The next AI shake-up could unlock even bigger opportunities

DeepSeek has sent shockwaves through the tech sector. Learn what it means for the Magnificent 7 and AI.

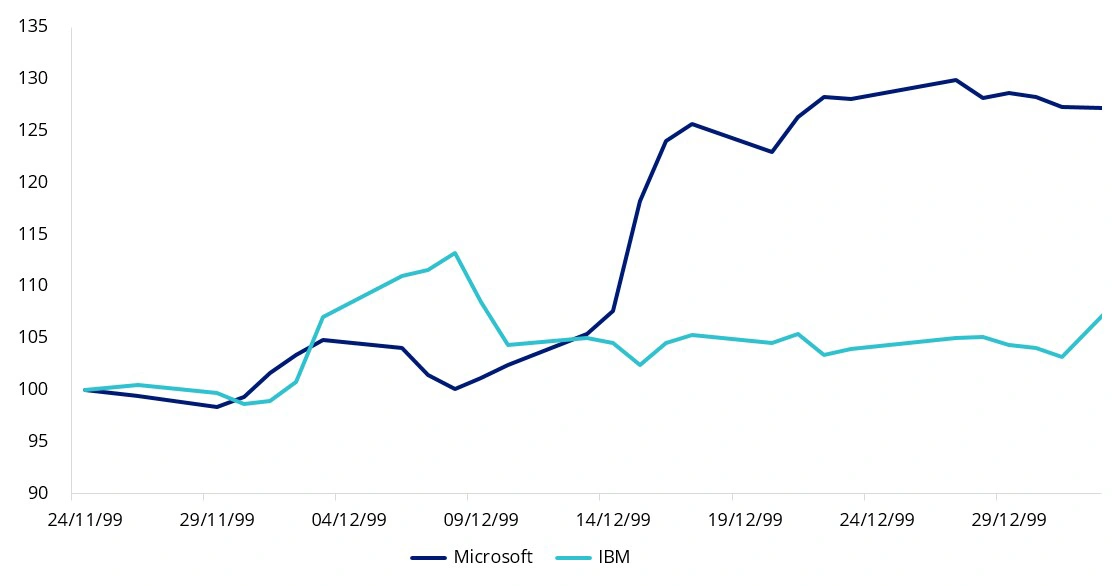

History repeats, smart investors remember

Most titans of industry usually follow the same pattern: boom, dominance, and inevitable disruption. From IBM’s once-unshakable PC empire overtaken by Microsoft to Nokia losing its mobile crown to Apple and Android, and AOL fading while Google reshaped the internet - no monopoly lasts forever. Now, the AI boom is evolving, and history cautions that no leader is immune to disruption.

Enter DeepSeek: The cost-efficient challenger

Born in Hangzhou, China, DeepSeek is an AI upstart that shook the industry last week with the launch of its R1 model, a direct competitor to ChatGPT and built at a cost 18 times lower than ChatGPT-4. The result? A market earthquake. The Magnificent 7 stocks, particularly NVIDIA, faced a sharp selloff as markets recalibrated AI’s next phase.

DeepSeek is a great story - a young disruptor taking on the titans, a tech David challenging the goliaths. But don’t miss the bigger picture. What truly rattled the market isn’t just DeepSeek or its ultra-cost-efficient R1 model - it’s the unmistakable signal that AI is entering its next chapter. The era dominated by brute-force computing is giving way to one defined by efficiency, specialised innovation, and strategic capital allocation.

A turning point for AI

We believe this transition—away from growth that is fuelled purely by ever-larger, power-hungry models, will spark fierce competition and a recalibration of AI economics. As 2025 unfolds, Big Tech may extend its dominance by leveraging massive technical and financial resources. Yet we also foresee AI gains broadening to specialised players, which can carve out high-growth niches and deliver diversification and superior risk-adjusted returns.

