Think property, think global

Australians have a love affair with property. Each year the AFR Rich List highlights that property has enabled developers and investors to make vast fortunes. Many of these have built their empires on a simple concept of diversifying beyond their backyard. Property investment should be diversified across geographies.

Many of the names in the rich list are associated with Australian real estate investment trusts (A-REITs). REITs are listed securities that own, operate or finance income-producing real estate. This can include office towers, hotels, shopping centres and warehouses. Examples of REITs include property developers, Mirvac Group and Scentre Group, which manages over 40 Westfield shopping centres, and these examples like many REITs, can be bought and sold on ASX.

Australia was one of the pioneers of listed real estate investing. General Property Trust was the first Australian Listed Property Trust (LPT) in 1971. LPTs were subsequently renamed REITs in line with international practice.

REITs enable investors to buy into the property sector without having to invest or lock up the huge sums of money involved in buying property directly. However, the opportunities to invest in REITs in Australia are limited. The US, Europe and Asia offer investment opportunities not readily available in Australia, including student housing developments and storage including data warehouses.

Most Australian portfolios do not have exposure to international property so we thought it would be worthwhile to run through the differences between the listed Australian property market and the listed international property market.

The listed property markets

APRA’s website includes a list of investment indices that the regulator uses to assess superannuation product performance. For our analysis, we will use these indices as being representative of the REIT markets we are assessing:

Australian listed property: S&P/ASX 300 A‑REIT Index (A-REIT Index)

International listed property: FTSE EPRA Nareit Developed ex Aus Rental Index (FTSE REIT Index)

