Golden opportunity to build resilience into portfolios

The recent market rout is a reminder of how swiftly stock markets can change direction. The recovery was quick, however investors who are bracing for further market turbulence may want to consider adding more ‘padding’ to their portfolio.

Allocations to global healthcare, infrastructure and gold miners, as well as gold bullion, are well-placed defensive strategies that can minimise the impact of unexpected market developments.

Healthcare and infrastructure stand out from other share market sectors due to their relative stable earnings profile. Gold is an important portfolio diversifier and hedge against potential flareups in geopolitical tensions and inflation, and gold miners can benefit from this positioning as the stocks have traditionally outpaced the price movements of gold.

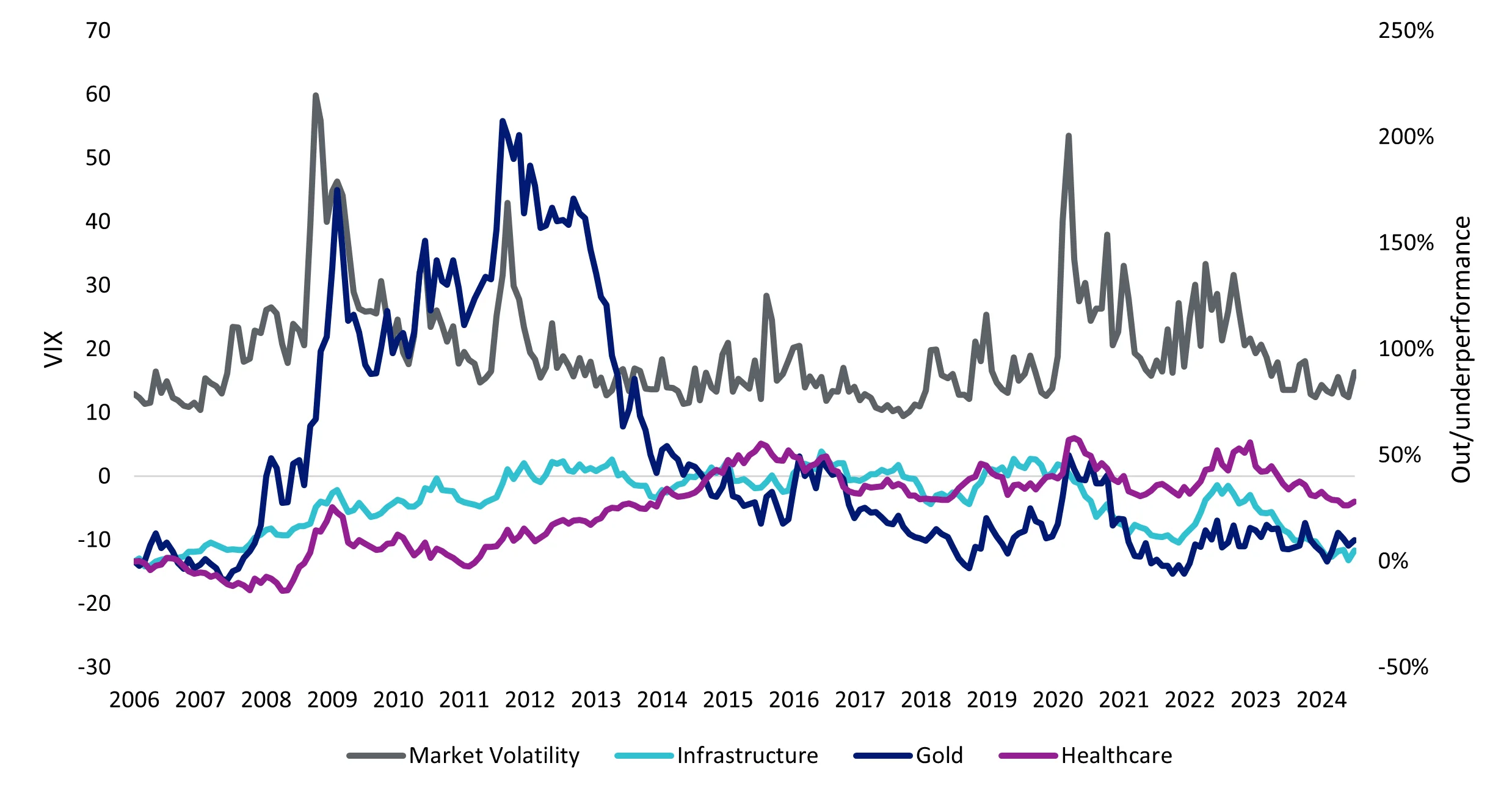

Chart 1: Infrastructure, gold and healthcare relative performance to MSCI World vs VIX

Source: Bloomberg, VanEck. Data as of 20 August 2024. Market Volatility as Chicago Board Options Exchange Volatility Index, Infrastructure as FTSE Global Core Infrastructure 50/50 Index, Gold as LBMA Gold Price PM USD, Health Care as MSCI World Health Care Index. Past performance is not indicative of future performance. You cannot invest in an index.

