A defensive diversifier for volatile times

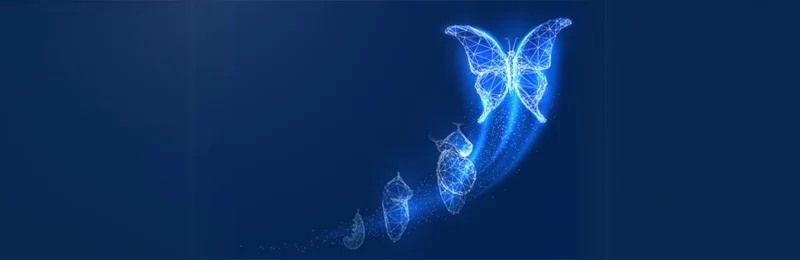

Over the past 12 months, global healthcare stocks, as represented by VanEck Global Healthcare Leaders ETF (HLTH), have lagged behind broader international equities as you can see in chart 1. This underperformance can be attributed to healthcare’s defensive nature, which fell out of favor as recession fears eased and risk-on sentiment prevailed.

Chart 1: Healthcare’s performance

Source: Bloomberg, 16 August 2024. Past performance is not indicative of future results. Results are calculated to the last business day of the month and assume immediate reinvestment of dividends. ETF results are net of management fees and costs incurred in the fund, but before brokerage fees or bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised.

However, in recent weeks, the outlook for the economy has taken a slight turn. In early August, markets went into a plunge, with the ‘Magnificent Seven’ stocks hitting hard and losing more than US$650 billion in market value. While markets have stabilised from this episode, key indices like the S&P500 remain below recent highs and the VIX is still elevated compared to where it has been.

Chart 2: Elevated VIX

Source: Bloomberg, 12 August 2024. Past performance is not indicative of future performance.

As analysts anticipate more volatility to come, now could be an opportune time for investors to consider allocations to more defensive sectors such as consumer staples, utilities, and healthcare.

