Four small-cap stocks taking the ASX and NYSE by storm

Small companies are considered to have greater scope for outperformance compared to mid-sized and large companies. The global easing cycle signals a shift in central banks’ focus from managing inflation to stimulating economic growth. This has historically benefited small caps, which tend to be more sensitive to the macro environment, underperforming during downturns but outperforming during expansions.

However, it’s crucial to be selective within this asset class. Investing in high-quality companies have shown to outperform across both local and global markets over the long term. Many small caps are in their infancy, characterised by variable sales growth, weak balance sheets and high leverage, making them undesirable.

Here are four themes uncovered by investing in high quality global and local small cap portfolio companies that denominate in their respective industries that continue to offer a compelling value proposition.

Theme 1: Invest strategically to displace competitors

HUB24 (ASX: HUB)

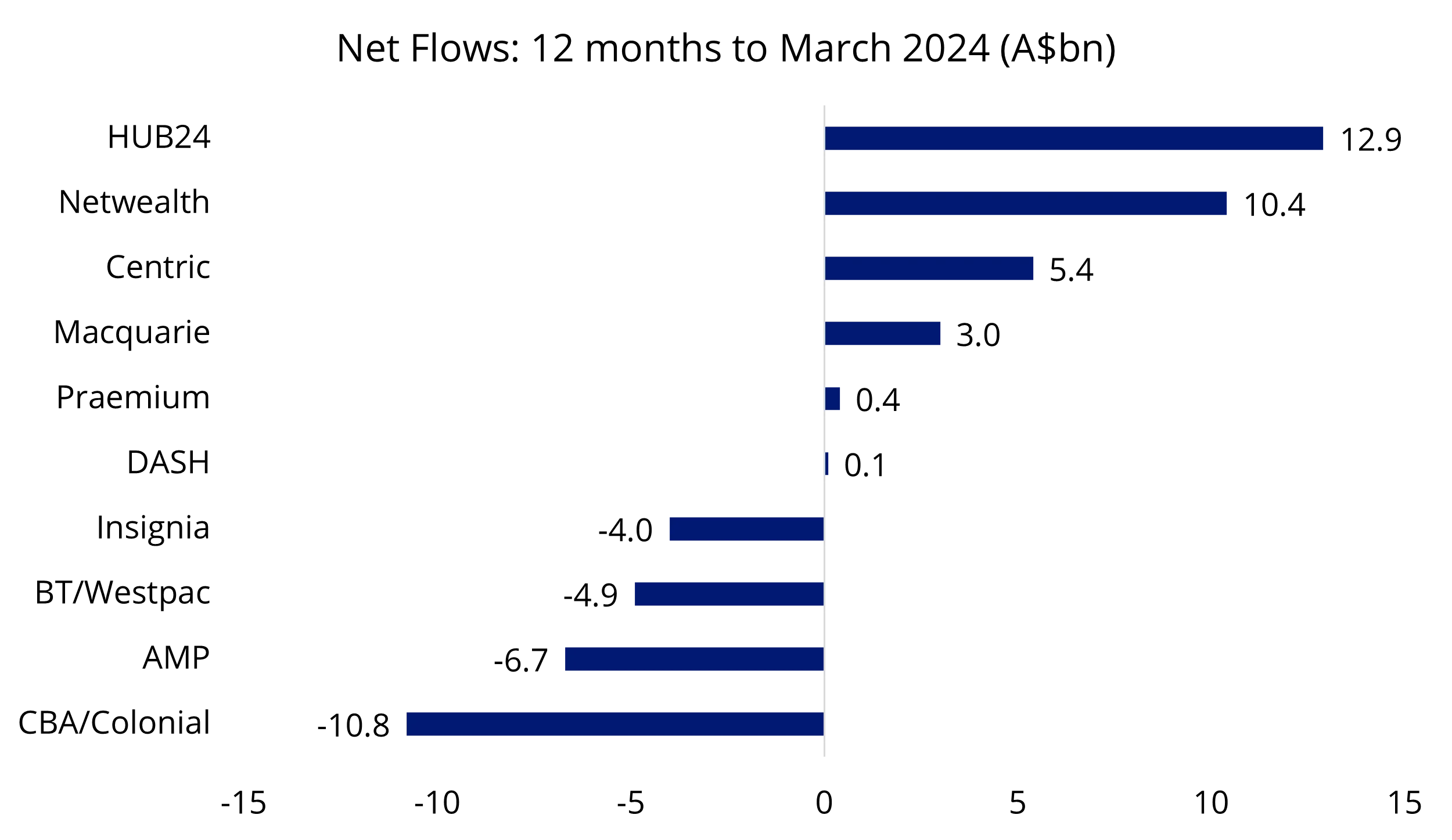

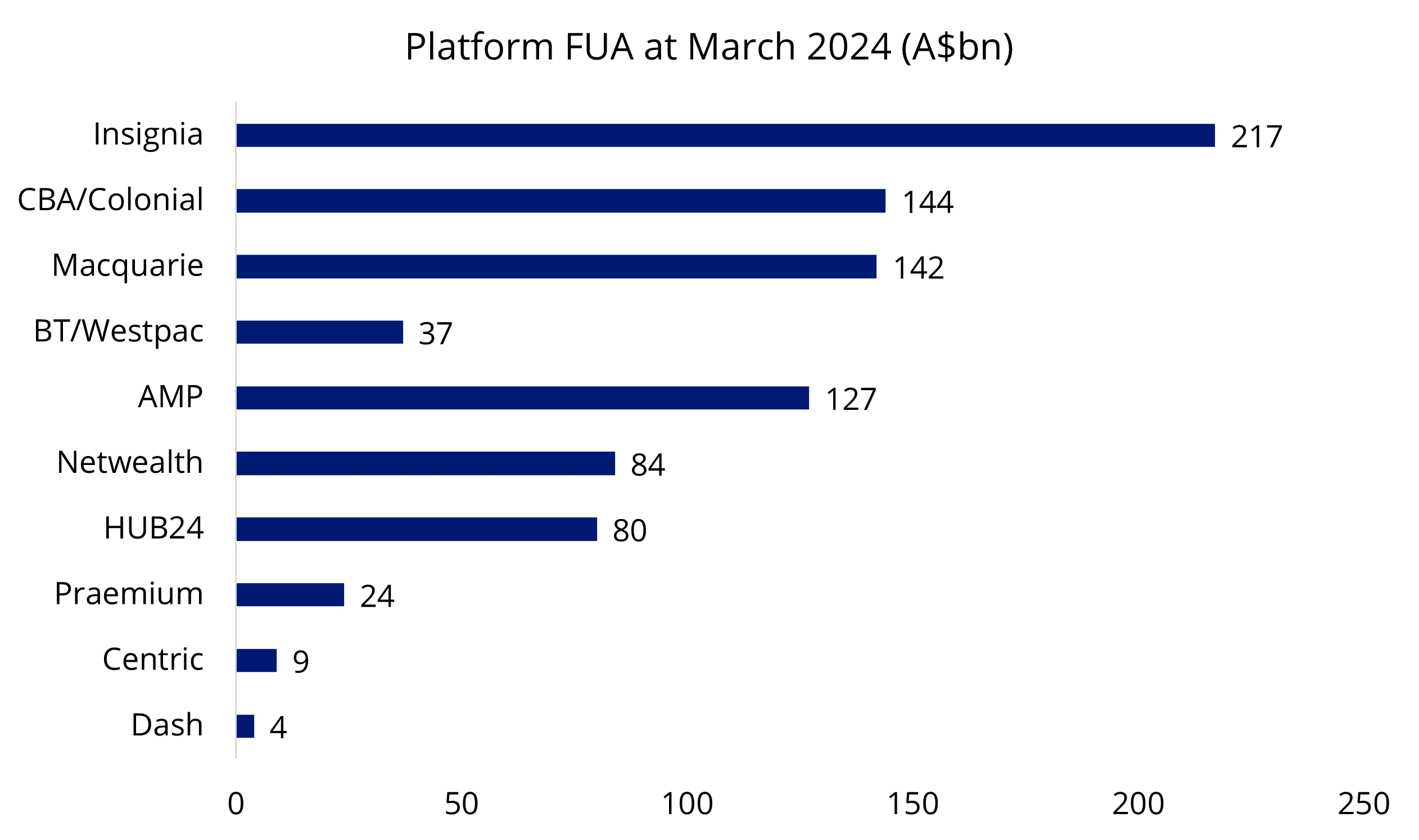

HUB24 is revolutionising financial management in Australia, consistently growing over the past decade by providing unmatched efficiencies for clients and advisers. It has disrupted incumbent platforms, capturing the largest share of inflows, and still has vast growth potential as the seventh largest platform by funds. With revenues soaring from $252 million in 2024 to a projected $375 million in 2026, and a 20% EPS growth forecast, HUB24’s share price is set to continue its impressive rise. This is a textbook growth story returning almost 40% p.a over 5 years, with no signs of slowing down.