Healthcare

The healthcare sector has characteristics that tend to help it outperform during periods of economic uncertainty.

It has a relatively low correlation with the state of the global economy, as its products are generally in demand irrespective of changes in the economic cycle.

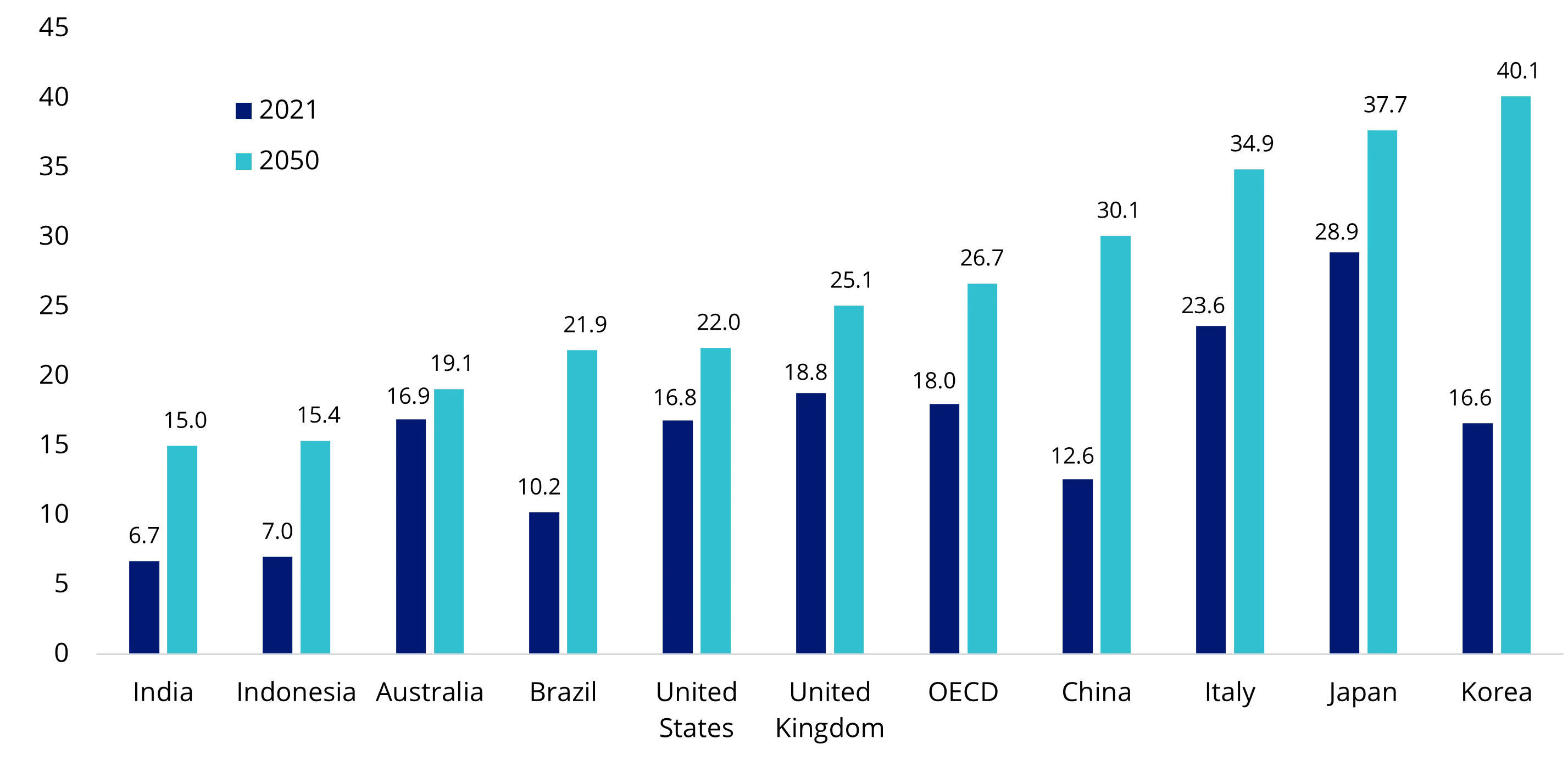

Structurally, its growth is supported by an expanding population that is getting older (over-65s are set to more than double by 2050 globally1), increasingly middle class, and reporting a higher incidence of chronic diseases. Emerging economies are also spending more on healthcare.

