Three asset classes that could thrive in 2025

As 2025 unfolds, markets are entering a new era, shaped by political shifts, heightened geopolitical tensions and economic uncertainty. While 2024 was a remarkable year for global equity markets, current valuations are stretched. Consequently, asset classes such as bonds, gold, and bitcoin could play a pivotal role as part of a diversified investment portfolio, and understanding how they typically behave and complement equity exposure is crucial.

The cornerstone of all asset allocation decisions – equities vs bonds

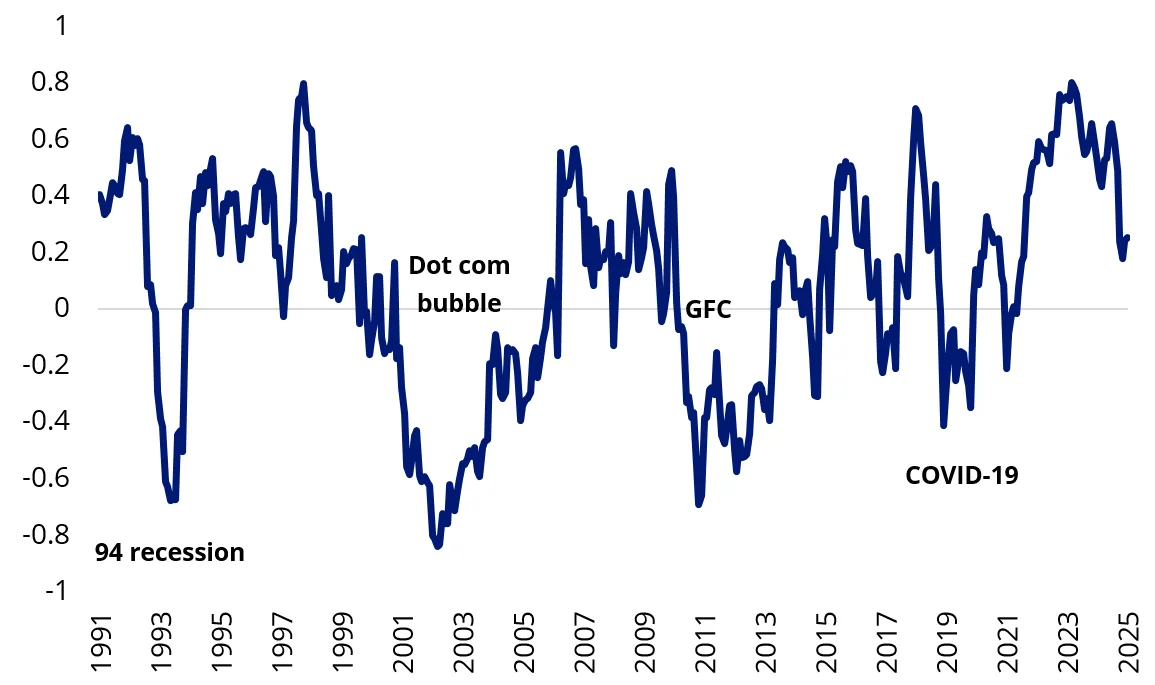

The 60 (equities) /40 (bonds) portfolio has long been the cornerstone of building a balanced investment portfolio, built on the assumption that equities and bonds move in opposite directions during systemic events. This inverse relationship was clearly demonstrated when government bonds rallied as investors sought safety while equities fell during the dot-com bubble burst, the global financial crisis, and the emergence of COVID-19.

However, this relationship broke down in 2022. Equities and bonds sold off together as aggressive rate hikes and persistent inflation hit both asset classes. This simultaneous decline was historically unusual, but the likelihood of it recurring is low. At the time, interest rates were at record lows and then surged to their highest levels in over a decade within a short period.

While equity markets have had a stellar run over the last few years, the risk of a systemic crisis lingers. Trump’s pursuit of tariffs could see us return to a scenario like the 2018-19 US-China trade war environment, where market volatility surfaced and government bonds rallied. This could see long dated bonds in a portfolio play an important role in 2025, as these typically rally the most when yields fall. The VanEck 10+ Year Australian Government Bond ETF (XGOV), the longest duration ETF in our suite of Australian government bond ETFs, allows investors to ‘play the yield curve’.

