Riding the Australian dollar wave

The Australian dollar has been on a ride. On 1 July, it was buying 0.6654 US dollars. By the middle of the month, it was heading to 0.68 US dollars and the Australian media was highlighting its relative strength as a benefit for overseas travellers here and here.

Then it started to turn. The reason for the slide was concerns about the health of China’s economy (our biggest trading partner) and the outcome of the Chinese Communist Party’s Third Plenum policy meeting that disappointed global equity markets. It fell further toward the end of the month following a softer reading on core inflation.

Currency fluctuations impact the value of Australian investors’ assets held offshore. For this reason, many investors choose to hedge their portfolio exposure.

To hedge to not to hedge? If Hamlet was an international equities investor, that may have been what he would have asked.

Currency hedging international exposures

The decision to hedge your currency exposure is important because movements in the Australian dollar can either erode or add value to your investment. For example, any drop in the Australian dollar helps unhedged investors as it magnifies gains when assets are converted back into Australian dollars. So if, for example, the Australian dollar fell by 10 per cent, all other things being equal, the value of your offshore investments would rise by 10 per cent. However, the converse is true and any rise in the Australian dollar diminishes returns when the value of foreign investments are converted back into Australian dollars.

This is where hedging an international portfolio may be advantageous, as it will benefit from rises in the value of the Australian dollar.

The chart below shows the impact of movements in the Australian dollar vs US dollar on the value of international equities since before the GFC. As the Australian dollar (black line) appreciated into 2008/09 hedged international equities (light blue line) outperformed. When the Australian dollar fell sharply from April to August 2013, unhedged equities (dark blue line) benefitted significantly while hedged equities gained only from underlying stock performance. As the Australian dollar depreciated further in 2014/15 hedged international equities continued to gain due to underlying stock performance but unhedged equities gained more. In March 2020, you can see that the value of hedged international equities fell much more sharply, versus the unhedged equities because these were cushioned with the simultaneous collapse of the Australian dollar.

Chart 1: Australian dollar and hedged and unhedged international equities returns

Source: Bloomberg, to 30 June 2024. Unhedged International equities is the MSCI World ex Australia Index. International equities hedged is MSCI World Ex Australia 100% Hedged to AUD Index. Past performance is not a reliable indicator of future performance. You cannot invest in an index.

To hedge or not to hedge a Quality international equity exposure

In July the value of the Australian dollar has been impacted by our exposure to China and the subsequent demand for the commodities we produce. Other drivers of the value of a currency include interest rates and the country’s creditworthiness. Australia has a high credit rating, but its interest rates could be moving in a different direction to other developed market central banks. It is for this reason many currency investors are speculating that the Australian dollar could continue to move.

For example, the market is expecting the US Federal Reserve to start cutting rates before the end of the year. Fed Chair Jerome Powell recently said that the central bank could possibly lower its benchmark interest rate at its next meeting in September. Meanwhile locally there is pressure on the RBA to increase rates to rein in inflation, or at the very best, keep high rates on hold. The future is unclear, even the immediate future.

That’s why we think it’s important to remember that over the long run currency risks generally even out.

