Is it safe to go back into bonds?

This year has been subdued for the bond market, however we still think investors should not be afraid of bonds. They just need to know where to swim.

This time last year, the market was predicting that the US Federal Reserve (Fed) would be cutting rates six to seven times in 2024. Equity markets responded by rallying. The prevailing thought was that lower interest rates would be great for business.

Locally, this time last year it was also anticipated that our central bank, the RBA, would also commence a rate-cutting cycle in 2024, though not to the same magnitude of the Fed.

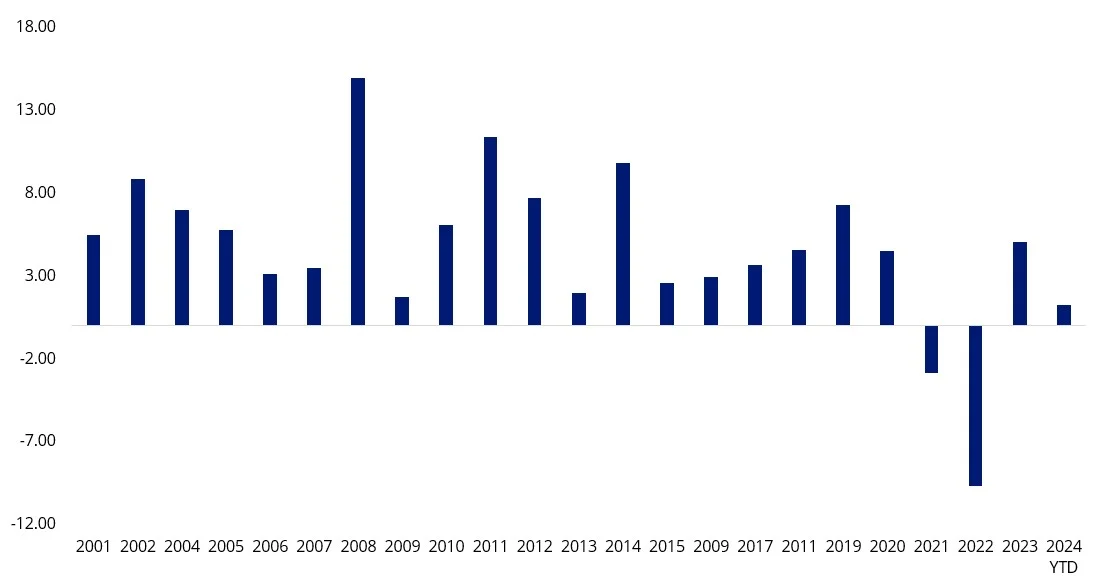

What transpired did not match what was anticipated. As a result of the interest rate actions of central banks this year, or lack thereof, government bond yields have crept higher and Australian bonds, as represented by the Bloomberg AusBond Composite 0+Yr Index (AusBond Index), could be on track for the third-worst year since the turn of the century.

However, now, we think, there could be opportunities for fixed-rate bond investors, especially in credit, as the likelihood of yields decreasing appears stronger than the chance of them increasing.

Bonds are back, but being selective is important.

But before we get to bond selection, it’s worthwhile to understand the bond market index and bond investment strategies.

Investing in bonds

As with equities, bond investors are continually searching for better investment outcomes. In the world of equities, indices have evolved and smart beta has flourished. However, for bonds index innovation is still gaining in its formative years.

Bond indices, unlike equity indices, are typically liability-weighted and not asset-weighted. This means that the most indebted issuers, i.e. those that have borrowed the most, make up more of the benchmark indices. You can imagine, sometimes that is not desirable from an investment standpoint.

In Australia the largest borrower is the Commonwealth Government, so its bonds represent the largest portion of the Australian benchmark bond index, the AusBond Index. Likewise, the most indebted companies make up a larger percentage of the index than those that don’t rely on borrowing.

An active Australian bond manager may attempt to outperform the AusBond Index by:

- Anticipating and positioning the portfolio for changes in interest rates (interest rate/duration strategy); and/or

- Allocating more to sectors and issuers they think will outperform the index (credit strategy).

They will do this using top-down economic and bottom-up company analysis. Top-down analysis involves analysing economic conditions to determine the direction and likelihood of interest rate moves and which sectors to rotate in and out of as the economy changes. Bottom-up analysis will involve assessing each bond issuer and determining the likelihood of them being able to repay the debt issued.

The peculiarities of the bond markets have made index innovation more difficult than equities. Early smart beta bond approaches focused on weighting the index differently from liability-weighting. Methods include weighting by GDP for global bonds, or using metrics such as earnings generation, and liquidity to determine index weights. However, because bond liquidity can be tight and prices are opaque, there is a lack of long-term data to test and/or prove the efficacy of these new approaches.