Chart 1: 1Yr equity-bond correlation – negative during systemic crises

Source: VanEck Australia, Bloomberg, as of February 2025. Equities are represented by the MSCI World. Bonds are represented by the Bloomberg Ausbond Composite Index. Performance in AUD. You cannot invest directly in an index. Past performance is not indicative of future performance. Data rebased to 100 for illustrative purposes only.

Gold’s role as a powerful portfolio diversifier

Gold has been one of best-performing asset classes in recent years, outpacing global and Australian equity benchmarks, the MSCI World and S&P/ASX 200 respectively. This strength is attributed to robust central bank net purchases aimed at diversifying reserves and heightened geopolitical tensions.

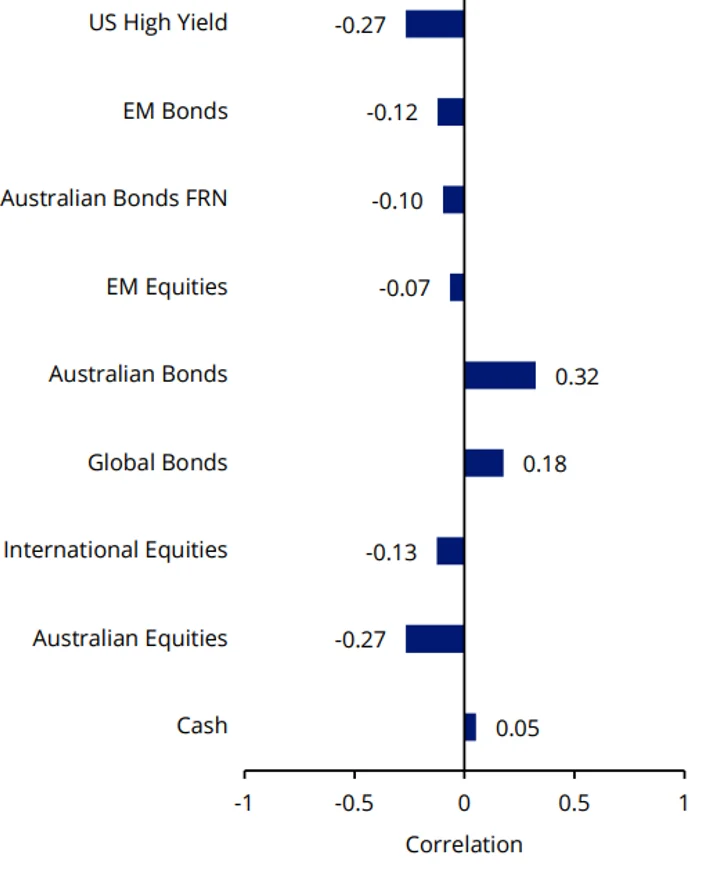

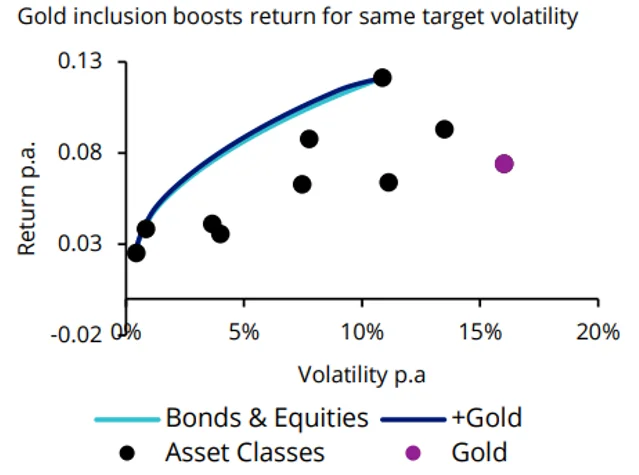

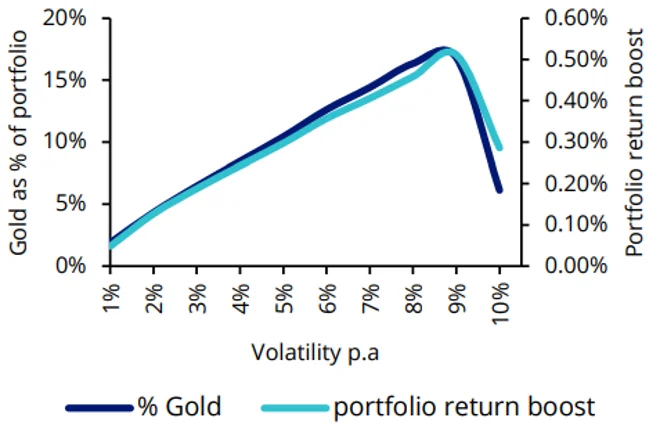

Gold’s strong performance and low correlation to traditional bond and equity investment reinforces its role as a powerful portfolio diversifier. Observing performance over the last 15 years, gold inclusion in a traditional bond and equity investment portfolio has historically enhanced returns by up to 0.5% p.a. for the same level of risk. Additionally, the optimal gold allocation as a percentage of the total investment portfolio reaches a maximum 17%, as determined by the efficient frontier model.

Looking ahead, we believe an allocation to gold is prudent to consider, particularly given the uncertainty surrounding Trump’s persistent tariff threats and the fractured geopolitical and economic landscape.

