The GOAT of investing

GOAT, as an acronym, is short for the “Greatest of All Time,” originated in boxing: Muhammad Ali.

Since then, the accolade has become a part of the English language, popularised in all sports and applied to other fields.

Some believe the investing GOAT to be Warren Buffett, who, when seeking companies to invest in, has said, “The most important thing [is] trying to find a business with a wide and long-lasting moat around it.”

To be sure, like many of the sporting GOATs, Buffett has had his fair share of misses, but there is no denying his long-term investment philosophy and success.

To Buffett, the castle is the business, and the moat is its competitive advantage: The wider the moat, the more sustainable the business.

The importance of moats

It is one thing for a company to be successful in the moment. The question is whether the business has characteristics that provide defence during economic downturns and make it difficult for competitors to attack earnings.

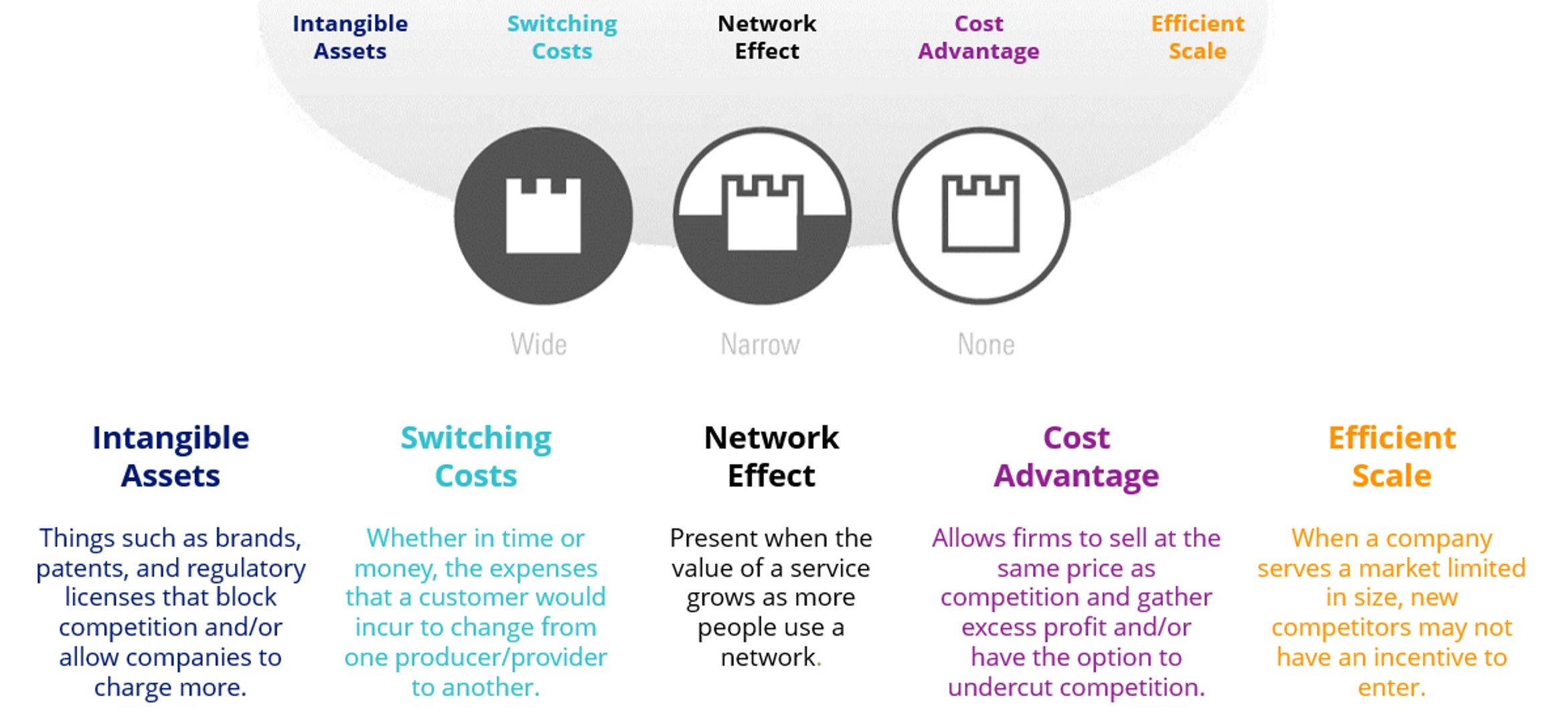

Building on Buffett’s moat analogy noted above, Morningstar® has taken the economic moat™ concept further and developed a comprehensive moat-based analytic framework. A company may have great management, size, market share, technology, efficiencies or hot products, but what Morningstar identifies is whether the company has a structural advantage that can sustain its high returns over a long period into the future. Morningstar has identified five potential sources of an economic moat: network effect, intangible assets, cost advantage, switching costs and efficient scale. Each company with a moat rating has at least one of these moats.