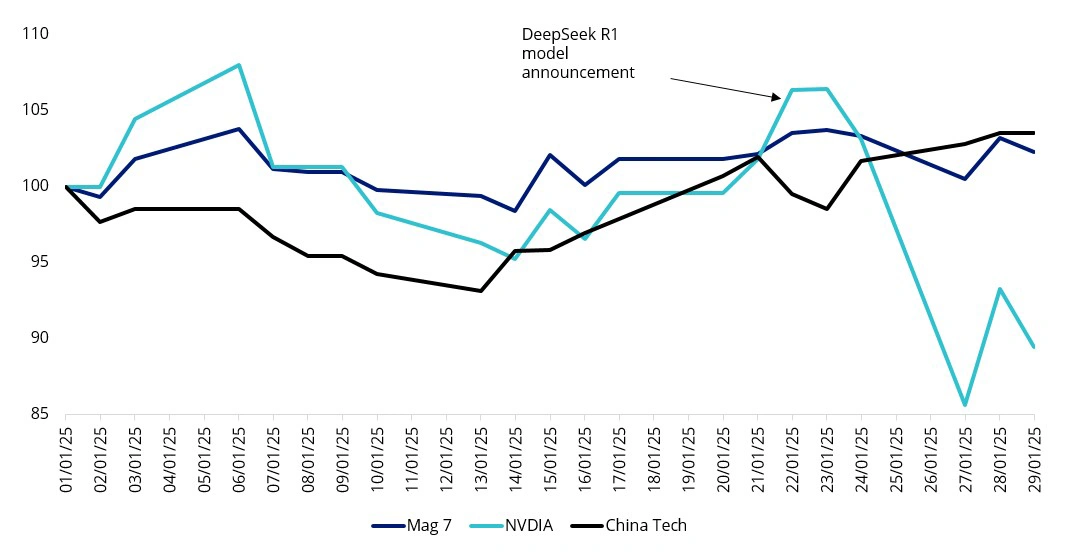

Chart 1: Magnificent 7 stocks’ sharp sell-off on DeepSeek shockwave

Source: VanEck Australia, Bloomberg, January 2025. Mag 7 refers to the Bloomberg Magnificent 7 Total Return Index. China Tech refers to the MSCI China Tech Top 100 Index. You cannot invest directly in an index. Past performance is not indicative of future performance. Data rebased to 100 for illustrative purposes only.

Chart 2: IBM’s challenges echoed by Microsoft’s disruption two decades ago

Source: VanEck, Bloomberg, January 2025. You cannot invest in an index. Past performance is not indicative of future performance. Share prices have been rebased to 100 for illustrative purposes only.

Key questions for AI chapter II

- What does this mean for Big Tech companies?

- Where are new disruptions likely to occur?

- How should investors navigate the next chapter of AI?

Let’s break these down.

1. What does this mean for the Big Tech companies?What sets DeepSeek’s R1 model apart is its optimised data processing and the use of techniques like the mixture of experts, allowing it to achieve high performance with significantly lower computing power and energy consumption. It begs the question – what does this mean for the mega cap tech players? We think this will impact the software and hardware markers differently.

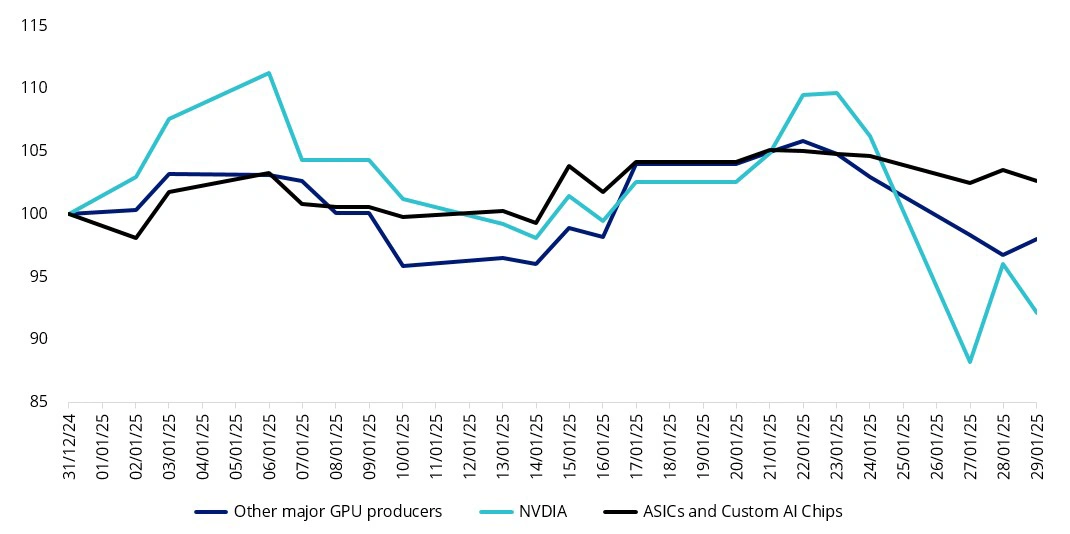

Impact on hardware makers:

- Potential margin compression for high-end chips: DeepSeek’s success raises concerns among investors about the massive capital race for ever-faster GPUs. While computing power remains a key driver of AI model performance, high-end producers like NVIDIA may lose pricing power as firms opt for more cost-effective solutions. This shift could potentially impact their margins.

