Did markets misread APRA’s proposed phase-out of ASX hybrids?

APRA’s proposed phase out of ASX hybrids leaves many points to consider.

Proposed APRA change

A few weeks ago, APRA released the second phase of its consultation paper on the ASX hybrid market (AT1) that proposed significant changes to the structure of bank capital stacks. Its key proposal is to phase out AT1 as a component of bank capital. For large banks, the existing 1.5% AT1 requirement would be replaced by 1.25% Tier 2 capital and 0.25% Common Equity Tier 1 (CET1) capital. Smaller banks would replace AT1 entirely with Tier 2 capital.

This proposal aims to strengthen the resilience of the banking sector by adjusting the composition of capital requirements. APRA Chair Jon Lonsdale stated, “Replacing AT1 with more reliable forms of capital will enable banks to more quickly and confidently use their capital buffers in a crisis scenario and is expected to reduce compliance costs for banks. It will also strengthen the proportionality of the prudential framework by embedding a simpler approach to capital requirements for small and mid-size banks compared to the new requirements for large banks.”

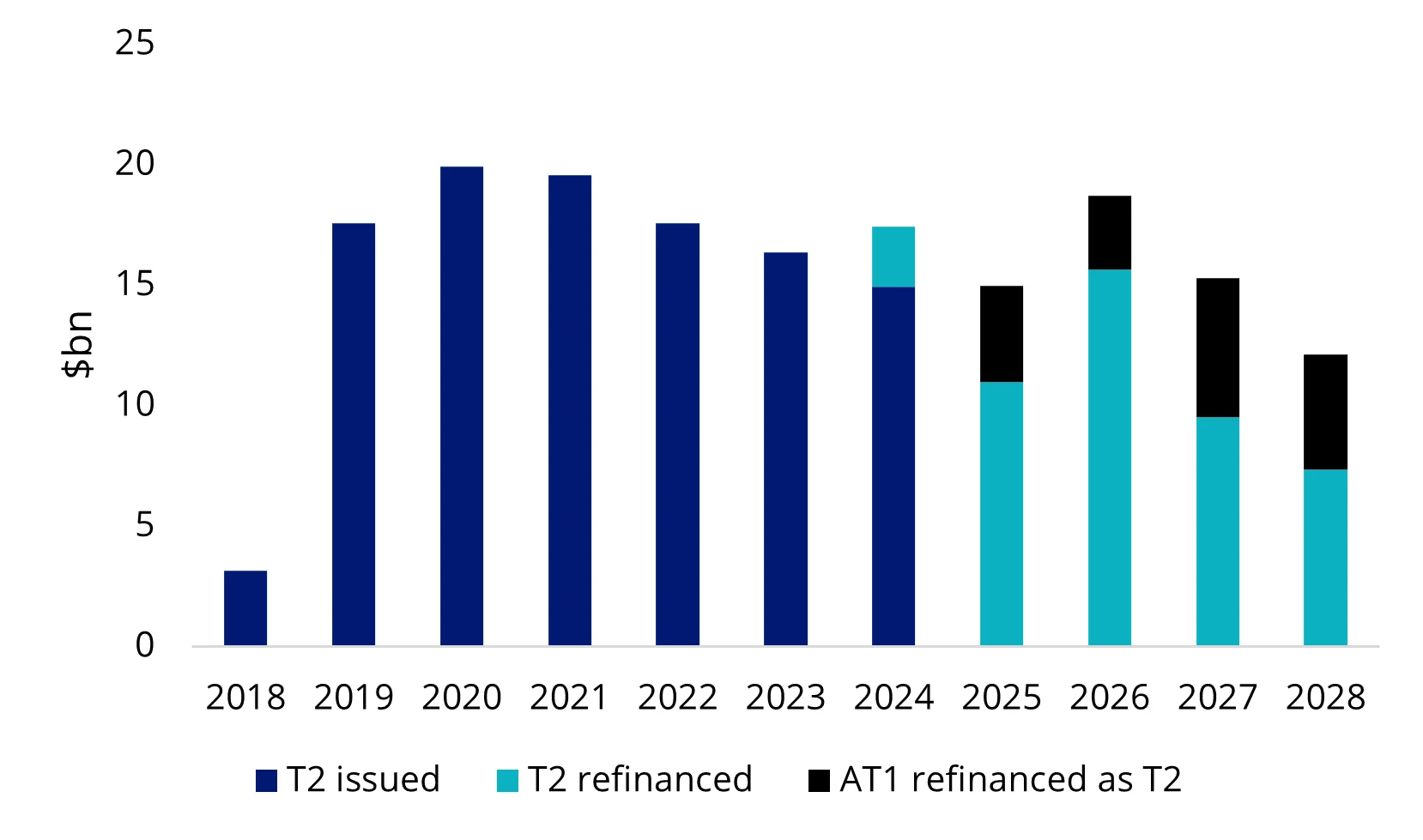

If implemented, this transition would begin in January 2027 and continue until 2032. During this period, upcoming AT1 calls would be refinanced with Tier 2 capital as they mature. Given the current Tier 2 requirement of 6.5%, the additional 1.25% would represent approximately a 20% increase in the size of the Tier 2 market by the end of the phase-out period.

Market reaction

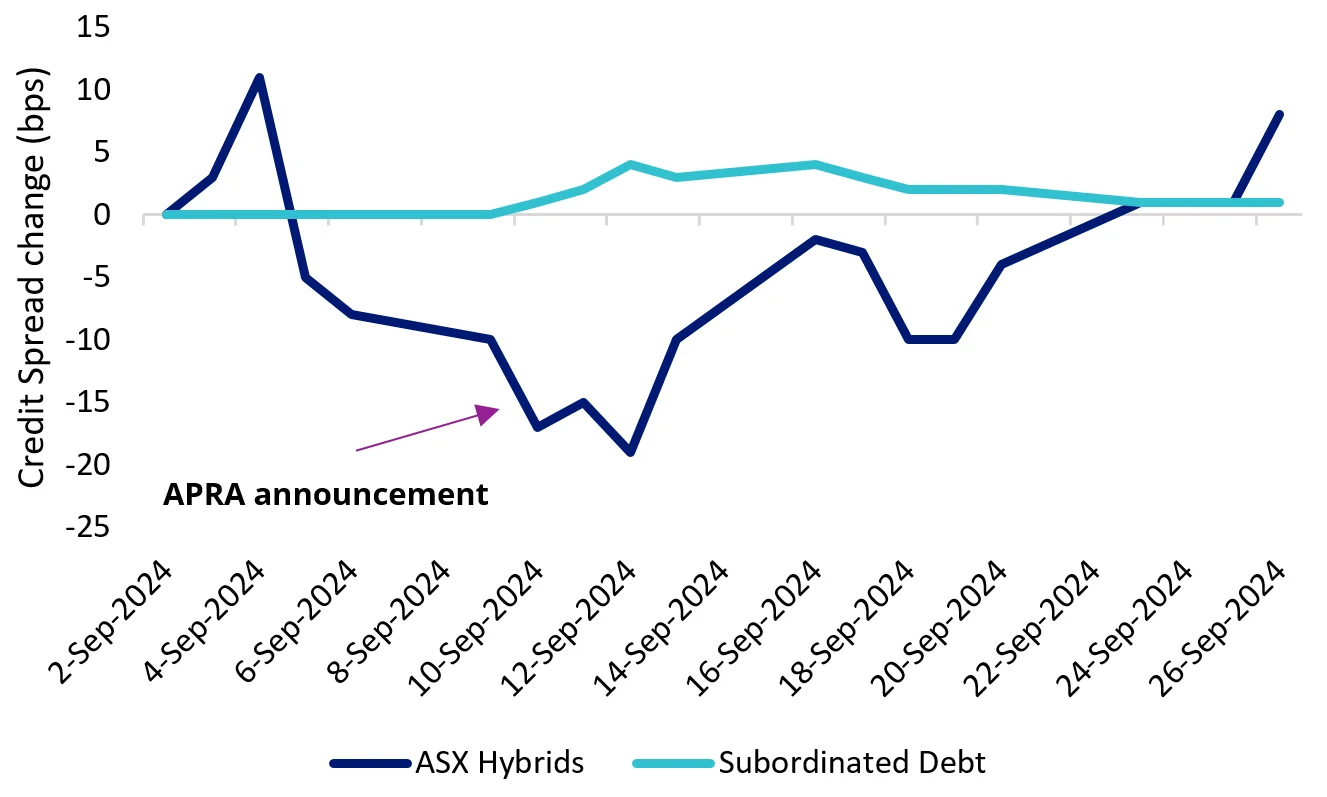

AT1 spreads tightened by approximately 19 basis points, while Tier 2 bonds slightly widened (2 basis points) in the days post announcement. However, those moves have since reversed, suggesting the market may have misinterpreted the proposed treatment of AT1s.