VanEck’s global leadership in gold investing stretches more than 50 years, encompassing gold equities and bullion across ETFs and active funds. Two ETFs for portfolio considerations:

VanEck Gold Bullion ETF (NUGG): invest in physical, Australian origin gold bullion bars held locally at The Perth Mint.

VanEck Gold Miners ETF (GDX): invest in a diversified portfolio of the largest gold mining companies in the world.

An allocation to gold can be a powerful portfolio diversifier

Chart 2: Correlation to gold performance

Chart 3: Efficient frontier portfolio: 15 years

Chart 4: Gold allocation by target volatility

Source for Charts 2, 3 and 4: Bloomberg, 1 January 2010 to 31 December 2024. returns in Australian dollars. International Equities is MSCI World ex Australia Index, Australian Equities is S&P/ASX 200 Accumulation Index, Gold is Gold Spot US$/oz, Global Bonds is Bloomberg Global Aggregate Bond Hedged AUD Index, Cash is Bloomberg AusBond Bank Bill Index, Australian Bonds is Bloomberg AusBond Composite 0+ yrs Index, Emerging Market Bonds is 50% J.P. Morgan Emerging Market Bond Index Global Diversified Hedged AUD and 50% J.P. Morgan Government Bond-Emerging Market Index Global Diversified, Emerging Market Equities is MSCI Emerging Markets Index, Australian FRN Bonds is Bloomberg Ausbond Credit 0+Yr FRN Index, Global High Yield is Bloomberg Global High Yield Index. You cannot invest in an index. Past performance is not indicative of future performance.

