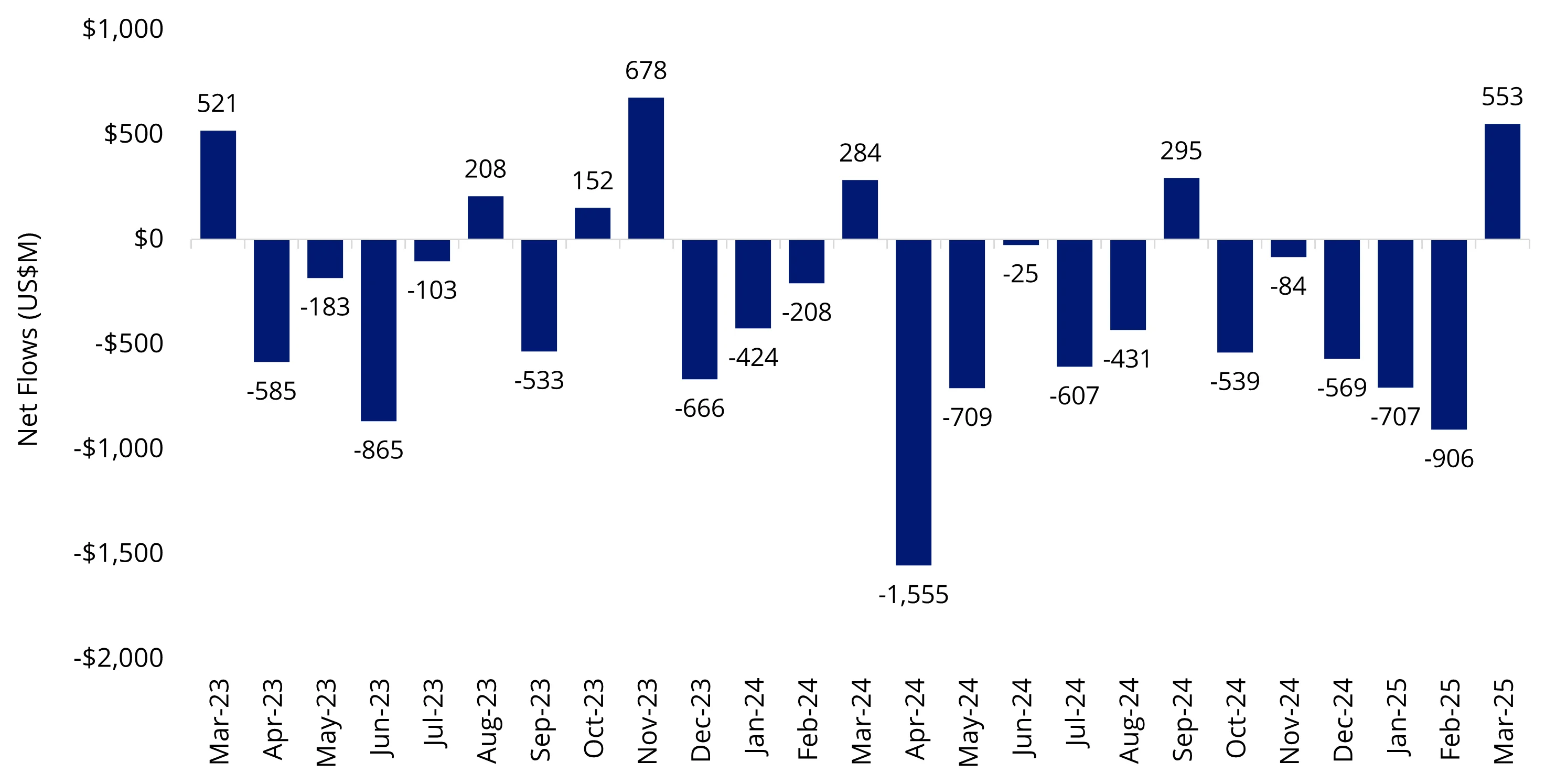

The contrasting performances highlight a shift in investor sentiment towards gold and related equities. Increasing investment demand for gold translated into another month of strong inflows for the gold bullion backed ETFs, with holdings up 2.82% during the month. More importantly, according to LSEG Lipper data, this surge in investor interest in the gold sector led to the largest monthly net inflows in more than a year for funds that invest in gold miners, reversing a trend of persistent net outflows over the last couple of years. Funds investing in physical gold and gold derivatives attracted net US$17.8 billion in 2024, the highest in five years, while funds investing in gold miners lost net US$4.6 billion, the most in a decade.

