Equity markets year in review and outlook for 2025

What were the main drivers of global performance in 2024, what should investors keep an eye on in the current environment, and where are this year’s stock market opportunities?

Debrief on 2024 Global markets

2024 was another impressive year for global equity markets. The MSCI World ex Australia index returned 31.18%, marking its strongest calendar year since 2013, with performance primarily driven by AUD weakness and US equity strength.

Return drivers for the year can be divided into two distinct periods.

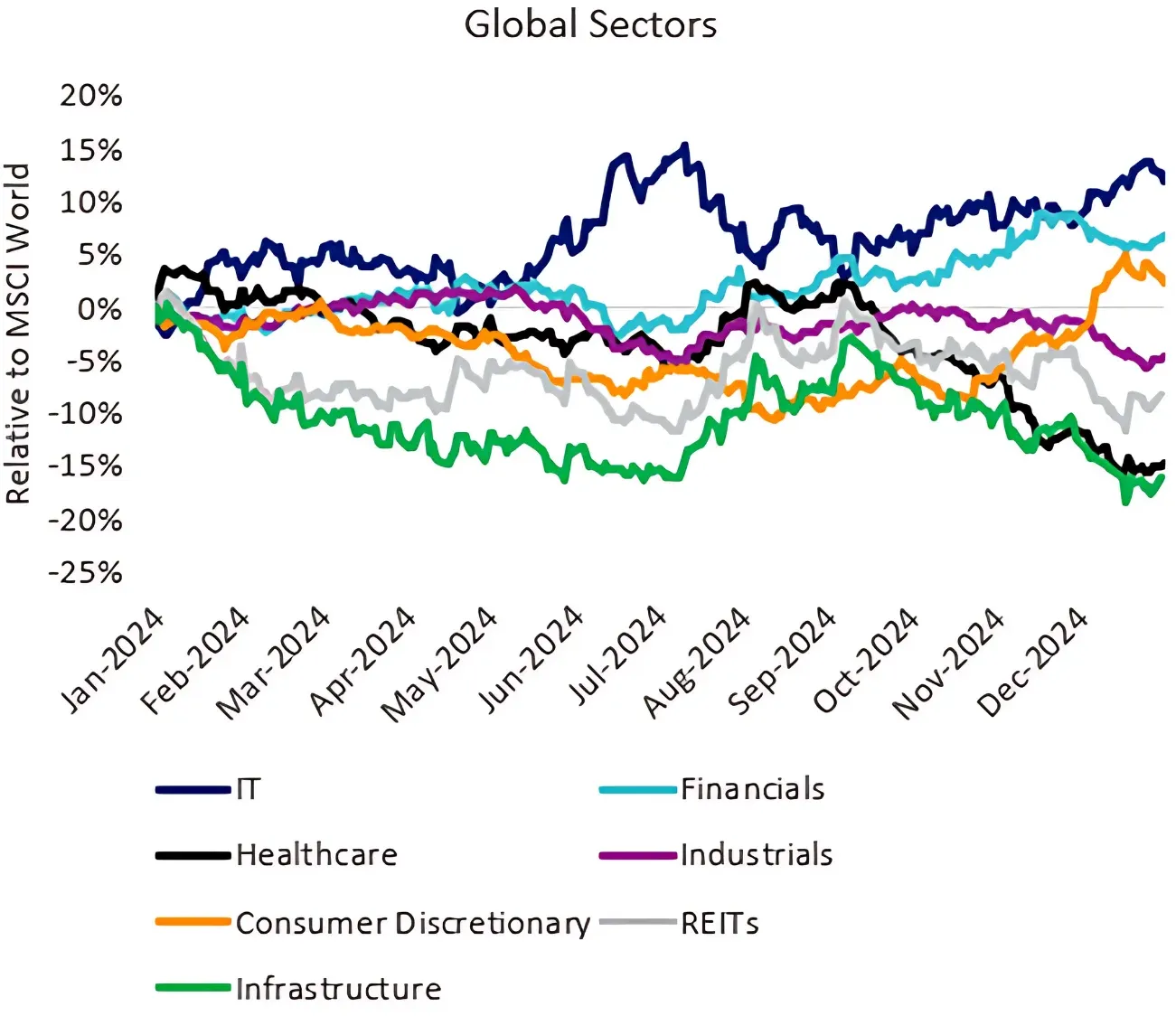

During the first half of the year, the late cycle environment – characterised by weak manufacturing activity, narrow earnings growth and delay in rate cut expectations – contributed to quality and US technology megacap companies outperforming. NVIDIA was the standout: its impressive 171.25% return was driven by 'hockey-stick' earnings growth, with businesses increasingly looking to enhance their AI capabilities driving strong demand for its data center GPUs.

During the second half of the year, a cyclical rotation occurred. Most global economies experienced significant reductions in headline inflation, which facilitated interest rate cuts and put a renewed focus on supporting economic growth. Additionally, the election of the Trump administration benefited small-caps and cyclical sectors such as financials and consumer discretionary, with the incoming US president perceived as more 'pro-business', with an increased likelihood of financial deregulation.

Chart 1: Global equity sector performance in 2024

Source: Bloomberg, MSCI World Sector Indices. REITs as FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged, Infrastructure as TSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index. Data to 31 December 2024. Past performance is not indicative of future performance. You cannot invest in an index.

