Making a value call

Coming into 2025, US equities appeared to be priced to perfection. It was a matter of time before prices would re-adjust.

Meanwhile, the threat of inflation came to the fore and markets digested the implications of Trump’s tariffs. To start 2025, growth assets that rose the AI wave up fell hardest as potential inflation loomed.

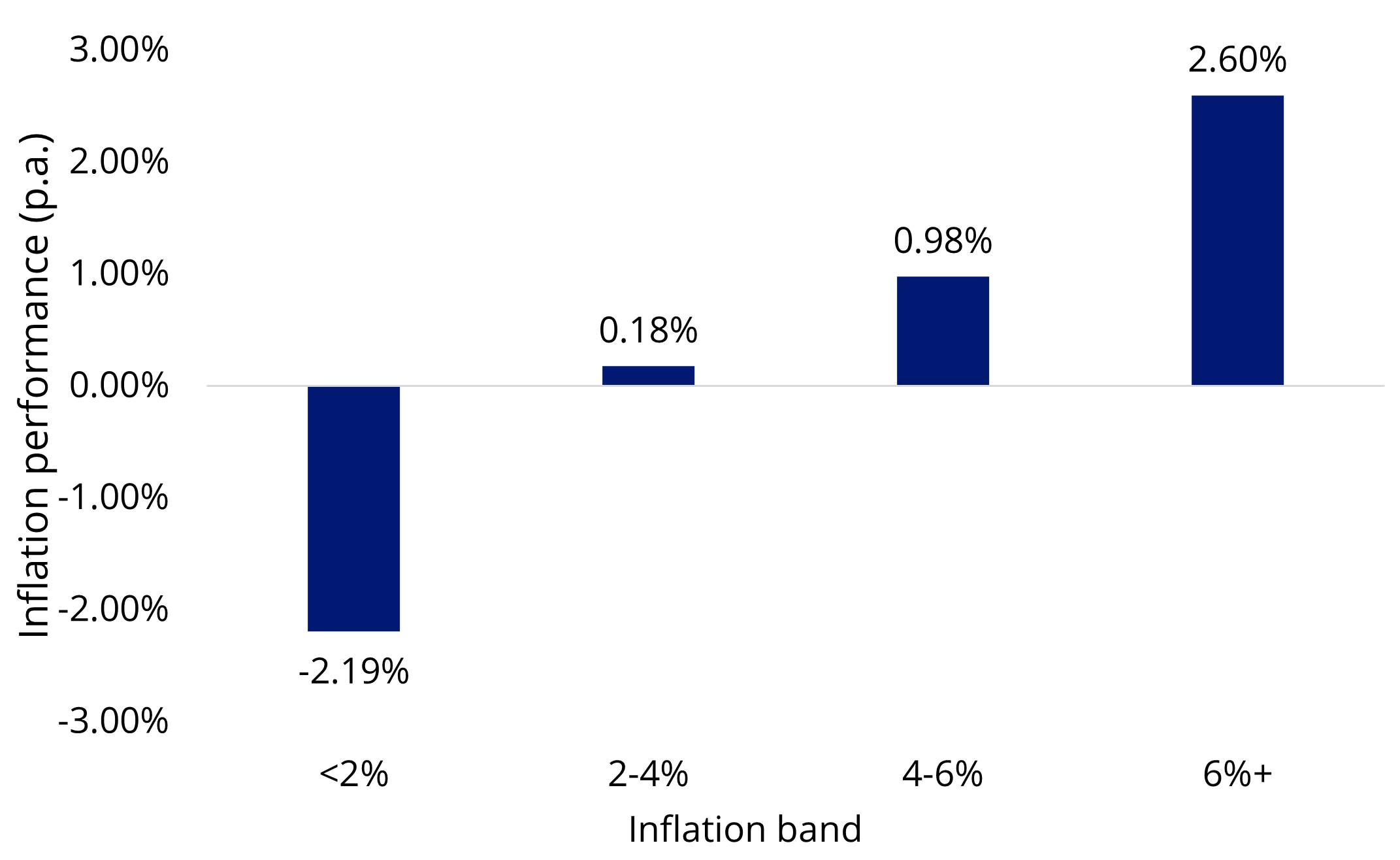

‘Value’ came to the fore. Value stocks generally have lower ‘duration’ versus growth stocks. While duration is considered a fixed income metric, it can be applied to a company’s cash flows. Long-duration companies realise a higher proportion of their cash flows far into the future. Many technology companies, that are not yet profitable, for example, would be long-duration.