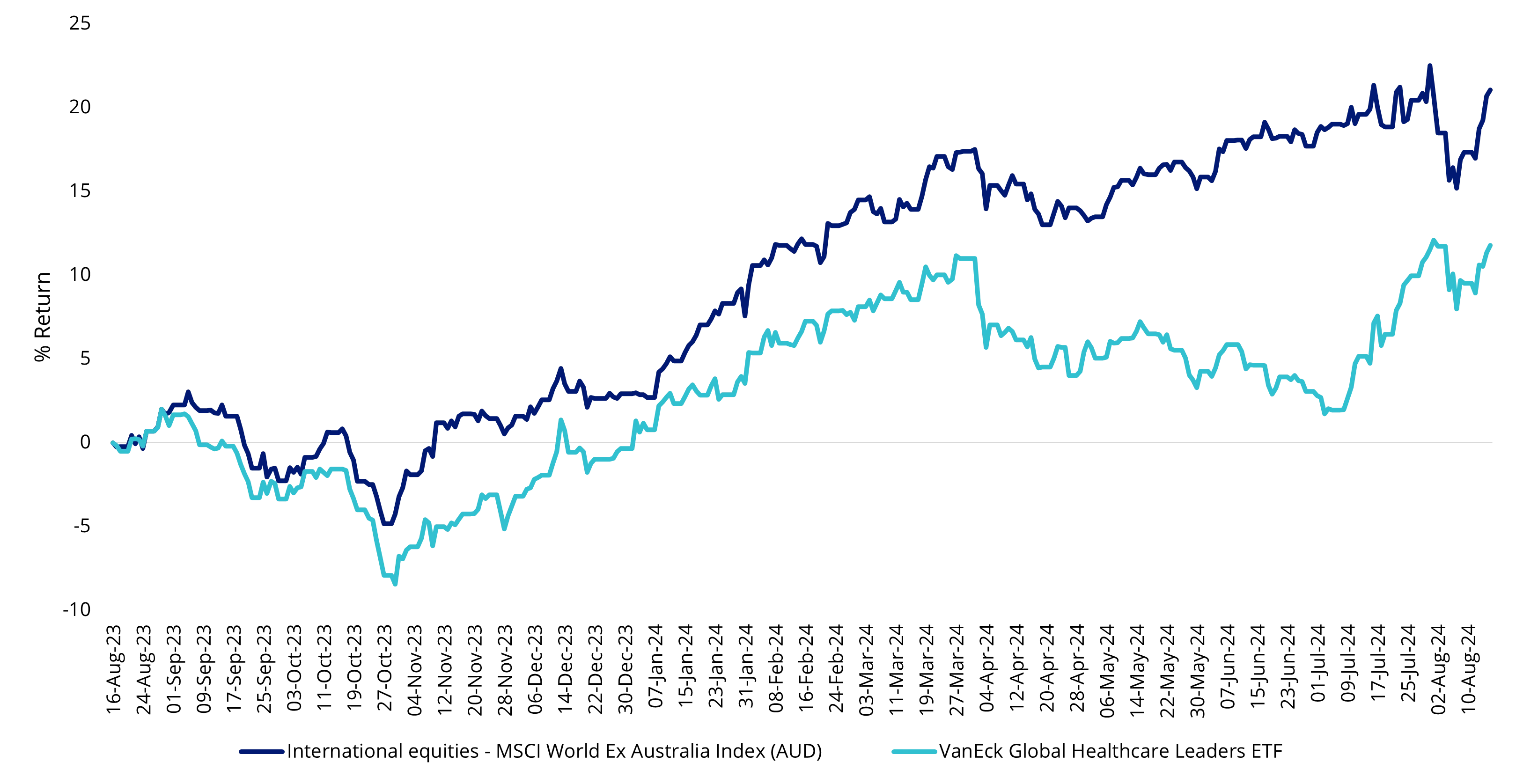

If you look at the below chart, it shows the relative performance of these defensive sectors vs the S&P 500 Index—defensives historically trough when the market peaks, and surge when the market rolls over into a crash, correction or a bear market.

Chart 3: Defensive stocks relative performance

Source: Bloomberg, 13 August. Defense sector represented by the MSCI World Defensive Sectors Net USD which has an allocation of 45.6% Healthcare, 25.78% Consumer Staples, 17.9% Energy and 10.72% Utilities. Past performance is not a reliable indicator of future performance.

A diversifier during macroeconomic volatility

In our view, healthcare stands out as a compelling diversifier in the current environment. Healthcare stocks tend to remain stable during periods of volatility and have historically been strong performers during late-cycle or recessionary periods. The sector's long-term growth is driven by consistent consumer demand for new medications and treatments, which remains relatively steady even during recessions.

During the 2009 global recession, for example, the healthcare sector, particularly the drug and biotech industries, posted steady results with limited impact on sales and profits. This resilience is largely due to the essential nature of healthcare services and the high gross margins of many biopharmaceutical products, which help cushion the sector against inflationary pressures.

Chart 4: Biopharma sales were largely unaffected by last major recession in 2008-09 (Morningstar)

Source: World Bank, Company reports, Morningstar’s Biopharma Landscape. Data as of April 2024.

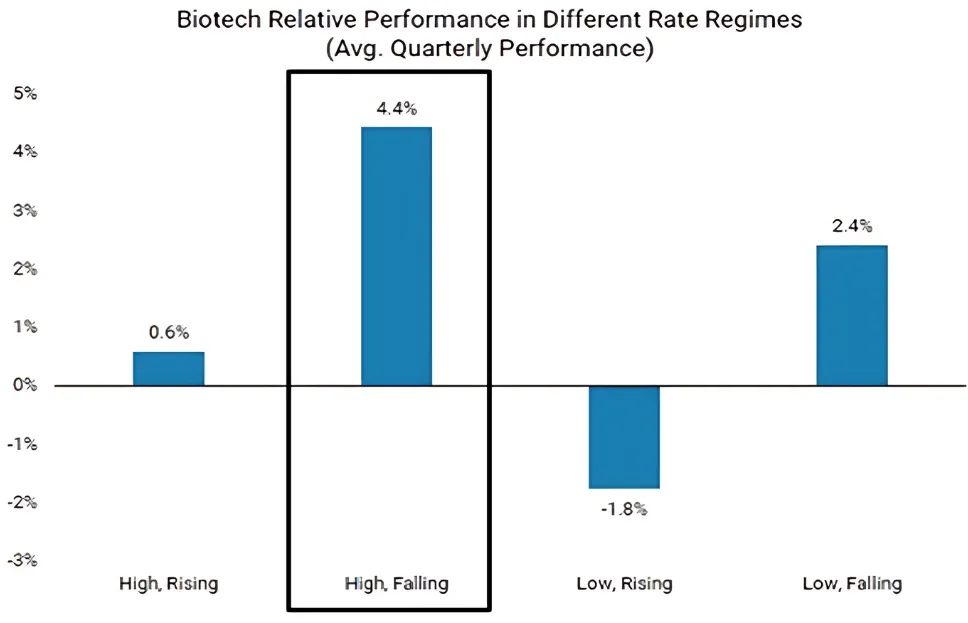

Furthermore, markets have fully priced in a rate cut in September and further easing by year-end. According to Morgan Stanley, the biotech sector is poised to benefit when the Federal Reserve eventually cuts rates. Historically, biotech stocks tend to outperform the market when rates are high but falling, as these companies have far-out cash flows that make them more sensitive to changing rates. They also benefit from cheaper financing costs and are more likely to be acquisition targets when rates are calmer.