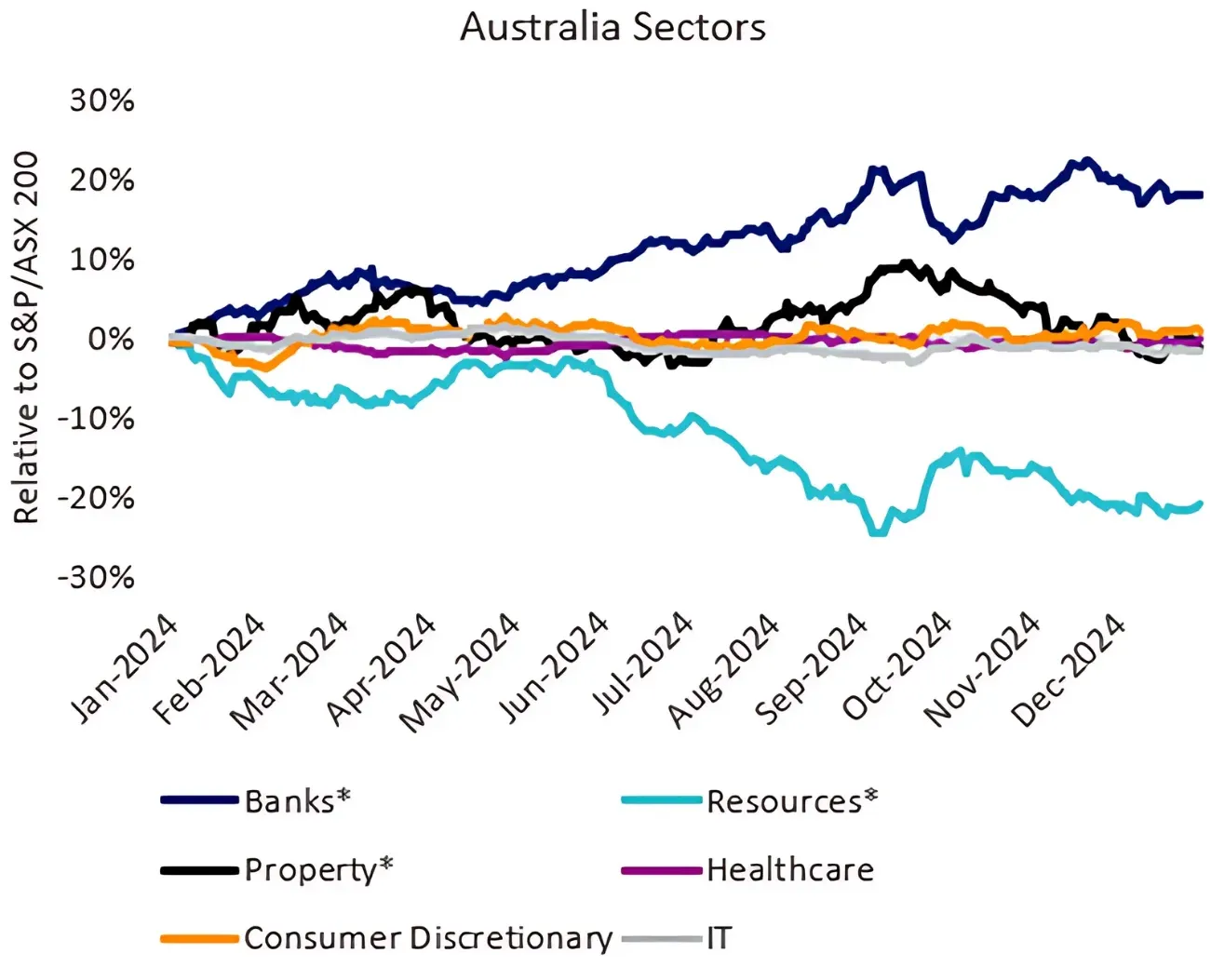

Australian markets

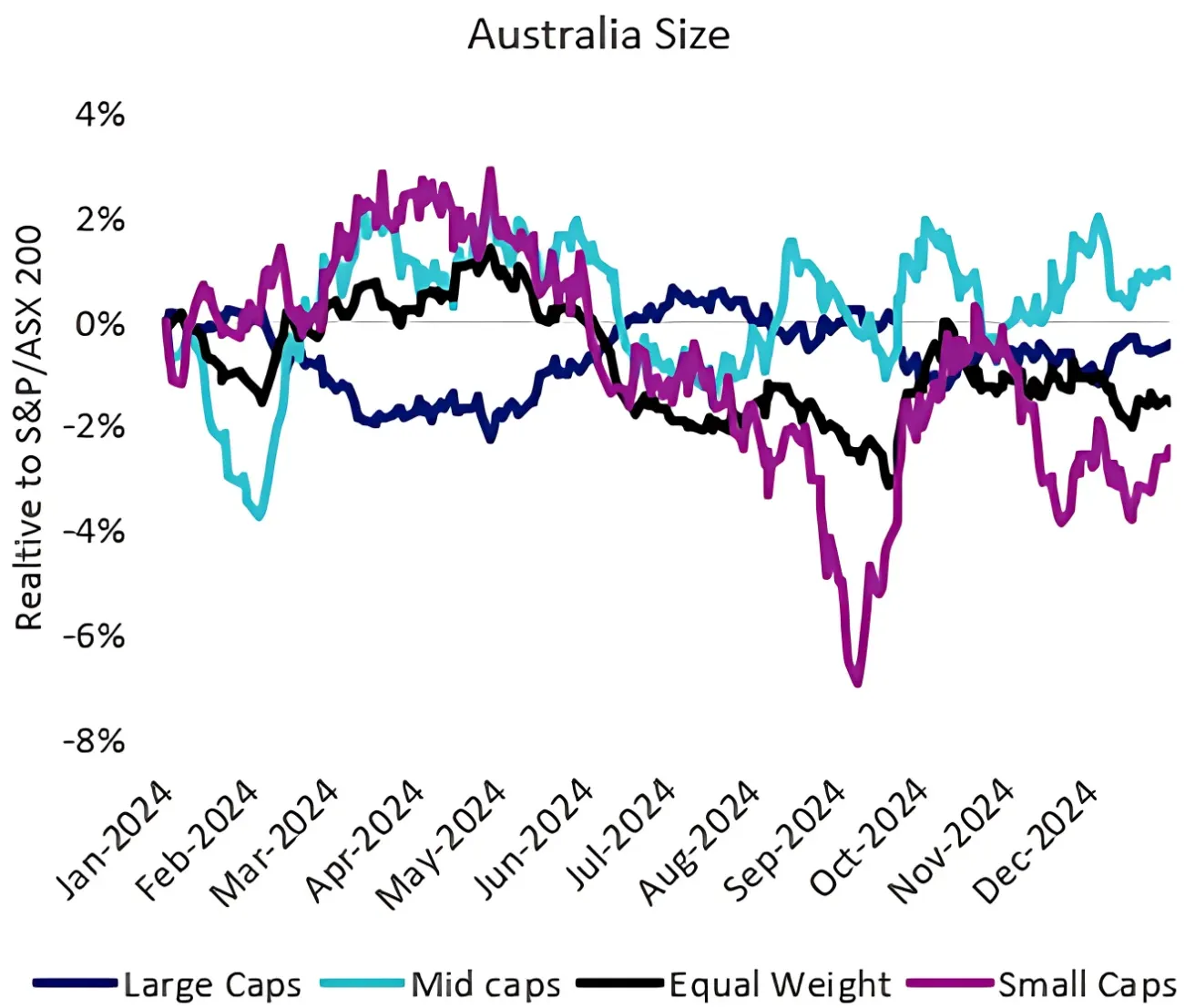

The S&P/ASX 200 returned 11.44% in 2024. The strongest contributor were the big banks, which saw valuations reach an all-time high. Materials were a significant drag, primarily due to China’s economic woes. Mid-caps outperformed large and small-caps. Pro Medicus, Technology One, JB Hi-Fi and AMP were the largest contributors.

Chart 2: Mid-caps outperformed the Australian equity market in 2024

Source: Bloomberg, S&P/ASX Size indices. Data to 31 December 2024. Past performance is not indicative of future performance. You cannot invest in an index.

Chart 3: Big banks were the major driver for Australian equities in 2024

Source: Bloomberg, S&P/ASX Sector Indices. *MVIS Australia sector indices. Data to 31 December 2024. Past performance is not indicative of future performance. You cannot invest in an index.

