Small caps hit the big time

Value hunters may find a lot of bargains in the global small caps universe, but they might be cheap for a reason. Selectivity is critical.

With large caps ‘fully priced’

The equity market rally continues. Usually when the US Federal Reserve starts cutting, it is in response to economic weakness. But the recession that never came has buoyed markets.

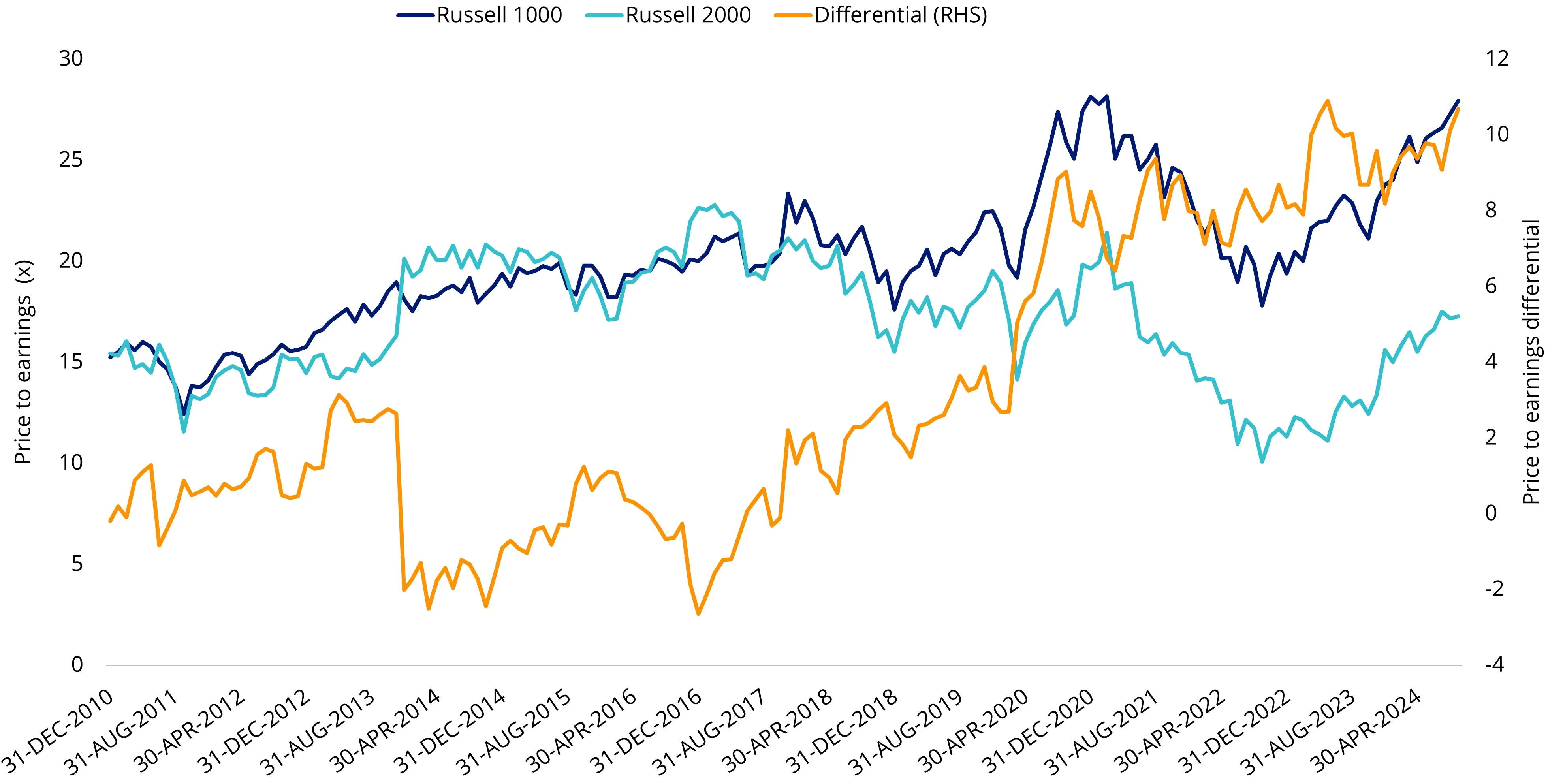

This rally in markets has had a greater impact on large cap valuations, and has meant that global small caps may present a compelling relative value opportunity. Small caps in the US, for example, were at their lowest level in the past 13 years as of July last year, and they remain as cheap as they have ever been relative to large caps.

