New research supports quality investing for global equities

At VanEck, we have offered investors opportunities to diversify offshore since 1956. Our approach is synonymous with investing greats Benjamin Graham and his student Warren Buffett’s investment philosophies. Deeply embedded in Benjamin Graham’s value investing philosophy is the concept of ‘quality’. In what is considered one of the world’s best investing almanacs, “The Intelligent Investor”, Benjamin Graham outlines some of the fundamental measures he looks for in a company. There are seven in total, but ones that investors should not ignore include a sufficiently strong financial condition, earnings stability and earnings growth.

Such companies show resilience by falling less in a downturn and recovering to previous highs quicker than other companies. Since 1949, the characteristics of ‘quality’ have been debated among investors and academia.

A new research paper summarises how MSCI’s findings on the result of equally considering three key quality characteristics::

- ROE;

- Earnings variability; and

- Debt to equity ratio.

These criteria could be used to create a ‘quality’ index, which could then be tracked by an ETF. As a factor, they identified quality has the best risk-adjusted returns above MSCI’s global equity benchmark.

According to MSCI, “Quality growth companies tend to have high ROE, stable earnings that are uncorrelated with the broad business cycle, and strong balance sheets with low financial leverage.”

MSCI’s description matches the characteristics Graham insists investors should demand from companies.

As we highlighted when QUAL had its 10thanniversary on ASX, it has outperformed the international benchmark, the MSCI World ex Australia Index (International Equity Index).

The new research paper analysed why quality is an enduring factor. The quality factor has historically experienced smaller declines during market downturns and recovered more swiftly to previous highs when considered against other investing approaches.

According to the paper, which compared the returns of six different factor approaches over the past 25 years, an allocation to the quality factor could serve investors over the long term. Around this position, other factors and sector positions could be taken depending on the expectations and risk tolerance of the investor.

We think the results of this analysis highlight the prudence of including a quality allocation to international equities - download the new research here

We thought it would also be worthwhile to share an update of the key differences between the MSCI World ex Australia Quality Index (QUAL Index) and the International Equity Index.