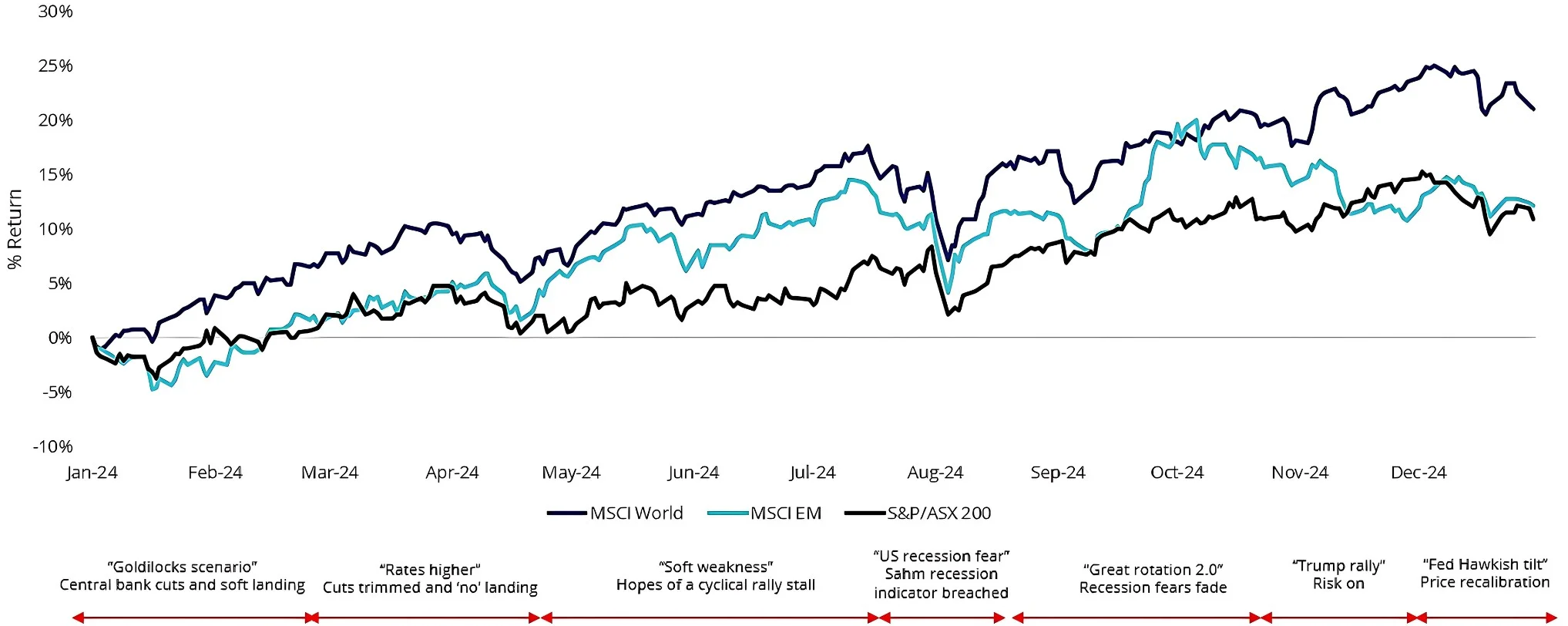

Chart 4: Relative performance of global equity markets in 2024

Source: Bloomberg, returns in hedged to Australian dollars. Data to 31 December 2024. Past performance is not indicative of future performance. You cannot invest in an index.

Looking ahead

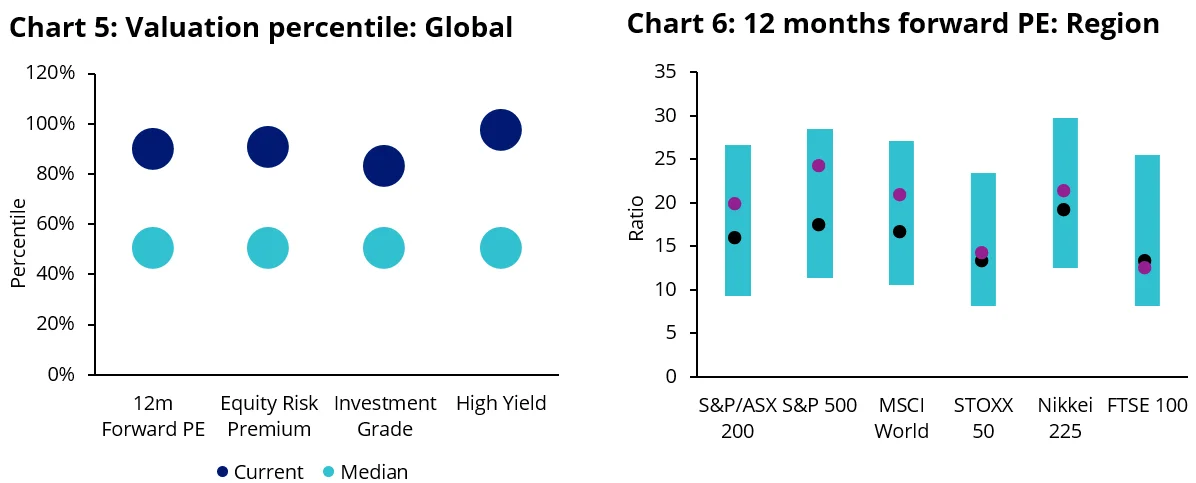

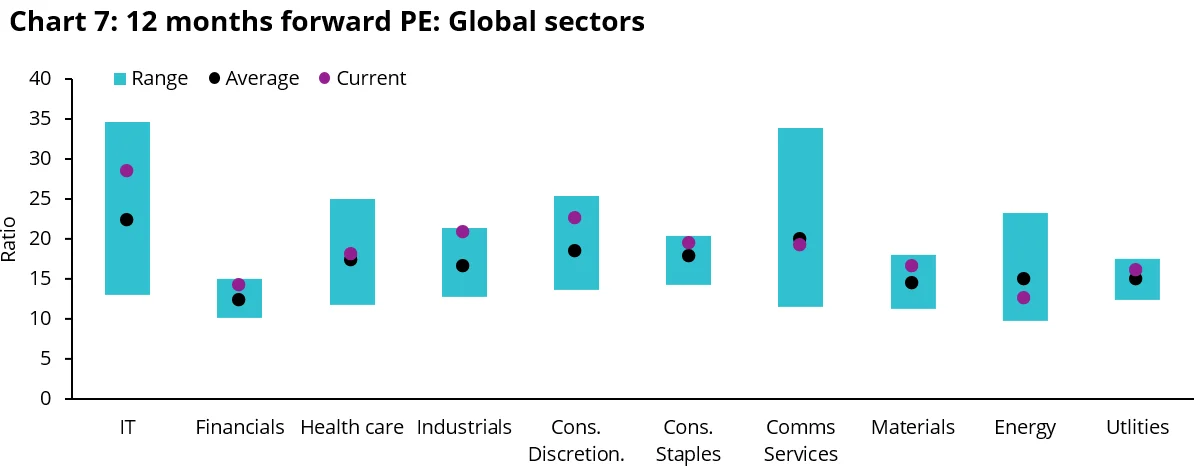

Valuations: Certain market segments stretched, reinforcing the need for selectivity

One of the main challenges moving forward is that the impressive equity market rally has contributed to stretched valuations in certain sectors and regions, suggesting that further upside may be constrained. Therefore, it is prudent to be selective and identify 'cheaper’ segments with attractive characteristics to navigate the next potential phase of the equity market rally. These include global small caps, quality companies, listed infrastructure and REITs.

