Finding true ‘Quality’

Buying ‘quality’ companies seems an intuitively straightforward path to investment success. However, definitions of quality vary. As such, so do the outcomes of various quality strategies.

Targeting high-quality companies is not a new idea - investors have been buying quality companies for as long as there have been share markets. The journey to understand ‘quality’ relating to investing is ongoing. Some have found their way, others haven’t.

From an investment perspective, “quality” is known as a “factor”. Factors are identifiable, persistent drivers of risk and return. According to index provider MSCI, there are six main equity style factors: quality, size, value, momentum, dividend yield and volatility. Quality, in particular, has been receiving a lot of attention recently.

Quality investing encompasses several considerations, much to do with the financial characteristics of a company.

Commonly accepted attributes of a ‘quality’ company include its profitability, earnings reliability, debt levels and balance sheet strength. These characteristics are not plucked out of the air, rather they have been empirically researched, tested, finessed and retested since the 1930s.

Identifying quality companies has been a focus of investors for a long time, Benjamin Graham wrote about it in Security Analysis way back in 1934. He followed up that with The Intelligent Investor, where he outlined, what has become the basis for, the quality factor. Graham said investors should demand from a company “a sufficiently strong financial position and the potential that its earnings will at least be maintained over the years.” Such companies, he claimed, show resilience by falling less in a downturn and recovering to previous highs quicker than other companies.

These tenets, strong financial position and dependable earnings have been used to identify quality companies since then, and researchers have tested their efficacy and refined quality to help investors understand the factor and improve investor outcomes.

In the academic world, Friend and Lang (1987) included a “quality ranking” in their analysis of the size effect. This is likely the earliest reference to quality as a standalone systematic factor in academic literature.

Over the next three decades, many more professors, researchers and the industry undertook research to define quality, understand why it behaved the way it did and to help identify the characteristics of quality companies.1

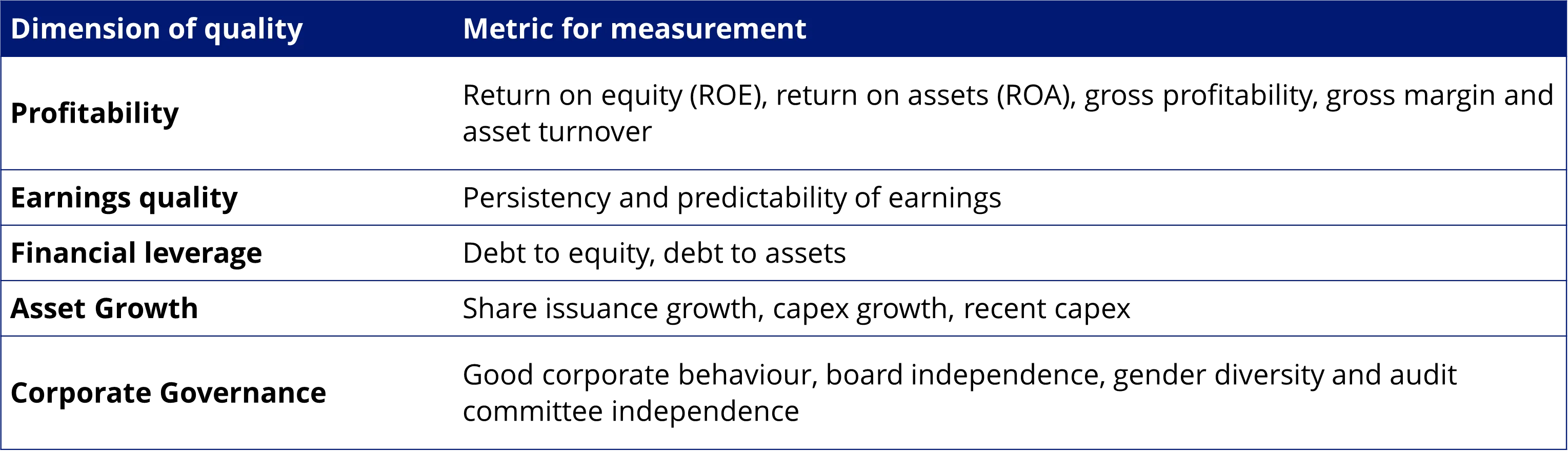

After considering the academic and commercial research, MSCI’s review of the quality factor found that a company’s quality can be evaluated along five key dimensions: profitability, earnings quality, financial leverage, asset growth and corporate governance.

