A tale as old as time: What past market crashes teach investors

Turbulence in markets is nothing new. From Tulip Mania to the GFC and COVID crash, history reveals critical lessons for investors navigating today’s market turbulence.

In the 1600s, the Dutch tulip mania saw single tulip bulbs selling for the price of a house—until the bubble burst, leaving investors in ruin.

A century later, the South Sea Bubble of 1720 promised untold riches after Chancellor of the Exchequer Robert Harley created a company that was granted a monopoly to supply African slaves to the islands of the South Seas and South America. The company was also responsible for repaying Great Britain’s national debt as the country fought wars on two fronts with France and Russia.

Over a year, shares in the South Sea Company went from ₤100 to ₤1,000, representing an 900% increase (higher than NVDIA’s 819% gain over 2023-24). It wasn’t only shares in that company, the whole market rose. But when profit-taking, instalments becoming due, fraud and rumour collided, shares went into freefall. Liquidity dried up.

Confidence in stock markets fell.

While these historical bubbles seem like distant anomalies, the truth is that market crashes are more common than we often realise.

In the 50 years before the Wall Street crash of 1929, the US stock exchange experienced no fewer than seven financial crises (the credit shortage of 1884, the 1893 economic depression, the panics of 1896, 1901, 1907, 1910-1911 and the Great War).

Throughout history, financial markets have experienced periods of significant turbulence. These can be due to:

- economic downturns,

- credit crises,

- a speculative bubble bursting, or

- an unforeseen global event (aka. Black Swans).

Historical patterns demonstrate that despite short-term turmoil, markets have shown long-term resilience. Understanding past crashes and their recoveries provides essential insights for today’s investors.

In the recent past, we have experienced each type of market crash:

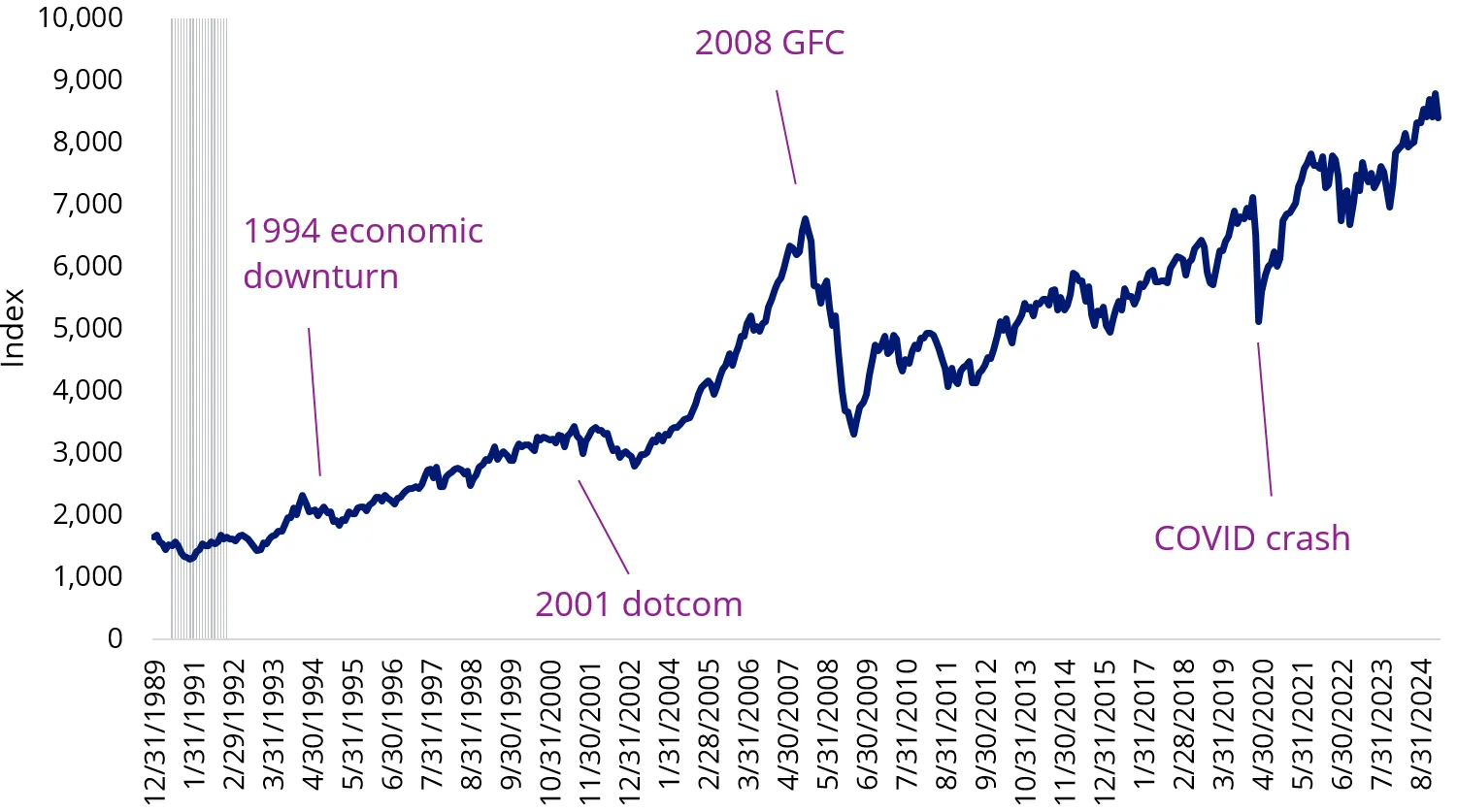

1 - Economic downturn – 1990s recession - In 1994, the Australian share market experienced a significant fall due to the ongoing effects of the early 1990s recession, which was primarily caused by the high interest rates implemented by the Reserve Bank of Australia to curb inflation, leading to a decline in economic activity and impacting company profits.

2 - Credit crises – The GFC - The 2008 crisis, driven by the collapse of US subprime mortgage-backed securities, sent markets into freefall. The US Dow Jones Industrial Average fell over 50%, but by 2013, it had fully recovered, driven by aggressive monetary policy, including near-zero interest rates and quantitative easing by the Federal Reserve, alongside corporate earnings recovery and improved investor confidence.

3 – Speculative bubble bursting – The dot-com bubble - The late 1990s saw a surge in technology stocks, leading to an overheated market that eventually burst in 2000. The US’s S&P 500 took about seven years to recover from its losses. The slower than usual recovery was partly due to Bush’s 2002-2003 Steel Tariff policy, which disrupted global trade, increased costs for steel-dependent industries, and created market uncertainty which delayed the equity market recovery. This policy combined with the lingering effects of the 2001 recession and corporate scandals like Enron and WorldCom, contributed to the prolonged US market downturn. The impact was not as severe on other markets like Australia’s.

4 - Unforeseen global event – COVID crash 2020 - The pandemic-induced crash of early 2020 was among the fastest in history, with the S&P 500 dropping over 30% in a matter of weeks. Thanks to swift government intervention, the market rebounded in just six months.

In each of these, the share market fell, but subsequently recovered, with the line trending upwards.

Chart 1: S&P All Ordinaries Price Return Index

Source: S&P, Morningstar, December 1989 to February 2025. The shaded area indicates recession.

The current environment

So far this year, the US equity market, as measured by the S&P 500 Index, and Australian equity market, the S&P/ASX 200 Index, have experienced falls. Notably, this past week, the market fell as investors anticipated the impact of President Trump’s economic agenda, including tariffs on the economy.

President Trump did not rule out the possibility of inflation rising or a recession, or what the press is already calling a “Trumpcession”. Investors have been scrambling to determine how that will impact their investments and position portfolios for the rest of 2025 and beyond.

The market will always look ahead and try to work out where the economy is headed. For example, it appears to be now anticipating the next economic downturn. Rate rises, tariffs, inflation and volatile markets naturally make investors anxious. These are potentially thorns to an investor’s returns, but it's important to consider the whole stem, including the potential rose buds.

While, the US equity market is not in ‘bear’ territory yet (nor is Australia’s), let's see what we know and how we can apply it to portfolios first by looking back at known market cycles. Below we use the US market for analyses because it has a longer history and because it always has been one of the bigger stock exchanges, it has far more data points.

