New research forecasts elevated global defence spending for years ahead

A new paper from Citi Research notes military spending is likely to stay near current levels for years ahead, albeit with priorities shifting to new initiatives and technologies such as space and AI.

The United States has the largest military expenditure in the world. In 2024, it totalled around US$967 billion, an increase from $916 billion in 2023, which exceeded the defence budgets of Russia, China and other NATO countries combined. The upcoming US presidential election, therefore, is likely to be consequential on global defence spending. This is a topic explored by Citi Research, which last week released a report Money and Might: Financing the Future of Defense (sic).

The paper considered three different scenarios while it also considered the geopolitical ‘view’ from different regions, namely the US, the Indo-Pacific and Europe. Ultimately, Citi found that defence stocks appear attractively priced.

The Citi paper noted that the outcome of the US Presidential election is likely to be consequential for the direction of defence spending, with a Harris victory weighing toward a continuation of spending at current levels or a step down in spending, while a Trump victory skewed toward a continuation or increase in spending levels.

Either way, the base case is that military spending stays near current levels for the years ahead. However, priorities will reflect lessons learned from recent and current battles, prioritising new initiatives (like space) and technologies (such as AI).

Among the companies it notes as exposed to current defence spending trends are Palantir, Booz-Allen Hamilton, Science Applications International Corp, Thales, Saab, Qinetiq, Leidos, Hensoldt, Babcock and Leonardo – all of which are held in the VanEck Global Defence ETF (DFND).

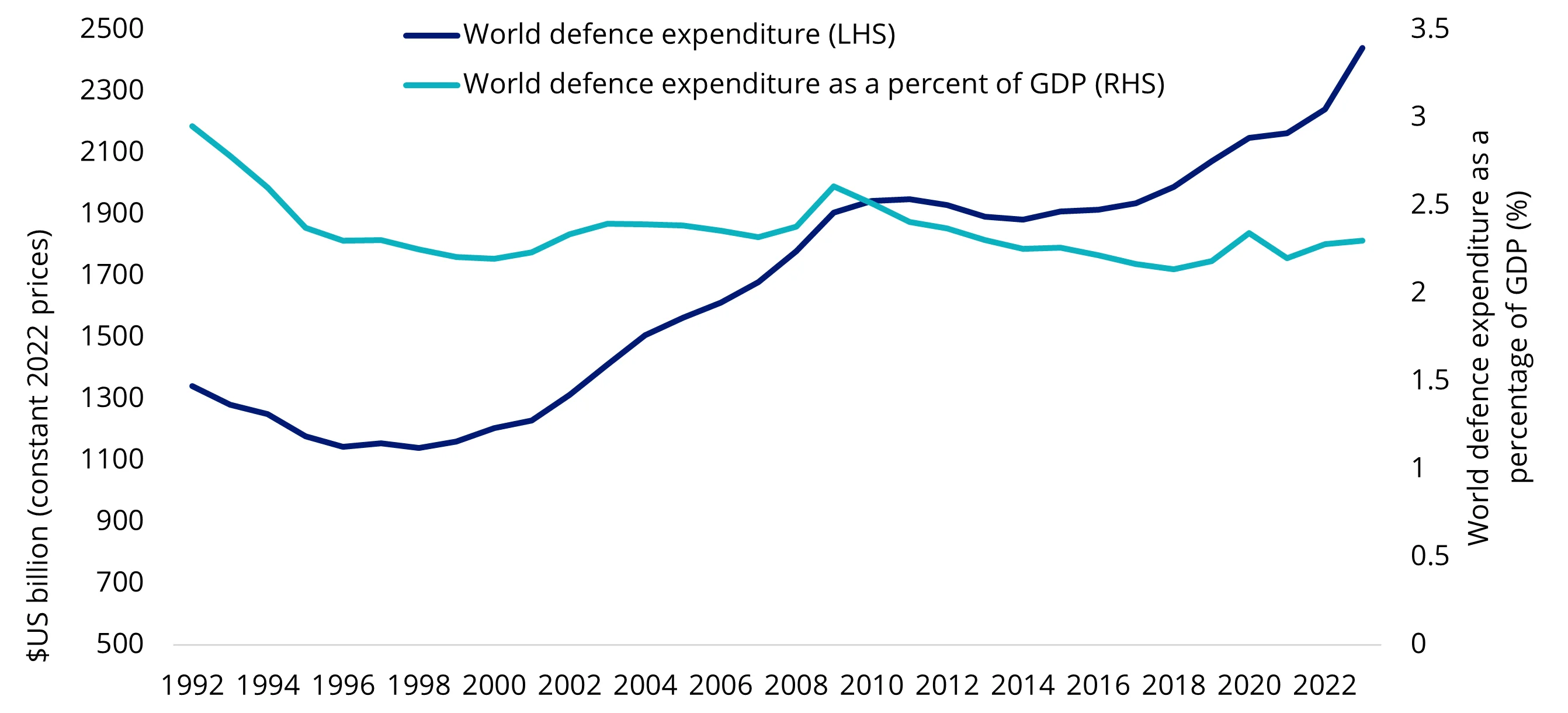

Global defence expenditure has remained consistently high over the last 30 years. In 2014, the governments of NATO member countries agreed to commit 2% of their national GDP to defence spending to help ensure the Alliance’s continued military readiness. In 2023, global defence expenditure reached an all-time high of US$2.44 trillion, representing 2.3% of total world GDP.

Chart 1: World defence expenditure: 1922 to 2023

Source: Source: SIPRI Military Expenditure Database, figures are represented in constant 2022 USD, Statista, World Bank

Historically, the United States and the European Union have seen much higher levels of defence spending than the current level. Through the late 1980s, for instance, US military spending was around 6% of its GDP. Citi research highlighted that more recently, the Bush Administration ratcheted up military expenditures to nearly 5% of GDP to fund the War on Terror, spending was reined in under Obama. President Trump, amid concerns about a rising China pushed up defence spending by roughly 1/3.