Charts 5, 6 and 7: Stretched valuations in certain sectors and regions may limit further upside in global equities

Source: Bloomberg. Chart 5 indices are Bloomberg Global High Yield Credit Spread, Bloomberg Global Investment Grade Spread, MSCI World 12 month forward PE, and the S&P 500 equity risk premium as earnings yield less US 10 year government bond yield. Chart 7 indices are the MSCI World Sector Indices. Data to 31 December 2024.

USA: Selectivity prudent for US equities

While valuations on aggregate in the US may seem elevated, we believe the market is poised to outperform international counterparts, with pockets of relative value and stocks with attractive characteristics. Selectivity is crucial.

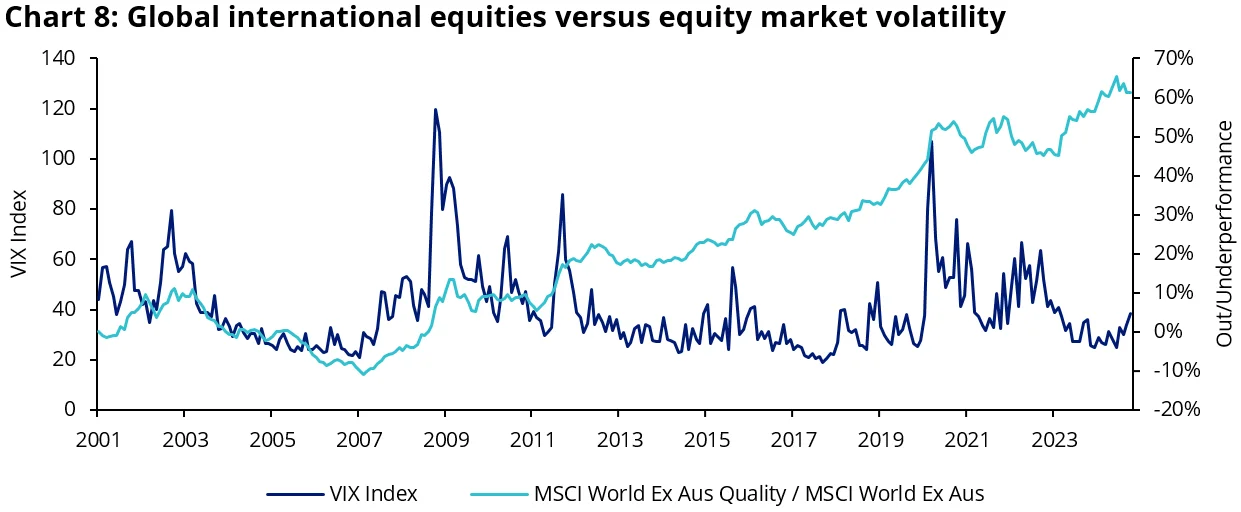

US equities have a higher proportion of 'quality' companies that demonstrate resilience and outperformance during heightened market volatility. These characteristics are particularly important given the market's vulnerability to disappointments and the heightened geopolitical environment.

Moreover, the US market's focus on innovative sectors like technology continues to drive growth. The US market also boasts the highest forward earnings per share growth, further enhancing its appeal.

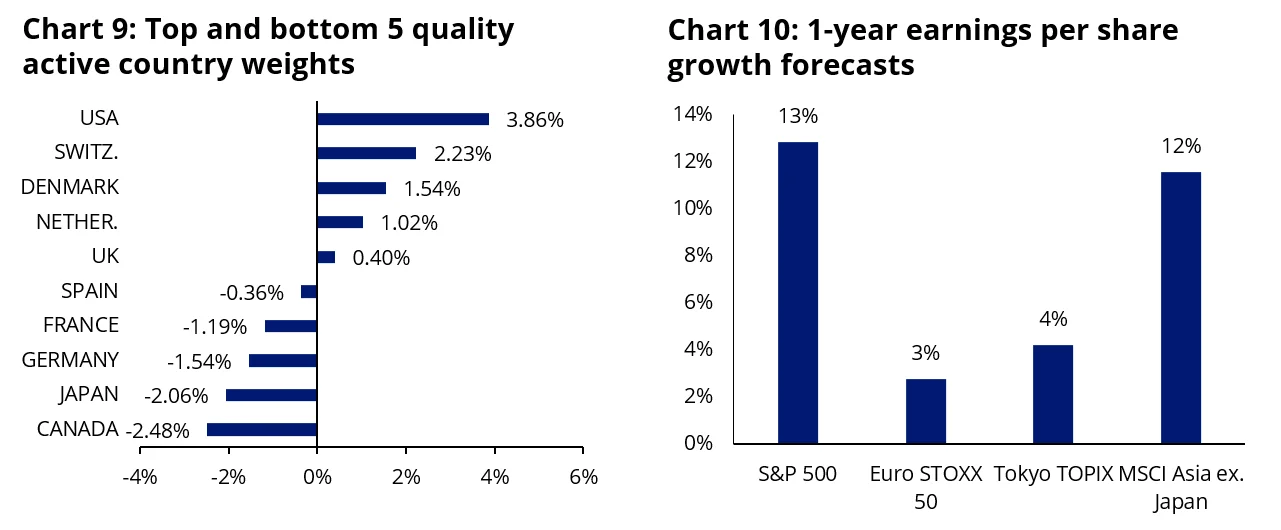

Charts 8. 9 and 10: US equities are set to outperform international counterparts in 2025, however a focus on quality companies is important in the current environment

Source: Bloomberg, Chart 10: Bloomberg forward consensus. Data to 31 December 2024. You cannot invest in an index. Past performance is not indicative of future performance. Index performance is not illustrative of fund performance.