Chart 2: The proportion of people aged over 65 in the total population by 2050

Source: OECD Health Statistics 2023; OECD Historical Population Data and Projections Database, 2023.

Infrastructure

Infrastructure has traditionally held up well during economic downturns. As a defensive asset class, these companies are generally monopolies with inelastic demand.

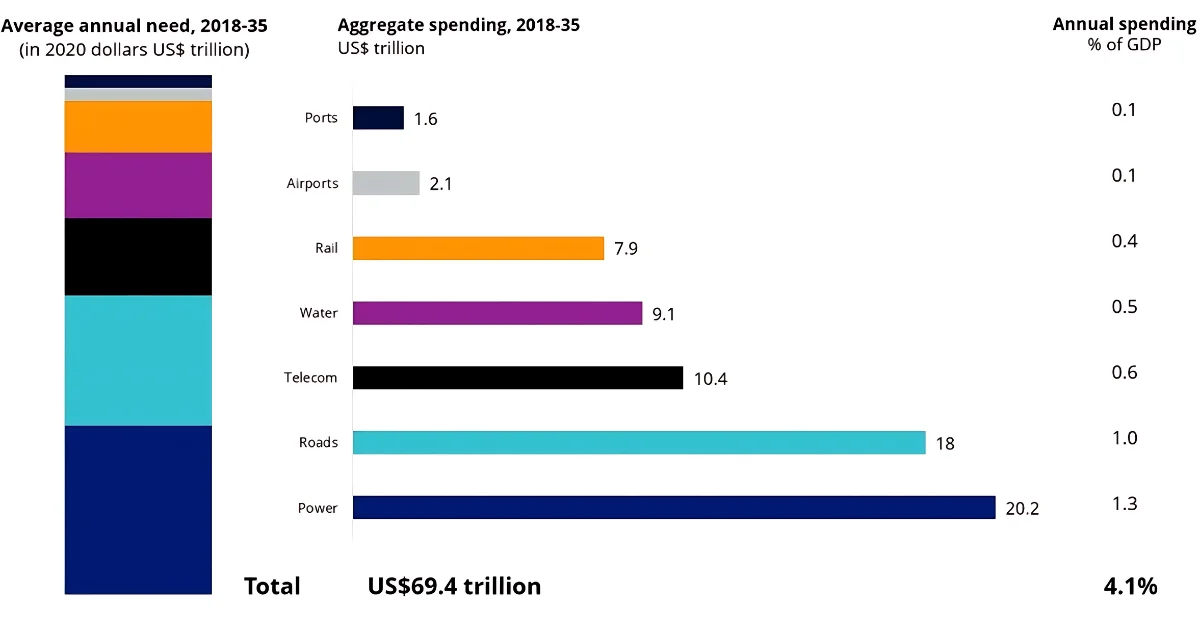

Critical infrastructure such as toll roads and utilities remain essential despite tougher economic conditions, with an estimated US$69.4 trillion in aggregate spending required to meet projected population growth.

Forecast US rate cuts bode well for utilities companies in particular due to heavy reliance on debt financing.

Income from infrastructure assets is typically more stable compared to equities, as the cashflow is often inflation-linked and mandated by government regulation. Historically, infrastructure yields have outperformed traditional defensive assets such as bonds.

There is also strong demand for infrastructure assets among super funds, with demand expected to grow given the attractive risk/return profile and investment life (30+ years).

Mounting public debt in developed countries is fostering an environment that could see listed infrastructure equities thrive as governments ‘tighten their belts’ and private infrastructure companies gain greater investment opportunities off the public sector.

The global clean energy transition is a tailwind, with significant infrastructure investment required to meet emission reduction goals by 20302.

