Quality shines during US earnings season

Investors have had plenty to cheer about this US earnings season as resilient consumer spending, upbeat big tech results and positive economic outlooks have typified many company’s results. The broadly better-than-expected first quarter earnings sparked a sharp rally in US stocks in April.

Quality companies shone the brightest, demonstrating earnings resilience despite concerns about a slowdown in the US economy following the sharpest rate hike cycle in 40 years. Quarter one earnings results surprised to the upside by a whopping 62 per cent with 55 per cent of S&P 500 companies by market capitalization having reported. Earnings per share has grown by 5.2%.

Economic environment

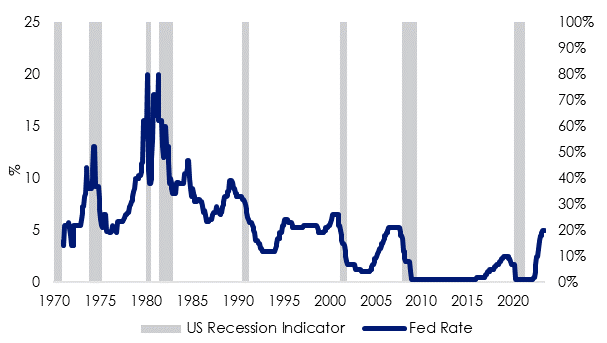

Sticky high inflation and aggressive rate hikes by central banks has investors on edge with fears of a recession building. Investors are contending with the unfortunate fact that historically, 75 per cent of rate hike cycles have resulted in a US recession since 1955.

US Federal Fund effective rate versus recession periods

Source: Board of Governors of the Federal Reserve System (US)

Macroeconomic indicators suggest that the US is in the last stage of the economic cycle with a recession likely by the end of 2023. The US government bond yields between the 2 and 10 year are inverted, and manufacturing activity is contracting. Yield inversion has historically been a leading indicator for a recession in the next 6 to 18 months. ISM Manufacturing PMI below 50 highlights that activity is contracting.

| US ISM Manufacturing Index | 10yr less 2yr US government bond yield |

|

|

| Source: ISM | Source: Bloomberg |

Given the current market uncertainty, investors are looking to defensive investment strategies. One strategy that has demonstrated defensive characteristics particularly so during the latest US earnings season is quality.

Flight to quality

The quality factor is a defensive strategy designed to outperform in a late cycle environment. Benjamin Graham wrote about it in The Intelligent Investor in 1949 , where he said investors should demand from a company “a sufficiently strong financial position and the potential that its earnings will at least be maintained over the years.”

Such companies, he claimed, show resilience by falling less in a downturn. World leader in index construction MSCI defines quality companies as those with: high return on equity (ROE), stable year-on-year earnings growth and low financial leverage. Applying a quality screen across global equities results in an overweight position to US technology mega caps as these businesses are established with a proven track record of delivering stable earnings growth. The latest US earnings season has been no different.

Despite fears of an imminent recession, US first quarter earnings results have been better than expected with quality companies ahead of the pack. Quality companies reported 9% more net beats than US equity market benchmark the S&P 500. Examples include tech names Google and Meta (formerly Facebook) which reported a bounce back in advertising and cloud computing revenue. These companies also efficiently reduced their expense base via layoffs, maintaining strong profit margins and return on equity. We can see below that MSCI USA Quality profit margin and return on equity has improved year to date while the benchmark index has decreased. Mega cap tech names don’t have high fixed operational costs like real estate and manufacturing plants that can be costly to wind down when activity slows, allowing these companies to have resilient balance sheets.

US Earnings Results

Source: Bloomberg, As at 1 May 2023, Quality as US constituents in MSCI World ex Australia Quality Index.

Meta Earnings Per Share Google Earnings Per Share

Source: Bloomberg Source: Bloomberg

Profit Margin Comparison Return on Equity Comparison

Source: Bloomberg Source: Bloomberg

Should the economy continue to deteriorate, quality companies could be well positioned. The graph below reinforces Benjamin Graham’s claim. It shows that quality companies historically outperform when manufacturing activity (proxy for economic activity) slows or contracts (orange or red).

US ISM Manufacturing PMI Index and quality versus MSCI World performance

Source: ISM, Bloomberg, January 2008 to March 2023. Economic phase is a function on the current value of PMI-50 and the three-month change in PMI.

VanEck offers three ETFs that invest in quality companies which track MSCI Quality indices: The VanEck MSCI International Quality ETF (ASX: QUAL), an Australian dollar hedged version of QUAL which has ASX code: QHAL, and the VanEck MSCI International Small Companies Quality ETF (ASX:QSML).

Key risks

An investment in the ETFs carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, currency hedging (QHAL), country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 05 May 2023