Quality investing should last a lifetime

Here’s the evidence.

This week MSCI, one of the world's largest index providers, released a research paper entitled Flight to Quality which evaluates the use of 'Quality' as a factor in quantitative stock selection. The paper assesses the performance of this factor and its risk against other factors and the broad global equity market.

Cutting through MSCI's thorough analysis, the conclusions of the paper are simple:

- Quality outperforms over the long term;

- the Quality factor provides diversification benefits; and

- during volatile periods and when there is a 'flight to quality', the Quality factor outperforms due to its defensive characteristics.

The first half of the paper analyses the various descriptions of 'Quality' and the factors which make a quality company. MSCI presents descriptions from Benjamin Graham (1973), who identified profitability and earnings stability, to Fama and French (2014) who revised their famous three factor model to include two Quality measures. Each individual Quality factor identified by 50 years of academic research outperformed the MSCI World Index. When a combination of Quality factors were used the outperformance was greater.

The MSCI World Quality Index combines the three Quality factors of profitability, low debt and stable earnings growth by only including the highest scoring companies based on return on equity, debt to equity and earnings variability.

The historical risk adjusted returns of the MSCI World Quality Index are superior to the MSCI World Index over the long term.

MSCI also compared its Quality Index to other factor indices and found that MSCI Quality traditionally has its strongest relative performance during volatile periods and periods of economic downturns due to its defensive characteristics. Quality has a large-cap bias and MSCI Quality also outperformed in periods identified as 'flight to quality'.

This new MSCI research - which can be found here - like previous research -highlighted here - demonstrates that Quality has outperformed in periods that had the characteristics of current global markets, namely low growth and low inflation.

Until recently, converting this research to an investment opportunity has been virtually impossible for Australian investors given the highest quality companies identified by MSCI are foreign ones. Australian investors can now action this research through an innovative ETF trading on ASX.

Market Vectors MSCI World ex Australia Quality ETF (ASX code: QUAL) tracks the MSCI World ex Australia Quality Index which means Australian investors can access a portfolio of 300 quality international companies in a single trade on the ASX.

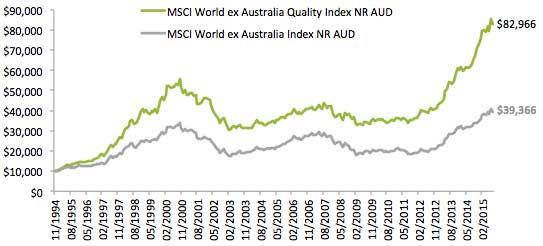

The following chart shows the outperformance of the MSCI World ex Australia Quality Index relative to its global universe and parent index, the standard benchmark MSCI World ex Australia Index.

Source: Bloomberg, iRate, as at 31 August, 2015

The above graph is a hypothetical comparison of performance of a $10,000 investment in the MSCI World ex Australia Quality Index and its parent index. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude costs associated with investing in QUAL. You cannot invest directly in an index. The above performance information is not a reliable indicator of current or future performance of the indices or QUAL, which may be lower or higher

QUAL is the only ETF that tracks the MSCI World ex Australia Quality Index. For more information on QUAL please speak to one of our ETF specialists on 02 8038 3300 or send an email to info@marketvectors.com.au

IMPORTANT NOTICE: This information is issued by Market Vectors Investments Limited ABN 22 146 596 116 AFSL 416755 as responsible entity ('MVIL') of the Market Vectors MSCI World ex Australia Quality ETF ('QUAL'). MVIL is a wholly owned subsidiary of Van Eck Associates Corporation based in New York ('Van Eck Global').

This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation nor needs ('circumstances'). Before making an investment decision in relation to QUAL, you should read the product disclosure statement ('PDS') and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.marketvectors.com.au or by calling 1300 MV ETFs (1300 68 3837).

QUAL is subject to investment risk, including possible delays in repayment and loss of capital invested. Past performance is not a reliable indicator of current or future performance. No member of the Van Eck Global group of companies guarantees the repayment of capital, the performance, or any particular rate of return from the Fund.

QUAL is indexed to a MSCI Index. QUAL is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to QUAL or the Reference Index. The PDS contains a more detailed description of the limited relationship MSCI has with MVI and QUAL.

Market Vectors® and Van Eck® are registered trademarks of Van Eck Global.

© 2015 Van Eck Global. All rights reserved.

Published: 09 August 2018