Figure 1: Identifying quality: 5 sources of moats

Source: Morningstar

Of the thousands of companies globally, Morningstar analysts have only assigned a wide moat rating to around 260 of these. A wide moat rating indicates Morningstar considers that only these companies can sustain their excess returns for 20+ years.

Morningstar’s analysis does not stop with its moat rating. Morningstar’s equity analysts also assign a fair value to each company in its coverage universe. Fair value is a per-share measure of what the business is worth. A three-stage discounted cash flow model is combined with a variety of supplementary fundamental methods such as sum-of-the-parts, multiples and yields to triangulate a company's worth.

Using a combination of the qualitative moat data and the quantitative fair value data Morningstar constructs its Moat Index series. Constituents in the indices are curated for quality via the wide-moat designation and value via Morningstar’s valuation approach.

This approach has come to the fore so far in 2025.

The importance of value and quality in the current market

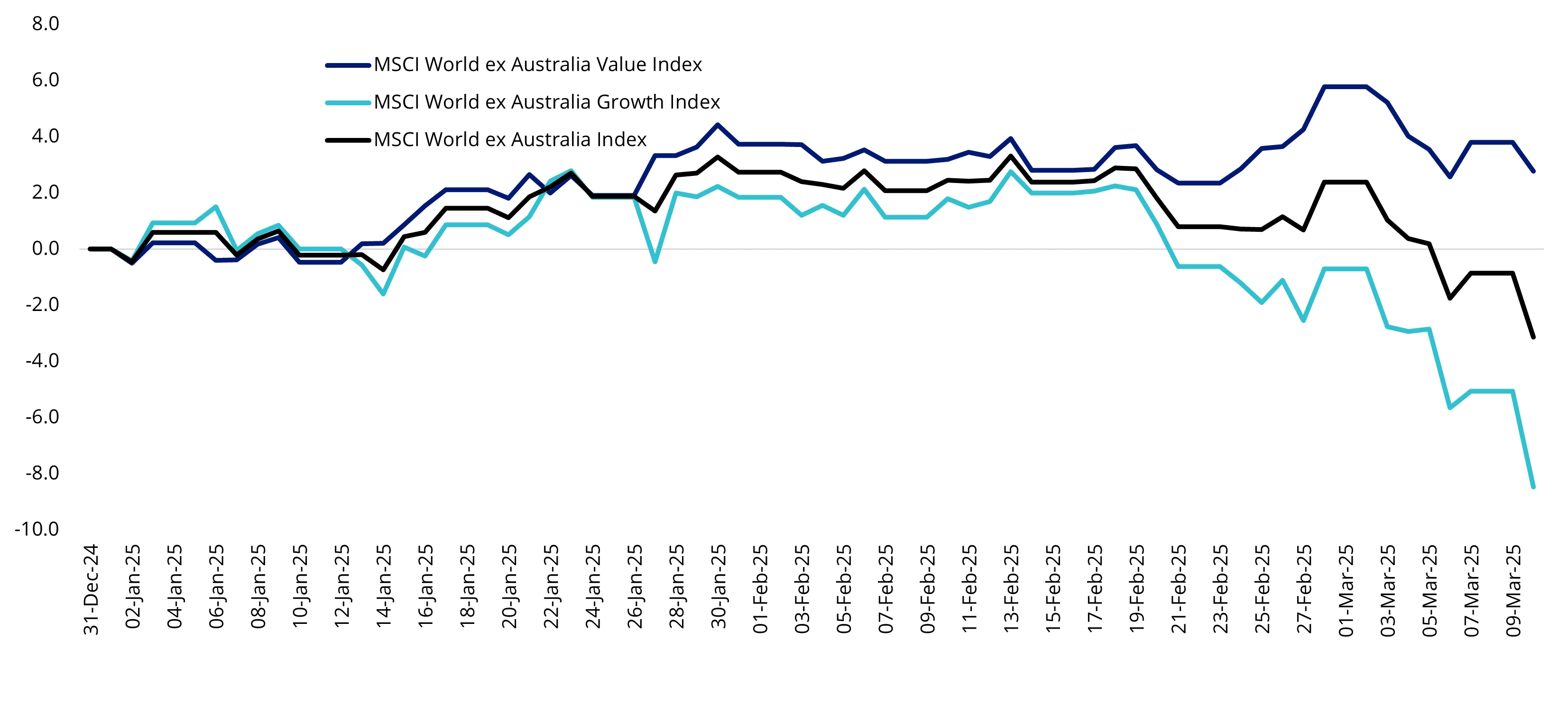

In 2025 so far, value investing has been thrust back in the spotlight. Value-oriented global equity stocks, as represented by MSCI World ex Australia Value Index, outperformed growth stocks as represented by MSCI World ex Australia Growth Index. The relative rebound in value stocks came after growth stocks did well in 2024.

Figure 2: Value stocks are holding up better in 2025

Source: Morningstar Direct, 31 December 2024 to 10 March 2025. All returns in Australian dollars. Past performance is not a reliable indicator of future performance. You cannot invest in an index.

Now, as the world anticipates a ‘Trumpcession’ in the US, uncertain geopolitics, a euro-zone emerging from a recession and inflation fears many investors are assessing their long-term approach.

If the global economic recovery falters and the US enters a recession, it could benefit international quality companies, as they tend to offer investors relative protection during weaker economic environments and heightened market volatility.

