The link between standup comedy and bond investing

As the RBA approaches an easing cycle, bond investors who play the yield curve effectively have a small window of opportunity for the last laugh.

The late comedian Bill Hicks understood the importance of perfect timing. His dark, pithy indictments on the human condition may not have been to everyone’s tastes, however his comedic timing was undeniably legendary.

Timing makes a difference with investing as well. Only in the share markets, getting the timing exactly right can be just as much down to luck as it is skill. Multiple factors and events can influence the markets – most of which are outside of an investor’s control – so knowing whether you’ve bought at the dip or sold at the tip is only apparent in hindsight.

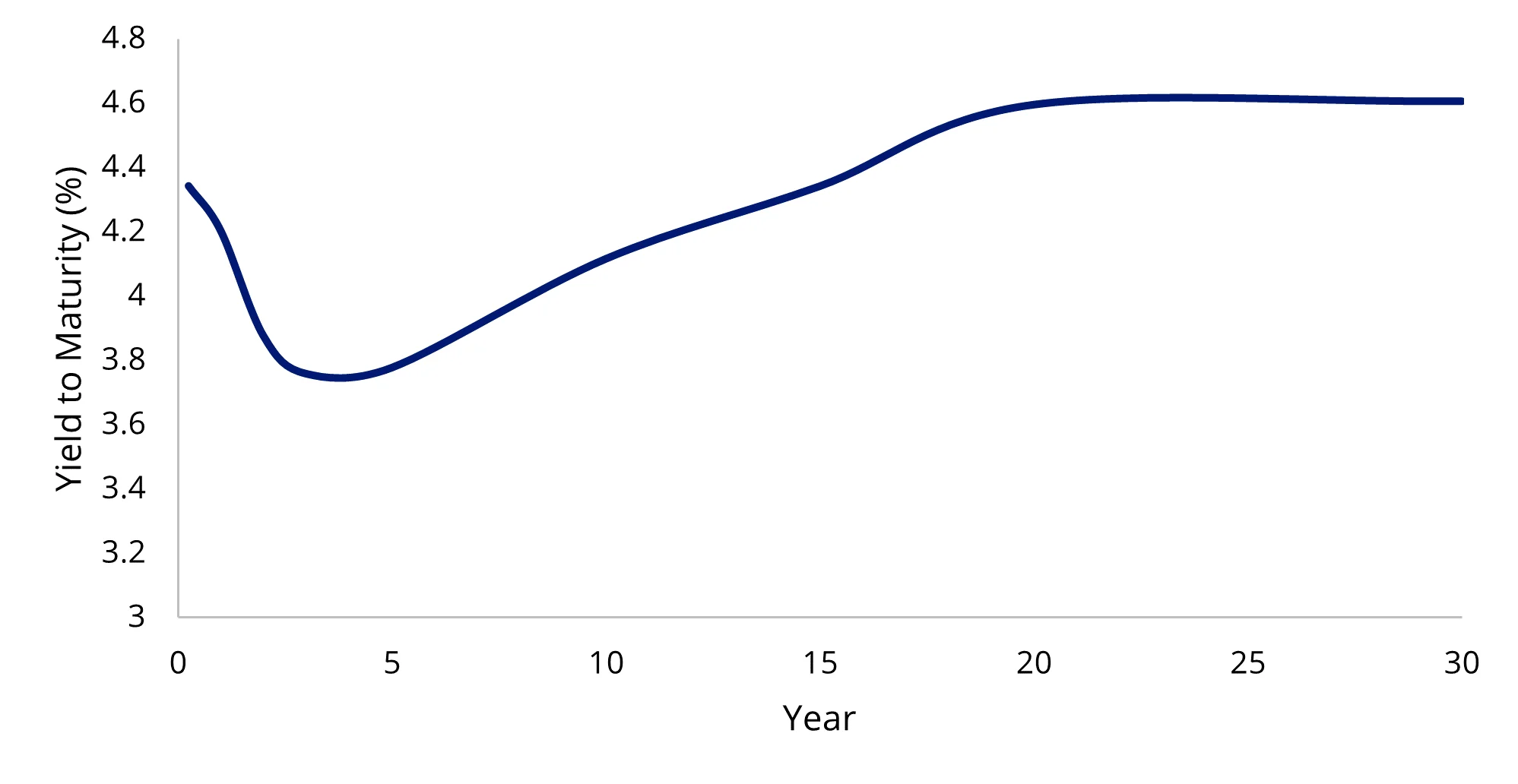

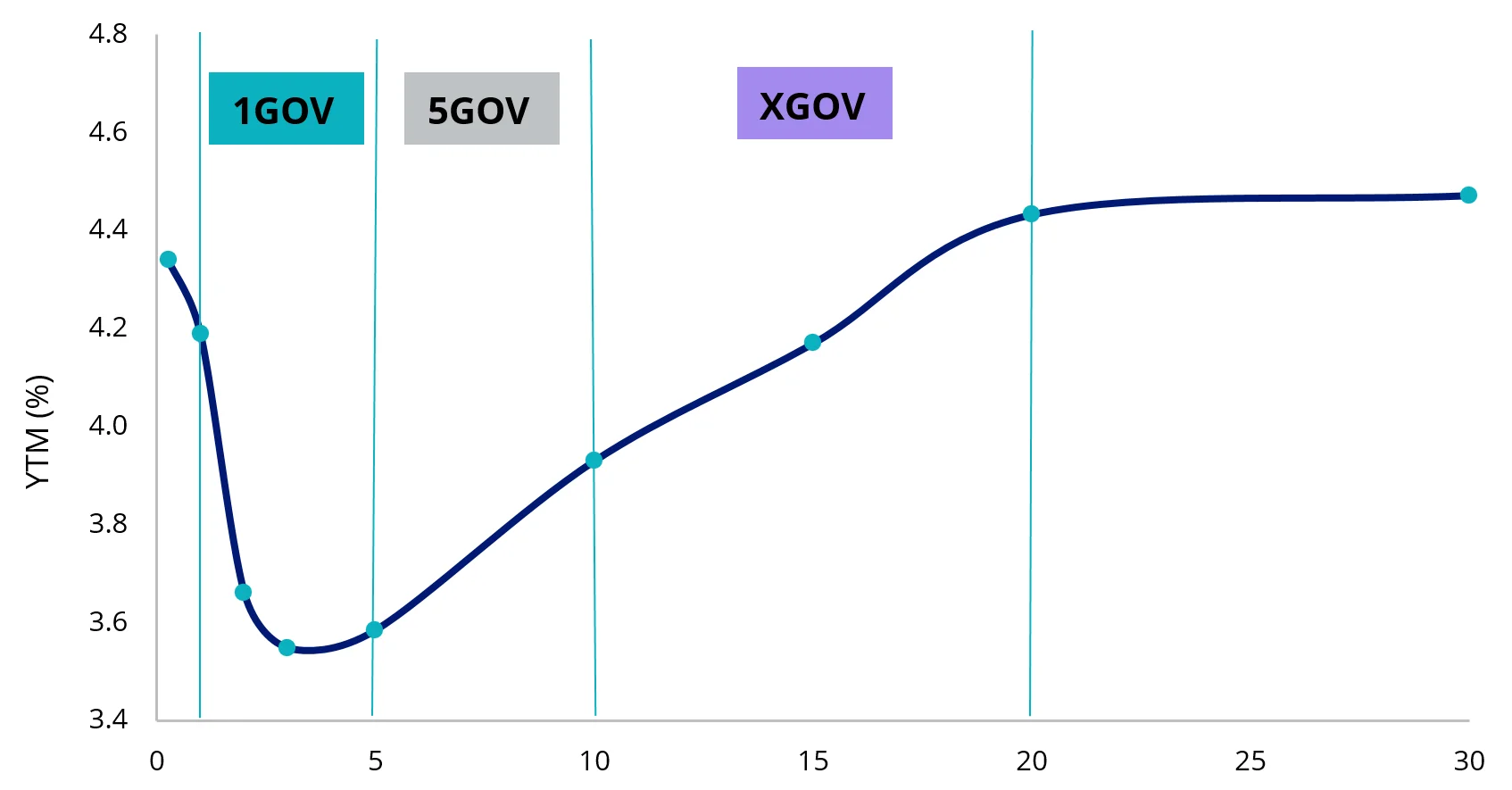

Bonds are a bit of a different beast. Investors who know how to ‘play the yield curve’ can benefit or seek protection from yield changes. If they get the timing right, they benefit from the most upside. Below is the line that plots Australian government bond yields with differing maturity dates.

