Gold vs. gold equities: post-election pressures

Gold and gold equities: post-election insights and investment opportunities

Following the US presidential election on 5 November 2024, which resulted in Donald Trump's victory, gold prices declined. The so-called “Trump Trade” drove the US Dollar and US Treasury yields higher, while the S&P, Dow Jones, and the Nasdaq reached record highs throughout the month.

Gold faced significant pressure, closing as low as US$2,563.25 on 15 November. However, it demonstrated resilience, briefly closing above US$2,700 for one trading session later in the month. Despite this recovery, November marked its worst monthly performance in over a year. The metal closed on 29 November at US$2,643.15, reflecting a US$100.83 drop per ounce or 3.67% decline for the month.

Looking ahead, we believe gold remains supported by both the US and global macroeconomic factors. Expectations of inflationary policies under the new US administration, heightened global geopolitical risks, strong central bank net buying, and anticipated rate cuts by the Federal Reserve suggest potential upward momentum for gold in the longer term.

Gold equities under pressure: sentiment, leverage, and market dislocations

A weaker gold price led to gold equities underperforming the metal in November. The NYSE Arca Gold Miners Index was down 7.09%. Gold equities are now lagging gold this year, which is surprising. We believe this is the compounding result of market dislocations in valuing the gold equities over the past several years.

We expect periods of rising gold prices to correspond with outperformance in gold stocks. However, while gold spot prices have risen 28% year to date, NYSE Arca Gold Miners Index were up only 21%. This disparity highlights poor sentiment toward the gold mining sector and the lack of investor interest.

The trading patterns of gold stocks during periods of rising versus declining gold prices further underscore this sentiment. Leverage works both ways, and we consistently emphasise this when discussing the benefits of investing in gold stocks. A movement in the gold price typically results in a more meaningful move on miners’ cash margins, resulting in operating leverage to gold prices.

However, in recent years, the market’s implied leverage of gold stocks to rising gold prices appears to be significantly lower than during periods of declining gold prices. We have been anecdotally making this observation, frustrated by the overly punitive impact this continues to have on the already oversold gold shares.

Understanding the market shifts of gold stocks vs. gold prices

Consider this year as an example: From the end of 2023 to the end of February, gold declined by 0.9%, while gold stocks were down 15.3%—a 17x multiple of gold’s move. In contrast, between the end of February and 22 October, gold gained 34.5%, while gold stocks rose 67.7%, representing a much smaller 1.96x to the metal’s gains. Then, from 22 October to the end of November, gold fell by 3.9%, and gold miners as a group decreased by 14.8%—a 3.8x multiple of gold’s decline.

These time periods correspond with the highs and lows of the NYSE Arca Gold Miners Index this year. Furthering our analysis, we reviewed the quarterly ratios of NYSE Arca Gold Miners Index moves relative to changes in the gold price over the past few years. The results confirmed our observations: on average, gold’s upward trading was not as beneficial to gold stocks, and a decline in the metal’s price disproportionally punished the sector.

