Get over the hedge

The decision of whether to hedge your international equities exposure or remain unhedged is an important question investors must face especially with currency movements being so hard to predict. The research suggests an answer.

In recent years investments in international assets have grown among Australian investors. Broadening portfolios beyond domestic assets has helped investors achieve greater diversification. However, investing in offshore assets exposes investors to currency risk. This is the risk that the value of the Australian dollar increases relative to the foreign currencies which the underlying assets are denominated. When this happens the value of the investment in Australian dollars decreases. Sometimes currency fluctuations are detrimental to investors and sometimes they are not.

Example: Market Vectors Morningstar Wide Moat ETF (ASX code: MOAT) trades on ASX in A$ but it invests in US equities which trade in US$. From the day you buy MOAT on ASX three things will change the value of your investment:

1) the value of the underlying US equities will go up and down;

2) income will be earned in US$ from those US equities; and

3) the AUD/USD exchange rate will change.

Assume you buy A$10,000 worth of MOAT on ASX (for simplicity we are ignoring brokerage) and the Australian dollar strengthens by 10% against the US$, the underlying investment will now be worth A$9,090.91 (10,000/1.10), assuming no income or change in the value of the underlying US securities. Conversely, if the Australian dollar weakens by 10%, your investment in $A will be worth A$11,111.11 (10,000/0.9).

Some investors seek to reduce currency risk by ‘hedging’. The above example only included one currency. Hedging becomes complex when multiple currencies are involved. Hedging aims to mitigate the volatility of foreign currency movements and is usually implemented by using derivatives in the form of swaps or forward foreign exchange contracts to lock-in exchange rates.

The research

A number of academic and industry studies have analysed the impact of currency and hedging on international equities portfolios. In a Portfolio Construction Forum Austalian researchers provided their views on currency hedging1. Morningstar found “there is no significant difference in long-term risk-adjusted returns between portfolios that use a currency-hedged international-equity strategy and portfolios that use an unhedged international-equity strategy. As such, long-term investors should focus on choosing well-run, low-cost international-equity funds for their portfolios and should be indifferent to whether or not the funds hedge their currency exposure.”

Further, Lonsec believes that on a strategic basis, an unhedged exposure to global equities is appropriate over the long term (i.e., 10 years or more) because:

1) Over the long term, the risk and return characteristics of hedged and unhedged global equities are broadly similar;

2) Unhedged global equities are less correlated to Australian equities than hedged global equities, therefore offering superior diversification characteristics to a portfolio; and

3) Most investors will have some exposure to hedged assets within their portfolio, including global fixed interest, global property securities and global listed infrastructure.1

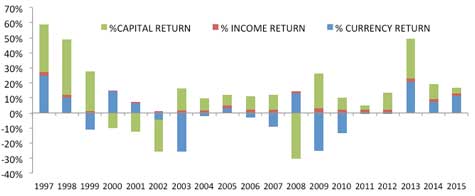

These findings are reinforced by the following data. This is long term returns for the index tracked by the Market Vectors MSCI World ex Australia Quality ETF (ASX code: QUAL). This index is unhedged.

Source: MSCI. Annual returns to end of each calendar year data.

The total return from currency since 1997 is -0.09% p.a. Over that same time the index has returned 8.37% p.a. In other words, over a long term period of 19 years returns from currency have had a negligible impact on overall portfolio performance.

Australia’s other major researcher, Zenith have cited Campbell, Serfaty, de Medeiros and Viciera (2009) who investigated the correlations of foreign exchange rates with stock returns for the 30 year period 1975 to 2005. The findings suggest that Australian investors reduce risk by not hedging.1

This is supported by the following standard deviations being a common measure of risk/volatility. Over the long term unhedged returns are less volatile than the hedged equivalent for Australian investors.

Source MSCI, as at 29 February 2016 based on monthly net returns data

There can be a temptation to avoid the short term volatility by hedging. The research suggests that over the long term, which is where investors should focus, this is not the right approach for international equities.

Whether investors want to hedge or not will be influenced by their investment objective. For asset classes that are used by investors to generate income such as fixed income and infrastructure, being hedged helps smooth income returns and guard against capital erosion. For equities, investors are also aiming to achieve capital gains so are able to absorb short term risks such as currency to achieve their investment goals.

Market Vectors offer the following unhedged international equities ETFs for Australian investors looking to gain the benefits of diversifying geographically.

For more information on our range or international ETFs, click here or call 02 8038 3300.

IMPORTANT NOTICE: Issued by Market Vectors Investments Limited ABN 22 146 596 116 AFSL 416755 ('MVIL'). MVIL is a wholly owned subsidiary of Van Eck Associates Corporation based in New York, United States ('Van Eck Global').

This is general information only and not financial advice. It does not take into account any person's individual objectives, financial situation nor needs. Before making an investment decision in relation to a Market Vectors ETF, you should read the relevant PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.marketvectors.com.au or by calling 1300 MV ETFs (1300 68 3837).

Australian domiciled ETFs: MVIL is the Responsible Entity, issuer and AQUA Product Issuer of units in the Australian domiciled Market Vectors ETFs traded on the Australian Securities Exchange ('ASX') under codes MVA, MVB, MVE, MVR, MVS, MVW and QUAL. QUAL is indexed to a MSCI Index.

United States domiciled ETFs: Market Vectors ETF Trust ARBN 604 339 808 ('Trust') is the issuer of shares in the US domiciled Market Vectors ETFs ('US ETFs') which trade on ASX under the codes CETF, GDX and MOAT. The Trust and the US ETFs are regulated by US laws which differ from Australian laws. Trading in the US ETFs' shares on ASX will be settled by CHESS Depositary Interests ('CDIs') which are also issued by the Trust. The Trust is organised in the State of Delaware, US. Liability of investors is limited. Van Eck Global serves as the investment advisor to the US ETFs. MVIL is, on behalf of the Trust, the authorised intermediary for the offering of CDIs over the Fund Shares and AQUA Product Issuer in respect of the CDIs and corresponding Fund Shares traded on ASX. Investing in international markets has specific risks which are in addition to the typical risks associated with investing in the Australian market. Investors must be willing to accept a high degree of volatility in the performance of the US ETFs currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign regulatory and tax regulations.

No member of the Van Eck Global group of companies or the Trust, MSCI, Morningstar or ChinaAMC guarantees the repayment of capital, the performance, or any particular rate of return of any Market Vectors ETF. Past performance is not a reliable indicator of current or future performance.

Market Vectors® and Van Eck® are registered trademarks of Van Eck Global. Morningstar® is a registered trademark of Morningstar, Inc.

© 2016 Van Eck Global. All rights reserved.

1Source: Portfolio Construction Forum, November 2011, Money Management Feature International equities - to hedge or not to hedge? Retrieved 15 March 2016.

Published: 09 August 2018