- Diversifying AI hardware demand: DeepSeek’s efficiency-first approach has accelerated the industry’s pivot toward real-world inference, where models are used in everyday applications. Inference tends to require a broader array of hardware—such as custom ASICs, FPGAs, and advanced networking—rather than just cutting-edge GPUs. This broader demand could benefit both investors and developers including the likes of TSMC and AMD.

Chart 3: Other hardware makers have been catching up recently

Source: VanEck, Bloomberg, January 2025. Other major GPU producers mean the average performance of AMD and Intel. ASICs and Custom AI chips producers mean average performance of Tesla, Alphabet and Amazon. You cannot invest in an index. Past performance is not indicative of future performance. Share prices have been rebased to 100 for illustrative purposes only.

- Broader client base to offset margin losses: Lower barriers to entry and decreasing model costs are likely to encourage more mid- and small-cap firms to adopt AI, increasing overall hardware demand. This surge in new AI adopters could partially counterbalance margin pressures at the high end.

Impact on software makers:

- Rising competition and pricing pressure: DeepSeek’s breakthrough was quickly followed by Alibaba’s announcement of another cost-efficient AI model. These moves, alongside Big Tech’s own AI products, create fierce competition that may force price adjustments and spark new strategic bets. Recent mixed earnings - Tesla’s rebound, Meta’s decline, and Microsoft’s slower cloud growth, show the market’s volatility in AI-related segments.

- AI accessibility and cost optimisation: Advancements in efficiency and cost optimisation will allow Big Tech to expand product offerings, lower AI adoption barriers, and drive broader industry integration. As deployment costs drop, AI-powered tools become more accessible, reinforcing Big Tech’s dominance while opening new revenue streams across enterprise and consumer applications.

- Specialised AI companies stand to gain from this shift: Companies focusing on cost-effective, high-performance AI, such as MosaicML, Modular AI, or Hugging Face, stand to benefit as businesses hunt for lower-cost, high-impact solutions. This shift toward scalable, affordable AI is likely to unlock long-term monetisation opportunities and accelerate overall adoption.

Overall, we see these pressures as part of AI’s natural progression. The winners will be those that innovate, adapt, and stake out clear advantages in a market that grows more competitive by the day. While the Magnificent 7 may face threats, their considerable resources still give them a chance to remain leaders—if they stay agile and open to change.

2. Where to look for disruptions?

We think AI Chapter II will unfold around diversification, innovation, and disruption. Investors should be looking for growth stories powered by these themes. So where to look?

Mass-market and enterprise-friendly AI solutions:

- Ultra-cheap, fast everyday AI: China is quickly emerging as a leader in low-cost AI models designed for mass adoption. These models focus on accessibility and speed, disrupting industries that rely on affordable automation and AI-powered services. Startups like DeepSeek are making moves in this space, competing with Western giants at a fraction of the cost.

- Enterprise adaptability: Businesses need AI that fits into existing workflows without massive overhauls. The winners will be those that offer plug-and-play solutions that enhance automation, customer insights, and operational efficiency. UiPath (process automation) and C3.ai (enterprise AI applications) are already capitalising on this shift, but there's plenty of room for new players.

AI for cost reduction and efficiency (government & beyond):

- Public service-focused AI: Governments worldwide, not just in the US, are under pressure to cut costs, making AI-powered automation an obvious solution. We expect to see an increase in AI-driven public services. Companies like Palantir (government AI analytics) and Civis Analytics (public sector data science) are already deeply embedded in this space. There is significant room for disruption and innovation.

- Infrastructure & automation: AI needs serious infrastructure to run efficiently, from storage and compute power to cooling systems. Nvidia still leads in chips, but startups like SambaNova are building cost-effective alternatives. On the software side, Deci AI is optimising model compression to reduce energy demands. Meanwhile, ASML and TSMC remain critical for next-gen semiconductors, and cooling technology is becoming just as important. Vertiv (VRT), which has outpaced Nvidia’s stock growth, is a key player in AI data centre cooling, providing advanced thermal management solutions to handle the increasing heat from high-performance AI workloads.