Chart 5: Biotech relative performance in different rate regimes (avg. quarterly performance)

Source: Compustat, Bloomberg, MS Research. Based on 10-year yield. High/low rates defined as current level vs. 5-year rolling median. Rising/falling rates defined as quarterly rate of change.

Attractive valuations

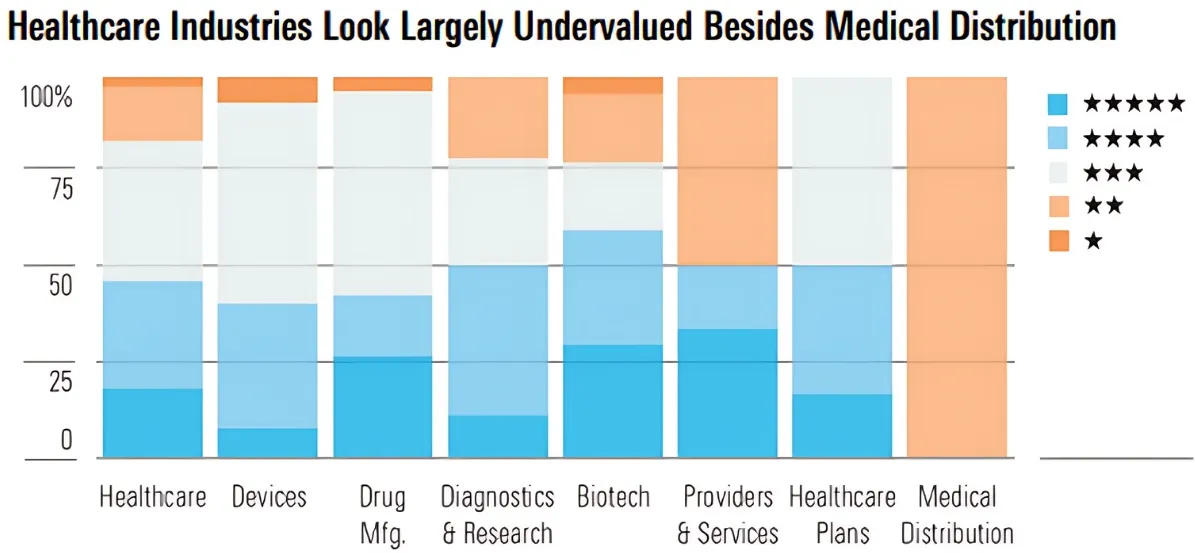

According to Morningstar research, the majority of stocks in the healthcare subsectors are currently undervalued.

Nearly 50% of the healthcare stocks covered by Morningstar research are rated 4 or 5 stars, indicating they are trading below their estimate of intrinsic value. The biotech sector in particular looks to be the most undervalued.

Chart 6: Majority of healthcare subsectors are undervalued (Morningstar)

Source: 24 June 2024, from the Morningstar report ‘Healthcare: Valuations look attractive in most industries’.

VanEck’s healthcare offering and subsectors we’re watching

Investors seeking exposure to the healthcare sector can consider the VanEck Global Healthcare Leaders ETF (ASX: HLTH)

In our view, two healthcare subsectors sparking our interest are pharmaceuticals (26.1% of the ETF as at July 2024) and biotechnology (18.6% of the ETF as at July 2024).

The global pharmaceutical industry is expected to experience healthy revenue growth through 2027, despite the looming patent cliff, headwinds from biosimilars, and the enacted US Government price negotiation via the Inflation Reduction Act. Key drivers behind this growth include the increased global use of and spending on medicines, the expanding obesity drug market, as well as a growing aging population which will drive demand for over-the-counter and specialty pharmaceuticals.

Meanwhile, compared to the pharmaceutical industry, the biotech industry is younger and grows at a faster rate. High growth rates breed more competition for any industry, leading to a robust IPO schedule and pipeline for the biotech industry. As mentioned above, the biotech industry is expected to outperform when rates eventually fall.

Furthermore, the US biotech market size was valued at US$246.18 billion in 2023 and is anticipated to reach around US$763.82 billion by 2033, poised to grow at a CAGR of 11.90% from 2024 to 2033. Notably, AI is expected to make significant contributions to various aspects of biotechnology, enhancing research, drug discovery, diagnostics, and personalised medicine.

Key risks

An investment in our global healthcare ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck Global Healthcare Leaders ETF PDS and TMD for more details.

Published: 25 August 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.