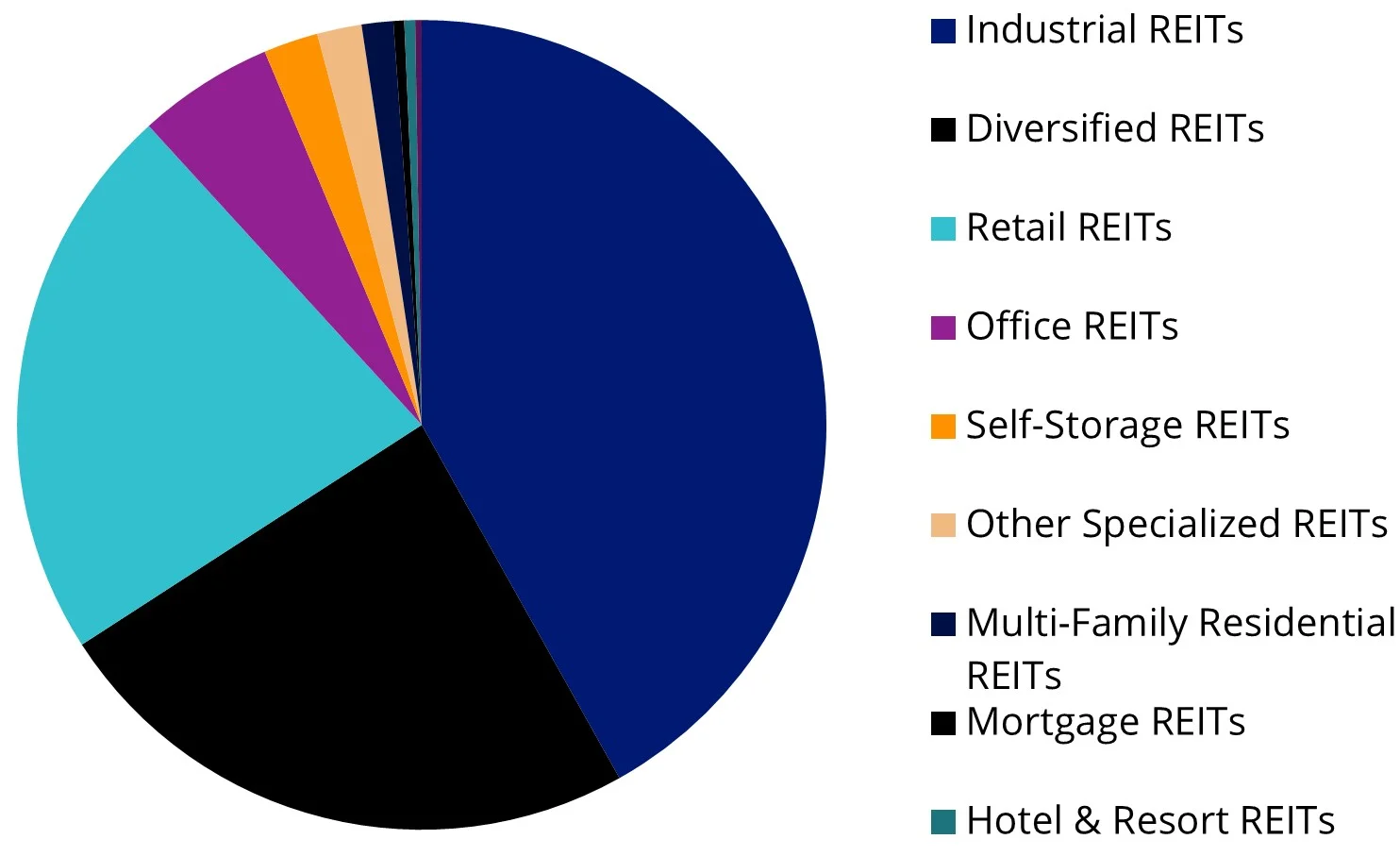

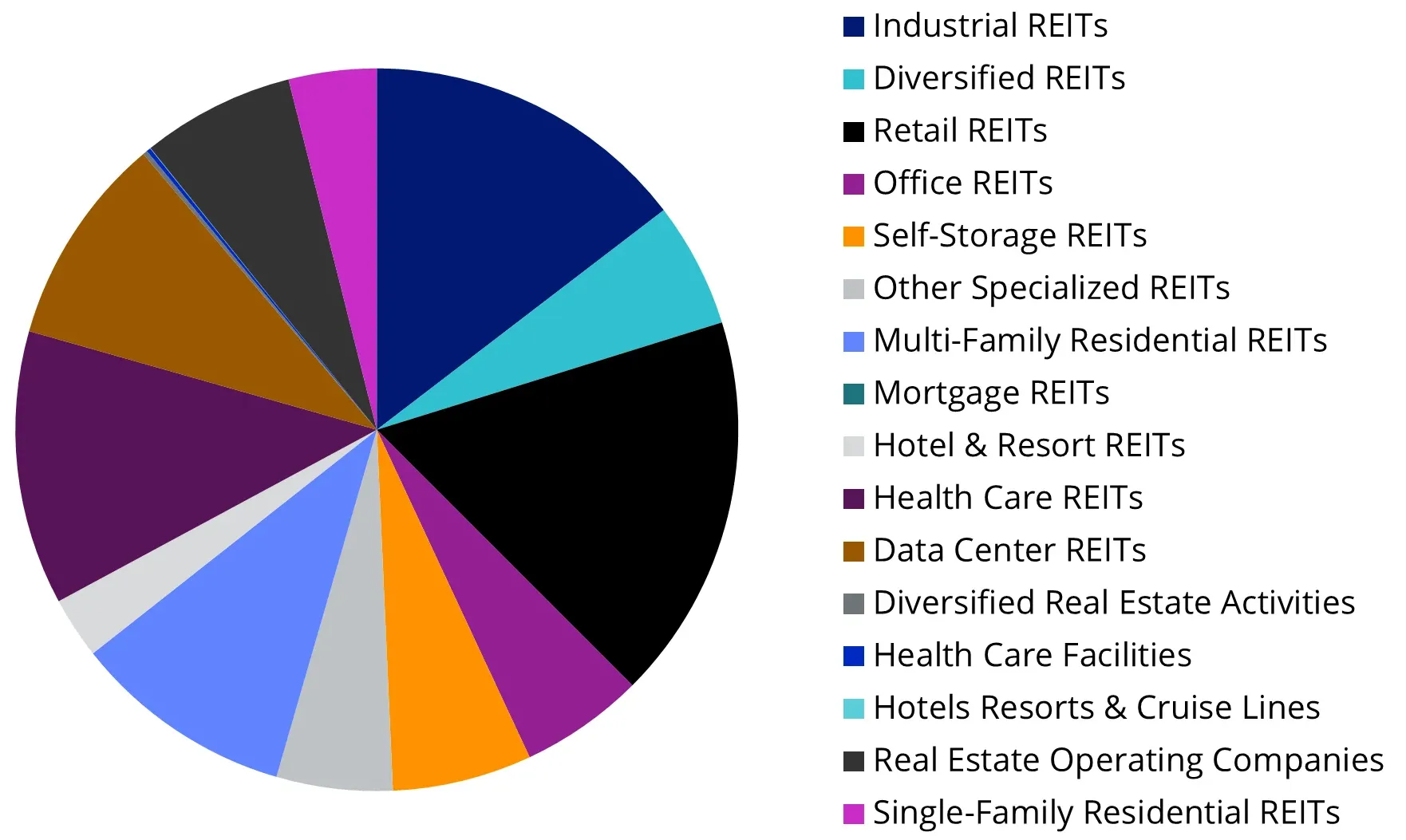

Sectors

You can see in charts 1 and 2 below that the international, FTSE REIT Index has more sectors. Its pie is also more evenly distributed among sectors than the A-REIT Index, which is dominated by one sector representing 41.87% of the index. Three sectors of the A-REIT index represent 88.21%. By comparison, the largest three sectors in the FTSE REIT Index represent close to half of that (44.17%). Therefore, not only does the FTSE REIT index include more sectors, but it is not as concentrated, from a sector perspective, as the A-REIT Index.