Highly specialised AI with high entry barriers:

- Deep domain expertise: AI is reshaping highly regulated industries like biotech, finance, and legal services, where specialised knowledge and compliance create high barriers to entry. Big tech companies may find more opportunities in this field, leveraging M&A and R&D activities, to increase their capabilities and justify premium pricing. For instance, Alphabet's subsidiary Isomorphic Labs focuses on AI-driven drug discovery, aiming to revolutionise the pharmaceutical industry. Similarly, Schrödinger, in collaboration with Novartis, is advancing AI applications in drug development, underscoring the trend of major players integrating AI to maintain a competitive edge.

- Technical & operational moats: These markets are tough to enter, but once a company gets in, it’s hard to dislodge them. The combination of high R&D costs, strict regulations, and deep specialisation makes these fields attractive for long-term investors looking for durable competitive advantages.

Data privacy and compliance solutions:

- Growing regulatory pressure: Data privacy is becoming a major headache for businesses as AI scales. With governments tightening regulations, companies need tools that help them stay compliant. OneTrust and BigID are already tackling AI-driven compliance, but this space is only getting bigger.

- Trust-building & competitive edge: Consumers are more aware of how their data is being used, and companies that prioritise privacy will stand out. AI solutions focused on encryption, anonymisation, and secure data-sharing, like Duality Technologies (privacy-preserving AI) and Skyflow (data vault security), are positioned to benefit as privacy-first AI becomes the norm.

AI is entering a new phase where cost efficiency, adaptability, and domain expertise will define success. The question now is not just where AI will disrupt, but how to position for it. With innovation reshaping competitive dynamics, investors must consider which sectors, business models, and companies are best equipped to thrive.

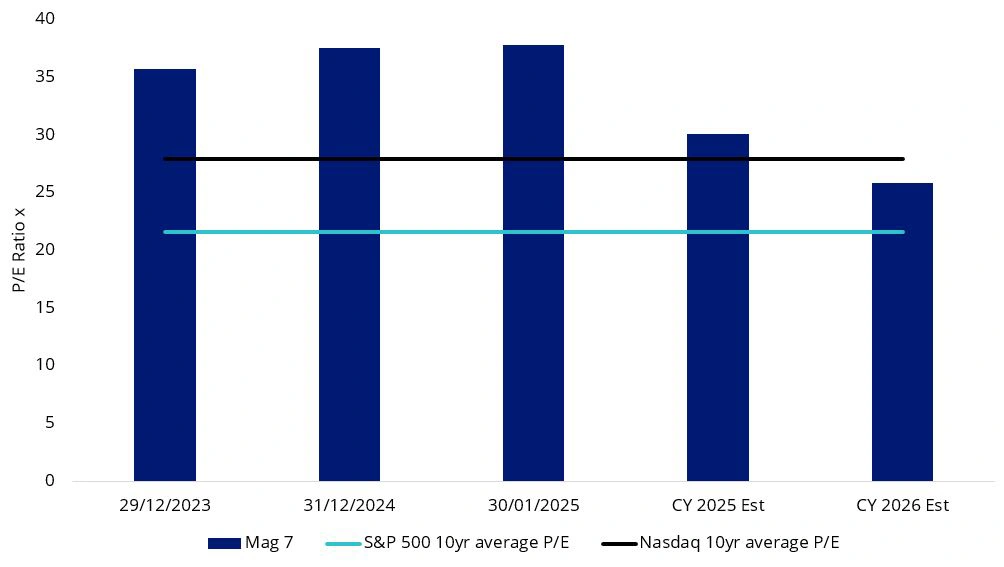

3. How to potentially navigate the next Chapter of AI? A balanced approach is needed.

Maintain exposure to big tech but avoid overconcentration: The dominant players have built their leadership for a reason - scale, resources, and technological superiority. However, given their historically high valuations, overweighting them poses asymmetrical downside risk. VanEck MSCI International Quality ETF (Ticker: QUAL), offers exposure to select Magnificent 7 companies as part of a broader high quality international equities portfolio. Apple, Nvidia, Alphabet, Meta, and Microsoft collectively account for ~25% of QUAL’s portfolio — lower than their ~35% weighting in the S&P 500, offering a more balanced exposure.