Chart 1: The Australian Government Bond yield curve

Source: Bloomberg, as at 30 August 2024. Yield measures are not a guarantee of future income.

In a rate easing environment, government bond yields typically fall. Investors with longer-term fixed rate bonds see the greatest returns by selling the bonds at a higher value than they bought them for.

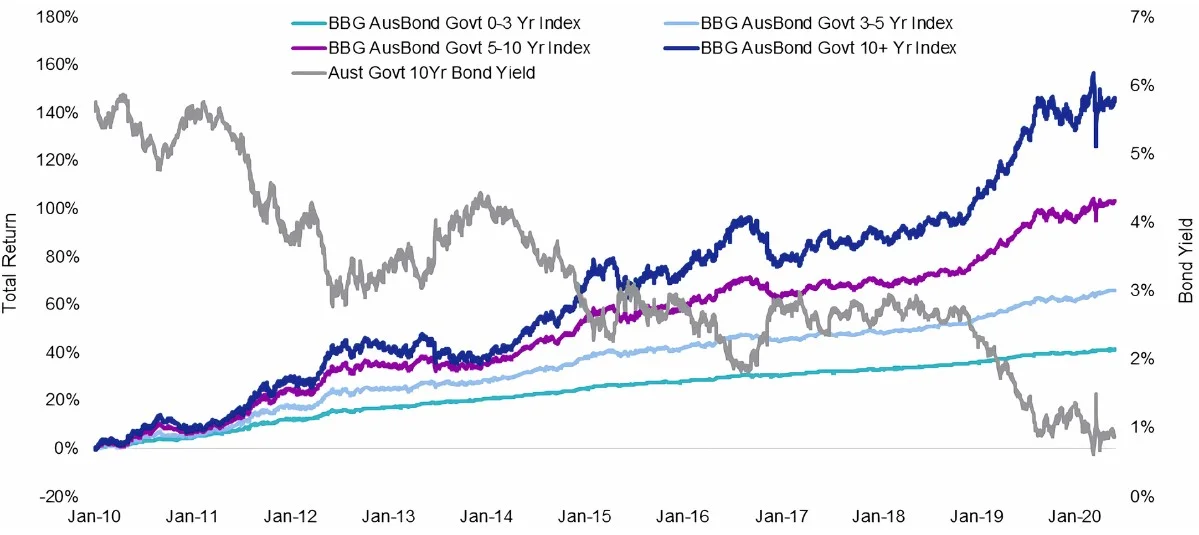

Between 2010 and 2020, the RBA cash rate gradually declined from 4.75% to 0.10%. During this period, government bond yields also fell, with long-dated bond investors experiencing the most significant outperformance.

Chart 2: Australian Government Bond Indices at different terms vs 10 year bond yield

Source: VanEck, Bloomberg. As at 31 May 2020. Past performance is not an indicative of future performance. You cannot invest in an index.

Currently, investors have a window of opportunity to position their fixed income portfolios in anticipation of the RBA potentially entering an easing cycle. The key variable to watch is the timing of the RBA’s interest rate cuts.