Many growth stocks experience negative cash-flow, ploughing money back into the business to grow it, with the hope it will turn a profit in the future. While value companies, which are generally well established, pay a higher portion back to shareholders, their valuations are more tied to current and near-term expected earnings. This lessens duration risk. So, when inflation spikes as it is expected to, central banks increase policy rates. As we are seeing now, markets are attempting to anticipate this and so are reassessing the present value of future earnings and it is adversely impacting growth stocks more. In this environment it is therefore desirable to hold companies where valuations are tied to the near team earnings. Value companies generally provide this.

Chart 1 - Value performance relative to MSCI World by inflation brackets

Source: Bloomberg. MSCI, Indices used MSCI World Index and MSCI World Value Index. Data from December 1975 to March 2025. You cannot invest in an index. Past performance is not indicative of future results.

It’s not too late to add value

So far in 2025 ‘value’ has emerged as the winning ‘factor’ and should a recession occur, which would be followed by a subsequent recovery, portfolios with exposure to value could again be well placed.

We think adding value is an important diversifier that can help investors traverse the impending macroeconomic environment. ETFs are an efficient tool to facilitate this.

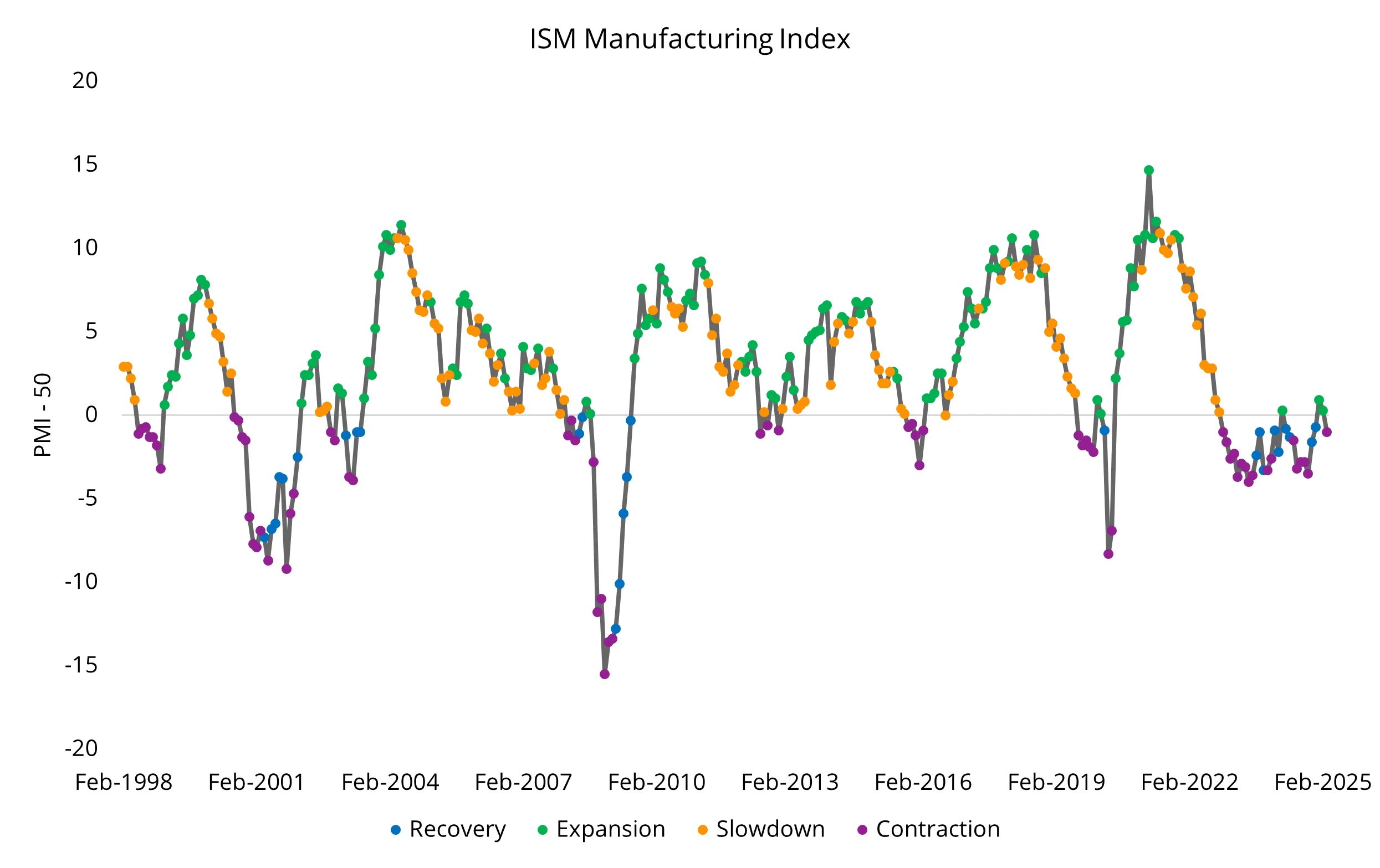

The Purchasing Managers' Index (PMI) is an index used to measure the prevailing direction of economic trends in the manufacturing and service sectors. It measures the change in production levels across the economy from month-to-month so is considered a key indicator of the state of the economy. The chart below shows the three-month rolling PMI changes since the start of 1998, highlighting the stage of the economic cycle at that time.