HUB24 has an impressive track record and long runway for growth

Chart 1: HUB has delivered industry leading net inflows over the last 12 months

Chart 2: With a long runway for growth for ongoing share gains

Chart 3: HUB24’s 5-year total return performance

Source: Bloomberg as at 15 October 2024. Past performance is not indicative of future performance. Not a recommendation to act.

Theme 2: Master your craft and expand global reach

New York Times (NYSE: NYT)

The New York Times, traditionally serving the US market, continues to expand its global reach through strategic investments in diverse news content across various mediums. In Q2 2024, the company added 300,000 subscribers, bringing the total to 10.8 million, with 10.2 million being digital subscribers. This growth has driven a 13.6% increase in earnings over the past year.

With a goal of reaching 15 million subscribers by 2027, the company needs only a 10% annual growth rate to achieve this target. The New York Times’ diverse product mix—including news, games, recipes, Wirecutter reviews, and The Athletic—provides multiple growth opportunities. Notably, half of its subscribers use more than one product.

With a robust digital business model and strong fundamentals, the company is well-positioned for double-digit growth in operating profit and increased shareholder returns in the coming year.

Chart 4: New York Times 5-year performance

Source: Bloomberg as at 15 October 2024. Past performance is not indicative of future performance. Not a recommendation to act.

Theme 3: Fast mover advantage

Lovisa (ASX: LOV)

Lovisa, a jewellery retailer, has excelled in swiftly adopting new fashion trends and translating them into affordable, ready-to-wear pieces. Since entering the global market less than five years ago, Lovisa has achieved an impressive expansion, now operating in 39 countries with over 800 stores. Despite this rapid growth, the company has maintained robust earnings, with an average annual growth rate of 20% over the past five years and a consistent gross profit margin of around 80%. The founder-led leadership team, with Chair Brett Blundy holding 40% of Lovisa shares, has provided strong management stability.

Chart 5: Lovisa 5-year performance

Source: Bloomberg as at 15 October 2024. Past performance is not indicative of future performance. Not a recommendation to act.

Theme 4: Economic moats found in small caps

ITT Inc (NYSE: ITT)

ITT exemplifies how ‘economic moat’ companies with strong pricing power can thrive within the small-cap universe. As a diversified manufacturer, ITT produces highly engineered critical components and customised technology solutions for the transportation, industrial, and energy markets under the umbrella of several portfolio companies. These components are essential to the operation of systems and manufacturing processes in these key sectors, underscoring the high barriers to entry for competitors due to the specialised nature of the markets it serves.

One notable portfolio company is Koni, which plays a crucial role in the automobile industry by manufacturing suspension parts for cars and motorsports. This specialisation highlights ITT's strategic positioning within niche markets.

Over the past 12 months, ITT has demonstrated impressive financial performance, delivering 12% earnings growth and achieving a 53% return.

Chart 6: ITT Inc 5-year performance

Source: Bloomberg as at 15 October 2024. Past performance is not indicative of future performance. Not a recommendation to act.

Access to quality small caps

VanEck’s Australian (MVS) and international (QSML) Small Cap ETFs are smart beta strategies that passively track indices which select companies with top fundamentals. While the approach might initially appear simplistic, it serves as the crucial first step for many active managers in refining their investment universe, a process that is strongly supported by academic research. However, the true power of this approach lies in the outcome. This investment strategy uncovers a portfolio of high-quality companies that are industry leaders, possess solid balance sheets, and have delivered impressive performance – all at a fraction of the management fees charged by active managers. The funds performance speaks for itself. MVS and QSML returned 19.87%* and 22.65% returns after fees over 1 year to 30 September 2024, outperforming their respective benchmarks by more than 7%. Since its inception in March 2021, QSML has consistently delivered top quartile performance relative to the active peer group according to Morningstar. Impressively, it has also surpassed $550 million in net flows over the past 12 months alone. Past performance is by no means indicative of future results. See the fund website for full details and performance history - QSML can be found here and MVS here.

The VanEck MSCI International Small Companies Quality ETF (QSML) selects the top 150 highest quality companies from a vast universe of approximately 4,000 stocks. This selection is based on screening for three fundamentals: high return on equity, low earnings variability, and low financial leverage.

The VanEck Small Companies Masters ETF (MVS) employs a Growth at a Reasonable Price (GARP) strategy that filters out the most expensive stocks, based on an assessment of 24 fundamentals. This rigorous screening results in a portfolio of 60 companies from an investment universe of 200, effectively eliminating ‘junk’ companies.

*index performance after fees. MVS changed the reference index in September 2024.

Key risks

An investment in these ETFs carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS and TMD for more details.

Published: 22 October 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.