Bank hybrids are expensive

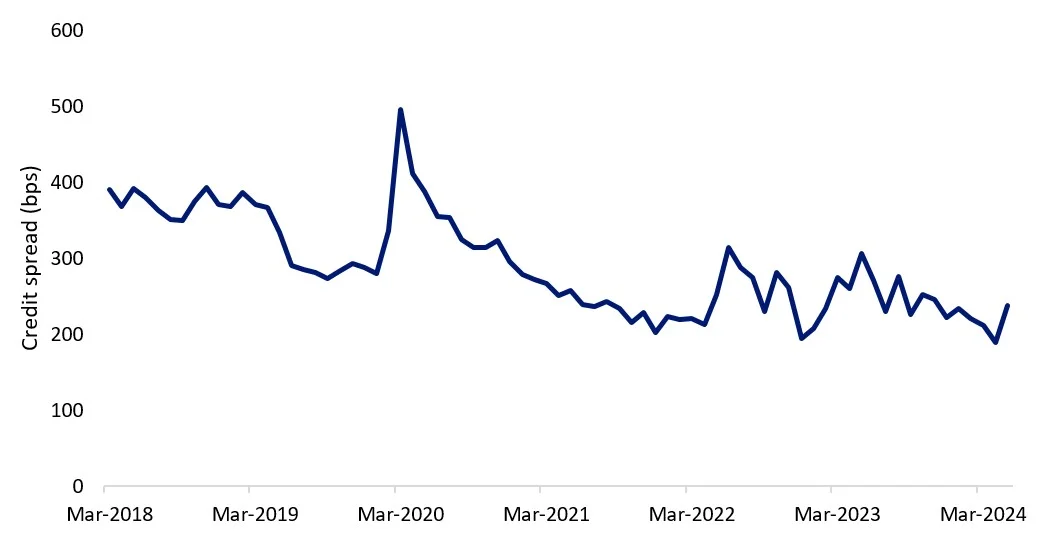

Investors concerned about bank hybrids are considering rotating exposure to Tier 2 capital, also known as ‘subordinated debt’ as they offer a similar yield, despite being higher up the bank capital structure.

A recent Australian Financial Review Article highlighted the headwinds facing Australian hybrids. According to the piece they are expensive and they face increasing regulatory scrutiny. Many savvy investors are considering alternatives.

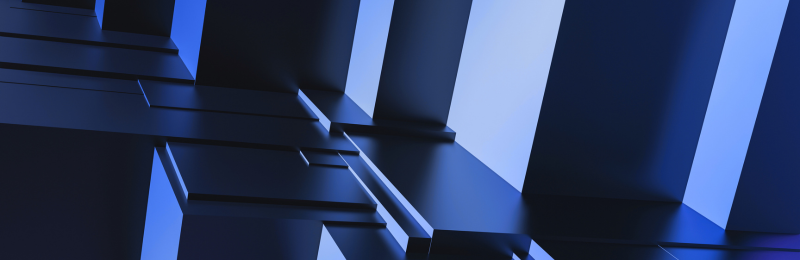

Interest (excuse the pun) in Australian hybrids (additional tier one or AT1 securities) is gathering pace as their spreads hover below pre-COVID lows and the market anticipates APRA changes. The ‘spreads’ in this instance refers to how risky these securities are relative to ‘risk-free’ government securities. The higher the risk (wider the spread), the more compensation i.e. yield investors demand. In this context, a tighter spread, implies these securities are more expensive than they have been in the past, as investors are not demanding more compensation for the risk.

There are many headwinds facing hybrids, which is why many in the market think they are expensive. One of these is increased regulator scrutiny.

Last September the Australian Prudential Regulatory Authority (APRA) sought feedback from participants in the hybrid market that raised the possibility that would restrict the retail ownership of hybrids. We wrote about this at the time – here. At the time, we suggested that hybrids were expensive, with spreads sitting well below pre-COVID levels and that issuing new bank hybrids under any proposed changes would be more costly for Australian banks and that seems to be the hypothesis of many in the market.