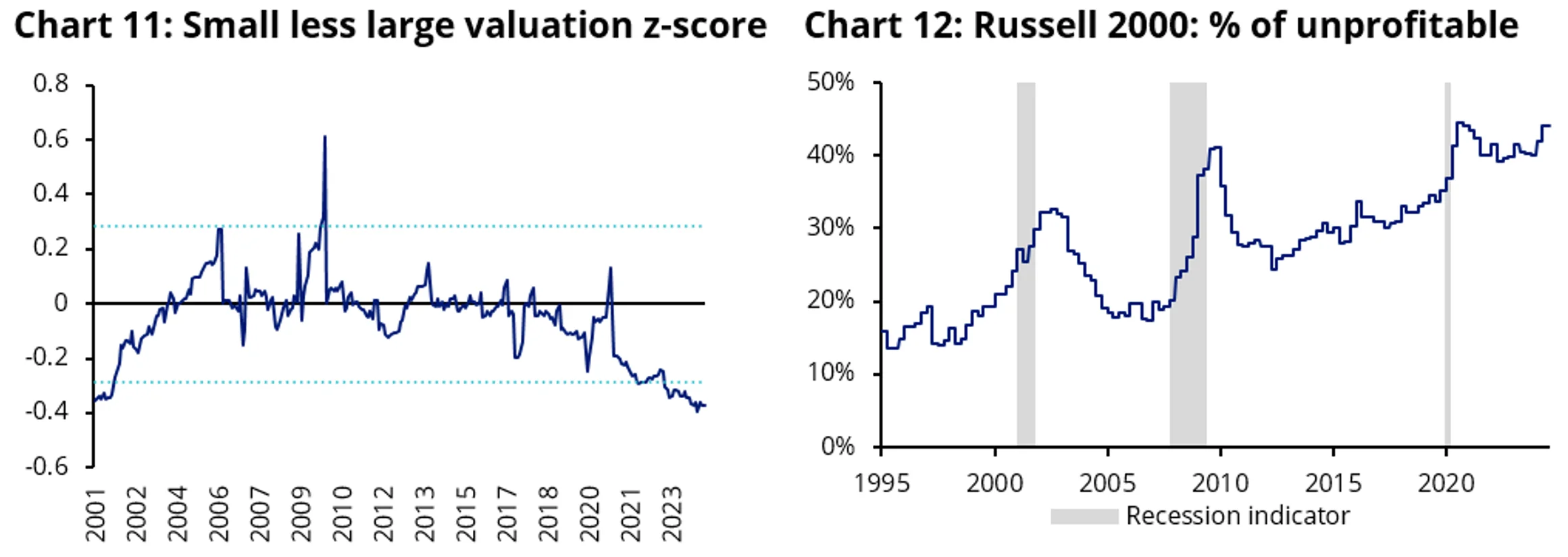

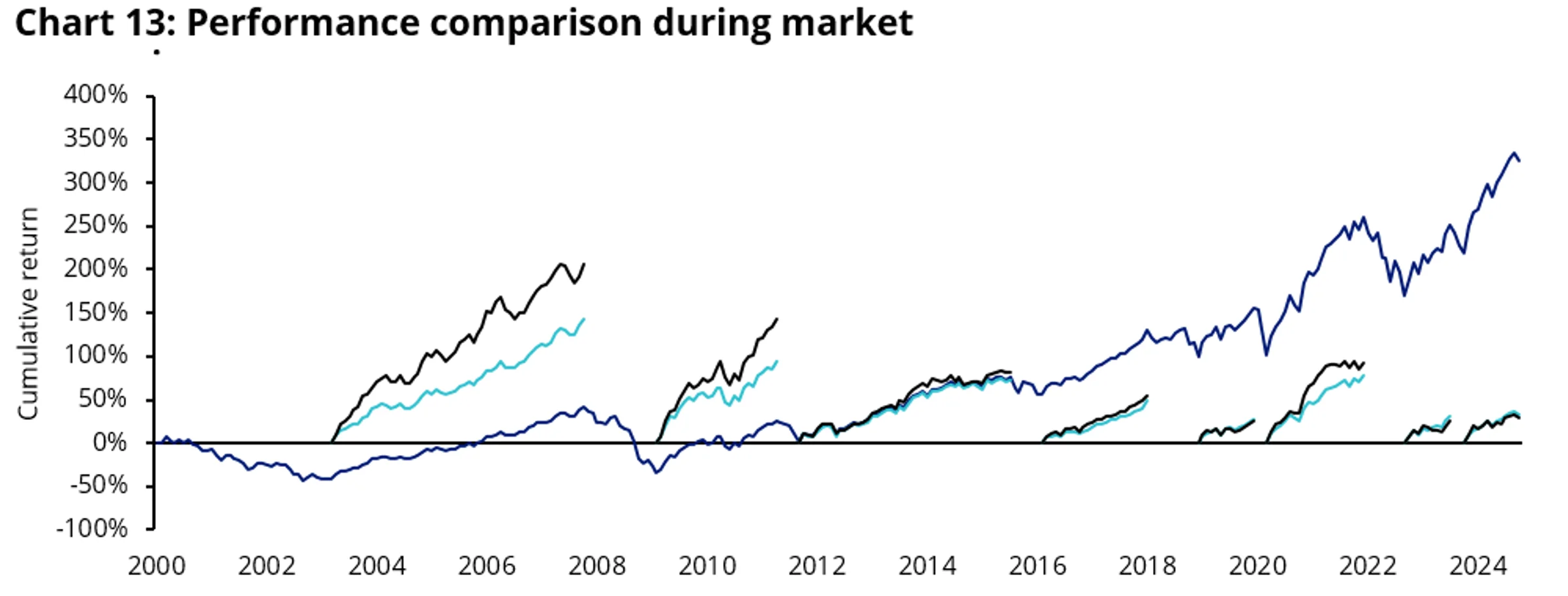

Small caps: Could lead the next stage of the market rally but consider company fundamentals

The stars are potentially aligning for global small caps to outperform. While large caps, notably the 'Magnificent Seven,' have delivered the lion's share of performance over the past 12 months, this trend could shift for several reasons.

Valuations are attractive, with global small caps relative to large caps near 25-year lows across various multiples. Further supporting global small caps could be a scenario of a prolonged market recovery; in the past, these periods have typically seen small caps outperforming large caps.

Small cap outperformance seems likely given the increasing prospect of the global economy avoiding a recession over the next 12 months. Furthermore, Trump’s pro-business agenda is expected to benefit US mid and small-cap companies.