Chart 4: Asymmetric risk of big tech names

Source: VanEck, Bloomberg, January 2025. Mag 7 means Bloomberg Magnificent 7 Total Return Index. You cannot invest in an index. Past performance is not indicative of future performance. Price/Earnings Ratio is the weighted average of the last closing price of each portfolio security divided by the last twelve months’ earnings of the security.

Diversify across the AI ecosystem: To manage potential volatility from high valuations, diversifying across the AI ecosystem - including infrastructure, enterprise solutions, and automation - is crucial. VanEck MSCI International Value ETF (VLUE) provides exposure to attractively valued companies, including those in the technology and industrials sectors that can potentially benefit from a broadening AI revolution, including (current) holdings such as Cisco, IBM, Intel, and General Motors, each of which play key roles in AI infrastructure and enterprise solutions. VanEck China New Economy ETF (CNEW) presently taps into China’s leadership in ultra-cost-efficient AI models and hardware manufacturing capabilities, with holdings such as Flaircomm Microelectronics, Delton Technology, and other emerging Chinese innovators shaping the next phase of AI adoption.

Be agile and selective in identifying emerging winners: Disruption creates opportunities, and small-cap AI companies may outperform due to attractive valuations and innovation-driven growth. Investors should remain agile, tracking the evolution of disruptive players gaining traction in key AI verticals. VanEck MSCI International Small Companies Quality ETF (QSML) provides targeted exposure to small and mid-cap companies poised to benefit from the next wave of AI-driven growth, with holdings such as Genpact Ltd, nVent Electric PLC, and BayCurrent Inc, which are leveraging AI-driven efficiencies and automation to enhance operations and scalability.

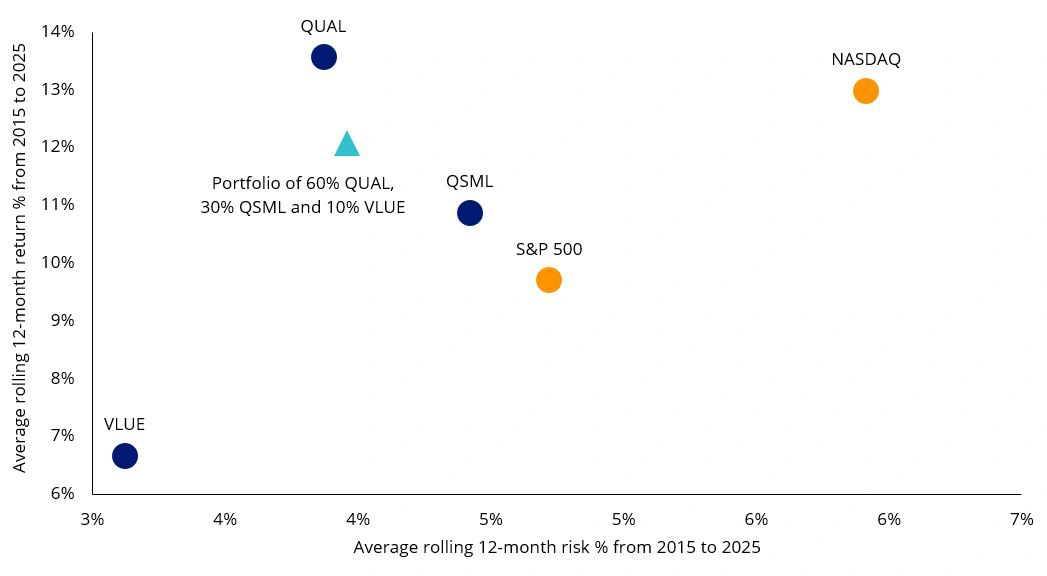

Chart 5: Diversification strategy leads to a more balanced risk and report profile

Source: VanEck Australia, Bloomberg, January 2025. Data as at January 2025. The performance data quoted represents past performance which is not a guarantee of future results. Results are calculated to the last business day of the month and assume immediate reinvestment of dividends. ETF results are net of management fees and costs, but before brokerage fees or bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a guarantee of future performance.

Published: 05 February 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

*VLUE, QSML, QUAL and CNEW do not have inclusionary screens that target AI companies as part of their respective investment strategies. As at the date of this publication the respective portfolios held companies with exposure to the AI sector.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.