The reason regulatory changes could put pressure on Australian bank hybrids is that, under a new regime, new hybrids could pay substantially higher yields than the existing ones. This could potentially result in the sale of existing securities to buy into the newer ones. This could in turn push spreads higher on incumbent assets.

Since the release of the APRA paper last September, Australian bank hybrid credit spreads have continued to tighten, despite a recent pullback in May, we expect regulatory changes could put further pressure on Australian Bank Hybrids causing them to widen further.

Figure 1: Bank hybrid credit spread

Source: IHS Markit, Bloomberg and VanEck, Aus Bank Hybrids Hybrids is an equally weighted basket of Westpac, ANZ, NAB, Macquarie and ANZ Additional Tier 1 Capital Securities live from March 2018. Past performance is not indicative of future performance. You cannot invest in an index.

It is useful to understand why regulators have hybrids in their sights. Hybrids are mainly issued by banks and insurers and sit at the bottom of a bank's debt capital structure, one tier above common equity. They are designed to have characteristics of both debt and equity which are risks, and how investors should be rewarded for these risks, are often not well understood by many investors. For this reason, hybrids have been in the eye of Australia’s regulators for some time. In 2012, ASIC warned on the risks of hybrids and that any additional restriction on their ownership imposed by regulators would be consistent with global peers, such as the UK, which banned hybrids for retail investors in 2014.

Now, investors concerned about bank hybrids are considering rotating exposure to Tier 2 capital, also known as ‘subordinated debt’ as they offer a similar yield, despite being higher up the bank capital structure.

Figure 2: Yield to Worst comparison

Source: IHS Markit, Bloomberg and VanEck; Subordinated bonds is the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index; Aus Bank Hybrids Hybrids is an equally weighted basket of Westpac, ANZ, NAB, Macquarie and ANZ Additional Tier 1 Capital Securities live from March 2018. Past performance is not indicative of future performance. You cannot invest in an index.

Tier 2 capital

Tier 2 capital, also known as ‘subordinated debt’, forms part of the buffer that banks are required to have to absorb potential losses in the event of financial distress and was mandated in response to the fallout of the GFC. Tier 2 capital is used to protect depositors and policyholders so that they can feel confident their money is safe. It also protects taxpayers from costly bailouts.

Subordinated debt has similar characteristics to traditional bonds, however in times of financial stress it can be converted to shares or may be written off completely. It is called ‘subordinated’ because it sits below ‘senior debt’ or traditional bonds in the capital structure, but it also sits above and takes priority over ordinary shares and hybrids, in the event of insolvency. See the shaded area in the chart below.

The following chart provides a simplified example of the capital structure in a financial institution to illustrate how different securities issued by financial institutions rank in priority of payment in the event of collapse.

Figure 3: Simplified capital structure of a financial institution

#Per ASIC Report 365. *Per market convention.

You can see from the above chart that in the event of bankruptcy, priority is given to deposits and other senior debt. Shareholders get paid last, if at all. Subordinated debt securities (also known as ‘subordinated bonds’) rank above ordinary shares and Additional Tier 1 Capital but below senior debt, including traditional bonds, deposits and unsecured debt obligations. For this reason, subordinated bonds carry more risk than deposits and traditional bonds but are considered less risky than shares and other hybrids.

Since subordinated debt ranks below traditional bonds and above hybrids, it is therefore considered more risky than traditional bonds and less risky than hybrids1. As a result, financial institutions typically offer subordinated bonds with a higher interest rate than traditional bonds, but a lower interest rate than hybrids.