Increasing adoption of bitcoin

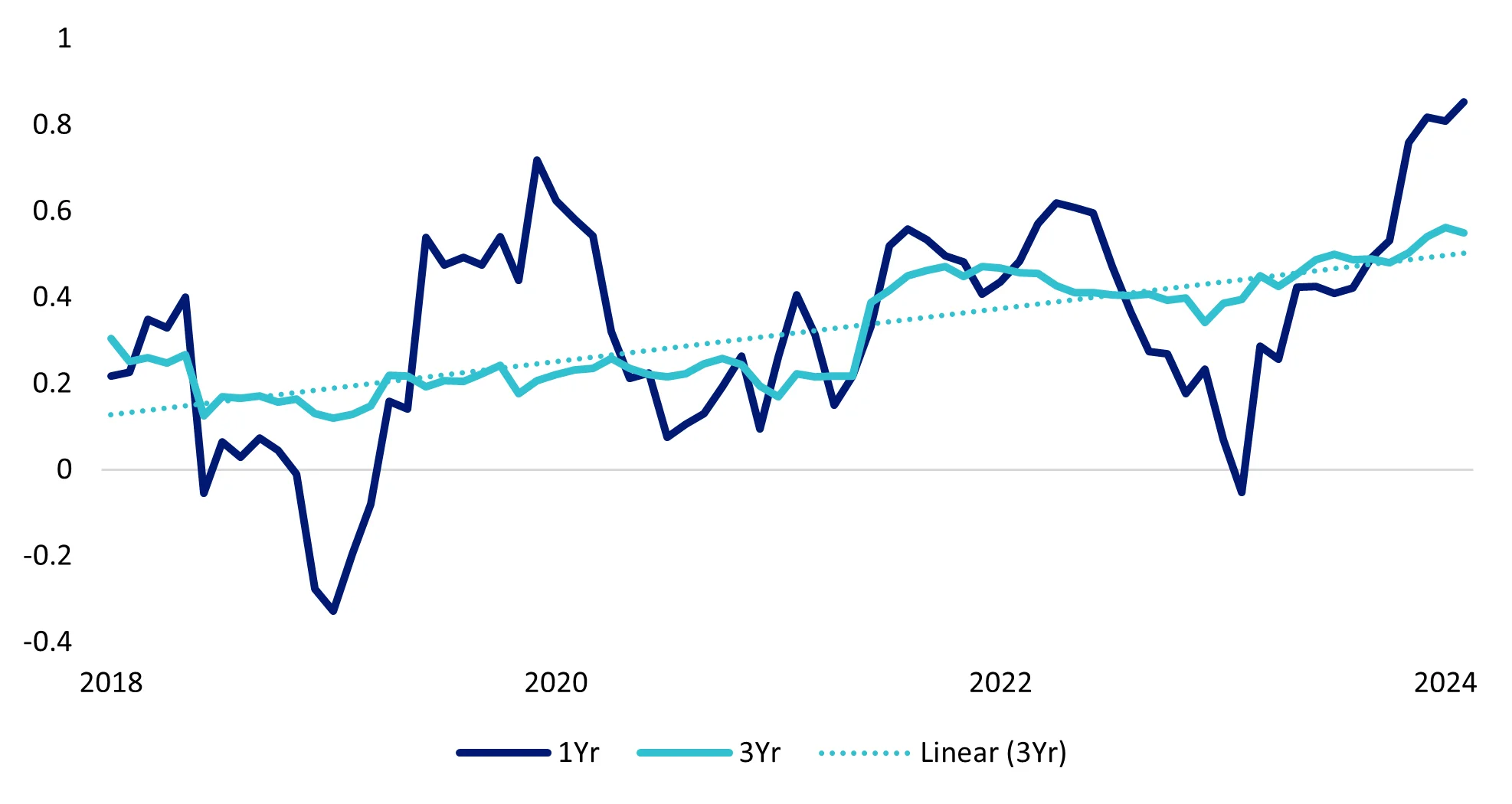

Bitcoin, introduced just 15 years ago, has seen its relationship with equities evolve significantly. Initially, it offered a low correlation with equities, underscoring its status as an emerging asset class. However, in recent years, this correlation has steadily increased, reflecting increasing global and institutional adoption. Key milestones include its acceptance as payment by major companies, status as legal tender in countries, use as a reserve asset by corporate treasuries and regulatory approval for use as an ETF.

With Trump positioning himself as a ‘crypto president’, bitcoin could play an increasingly important role as a part of a broader investment portfolio. Crypto-friendly measures include signing the first-ever cryptocurrency executive order, marking the creation of a Crypto Task Force and the prohibition of central bank digital currencies.

VanEck Bitcoin ETF (VBTC) is the largest and most cost-effective bitcoin ETF in Australia.

Chart 5: Bitcoin versus equities correlation – steadily increasing

Source: VanEck Australia, Bloomberg, as of February 2025. Equities are represented by MSCI World. Performance in AUD. You cannot invest directly in an index. Past performance is not indicative of future performance.

Key risks

An investment in XGOV carries risks associated with: interest rate movements, bond markets generally, issuer default, credit ratings, country and issuer concentration, liquidity, tracking an index and fund operations. See the VanEck 10+ Year Australian Government Bond ETF PDS and TMD for more details.

An investment in NUGG or GDX carries investment risk. These risks vary depending on the fund and may include gold pricing risk, currency risk, custody risk, Australian sourced gold bullion risk, ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDSs for details on risks.

An investment in VBTC involves extremely high risk and the potential for loss of all capital invested. Investors should actively monitor their investment as frequently as daily to ensure it continues to meet their investment objectives. Risks associated with an investment in the fund include those associated with pricing risk, regulatory risk, custody risk, immutability risk, ASX trading time risk, concentration risk, environmental risk, currency risk, operational risk, underlying fund risk and forking risk. See the VanEck Bitcoin ETF PDS and TMD for more details.

Published: 20 February 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.