Chart 2: ISM Manufacturing PMI Index

Source: VanEck, Bloomberg. November 1998 to February 2025

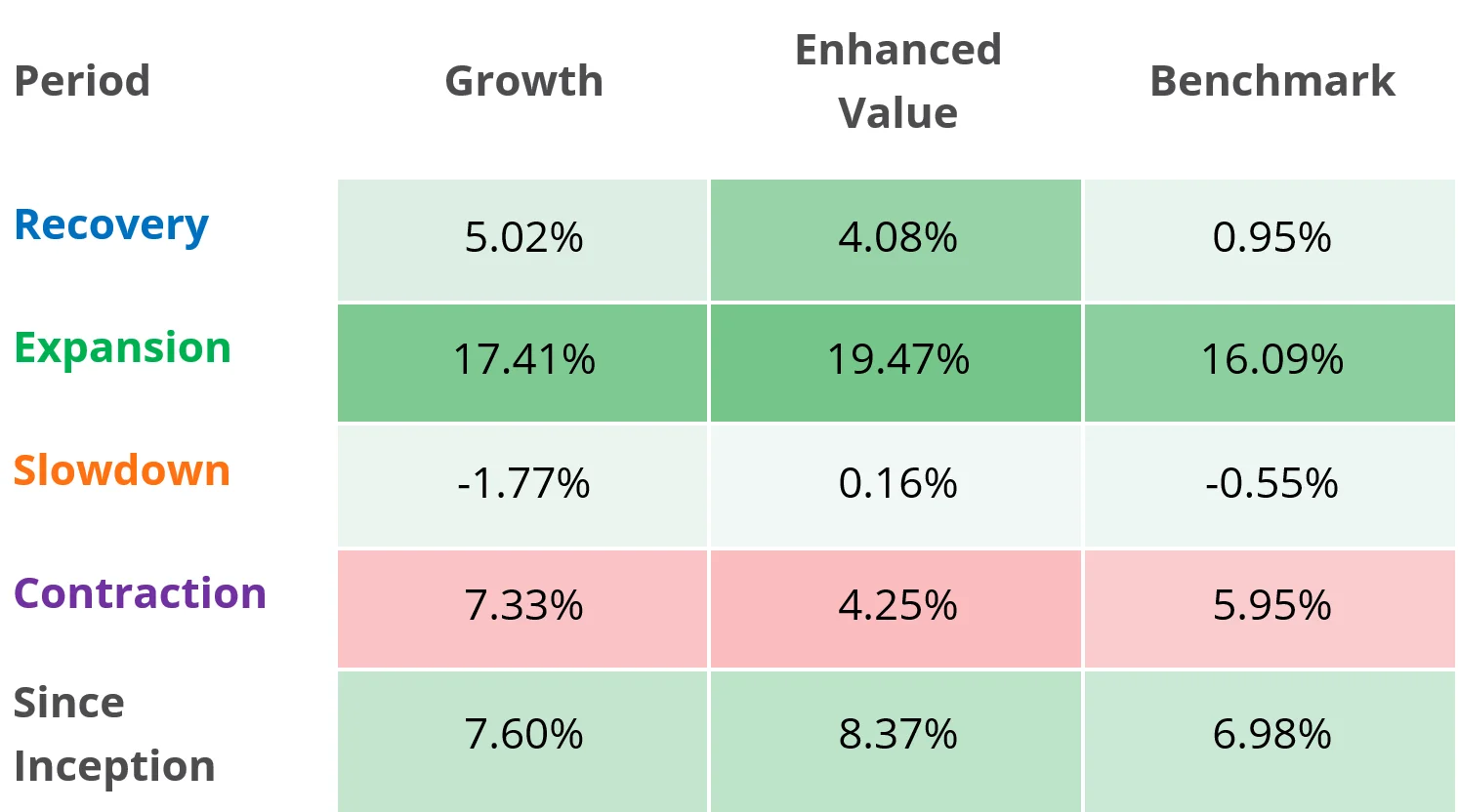

We analysed the performance of MSCI’s equity style factors of enhanced value and growth over the different economic regimes charted above. The performance of enhanced value and growth broken up by each economic ‘regime’ is presented below.

Table 1: Total performance (% per annum) during different economic regimes

Source: VanEck, Bloomberg. November 1998 to February 2025. Past performance is not a reliable indicator of future performance. Growth is MSCI World Growth Index, Enhanced Value is MSCI Enhanced Value Index, Benchmark is MSCI World Index.