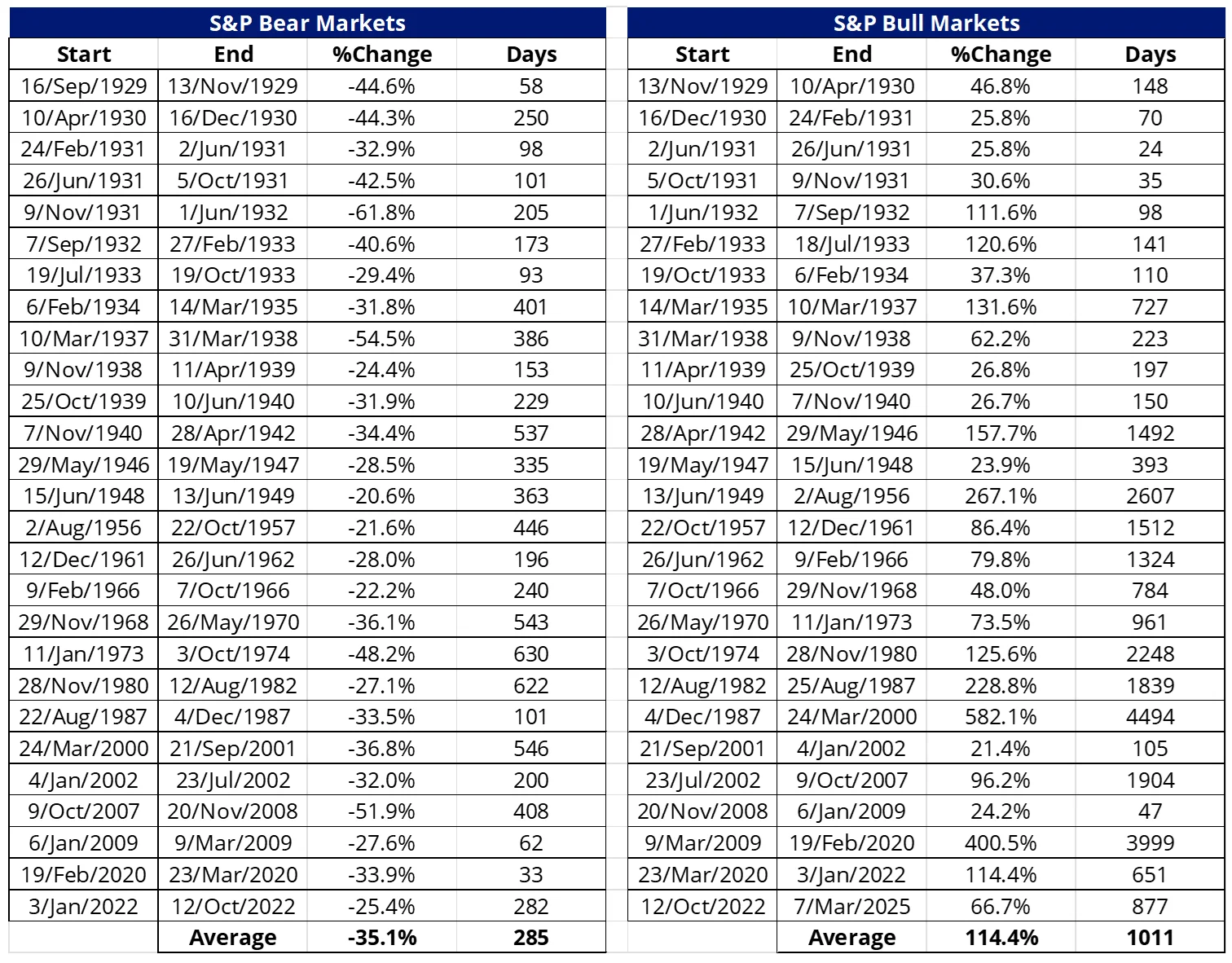

Table 1: S&P 500 bear and bull market returns

* current period, data to COB 23 July 2024.

Source: BofA US Equity & Quant Strategy, Dartmouth University Data Library, Bloomberg, S&P, Morningstar. Returns in US dollars. You cannot invest in an index. Past performance is not a reliable indicator for future performance. Bull market starts when the market increases 20% following the most recent bear market. A Bear market starts when the market decreases 20% following the most recent bull market. Bull market average does not include the current market.

The takeaways are that since 1928, overall, the US share market has been positive, so while bear markets can be painful over the long term the US share market’s return has been positive. There are two reasons for this.

- Markets are positive most of the time – Bear markets comprise only about 20% of the months since 1928. Bull markets around 80%. Therefore, roughly 80% of the time, share markets were rising and they rose by more than they fell. This leads us to reason two.

- The asymmetry of returns – You’ll note above that the average bull market return was more than 100%. It is impossible during a bear market for shares to go down by more than that much. Shares cannot fall more than 100%. Therefore, there is potential for bull markets to experience higher returns than bull market losses. Put simply, over the last century, the larger positive returns of bull markets offset the negative returns of bull markets.

Remaining invested in important.

Diversification is also a strategy for navigating different types of markets. We’ve written about this before here and here. By holding a mix of asset classes, investors potentially reduce risk and cushion their losses. Investing has evolved, so the breadth of asset classes available to investors has evolved.

ETFs are democratising markets so that investors can access these investments via ASX.

It is also possible to invest for the prevailing economic conditions. We have also written about this before here and here.

Beyond diversification, concentrating on long-term investment goals is important.

Opportunities will present themselves to savvy investors. Successful long-term investors survive short-term falls by sticking to investment principles that have withstood the tests of time. For equities, investing in profitable companies with strong balance sheets and stable earnings has historically given resilience to portfolios or seeking value in oversold companies where others have shied away, but still have plenty to offer.

While market crashes and falls are inevitable, so too are recoveries. History demonstrates that markets tend to recover over time. By employing prudent investment strategies and maintaining a disciplined approach, investors can navigate these turbulent periods and potentially emerge stronger. It’s a tale as old as time.

Published: 14 March 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.