Small companies tend to be domestic rather than internationally focused and they also tend to be more sensitive to the macro environment, In the past, small-caps have offered more upside than large caps at this stage of the cycle because they have underperformed large-caps during the preceding period of economic weakness.

Chart 1: Price to equity (P/E) of Russell 1000 (US large caps) and Russell 2000 (US small caps)

Source: FactSet, 30 September 2024. Past performance is not indicative of future results.

Savvy investors are reassessing portfolios and preparing for the next cycle and the expected period of recovery.

Small companies appear cheaper on a historical level, but broadly, return on equity and balance sheet strength reflect this weakness.

As we know, it pays to be prudent when it comes to small companies investing. There could be a reason why many of these companies are being overlooked by investors.

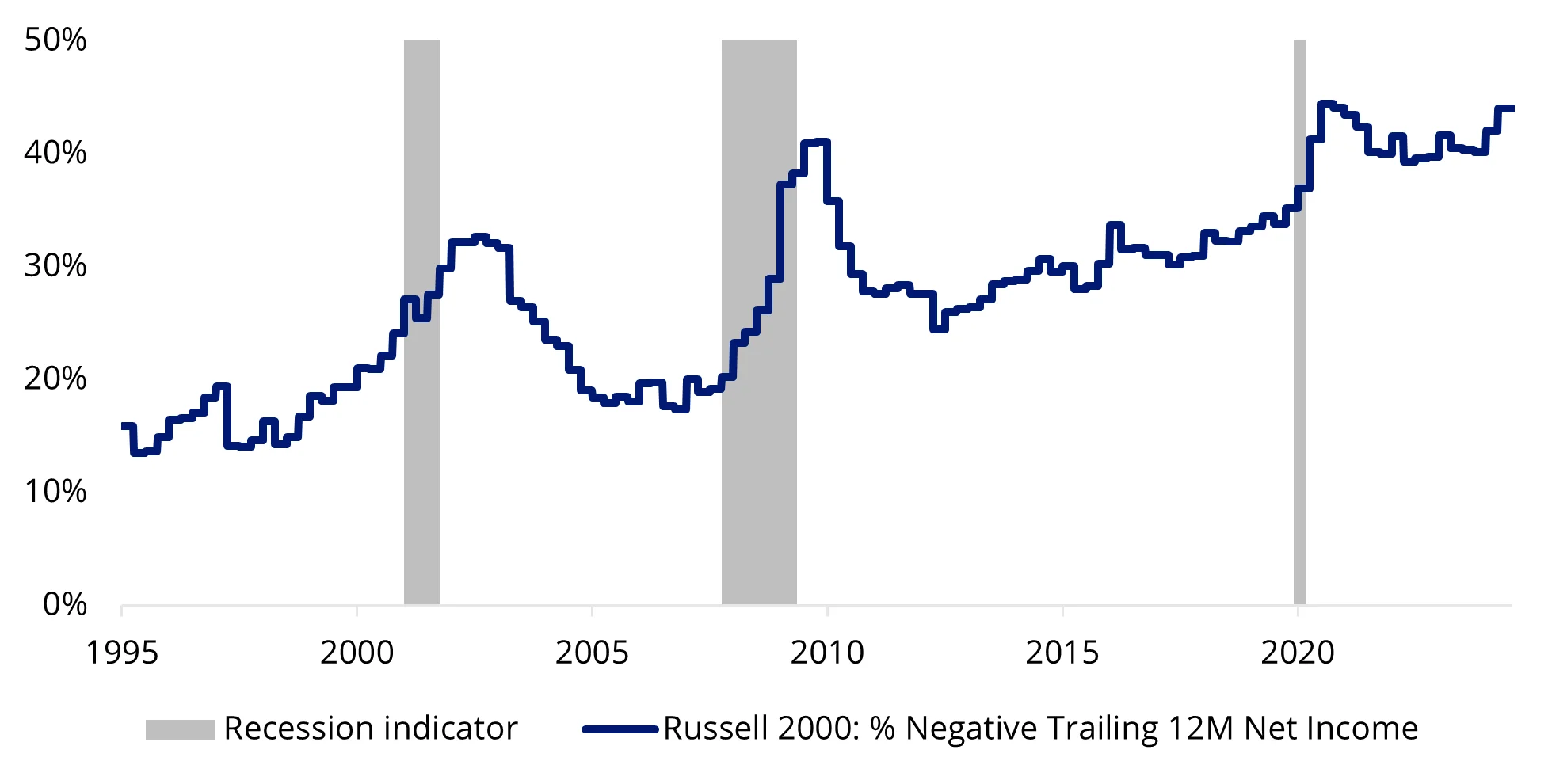

Chart 2: The share of Russell 2000 companies that have negative earnings

Source: Bloomberg, 30 September 2024

The reality is that more and more of these companies are not making money. Selectivity is key in international small companies.