The paper considers a ramp-up in US defence spending to its 1980s levels, noting that tensions with China could be the impetus for a return to such levels.

Spending priorities moving forward

The paper points to recent conflicts in the Ukraine and the Middle East, and how these have informed current government spending on defence, with allies prioritising investments in space, unmanned aerial vehicles (IUAVs), AI, autonomy, and cyber technologies and innovations.

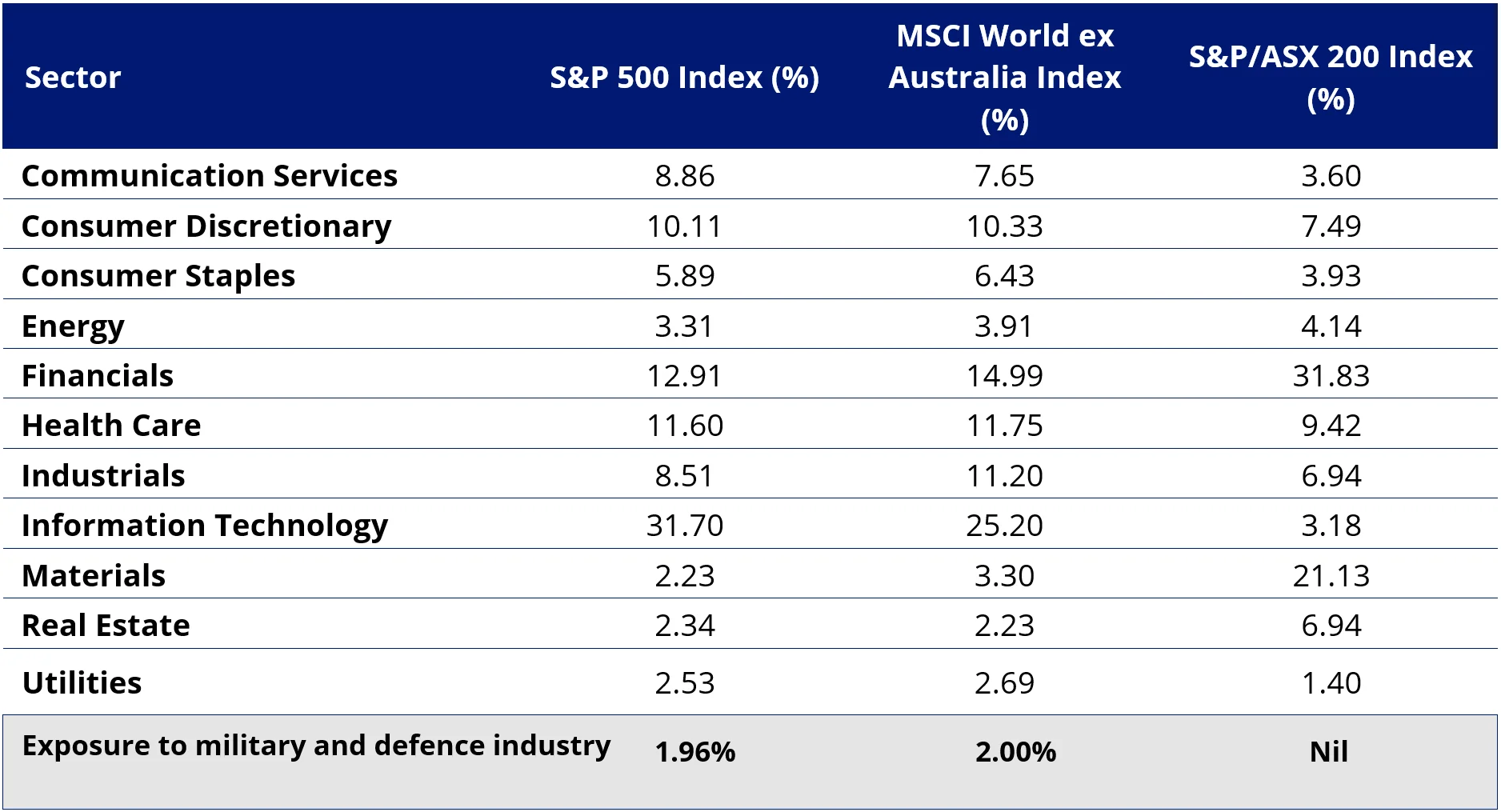

Companies that work within this space, are under-represented in most portfolios and indices.

Table 1: Defence company representation in broad-based market benchmarks

Source: FactSet, as at 30 September 2024. Weightings represent weighting in GICS sub industry: Aerospace & Defense.

Citi Research’s paper concludes that defence stocks appear attractively priced, as investors appear to be pricing in 0-3% annual growth into most companies indefinitely, whereas its team believes this level undershoots likely outcomes over the long term. One of the areas it expects spending to rise faster than overall military expenditure across the Western world is investments in the tools of deterrence.

For AI and Cyber, for instance, the US is expected to spend $21.1 billion in FY25, with a four-year CAGR of 15.4%.

The VanEck Global Defence ETF, which trades under the ASX ticker ‘DFND’, gives investors exposure to a portfolio of the largest global companies involved in aerospace & defence, research & consulting, application software and electronic equipment & instruments. DFND tracks the MarketVector Global Defence Industry (AUD) Index, and may be used by investors to get differentiated exposure to companies at the forefront of technological innovation and development, with revenues that are not necessarily correlated to general economic cycles, but rather government spending.

Key risks: An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for more details on risk.

Published: 23 October 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.