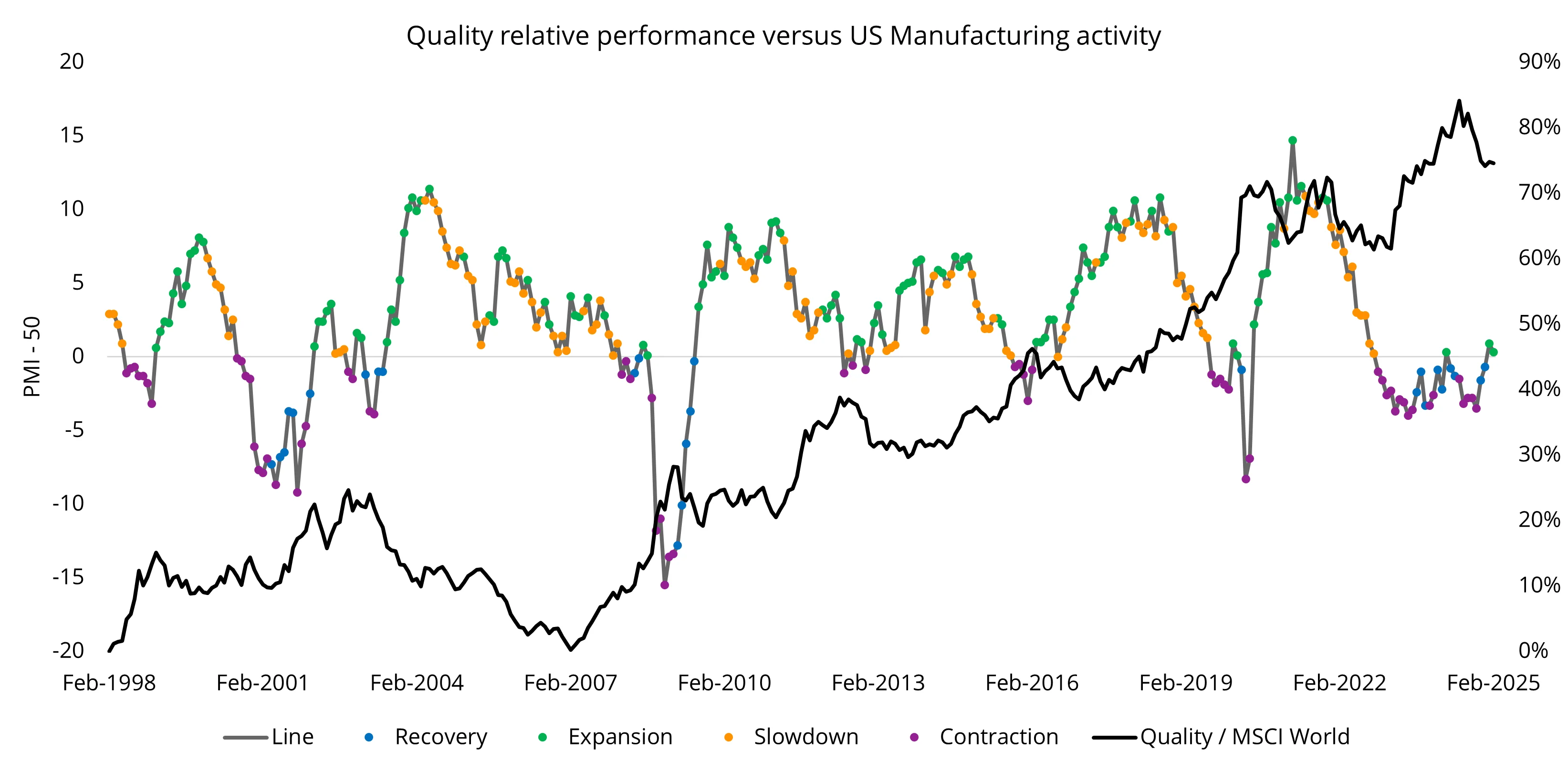

Figure 3 illustrates how quality companies typically outperform when manufacturing activity (a proxy for economic activity) decelerates (orange) and/or contracts (purple).

Figure 3 – US ISM Manufacturing PMI Index and MSCI World Quality versus MSCI World performance

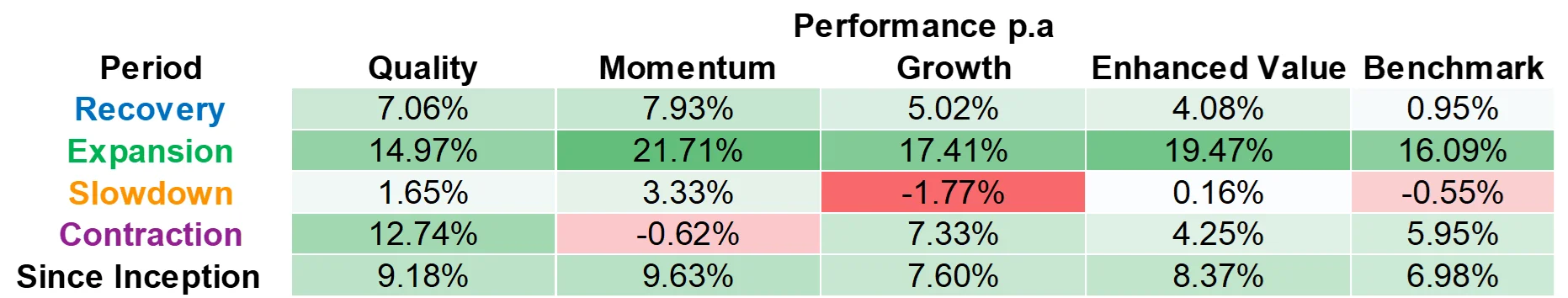

Table 1: Factor performance during different economic regimes

Figure 3 and table 1, Data to 28 February 2025. Source Bloomberg. MSCI. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index. Since Inception date is common inception of indices used, 31 December 1998. Quality is MSCI World Quality Index, Momentum is MSCI World Momentum Index, Growth is MSCI World Growth Index, Enhanced Value is MSCI World Enhanced Value Index, Benchmark is MSCI World Index.

It is little wonder then, why savvy investors are looking for quality opportunities, those companies with the potential to maintain their competitive advantages over the long term, understanding they may not pick the bottom. But they were not going to pick the top either. Investors are fortifying their portfolios with these quality companies and are also wary not to overpay in the current market.

With its qualitative assessment and valuation approach, Morningstar’s rules-based index series offers exposure to companies with relatively attractive valuations and are high quality, having identifiable sustainable competitive advantages.

The VanEck Morningstar International Wide Moat ETF (GOAT) tracks the Morningstar® Developed Markets ex Australia Wide Moat Focus Index™ (the GOAT index).

GOAT is a high-conviction international equity portfolio of between 50 to 100 companies that utilises active stock selection using Morningstar research, for passive fees.