The international small companies benchmark, which includes more than 4,000 companies, captures many companies that are not attractive from an investment point of view. The same issue is true when you consider an international mid- and large-cap passive approach; not all the 1,500 plus in the MSCI World ex Australia Universe are attractive from an investability point of view.

The Quality Factor, inspired by investment pioneers such as Benjamin Graham and Warren Buffett, focuses on return on equity and balance sheet strength. This approach has shown historical outperformance in the mid- and large-cap universe, so could potentially help investors manoeuvre through into the next stage of the cycle.

It may be worthwhile preparing portfolios for a recovery, and one way investors can do this is via the VanEck MSCI International Small Companies Quality ETF (QSML) which is the only smart beta international small-cap ETF in Australia.

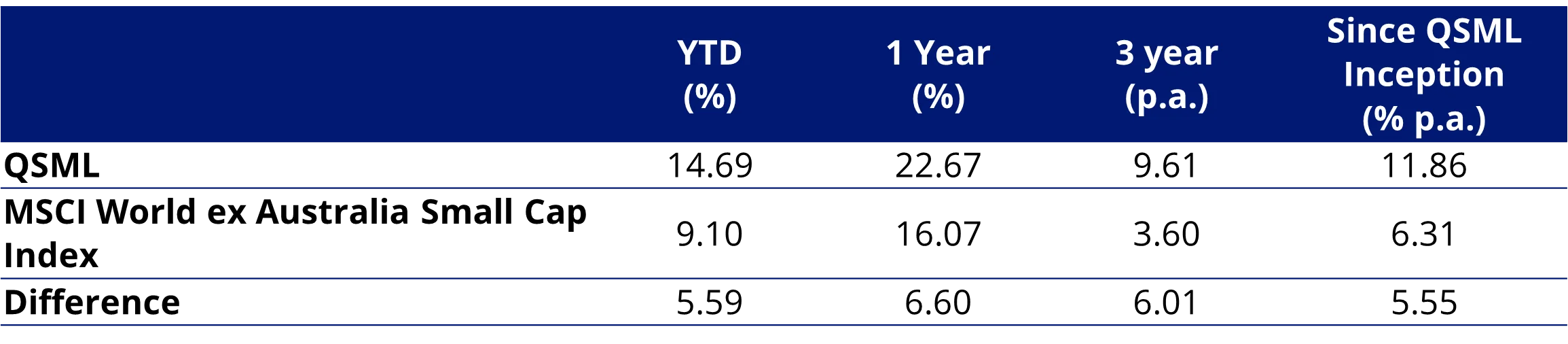

Australian investors have experienced this with the VanEck MSCI International Quality ETF (QUAL). So far in 2024, the quality factor in global small companies has shone, with VanEck MSCI International Small Companies Quality ETF (QSML) outperforming the market benchmark index for international small-cap companies, the MSCI World ex Australia Small Cap Index. It is worth noting that past performance is by no means a reliable indicator of future performance.

Table 1: Trailing returns as at 30 September 2024: QSML vs MSCI World ex Australia Small Cap Index

Source: VanEck, Morningstar. Past performance is not a reliable indicator of future performance. QSML results are net of management fees and costs, but before brokerage fees or bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised.

QSML inception date is 8 March 2021 and a copy of the factsheet is here.

The MSCI World ex Australia Small Cap Index is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of developed market small companies, weighted by market cap.

Baby QUAL

QSML is a diversified, international small companies quality portfolio. QSML tracks the MSCI World ex Australia Small Cap Quality 150 Index (QSML Index). Like QUAL, it includes companies on the basis of:

- High ROE;

- Stable year-on-year earnings growth; and

- Low financial leverage.

Hence, its nickname, “Baby QUAL”.

QHSM is an Australian dollar hedged version of QSML, enabling investors to manage their desired currency exposure.

Key risks: An investment in the ETF carries risks associated with ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

QSML is indexed to a MSCI index. QSML is not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to QSML or the MSCI World ex Australia Small Cap Quality 150 Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QSML.

Published: 31 October 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.