Chart 1: September 2024 credit spread change

Source: Bloomberg, IHS Markit, Bloomberg and VanEck; Subordinated bonds is the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index; Aus Bank Hybrids is an equally weighted basket of Westpac, ANZ, NAB, Macquarie and ANZ Additional Tier 1 Capital Securities live from March 2018.

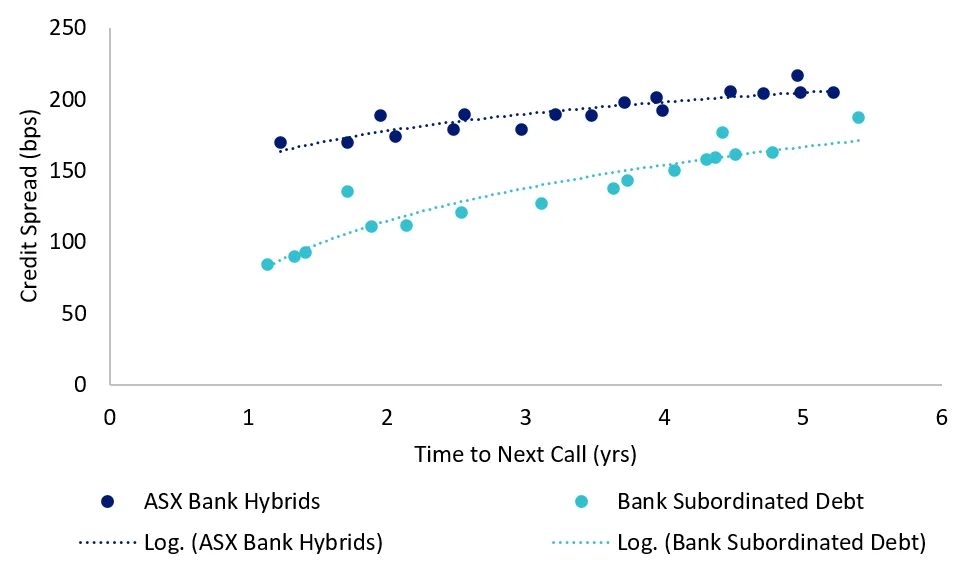

Yield differential between instruments currently stands at 55 basis points (including franking) at 3 years’ time to next call. Additionally, AT1 spreads are at near lowest since the global financial crisis.

Chart 2: Credit spread versus time to next call

Source: Bloomberg, Markit.