Focusing on company fundamentals offers the potential to harness additional alpha. The percentage of unprofitable small caps has steadily increased, making them more susceptible to share price corrections. Research by Novy-Marx has shown that screening for quality companies was able to “generate higher returns in the small-cap universe.”

Charts 11, 12 and 13: Quality global small caps could outperform large caps

Source: Bloomberg. Data to 31 December 2024, z-score quantifies how many standard deviations valuations are different to the historical average. The graph above shows the average z-score by 12 month forward price to earnings, 12 month forward price to book, 12 month forward price to sales. Latest value is 2 standard deviations above the historical average. Global small caps represents MSCI World Small Cap Index, Large cap represents MSCI World Index. You cannot invest in an index. Past performance is not indicative of future performance. You cannot invest directly in an index.

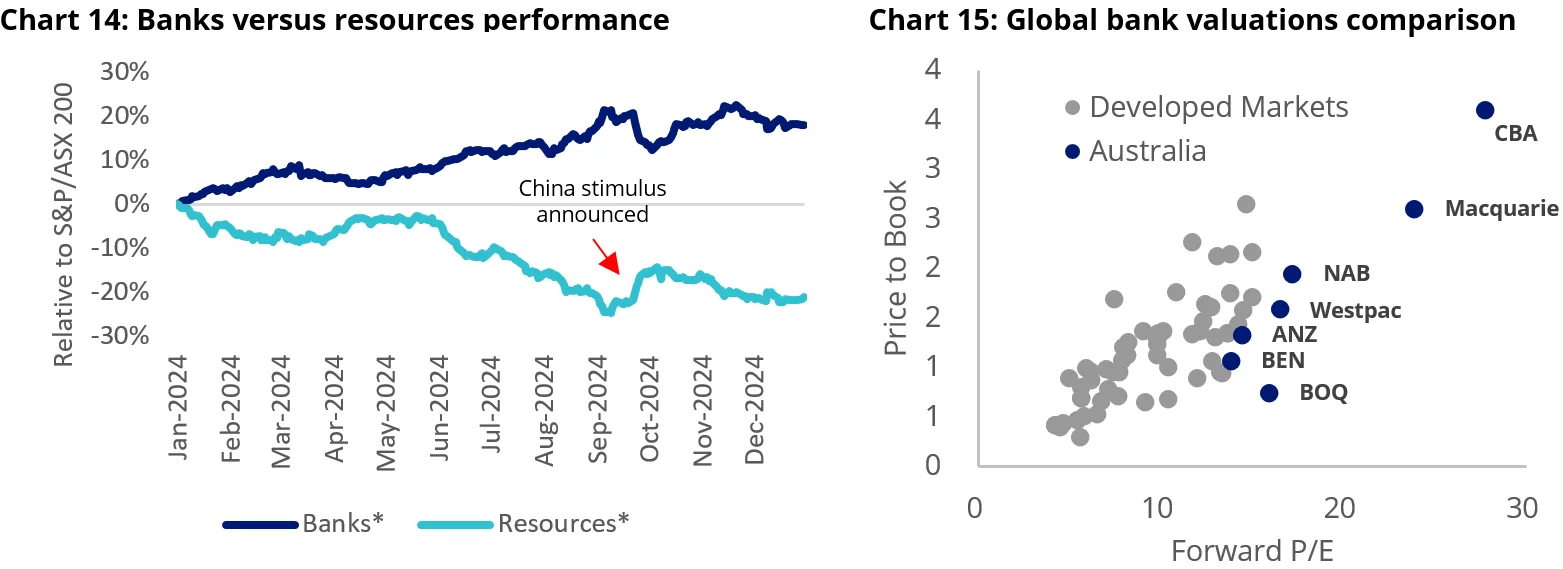

Australia: how much further can the big banks run?