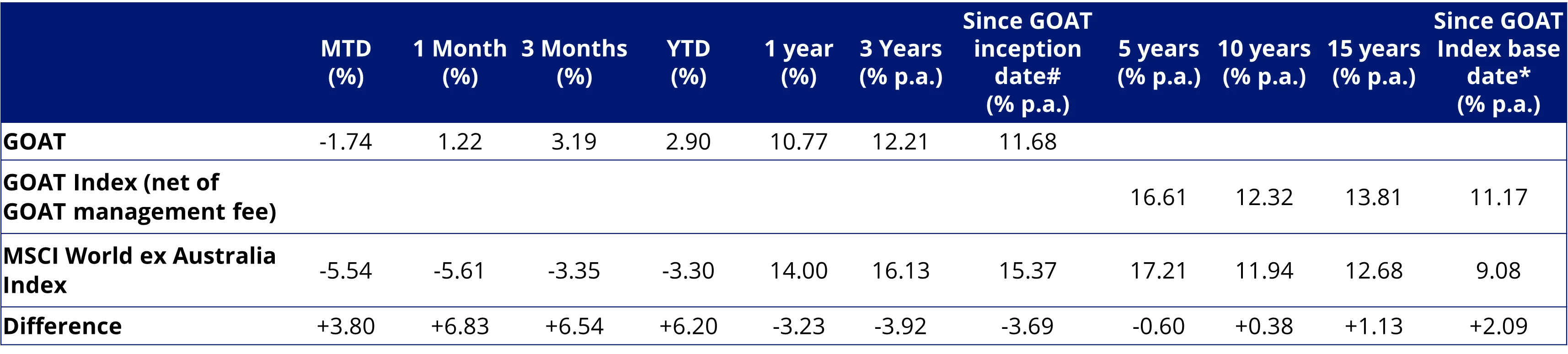

So far in 2025, this approach has been successful, with the VanEck Morningstar International Wide Moat ETF (GOAT) outperforming the MSCI World ex Australia Index by 6.20% (1 January 2025 to 12 March 2025, source Morningstar Direct). This is a short period and past performance is not a reliable indicator of future performance.

Taking a conviction, but low-cost approach

As GOAT tracks an index, it maintains the low fees associated with passive investing while targeting those wide-moat companies with compelling valuations. We believe GOAT provides investors with an alternative to concentrated actively managed funds.

Active share is a measurement that investors use to quantify how much a fund manager's portfolio differs from the benchmark index. A fund with no holdings in common with the benchmark would have 100% active share, while a portfolio identical to the benchmark would have 0% active share.