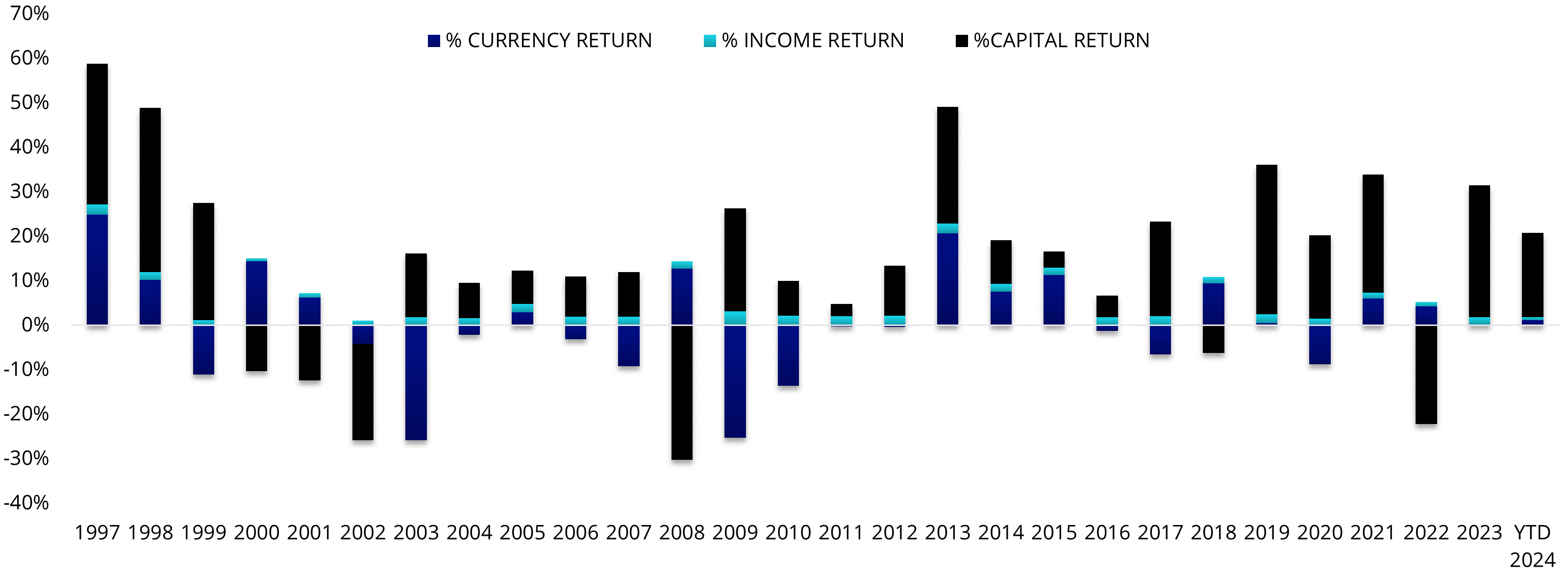

As an example, Chart 2 below shows the long-term returns for the unhedged index tracked by our popular international equities ETF, QUAL.

Chart 2: Calendar year breakdown of QUAL’s Index returns

Source: MSCI. Annual returns to the end of each calendar year. 2024 YTD to 30 June 2024. Performance shown of the QUAL’s Index prior to its launch date is simulated based on the current index methodology. Results assume immediate reinvestment of all dividends and exclude costs associated with investing in the ETF and taxes. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance of the QUAL Index or QUAL.

The total return from currency for the calendar years from the start of 1997 to June 2024 is 0.08% p.a. Over that same time the index has returned 10.26% p.a. In other words, over a long-term period of 27 and a half years, the decision to hedge or not hedge your international equities investment would have had a negligible impact on your overall portfolio performance. For short to medium-term investors the decision becomes more important as we saw in Chart 1 above and can see in many of the calendar years in Chart 2 where the dark blue contributes (or detracts) returns.

Australian dollar hedged opportunities on ASX

In response to investor and adviser demand, late last year we launched the currency-hedged versions of the popular MSCI International Small Companies Quality ETF (QSML), MSCI International Value ETF (VLUE) and Morningstar Wide Moat ETF (MOAT), this is in addition to our long-running currency-hedged version of the VanEck MSCI International Quality ETF (QUAL) that has the ticker QHAL

The new currency-hedged ETFs were:

- VanEck MSCI International Small Companies Quality (AUD Hedged) ETF – ASX ticker: QHSM

- VanEck MSCI International Value (AUD Hedged) ETF – ASX ticker: HVLU

- VanEck Morningstar Wide Moat (AUD Hedged) ETF – ASX ticker: MHOT

VanEck’s AUD-hedged ETFs allow investors to consider their currency position while gaining exposure to smart-beta ETFs. The decision to manage currency exposures can also be made through a blend of both e.g. 50% QUAL, 50% QHAL.

In addition to international equities, we also offer currency-hedged ETFs with exposure to asset classes traditionally associated with income such as global infrastructure (IFRA), international property (REIT) and global listed private credit (LEND). For income-oriented investors, hedging ensures income generated offshore is not offset by currency movements.

It is impossible to predict markets and the same could be said of currencies. As always, we recommend talking to a financial professional to determine which currency strategy is right for you.

Key risks: An investment in the ETFs carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, currency hedging (hedged funds), country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the respective PDS for details.

Published: 02 August 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

QUAL is indexed to a MSCI index. QUAL is not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to QUAL or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QUAL.