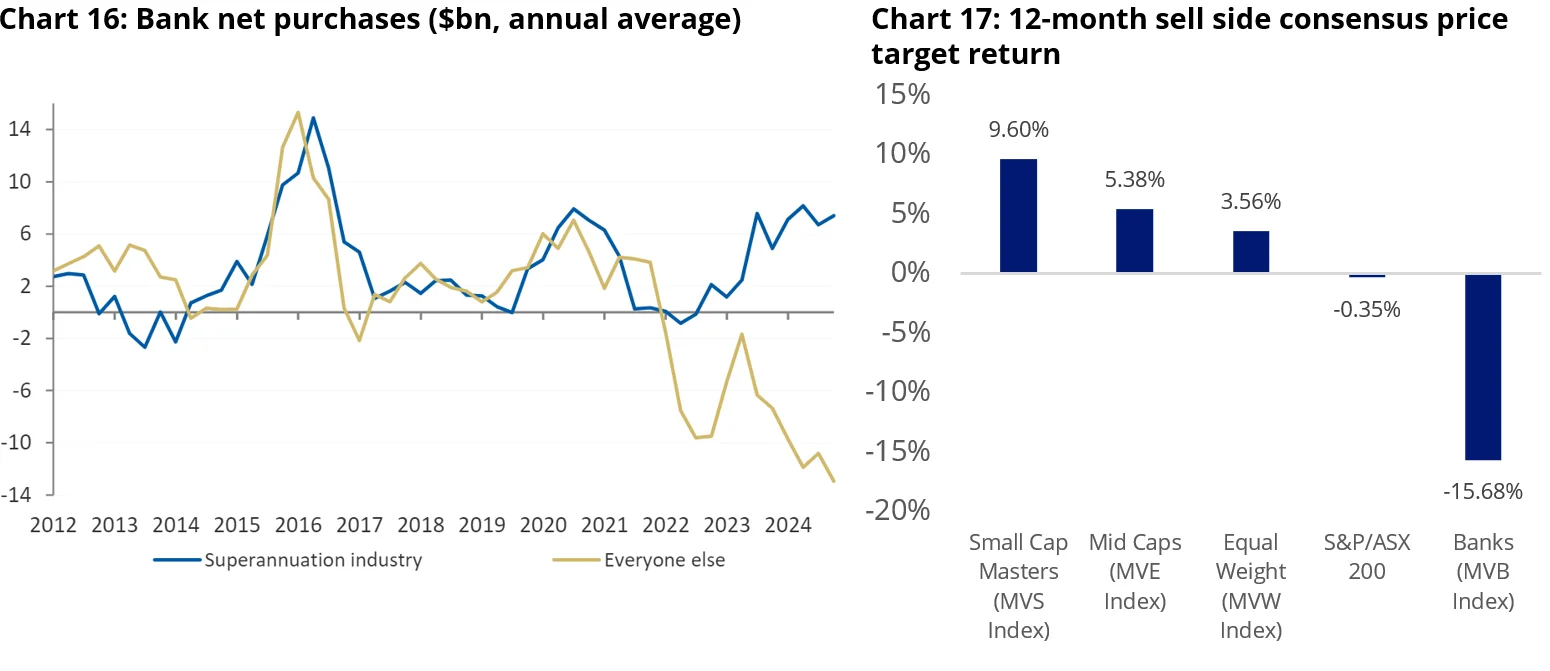

The stellar performance of the big four banks has driven valuations to an all-time high, making them the most expensive globally. This performance is primarily due to the increasing allocation of Australia's superannuation industry to banks, at the expense of materials, which have been impacted by China's economic woes, as well as property, which has been affected by prolonged higher interest rates.

However, the big bank lead could reverse if China introduces further fiscal stimulus measures beyond those seen in September. Another potential catalyst is the RBA commencing an easing cycle, priced for February, which could put rate-sensitive asset classes like property back in favour. Additionally, sell-side analysts are currently seeing more upside potential away from Australian banks, given their stretched valuations.

Charts 14, 15, 16, 17: Stretched valuations of the big four banks may see a rotation back to resources in the near-term

Source: Bloomberg, ABS, Banks represented by MVIS Australian Banks Index, Resources represented by MVIS Australian Resources Index. Data to 31 December 2024. Past performance is not indicative of future performance. You cannot invest directly in an index.

For more information on international equities markets, read our latest portfolio compass, which dissects our observations on inflation, policy rates, economic growth, exogenous risks and international equity markets. Link here: VanEck International Equities Portfolio Compass.

Published: 23 January 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

The Index Providers do not sponsor, endorse or promote the funds and do not guarantee the timeliness, accurateness, or completeness of any data or information relating to the indices or accept any liability for any errors, omissions, or interruptions of their index and do not give any assurance that the funds will accurately track the performance of their respective index. The indices and associated trademarks referenced herein are the property of the respective Index Provider and used by VanEck under license. See the relevant PDS for detailed information on the indices and limited relationship that the Index Provider has with VanEck.