The table below summarises how these dimensions can be measured.

Asset growth and corporate governance tend to be more difficult to quantify. Profitability, earnings quality and financial leverage are readily available in financial statements and thus can be used to construct transparent, rules-based indices. Indices are MSCI’s bread and butter.

To work out how to best construct an index that captured the quality factor and understand how these metrics perform, MSCI created 10 portfolios with variable exposure to ROE, debt to equity and earnings variability, including an equal composite of the three descriptors. MSCI chose these metrics as in addition to being supported by academic research, they were tangible, transparent and readily available in financial statements.

MSCI found that indices that considered these metrics individually achieved a positive return against the MSCI World Index. However, combining all three equally provided superior performance to the standalone indices or different combinations of the metrics. From this, MSCI had the foundation for its Quality Index.

This research was supported by Novy-Marx (2014) who reported significant ‘alpha’ (alpha is industry jargon for outperformance) from the combination of these metrics.

So, what does all this mean for Australian investors? Well only the VanEck MSCI International Quality ETF (QUAL) tracks an MSCI index that combines all three factors, without capping sectors or giving different weightings to different metrics.

And the proof is in the pudding.

While we always caution that past performance is not indicative of future results, QUAL has delivered outperformance since its inception, and it has outperformed many of the other funds that describe themselves as ‘quality’. QUAL’s performance is readily available here and we welcome you to compare its performance to your existing international equity fund.

While the quality factor can have periods of underperformance, its potential to outperform through the cycle, we think, means that it could be used as the factor for all seasons.

Only QUAL tracks the MSCI World ex Australia Quality Index, an index supported by empirical research. True quality is not an accident. It is the result of intelligent effort.

The journey to understand ‘quality’ relating to investing is ongoing. Some have found their way, others haven’t.

Sources

Asness, Clifford S., Andrea Frazzini, and Lasse H. Pedersen, 2013, “Quality minus junk.” Alternative Investment Analyst Review

Chen, Nai-fu, and Feng Zhang, 1998, “Risk and Return of Value Stocks,” Journal of Business, Vol. 71, No. 4.

Fama, E. F., and K. R. French, 1996, “Multifactor Explanations of Asset Pricing Anomalies” Journal of Finance 51:55–84.

Friend, I. and Lang, L.H., 1987, An Empirical Test of the Impact of Managerial Self-Interest on Corporate Capital Structure. The Journal of Finance, 43, 271-281.

Graham, B., and D. L. Dodd. 1934. Security Analysis, 1st ed. New York: McGraw Hill.

Graham, Benjamin. 1973. The Intelligent Investor (4th Rev. ed.). Harpers & Row, New York, New York.

Lim, Eugene, Raphael Hung, Chin-Ping Chia, Subhajit Barman, Anand Muthukrishnan, 2015, “Flight to Quality: Understanding Factor Investing.” MSCI Research Insight

Novy-Marx, Robert, 2012, “The Quality Dimension of Value Investing.” Working Paper

Novy-Marx, Robert, 2012 (revised 2014), “Quality Investing.” Working Paper

Key risks: An investment in the ETFs carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

Published: 04 July 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act. VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

QUAL is indexed to a MSCI index. The ETF is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to QUAL or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and the ETFs.

1- A short summary of some of the academic research associated with quality included analysis which associated quality with ‘growth’. The ‘quality’ dimension of value investing was loosely defined by GARP (growth at a reasonable price). Subsequently, Chen and Zhang (2011) and Novy Marx (2012) made ambitious attempts to understand quality better. Novy Marx included return on equity, in addition to the strong balance sheets, dependable earnings and profitability that had defined the quality factor to that point.

Other considerations continued to be associated with quality including company asset growth, size, re-investment patterns and the quality of management (Asness, Frazzini, and Pedersen 2013, Fama and French, 2014).