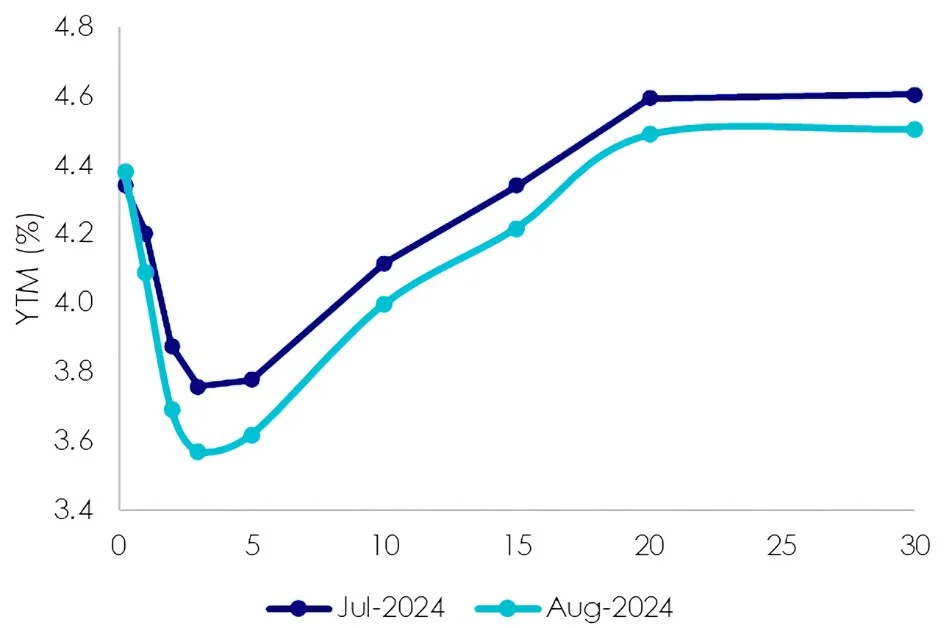

In August, markets dialed up rate cut expectations and priced in a rate cut for December. This position was reflected in the yield curve shift downwards. However, the RBA is skeptical of this market narrative. In the latest meeting minutes, the RBA mentioned a rate reduction by the end of the year “didn’t align” with its thinking.

Chart 3: Australian yield curve shift

Source: Bloomberg. Month ends. Yield measures are not a guarantee of future income.