Chart 3: Infrastructure sector outlook

Source: McKinsey analysis, McKinsey Global Institute analysis, VanEck

Gold bullion and equities

We’ve seen record-breaking gold prices multiple times this year already, and we expect to see the rally continue. With rate cuts on the horizon in the US, a potentially weakened USD, ongoing geopolitics and indications central banks in emerging countries are looking to stock up, gold is presenting an attractive opportunity.

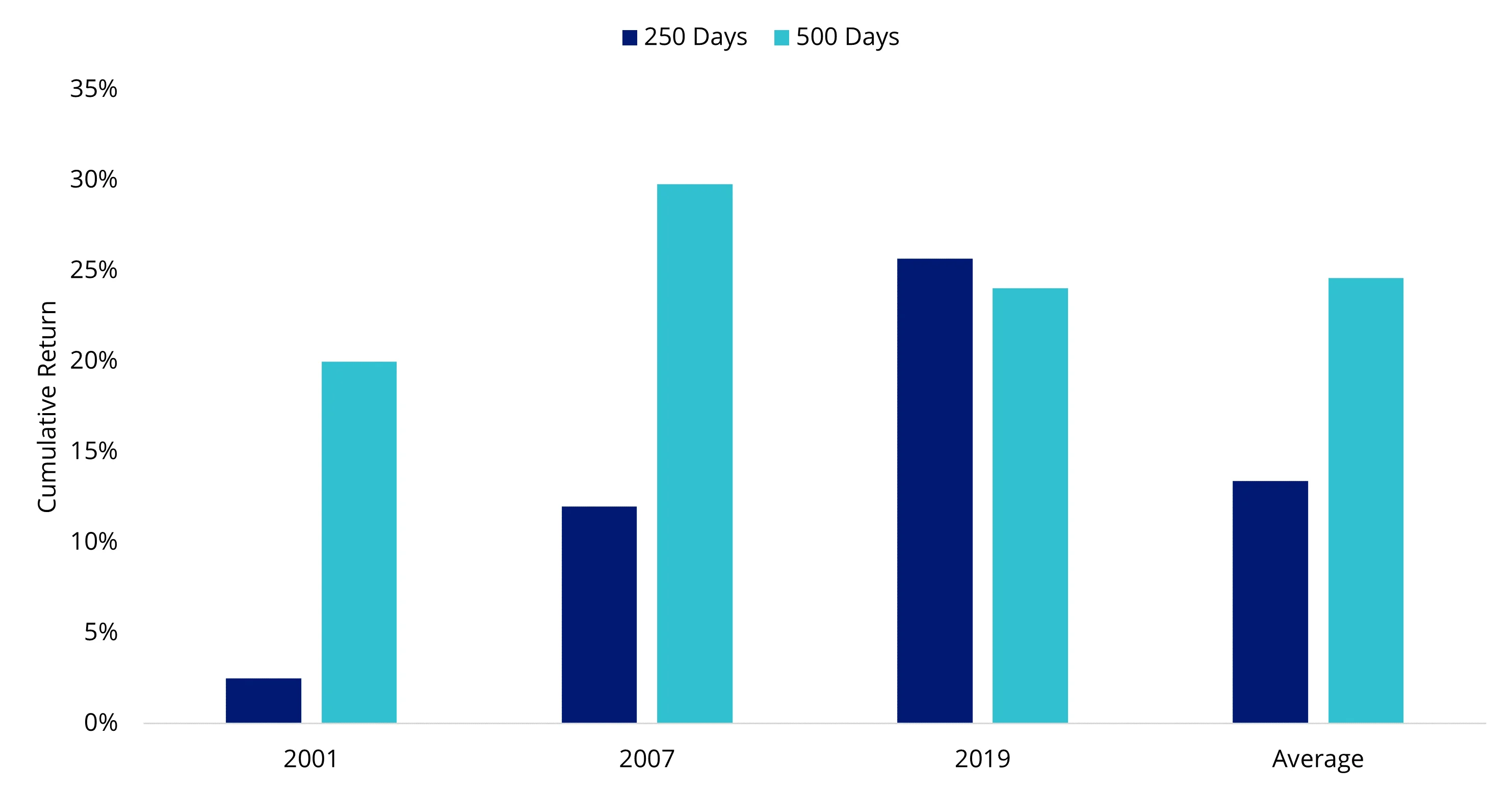

In July, the strength of gold coincided with a 1.60% decline in the Nasdaq 100 Index, reflecting a broader pullback in equity markets driven by the powerful technology stocks. Lower real interest rates have historically been positive for gold, with performance in the year or so following the start of the last three rate-cutting cycles supportive of this view.