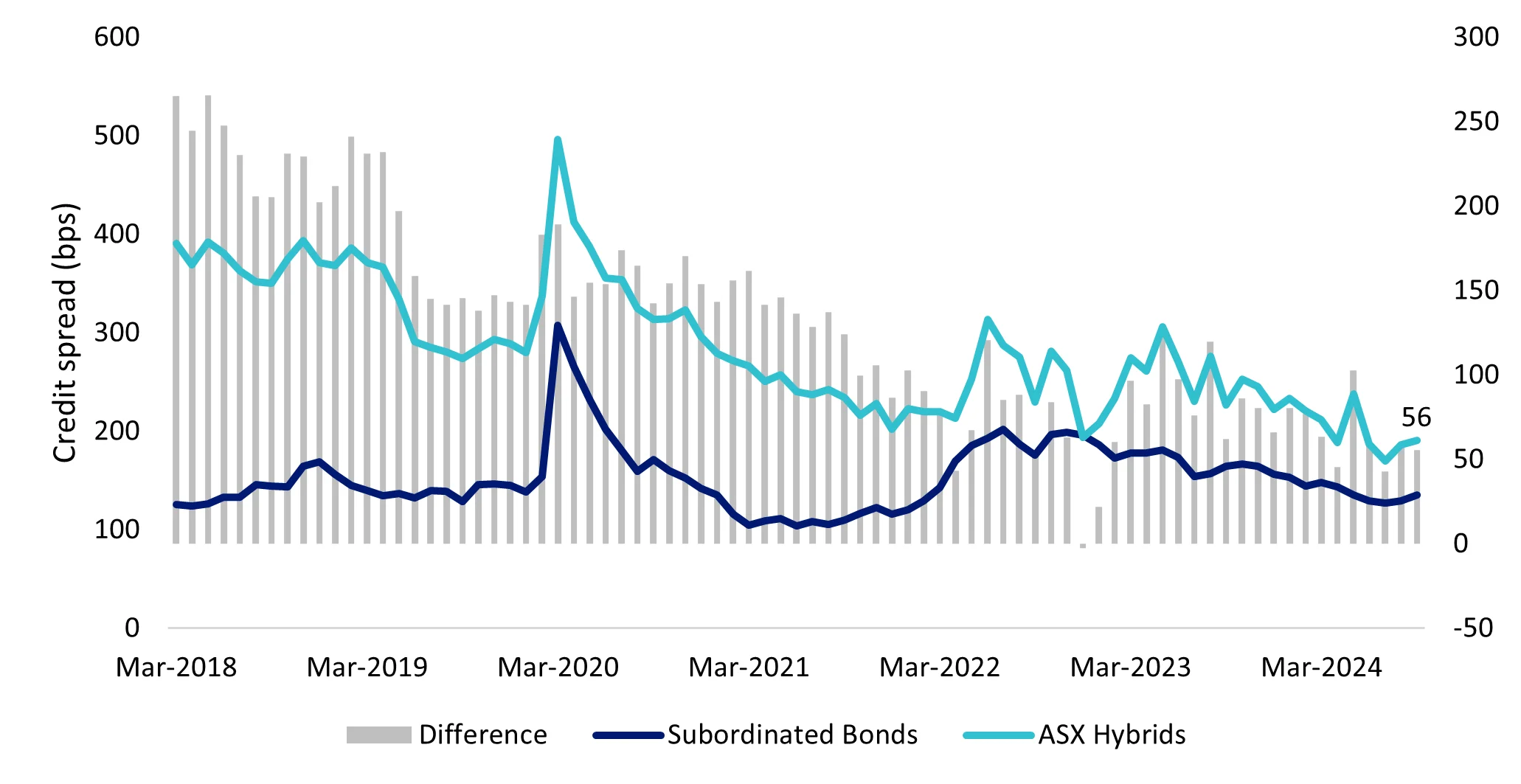

Chart 3: Australian subordinated debt versus bank hybrid credit spread comparison

Source: IHS Markit, Bloomberg and VanEck; Subordinated bonds is the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index; Aus Bank Hybrids is an equally weighted basket of Westpac, ANZ, NAB, Macquarie and ANZ Additional Tier 1 Capital Securities live from March 2018. Past performance is not indicative of future performance.

AT1s should continue to command a yield premium over Tier 2 instruments: While AT1s become eligible for Tier 2 treatment from a bank capital perspective during the transition period, the proposal does not suggest that existing policy terms cease. AT1s will still be treated in accordance with a ‘going concern’ stress event and Tier 2 in a ‘gone concern’ event. Additionally, there is more than a two-year period before the transition period initiates. The tight AT1 spreads suggest that they appear expensive.