You can see in an expansion and a slowdown, enhanced value outperformed growth.

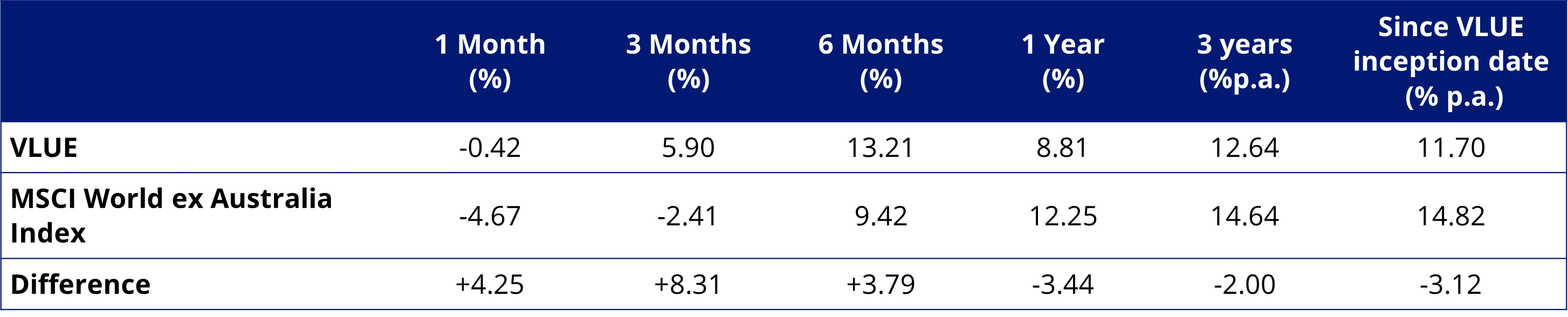

One way to play the value resurgence and position for the macro environment for the rest of 2025 and beyond is the VanEck MSCI International Value ETF (ASX: VLUE) or its AUD hedged equivalent HVLU.

Over the first quarter of 2025, VLUE has outperformed the MSCI World ex Australia Index by 8.31%, returning 5.90% (source: Morningstar), and as always, past performance is not indicative of future performance.

VLUE and HVLU offers exposure to 250 international large and mid-cap companies with high value scores determined by MSCI.