Enter Markit (now a part of S&P Dow Jones Indices): the index provider best known for iTraxx, which active managers use to assess the credit risk spread of corporate bonds to government bonds. Founded on their deep knowledge of bond markets, a smart beta corporate Australian dollar bond index based on yield and credit quality that only includes investment grade bonds was created.

It is this index that the VanEck Australian Corporate Bond Plus ETF (PLUS) tracks.

Interest rates are high. So why are bonds having a bad year?

Remember, the most important factor affecting a bond’s price is the level of interest rates. When rates fall, existing fixed-rate bonds of all types become more valuable as they continue paying out the same coupon even though interest rates have fallen.

On the other hand, if interest rates rise, fixed-rate bonds become less valuable because their coupons are static and they therefore trade at a ‘discount’.

This year, while the RBA has kept rates steady, the market price for bonds, however, has been shifting as the market anticipates the next rate move and the direction of the economy. The yield on 10-year Australian government bonds, for example, has risen from 3.97% at the start of the year to be above 4.60% at the time of writing.

This means the value of these longer-dated bonds has fallen so far in 2024.

With memories of 2021 and 2022 still fresh in bond investors’ minds, it is little wonder that they are wary about the direction of rates.

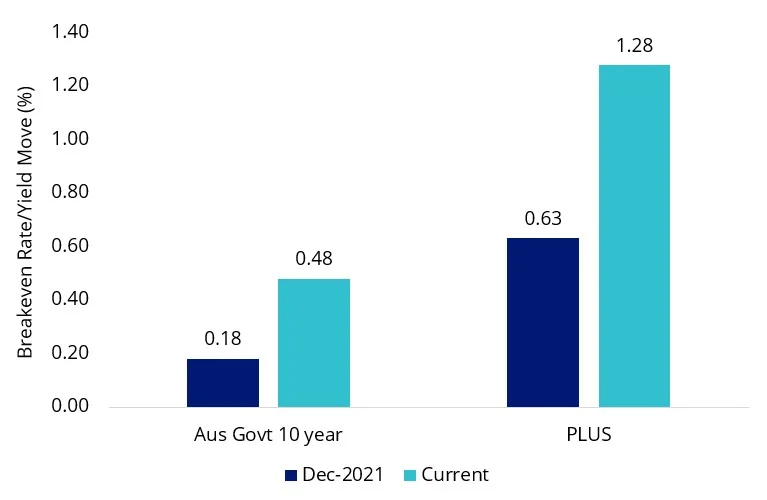

Making the problem more acute for bond investors, was that a couple of decades ago they could rely on reasonable current income to mitigate price losses when yields were rising. In 2021 and 2022 the current income was too low to provide a ‘carry cushion’ for the unprecedented price falls as rates rose.

The ‘carry cushion’ quantifies how much yields, relative to duration, can increase before a bond investment return over 12 months becomes negative. With rates at historic lows after the COVID crisis, it was little wonder bonds were underwater on a total return basis when the RBA started hiking.

For reference, in 2021 Australian 10-year government bonds were yielding 1.60% (as of 31 December 2021), not only was the current income negligible, but it was also only enough to absorb a 0.18% rise in yield over the next 12 months before an investor was underwater on a total return basis. We know what happened.

Now that the RBA has kept rates at 4.35% since its November 2023 hike, bonds have been having a bad year, with the AusBond Index, barely posting a positive return because investors were anticipating rate cuts through 2024 and many bonds were pricing in these expectations.

Chart 1: Calendar year returns of the AusBond Index

Source: Morningstar Direct. YTD is to 31 October 2024. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

But investors should not be afraid of bonds. They just need to know where to swim. The yields on bonds is closer to, or in some instances higher, than the rates at the long end of the curve.

Rates are not the only determinant to bond prices. A perceived deterioration or improvement in creditworthiness also impacts bond prices. For corporate bonds, this is measured by credit spreads, which have recently tightened, coinciding with improving economic conditions.

Chart 2: Australian credit spreads

Source: Bloomberg, Bloomberg AusBond Credit 0Yr+ Index.

A higher yield means that ‘carry’ is once again providing fixed income investors a cushion. The income earned on the current 10-year Australian Government bond note provides a return buffer that would allow investors to break even, even if the yield increases by 48 bps to 5.00% over the next year. For corporate bonds, the carry is higher. The yield at which investors in PLUS would break even in 12-months’ time is about 6.97%, or 128 basis points above where it stands today. In other words, yields would have to rise over 1% in the next twelve months for the total return of PLUS to be below zero.

Chart 3: The higher carry provides greater cushion against higher yields

Source: Bloomberg, S&P, as at 18 November 2024.