Chart 1: Fund flows into gold miners

Source: Mining.com. Data as of 21 March, 2025. Note—data covers 493 funds with combined assets under management of US$62 billion.

Surging gold prices are driving record cash flow for gold producers, and when paired with rising stock valuations, are creating a more favorable climate for mergers and acquisitions (M&A) within the sector. Gold miners led the way in metals and mining M&A in 2024, according to research from S&P Global Market Intelligence, which revealed that gold deals made up 70% of the total transaction value. The report highlighted 62 gold-focused transactions during the year—representing a 32% increase from 47 deals in 2023.

Diverging deals: A critical look at recent mergers

Recently announced/proposed M&A transactions include:

- the acquisition of De Grey Mining by Northern Star Resources;

- the merger of Equinox Gold and Calibre Mining;

- the acquisition of Spartan Resources by Ramelius Resources; and

- a public offer by Gold Fields to acquire Gold Road Resources, which has been rejected by the board of Gold Road Resources.

We are not supportive of the friendly, at-the-market merger between Equinox Gold and Calibre Resources, announced on 23 February, 2025. The implied market capitalisation of the combined company was estimated at around CAD$7.7 billion. We don’t see any synergies between any of the two companies’ operations. Both operate in the Americas, but in different locations. Calibre is ramping up its Valentine Gold Mine in Newfoundland, Canada. This is a transformational asset that will vault the company to mid-tier status. Construction is progressing as planned and we expected Calibre shares to have a positive re-rating once it achieves commercial production later in 2025. The terms of the proposed combination, which is subject to shareholder approval, do not include a takeover premium for Calibre shareholders. In our view, a premium would be necessary to justify Calibre shareholders walking away from the share price appreciation they were likely to realise as the company transformed itself into a multi-asset producer with a flagship asset in Canada.

In contrast, the other three transactions highlighted (all coincidently involving the acquisition of assets in Australia) offer obvious regional and operational synergies, along with significant takeover premiums.

Strategic consolidations in Australia

On 2 December, 2024, Australian major Northern Star Resources, announced an A$5 billion friendly acquisition of De Grey Mining at a 37.1% premium to the prior day’s close. The deal is expected to close in the second quarter of this year. Northern Star is probably, we think, the company that is best suited to develop De Grey’s Hemi gold project. The company is established in Western Australia and has seen a tremendous growth trajectory over the past decade from scrappy junior to established mid-tier and now an emerging major. Its growth has come primarily from smart acquisitions, through which they have constantly created more value than expected through operational efficiencies and exploration. While Northern Star Resources is paying a premium for De Grey Mining, the land package offers upside from an additional five-million-ounce resource with exploration potential likely to extend the project’s life. The Hemi project also presents technical challenges due to metallurgically complex ores—challenges Northern Star Resources is well-equipped to handle. This project establishes Northern Star Resources among the ranks of the world’s leading gold majors.

Regarding the Spartan/Ramelius Resources transaction, the story starts with the Dalgaranga low-grade open pit operation in Western Australia that opened in 2018. By 2021, the junior company that owned it was failing due to poor planning and execution. Management was replaced, and in early 2022, new geologic ideas led to the discovery of the high-grade Never Never lode deposit beneath the pit. The unprofitable open pit was shut down, and in 2023 the company was recapitalised and renamed Spartan Resources. On 17 March, 2025, Australian junior Ramelius Resources announced the friendly A$2.4 billion acquisition of Spartan at a 27.5% premium to the 30-day volume weighted average price. There are considerable synergies between the Dalgaranga properties and Ramelius Resources’ nearby Mt. Magnet operation that justify this premium. The merger will also transform Ramelius into a mid-tier producing a half-million ounces per year once Never Never is developed.

On March 25, 2025, senior gold producer Gold Fields made public an offer to acquire Gold Road Resources for a cash consideration that valued Gold Road Resources at A$3.3 billion, representing a 28% premium to its closing share price on 21 March. Gold Fields already owns a 50% interest in and is the operator of the Gruyere mine in Western Australia. Gold Road holds the other 50% non-operating interest in the Gruyere joint venture, which is its only producing asset. The rationale is clear: consolidating ownership of the asset would allow Gold Fields to unlock the full potential of the Gruyere mine by eliminating dis-synergies stemming from the current joint venture structure. Gold Road Resources’ shareholders would have the opportunity to monetise their investment at a nice premium. It is now up to them to decide whether this is a good deal.

Published: 07 April 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

NYSE Arca Gold Miners Index is a service mark of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by Van Eck Associates Corporation (“VanEck”). VanEck products are not sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding VanEck products or the ability of the NYSE Arca Gold Miners Index to track general stock market performance.

ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.