Chart 1: Sector breakdown A-REIT Index

Source: FactSet, 31 January 2025. A-REIT Index is S&P/ASX 300 A‑REIT Index

Chart 2: Sector breakdown FTSE REIT Index

Source: FactSet, 31 January 2025. FTSE REIT Index is FTSE EPRA Nareit Developed ex Aus Rental Index.

Geographies

Australian investors understand the benefits of investing internationally including diversification across more markets. Australia represents only 3% of the listed REIT market. Investing internationally can give Australian investors access to economies that may be at a different stage of the economic cycle than we are. It also gives you access to bigger REITs, like Prologis, which is roughly the same size as all the companies in the A-REIT Index combined.

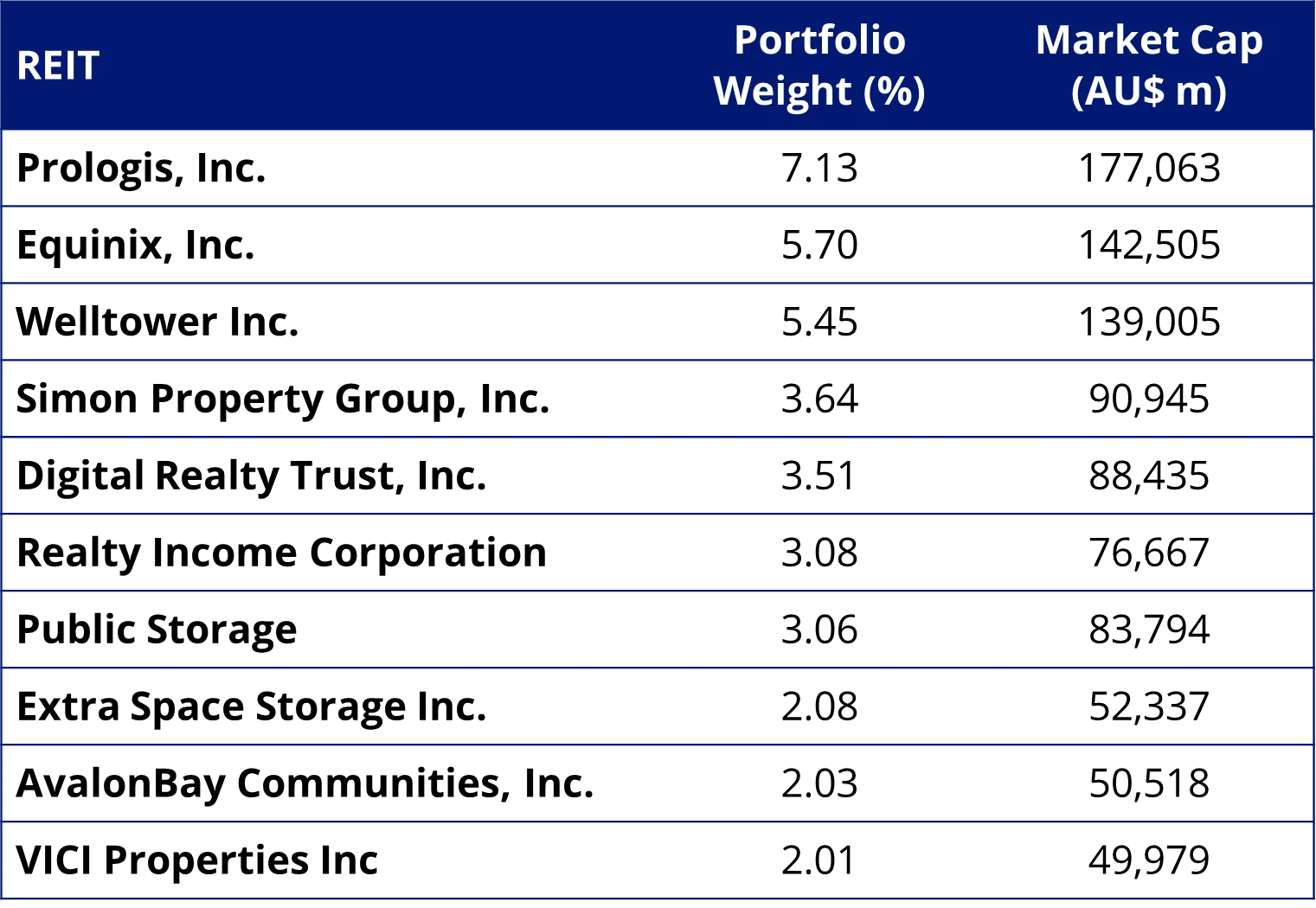

Companies

Tables 1 and 2 show the top 10 REITs in the Australian and international REIT indices. The tables also include each company’s size (measured by market capitalisation).

Table 1: A-REIT Index, Top 10 & Market Capitalisation

Source: FactSet, 31 January 2025. A-REIT Index is S&P/ASX 300 A‑REIT Index, Not a recommendation to act.

Table 2: FTSE REIT Index, Top 10 & Market Capitalisation

Source: FactSet, 31 January 2025. FTSE REIT Index is FTSE EPRA Nareit Developed ex Aus Rental Index. Not a recommendation to act.

You can see that the REITs in the international FTSE REIT Index are bigger than those in the A-REIT Index, with one exception, Goodman Group. Goodman Group makes up a whopping 40.62% of the A-REIT Index. In other words, if you were investing a fund for diversification and that fund tracked the A-REIT index, two out of every five dollars invested would be buying one company. That is not diversified. The A-REIT index is dominated by one company. The top 10 represent 85.89% of the index.

On the other hand, the top 10 of the FTSE REIT index represent 37.69% of the index. From a company perspective, the international index is better diversified.

Other considerations

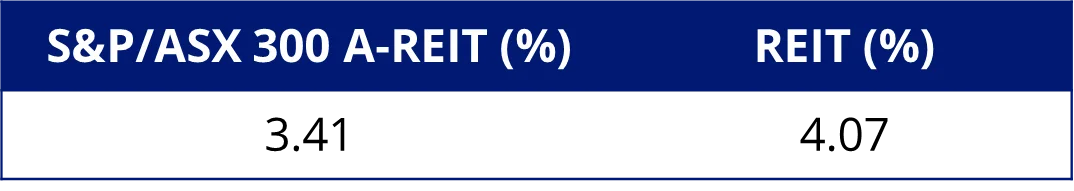

One of the reasons investors like REITs are the income they pay. REITs generate income by leasing space and collecting rent on their real estate, which is distributed to investors as dividends. Right now, the REIT index has a higher dividend yield than the A-REIT Index.

Table 3: 12-month Dividend Yield