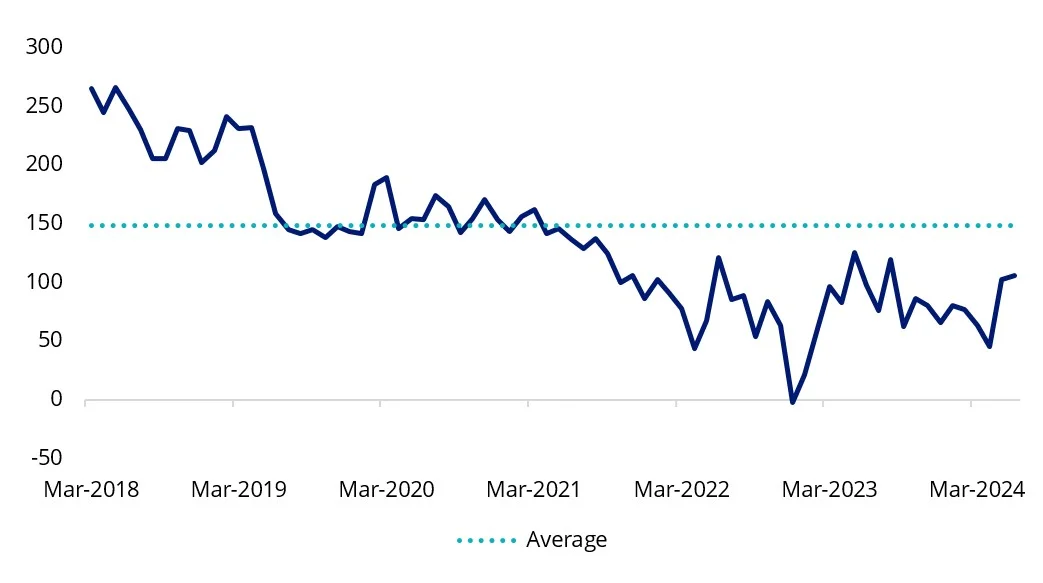

Subordinated bonds versus bank hybrids credit spreads

As noted above, you would expect the yield on subordinated debt to be lower than bank hybrids, because hybrids sit lower on the capital structure. However, the credit spread differential (the difference of the yields) between Australian subordinated bonds and bank hybrids, including franking, has been compressing since March 2018.

Figure 4: Australian subordinated bonds versus bank hybrid credit spread differential

Source: IHS Markit, Bloomberg and VanEck; Subordinated bonds is the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index; Aus Bank Hybrids Hybrids is an equally weighted basket of Westpac, ANZ, NAB, Macquarie and ANZ Additional Tier 1 Capital Securities live from March 2018. Past performance is not indicative of future performance. You cannot invest in an index.

Savvy investors may already be preparing for an unfavourable hybrid environment by moving into subordinated bonds, for a similar but lower yield, but with differing credit risk and differing regulatory scrutiny.

For investors, subordinated bonds can serve two important roles in a portfolio:

- Increase return for a commensurate increase in risk – for investors with large holdings of traditional senior bonds, who are willing to take more credit risk, subordinated bonds issued by financial institutions can enhance income;

- Decrease risk – for investors with large holdings in hybrids or bank shares who are seeking to reduce their overall risk, subordinated bonds may perform a useful role.

How to access the Australian subordinated debt market

VanEck Australian Subordinated Debt ETF (ASX: SUBD) gives investors access to a portfolio of investment grade subordinated bonds via a single trade on ASX.

SUBD tracks iBoxx AUD Investment Grade Subordinated Debt Mid Price Index which is designed to reflect the performance of investment grade subordinated bonds denominated in AUD. The index only includes AUD denominated floating rate bonds issued by financial institutions that qualify as Tier 2 Capital under APRA's2 Rules (or equivalent foreign rules), and which hold an iBoxx credit rating of investment grade.

As always, we recommend you speak to a financial adviser to determine if an investment in subordinated bonds is right for you. Past performance is by no means indicative of future performance.

Key risks: An investment in the ETF carries risks associated with: subordinated debt, bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. See the PDS for details.

1Please note: Although the term “hybrid” is used by ASIC to refer to both Tier 2 Capital and Additional Tier 1 Capital, this term tends to be used in the market (by advisers and the media) to describe only Additional Tier 1 Capital securities or ‘capital notes’. In this document, the word “hybrid” refers to Additional Tier 1 Capital securities or capital notes and “subordinated bonds” or “bonds” refers to Tier 2 Capital or subordinated debt.

Published: 07 June 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

The Fund is based on the Markit iBoxx Investment Grade Subordinated Debt Index (‘the Index’). The Index is the property of Markit Indices Limited (‘Markit’) and iBoxx® and Markit® are trademarks of Markit or its affiliates. The Index and trademarks have been licensed for use by VanEck. The Fund is not sponsored, endorsed, or promoted by Markit.