Chart 4: Historically, gold has performed well following the Fed’s first rate cuts

Source: JPMorgan, VanEck. Data as of July 31, 2024.

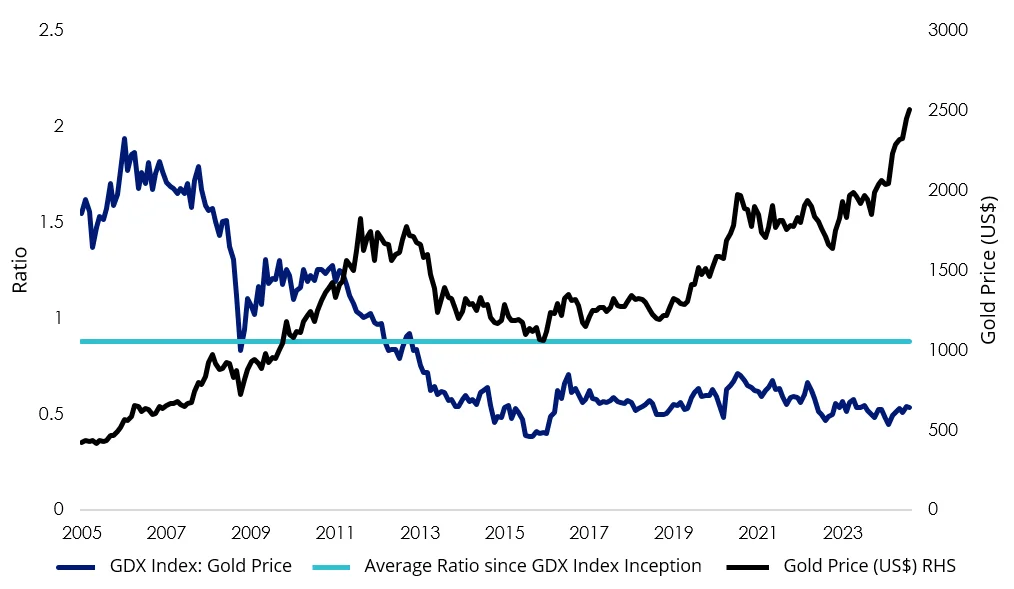

Gold mining companies are another option. Record gold prices mean elevated margins, and while gold stocks were reporting a net positive for quarterly earnings as of 31 July 2024, prices remain well below historic peaks. Many miners pay dividends, too, adding to the potential return.

Chart 5: Relative price ratio – gold miners to gold price

Source: Bloomberg, VanEck. Data as of 30 August 2024. GDX Index is the NYSE Arca Gold Miners Index.

Investment opportunities

As always, it’s important to be selective.

The health and infrastructure sectors are relatively small in Australia, therefore a global approach can provide investors with a better opportunity to benefit from the defensive characteristics inherent to these sectors.

The VanEck FTSE Global Infrastructure (Hedged) ETF) (ASX: IFRA) gives investors currency-hedged exposure to more than a hundred listed infrastructure companies around the world. The VanEck Global Healthcare Leaders ETF (ASX: HLTH) offers a diversified portfolio of 50 of the largest international companies in healthcare across sub-sectors such as pharmaceuticals, equipment and supplies, life sciences and biotechnology.

To gain exposure to gold price movements, consider the VanEck Gold Bullion ETF (ASX: NUGG), which gives investors investment in physical Australian-origin gold bullion bars and is redeemable at an Australian vault. Additionally, the VanEck Gold Miners ETF (ASX: GDX) is the largest gold miners ETF in the world.

We recommend speaking to your financial advisor or broker to determine which investments are best suited to your individual needs. Past performance is no guarantee of future performance.

Key risks

An investment in IFRA, HLTH, NUGG or GDX carries risks associated with: financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, sector concentration, political, regulatory and tax risks, currency risk, gold bullion, fund operations, liquidity and tracking an index. See the relevant PDS and TMD for more details.

Source:

1United Nations, World Social Report 2023

Published: 02 September 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

NYSE® Arca Gold Miners Index® is a trademark of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by VanEck in connection with the US Fund. Neither the Trust nor the Fund is sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding the Trust or the Fund or the ability of the NYSE Arca Gold Miners Index to track general stock market performance.

ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.