Source: FactSet, 31 January 2025. A-REIT Index is S&P/ASX 300 A‑REIT Index, FTSE REIT Index is FTSE EPRA Nareit Developed ex Aus Rental Index. The index’s 12-month dividend yield is not a guarantee of future dividends payable from REIT.

Investing in REITs

We expect Australian investors will continue to have an affinity with property investing, including A-REITs. ETFs provide easy access to a diversified portfolio of either Australian or international REITs.

VanEck’s FTSE International Property (AUD Hedged) ETF (ASX: REIT) tracks the FTSE REIT Index.

In terms of A-REITs, VanEck’s Australian Property ETF (ASX: MVA) tracks an index that limits holdings to a maximum of 10% at each rebalance to ensure that no single stock or sector dominates the index.

It is important that your REIT exposure is not concentrated to one or two names or sectors, and you should assess all the risks and consider your investment objectives.

You can find out more about investing in listed property here.

Key risks

An investment in REIT carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, currency hedging, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the REIT PDS and TMD for more details.

An investment in MVA carries risks associated with: financial markets generally, individual company management, industry sectors, stock and sector concentration, fund operations and tracking an index. See the MVA PDS and TMD for more details.

Published: 20 February 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

REIT is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited or the London Stock Exchange Group companies (‘LSEG’) (together the ‘Licensor Parties’) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged (‘Index’) upon which the Fund is based, (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Index to VanEck or to its clients. The Index is calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Index or (b) under any obligation to advise any person of any error therein. All rights in the Index vest in FTSE. “FTSE®” is a trademark of LSEG and is used by FTSE and VanEck under license.

MVIS Australia A-REITs Index (‘MVIS Index’) is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany (‘MVIS’). MVIS is a related entity of VanEck. MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVIS Index. Solactive uses its best efforts to ensure that the MVIS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVIS Index to third parties.