Using Value in a portfolio

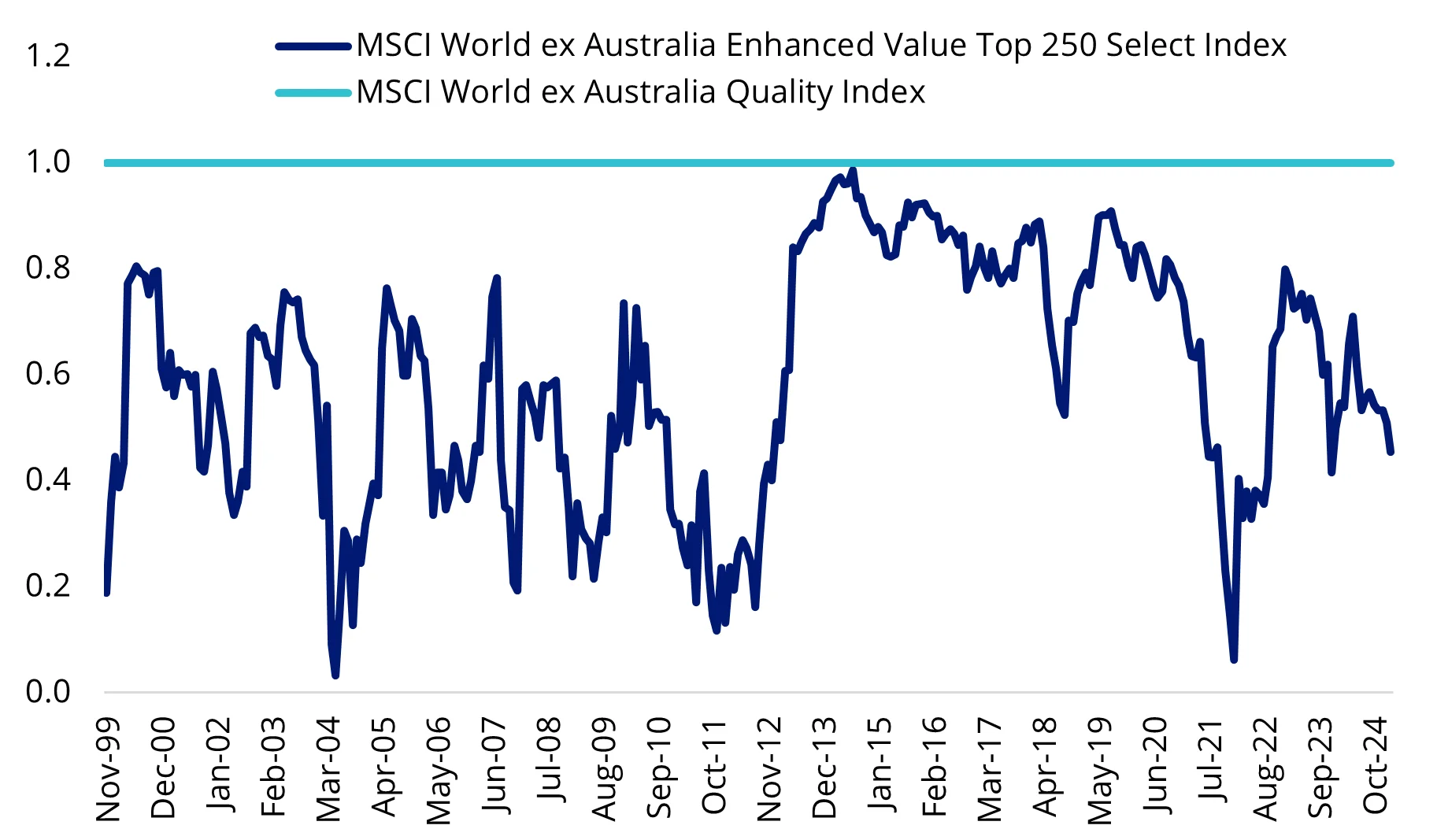

As evidenced above, the performance of factors can be cyclical. Value has been used by savvy investors to diversify their other exposures, by combining approaches.