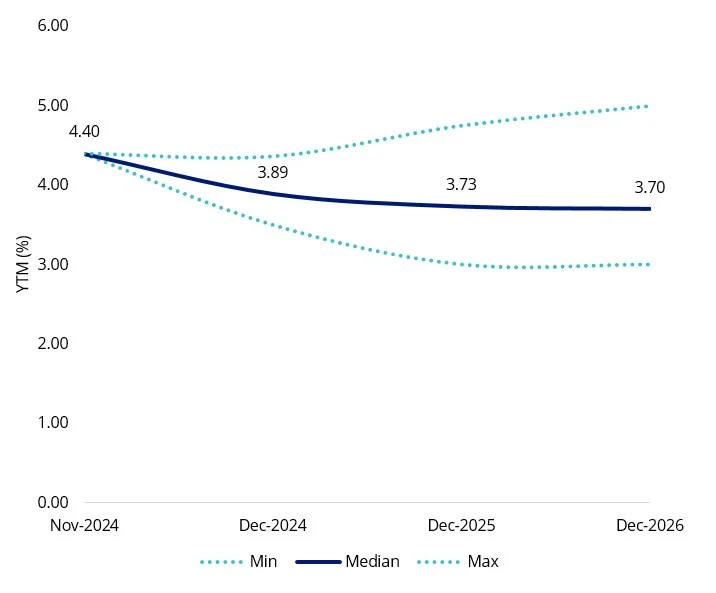

Another positive going into 2025 is that broker consensus is for the Australian government 10-year government bond yields edging lower over the next 24 months, as the RBA moves closer to an easing cycle. If this does play out, investing in fixed-rate bonds could be advantageous, offering the potential for bond price appreciation from decreasing yields.

Chart 4: Australian government 10 year bond yield median broker forecast

Source: Bloomberg, As at 20 November 2024.

Bonds could be back in 2025 and one way to gain access to a portfolio of the highest-yielding investment-grade corporate bonds is via PLUS.

PLUS: Investment-grade, short-dated over long-dated securities

The VanEck Australian Corporate Bond Plus ETF (PLUS) provides a diversified and higher yielding investment-grade credit exposure relative to the Bloomberg AusBond Corporate Index.

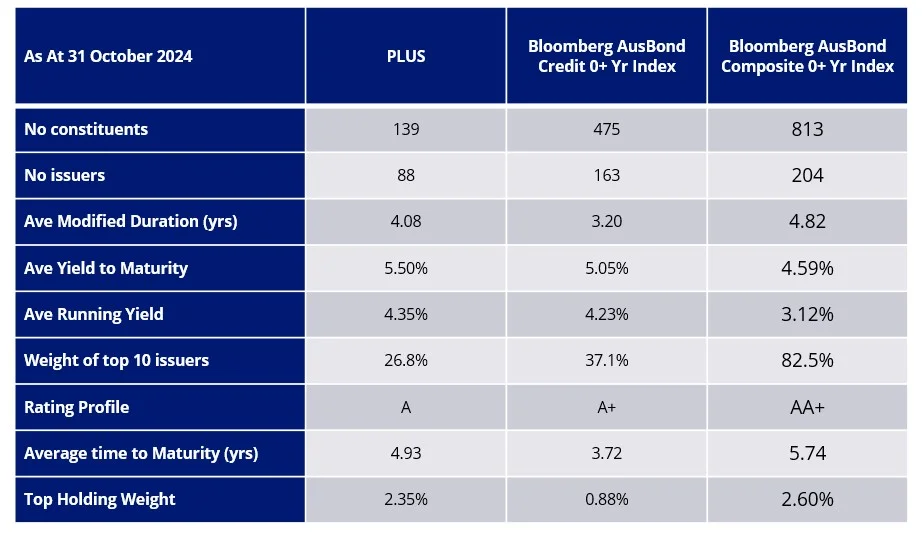

PLUS is yielding 5.50% as at 31 October 2024 compared to 4.59% of the AusBond Index and 5.05% for the Australian Corporate Bond index, the Bloomberg AusBond Credit 0+ Yr Index. Noting past performance is by no means an indication of future performance.

Fund characteristics

Source: VanEck, Markit, Bloomberg; as at 31 October 2024. Past performance is not indicative of future performance. See Footnote 1 below.

Key risks

An investment in PLUS carries risks associated with: bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 21 November 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

The Fund is based on the Markit iBoxx AUD Corporates Yield Plus Index (‘the Index’). The Index is the property of Markit Indices Limited (‘Markit’) and iBoxx® and Markit® are trademarks of Markit or its affiliates. The Index and trademarks have been licensed for use by VanEck. The Fund is not sponsored, endorsed, or promoted by Markit

1The Bloomberg AusBond Composite 0+ Yr Index (“BACI”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of the broad Australian bond market, weighted by market value. The Bloomberg AusBond Credit 0+ Yr Index (“BACC”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of the Australian corporate bond market, weighted by market value. PLUS’s index measures the performance of the higher-yielding AUD denominated corporate bond market with credit ratings from AAA to BB-. The index PLUS tracks has fewer bonds, fewer issuers, a different rating profile, different industry allocations, different sensitivity to interest rates and a different maturity profile than BACI and BACC. ‘Click here for more details’