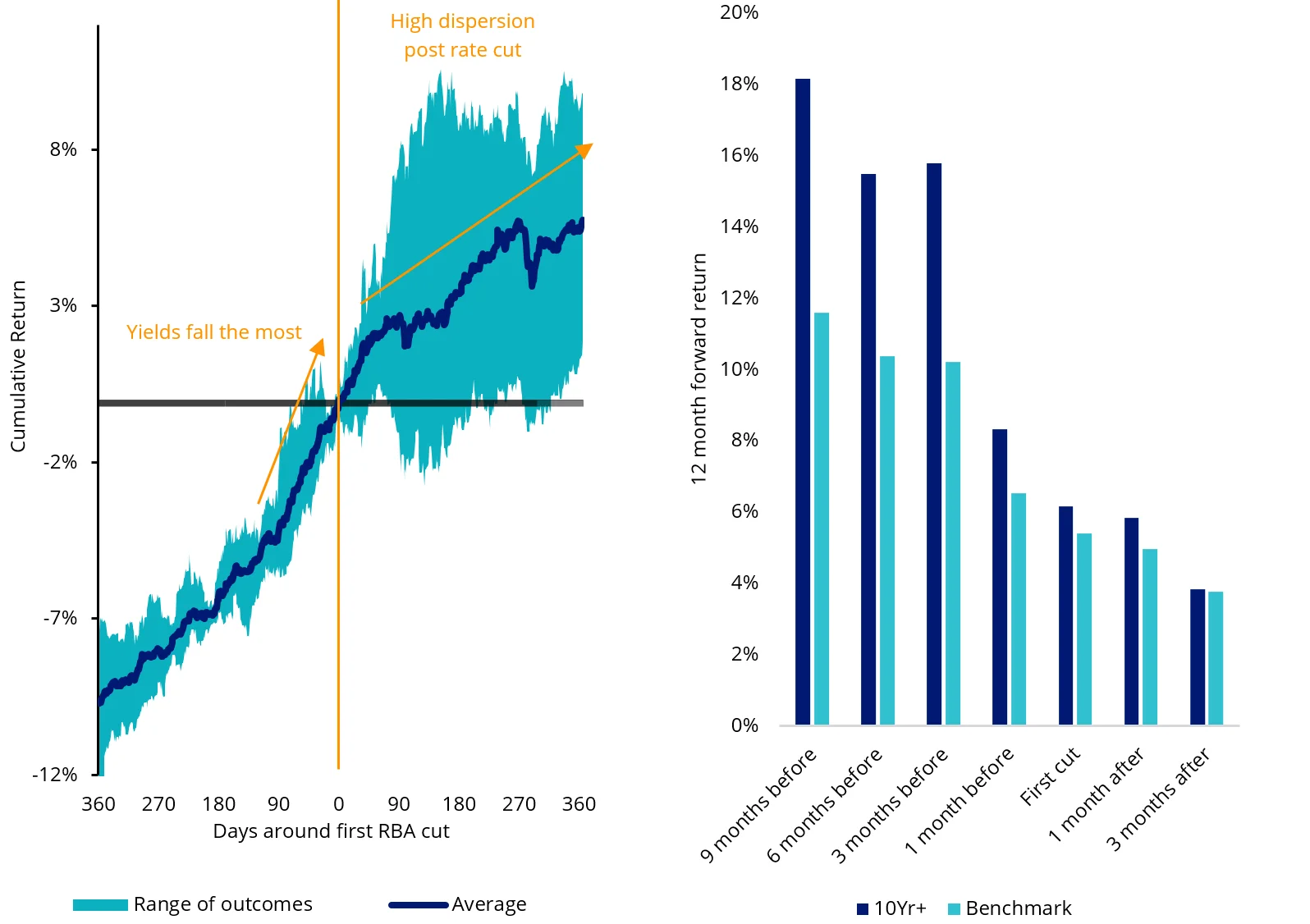

While the RBA is moving towards an easing cycle, the exact timing remains uncertain. Looking back at the last five rate cuts, three months before the first rate cut appears to be the sweet spot for maximising returns with yields falling the most and long-dated bonds experiencing the most upside.

Chart 4: Australian government bond performance around the first rate cut

Source: Bloomberg. Benchmark as S&P/ASX Government Bond Index, 10Yr+ as S&P/ASX Government Bond 10Yr+ Index. Rate cuts include 6 February 2001, 2 September 2008, 1 November 2011, 3 February 2015 and 4 June 2019. Past performance is not indicative of future performance.

Past performance is not indicative of future performance, but assuming the RBA announces a rate cut after its Board meeting on 10 December 2024, as the market anticipates, three months prior to that date is 10 September.

The market isn’t always right. In fact, it’s often wrong. It was only a month ago that global markets were panicking that the US was going into recession, which has now subsided. The RBA has also been known to backflip. In fact, the next rate move could be an increase. As noted in the minutes of the RBA’s last meeting, a rate hike was something they seriously considered before they ultimately decided to hold. Services inflation, wage inflation, and housing prices continue to be persistently elevated, with no clear short-term solution. There is also still a chance that goods inflation may pick up again due to geopolitical conflicts.

Timing is key. Standup comedians can control their performance and influence their audience, which enables them to deliver their punchlines at just the right moment. Investors don’t have that kind of power, but they can potentially play the yield curve more effectively with deeper understanding of the macroeconomic landscape and access to government bonds that target particular points of the yield curve. The latest VanEck Portfolio Compass: Credit and Fixed Income 2024 can help with the former, providing an analysis of the current and expected impact of inflation, policy rates, economic growth, and exogenous risks on Australian and global bonds markets.

Fixed income ETFs offer investors a means to express their views on interest rates. VanEck offers three Australian government bond ETFs that target distinct maturity buckets.

Chart 5: Australian government bond yield curve

Source: Bloomberg, as at 30 August 2024. Yield measures are not a guarantee of future dividend income from the funds.

1GOV - Targeted access to the short-end of the curve. Access to a portfolio of Australian government bonds which have maturity dates between 1 and 5 years.

5GOV - Targeted access to the mid-end of the curve. Access to a portfolio of Australian government bonds which have maturity dates between 5 and 10 years.

XGOV - Targeted access to the long-end of the curve. Access to a portfolio of Australian government bonds which have maturity dates between 10 and 20 years.

The VanEck Australian Floating Rate ETF (ASX: FLOT) is also available for investors who think the RBA’s next rate movement will either be a prolonged hold or an increase. As returns are based on short-term interest rates that are reset periodically, there is reduced duration risk compared to fixed rate bonds. These bonds are of investment grade quality, typically issued by corporate entities such as the big four banks, foreign banks, other lending institutions and listed property trusts. As this is deemed an elevated risk compared to government bonds, the yields are typically higher.

Key risks

An investment in these ETFs carries risks associated with: interest rate movements, bond markets generally, issuer default, credit ratings, country and issuer concentration, liquidity, tracking an index and fund operations. See the PDS and TMD for more details.

Published: 10 September 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.