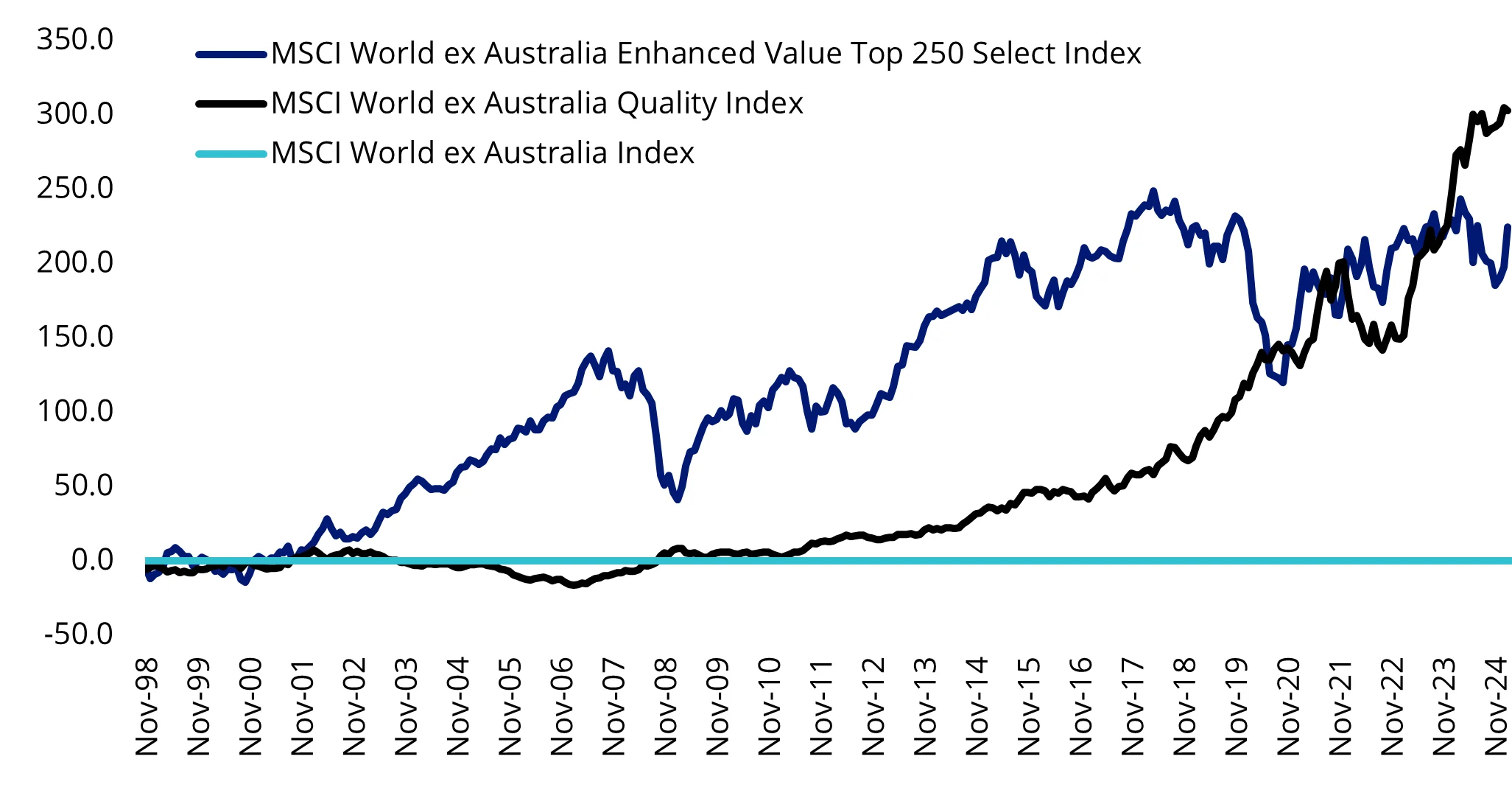

Chart 3: Cumulative outperformance of VLUE’s Index and MSCI World ex Australia Quality Index against MSCI World ex Australian Index

Chart 4: Rolling 12-month correlation: VLUE Index and MSCI World ex Australia Quality Index

Chart 3 and 4 Source: VanEck, Morningstar, Bloomberg as at 31 March 2025. You cannot invest in an index. Past performance is not a reliable indicator of future performance. VLUE index is the MSCI World ex Australia Enhanced Value Top 250 Select Index. Index results do not include any management fees, and do not include brokerage costs or buy/sell spreads of investing. Results assume immediate reinvestment of all dividends.

Table 2: Performance as at 31 March 2025

Source: VanEck, Morningstar, Bloomberg. Results assume immediate reinvestment of all dividends and include management fees but exclude brokerage costs and taxes. Past performance is not a reliable indicator of future performance.

VLUE inception date is 8 March 2021 and a copy of the factsheet is here.

The MSCI World ex Australia Index (“MSCI World ex Aus”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of developed market large- and mid-cap companies, weighted by market capitalisation. VLUE’s index measures the performance of 250 international large- and mid-cap companies selected from the MSCI World ex Australia Index with high value scores relative to their peers at rebalance. Exclusions apply for weapons and tobacco. Consequently, VLUE’s index has fewer companies and different country and industry allocations than MSCI World ex Aus. ‘Click here for more details’.

Key risks An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency (VLUE), currency hedging (HVLU) country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 09 April 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

VLUE and HVLU are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to VLUE and HVLU, or Parent Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and VLUE and HVLU.