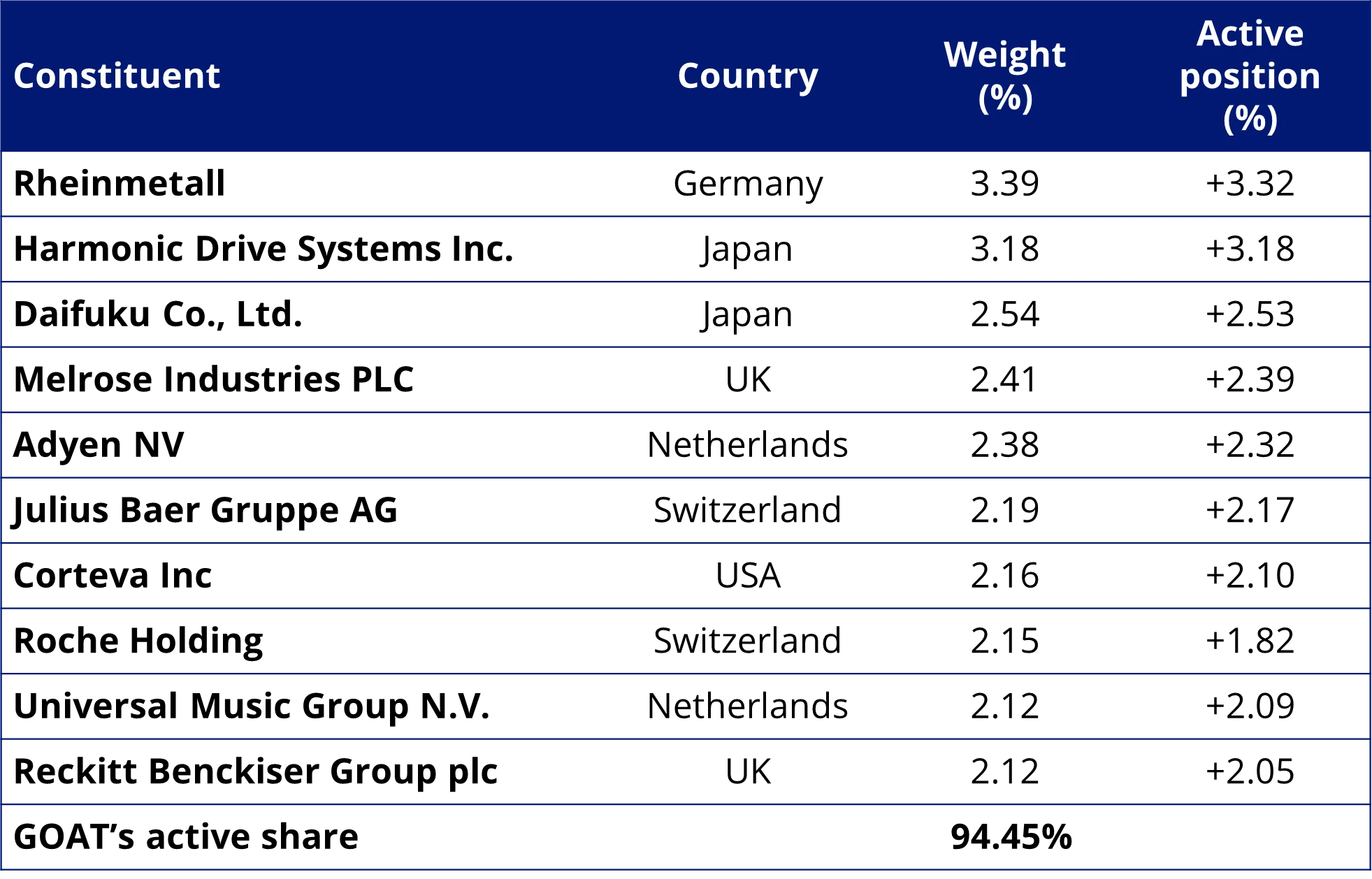

You can see in the table below that GOAT’s active share is high, and its top 10 holdings differ from the usual suspects that dominate global benchmark indices. They may also differ from the active funds you now invest.

Table 2: GOAT’s ‘active’ Top 10

Table 2 source: FactSet, VanEck, MSCI, 28 February 2025. Active position is relative to benchmark index. Benchmark index is MSCI World ex Australia Index

Performance

GOAT vs MSCI World ex Australia Index - Performance

GOAT has started 2025 strongly, noting as always, that past performance is not a reliable indicator of future performance.

Table 3: GOAT and modelled GOAT Index-after-fees performance as at 12 March 2025

#GOAT inception date is 10 September 2020 and a copy of the factsheet is here.

* GOAT Index base date is 31 December 2007. GOAT’s Index results are net of GOAT’s 0.55% p.a. management fee, calculated daily but do not include brokerage costs or buy/sell spreads of investing in GOAT. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Past performance of the index is not indicative of, and should not be attributed to, the performance of the fund.

Source: Morningstar Direct, VanEck. All returns in Australian dollars. The chart and table above show past performance of GOAT, GOAT Index and of the MSCI World ex Australia Index. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. GOAT results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of future performance. The MSCI World ex Australia Index (“MSCI World ex Aus”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of developed market large- and mid-cap companies, weighted by market capitalisation. GOAT’s index measures the performance of 50 to 100 developed market companies with a Morningstar Economic Moat Rating™ of “Wide” at rebalance. GOAT’s index has fewer companies and different country and industry allocations than MSCI World ex Aus. Click here for more details

Accessing the power of wide moats

Learn more about moat investing with our dedicated education portal.

Key risks

An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the VanEck Morningstar International Wide Moat ETF PDS and TMD for more details.

Published: 19 March 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

The Morningstar® Developed Markets ex Australia Wide Moat Focus Select Index™ was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote GOAT and bears no liability with respect to GOAT or any security. Morningstar®, Morningstar® Developed Markets ex Australia Wide Moat Focus Index™, and Morningstar Economic Moat™ are trademarks of Morningstar, Inc. and have been licensed for use by VanEck by Morningstar Australasia Pty Ltd (ABN 95 090 665 544, AFSL 240892).