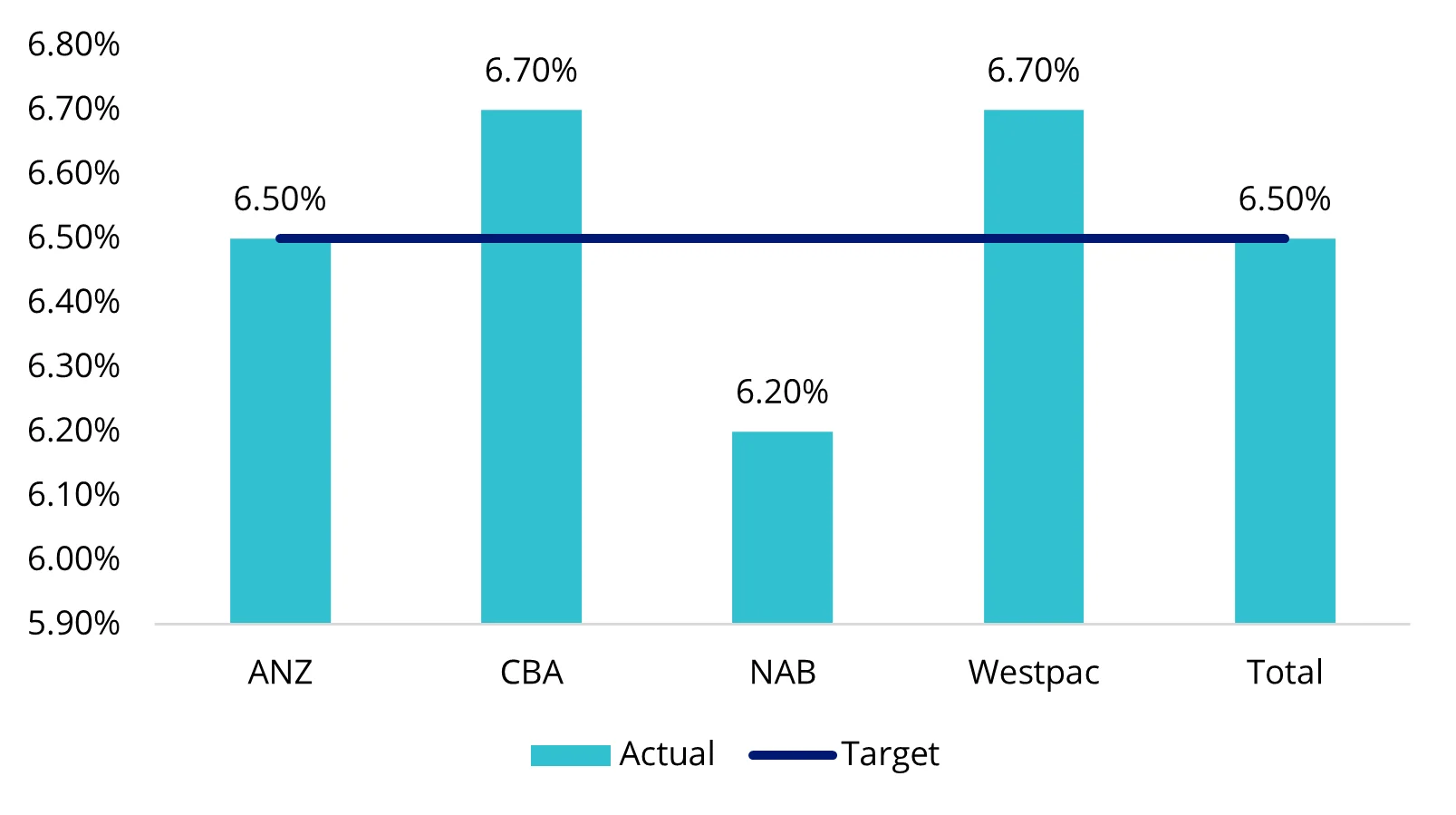

Sufficient market capacity to absorb additional Tier 2 issuance: APRA increased the Tier 2 capital requirement buffer for Australia’s big four banks in 2019 and 2021. Specifically, the Tier 2 target was raised to 6.5% of risk-weighted assets (RWA), effective 1 January 2026. Consequently, the Tier 2 market has expanded significantly, reaching $125 billion in recent years. With the majority of the big four banks achieving the 6.5% target, it suggests that there will be limited additional net new issuance going forward.

APRA’s proposal mandates that AT1 calls, amounting to $40 billion outstanding, be refinanced as Tier 2 capital. Projecting the upcoming calls for AT1s and Tier 2 bonds indicates that the total issuance will be lower than the total Tier 2 issuance observed in recent years. This suggests there is adequate market demand to comfortably absorb the supply. Additionally, despite the rapid increase in Tier 2 market size, Tier 2 credit spreads have steadily declined since July 2022.

Chart 4: Tier 2 as % of Risk Weighted Assets (RWA)

Big four banks have reached APRA’s Tier 2 target effective 1 January 2026

Source: Company Reports

Chart 5: Tier 2 issuance pipeline estimate

Next four years will on average be less than the previous six years

Source: Bloomberg.