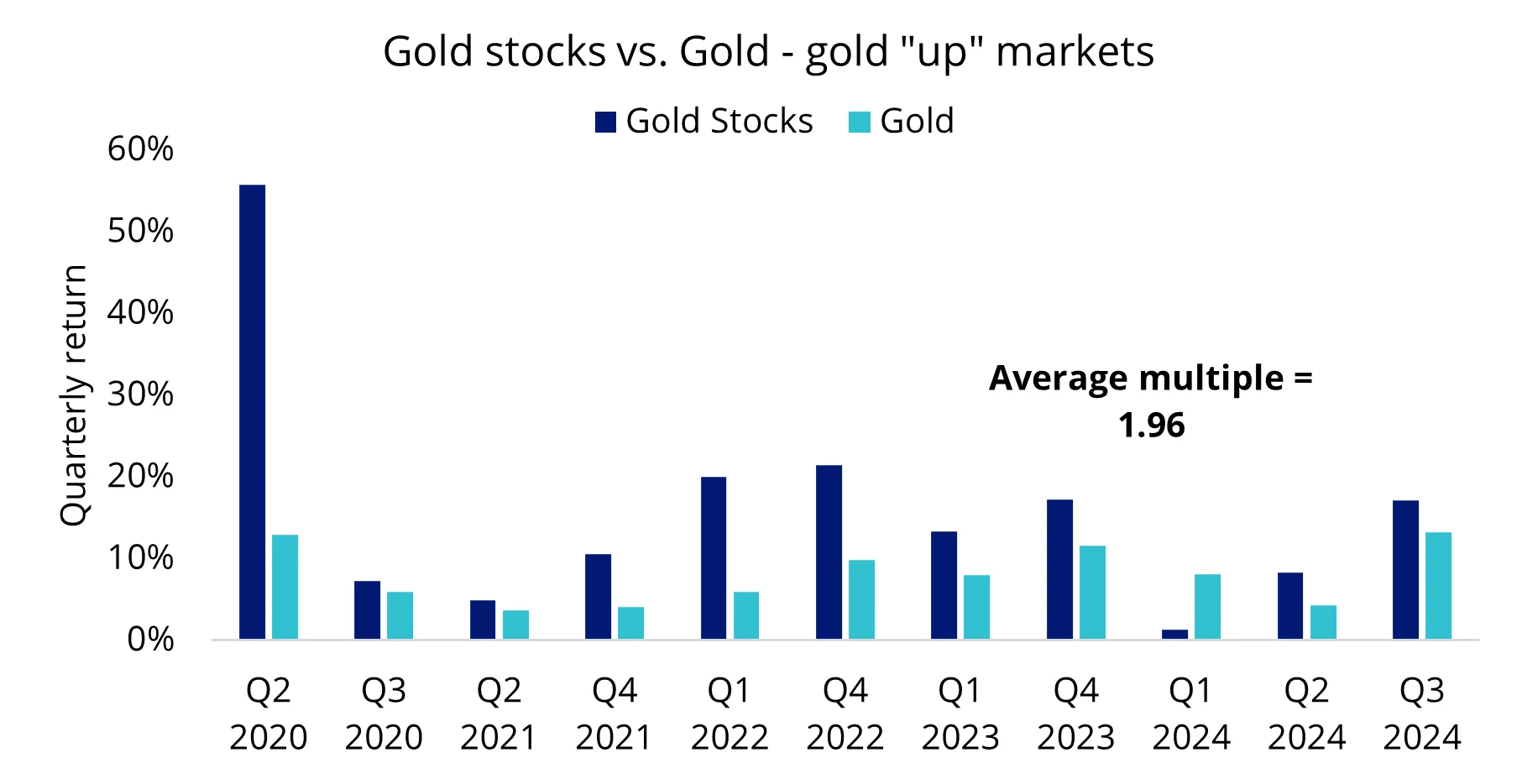

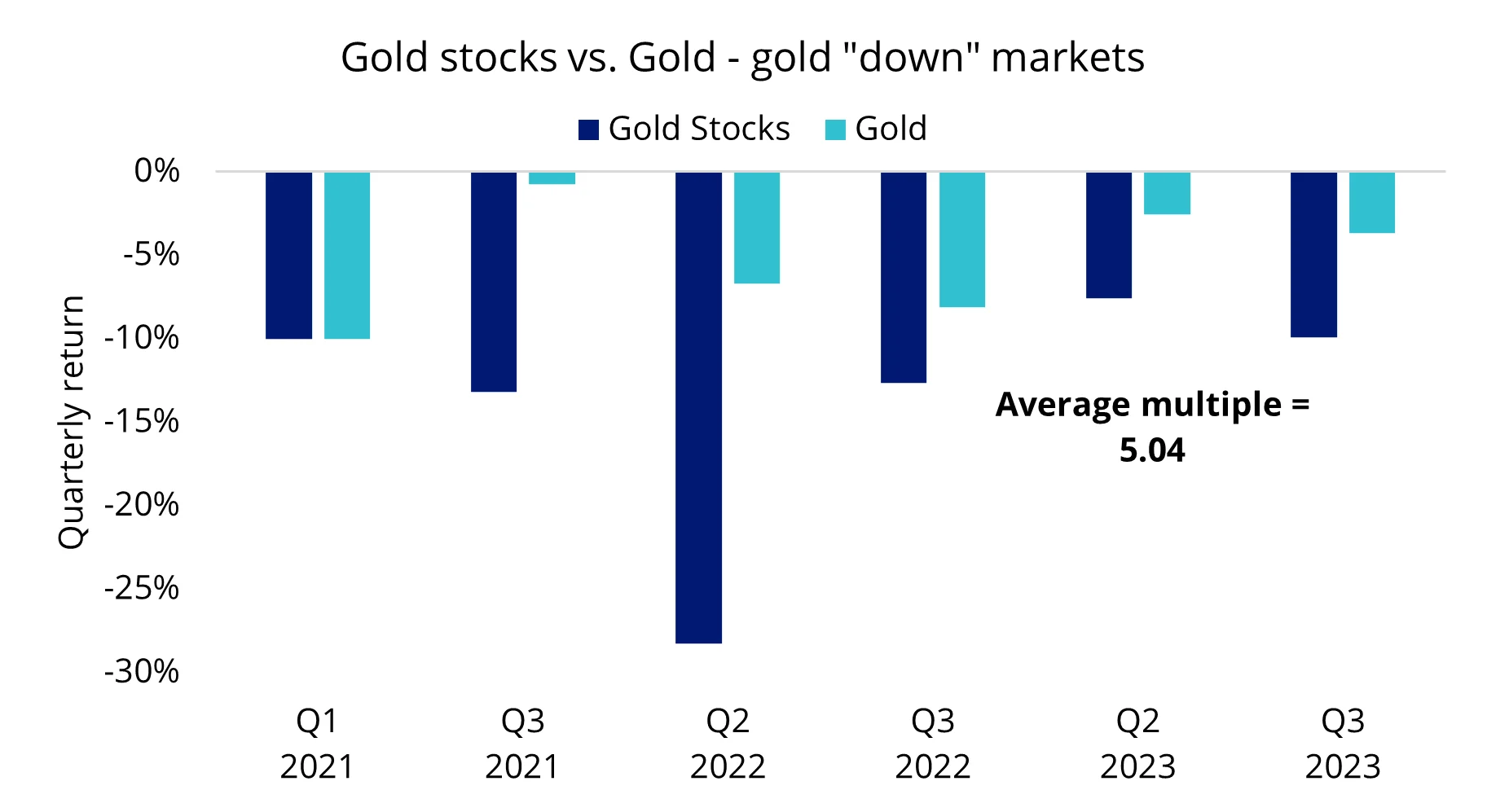

Observe the comparisons of gold stocks versus gold in both “up” and “down” markets:

Chart 1: Gold stocks vs. Gold - gold "up" markets

On average, gold’s upward trading was not nearly as beneficial to gold stocks.

Source: Bloomberg. Data as of September 2024. Past performance is no guarantee of future results.

Chart 2: Gold stocks vs. Gold - gold "down" markets

A decline in gold’s price disproportionally punished gold stocks.

Source: Bloomberg. Data as of September 2024. Past performance is no guarantee of future results.

Since 2020, positive quarterly moves in the gold price have, on average, translated to outperformance by gold equities with a 1.96x multiple. We excluded the first and last quarters of 2020 from this calculation, as gold prices rose during those periods while gold stocks traded lower. Meanwhile, negative quarterly moves in the gold price led to underperformance of the gold equities by an average factor of 5.04x. We conducted the same analysis monthly and observed similar results.

Gold equities as a compelling opportunity amidst post-election weakness

Over the past year, the significant gap between gold and gold equities has been narrowing. However, the post-election weakness in the gold sector has widened it again. With gold producers enjoying record margins and generating substantial free cash flow, we believe this disconnect won’t last forever. Currently, the NYSE Arca Gold Miners Index is trading approximately 35% below its September 2011 highs, despite the gold price being higher by 41% since that time.

For investors looking to hedge broader market risks through gold exposure, allocating to the gold mining sector alongside gold bullion presents a compelling opportunity.

Published: 15 December 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (‘VanEck’) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.