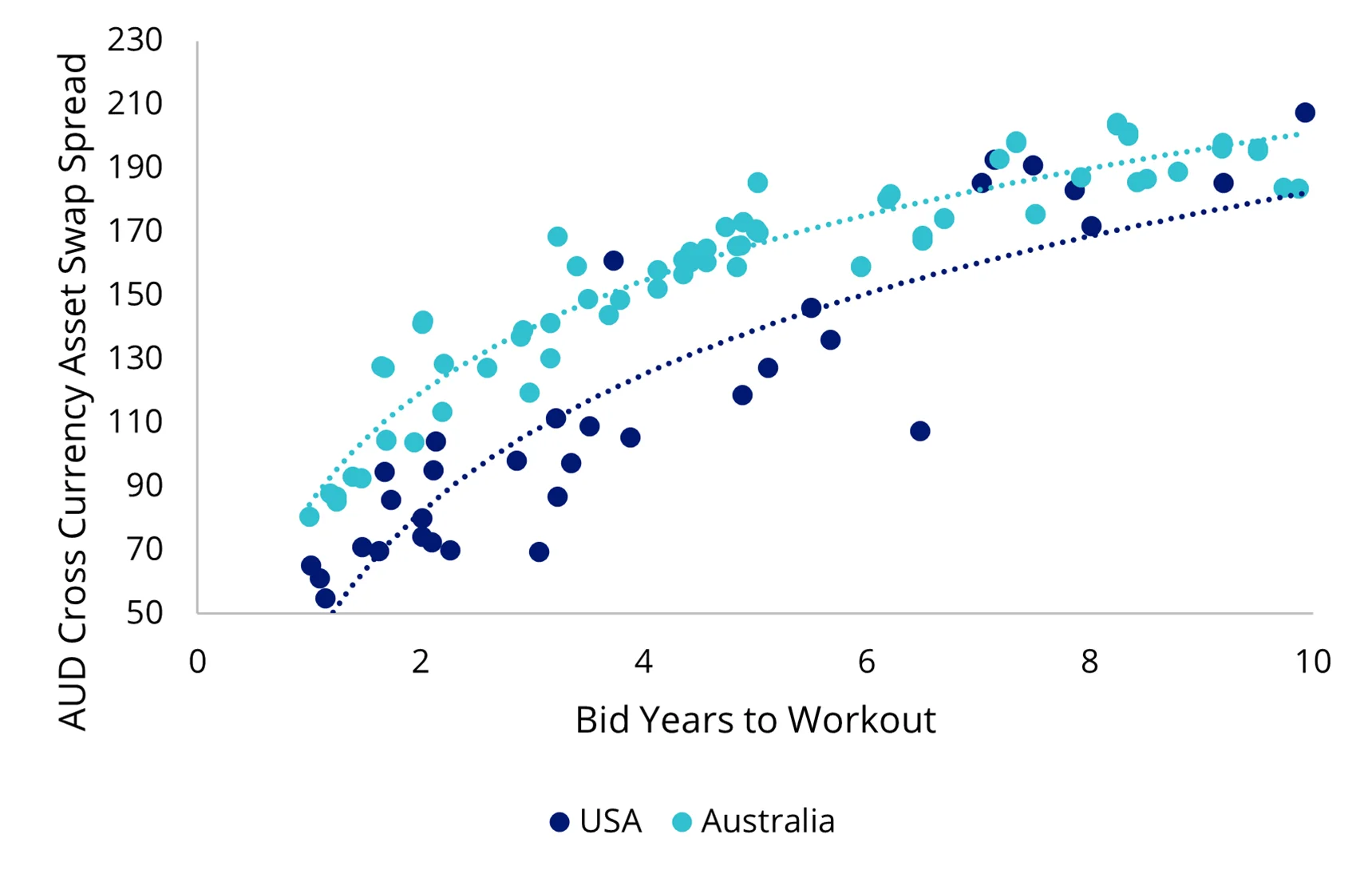

Additionally, Tier 2 paper from Australia’s big four banks, which hold an A- credit rating, offers a 20 basis points yield pickup compared to equivalent US A- rated bank paper, presenting compelling value.

Chart 6: Tier 2 A- rated major bank credit spread comparison

Source: Bloomberg, 6 September 2024.

Access to subordinated debt

For investors, subordinated bonds can serve two important roles in a portfolio:

- Increase return for a commensurate increase in risk – for investors with large holdings of traditional senior bonds, who are willing to take more credit risk, subordinated bonds issued by financial institutions can enhance income;

- Decrease risk – for investors with large holdings in hybrids or bank shares who are seeking to reduce their overall risk, subordinated bonds may perform a useful role.

Subordinated bonds have traditionally only been available to wholesale investors, but they can be accessed on ASX via the VanEck Australian Subordinated Debt ETF (ASX: SUBD). SUBD invests in a portfolio of subordinated bonds with the aim of providing investment returns before fees and other costs that track the performance of the Index.

Key risks

An investment in our Australian Subordinated Debt ETF carries risks associated with: subordinated debt, bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. See the VanEck Australian Subordinated Debt ETF PDS and TMD for more details.

Published: 16 October 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.