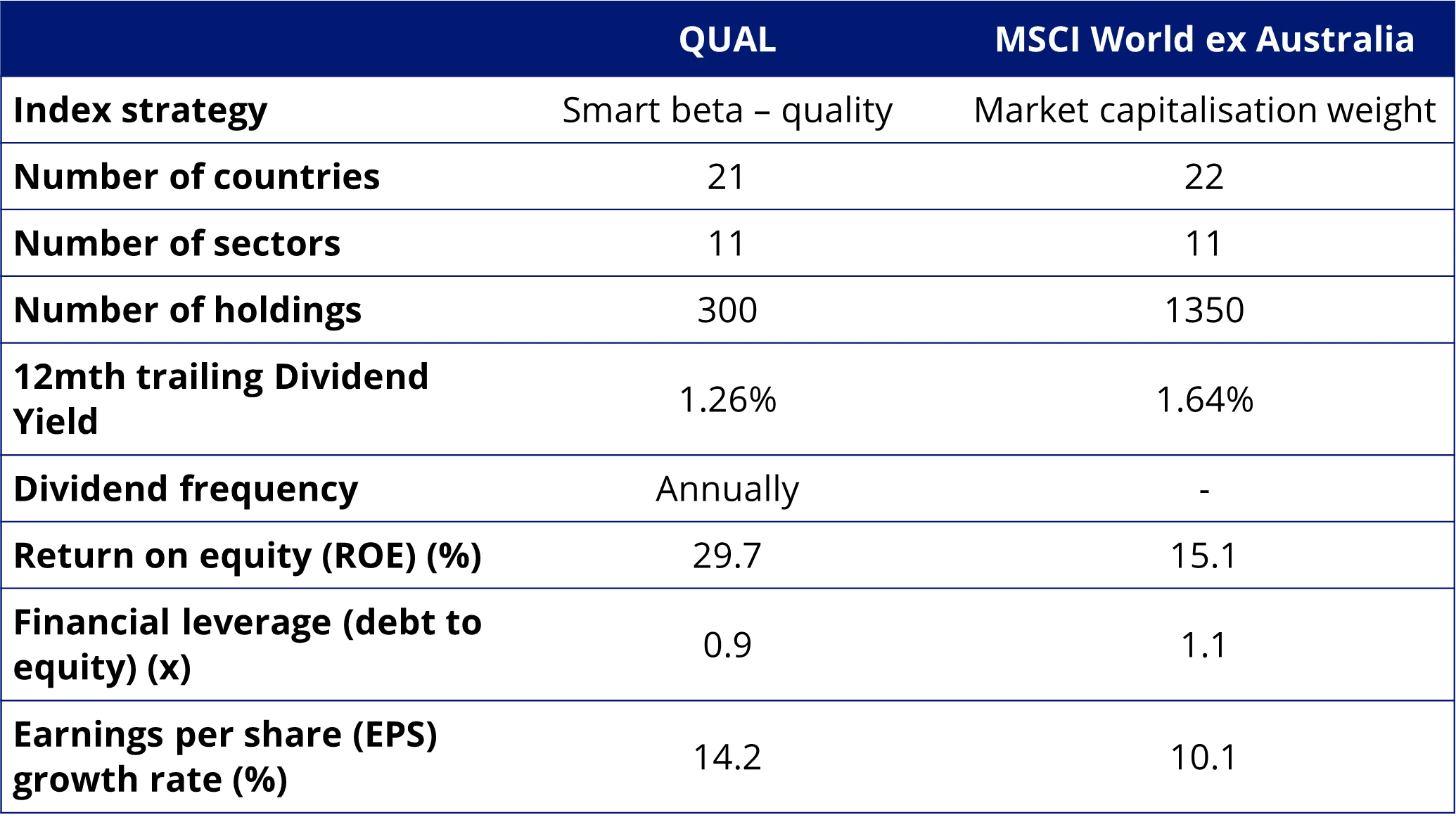

Difference #1: Fundamentals

QUAL targets companies with higher profitability, lower leverage, and stronger earnings growth compared to the broader market and the numbers prove it. As designed, QUAL has a higher ROE, lower debt to equity and a higher EPS growth rate.

Table 1: Statistics and fundamentals: QUAL vs International Equity Index

Source: VanEck, MSCI, FactSet, as at 28 February 2025. You cannot invest directly in an index. Past dividend yields do not reflect future dividend yields.

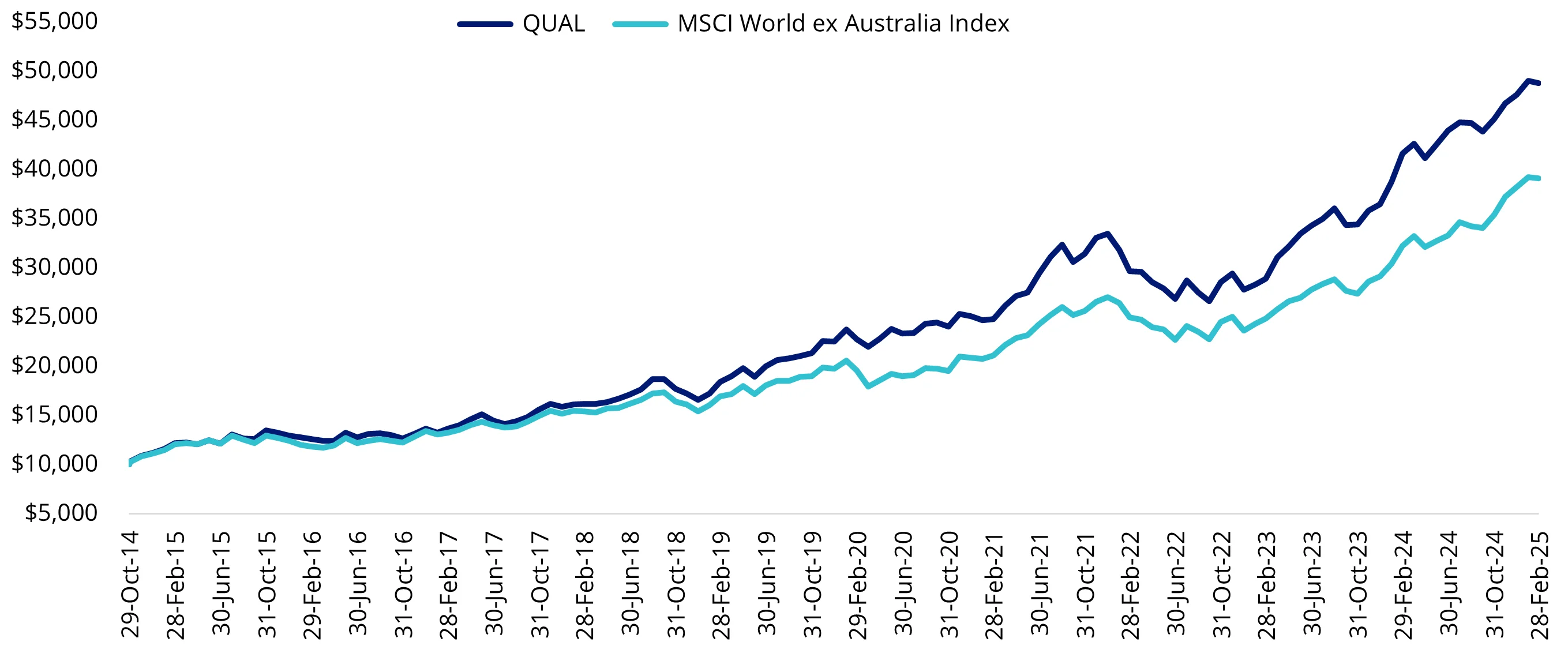

Difference #2: Performance

Quality international investing has served Australian investors well.

Chart 1: Hypothetical growth of $10,000, QUAL vs International Equity Index, since QUAL inception date to 28 February 2025

Table 2: Trailing performance to 28 February 2025

*Inception date is 29 October 2014

Chart 1 and Table 2 source: Morningstar Direct. The chart and table above show the past performance of QUAL and of the MSCI World ex Australia Index. You cannot invest directly in an index. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. QUAL results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of future performance. The MSCI World ex Australia Index (“MSCI World ex Aus”) is shown for comparison purposes, as it is the widely recognised benchmark used to measure the performance of developed market large- and mid-cap companies, weighted by market capitalisation. QUAL’s index measures the performance of 300 companies selected from MSCI World ex Aus based on MSCI quality scores, weighted by market cap x quality score at rebalance. Consequently, QUAL’s index has fewer companies and different country and industry allocations than MSCI World ex Aus. Click here for more details.

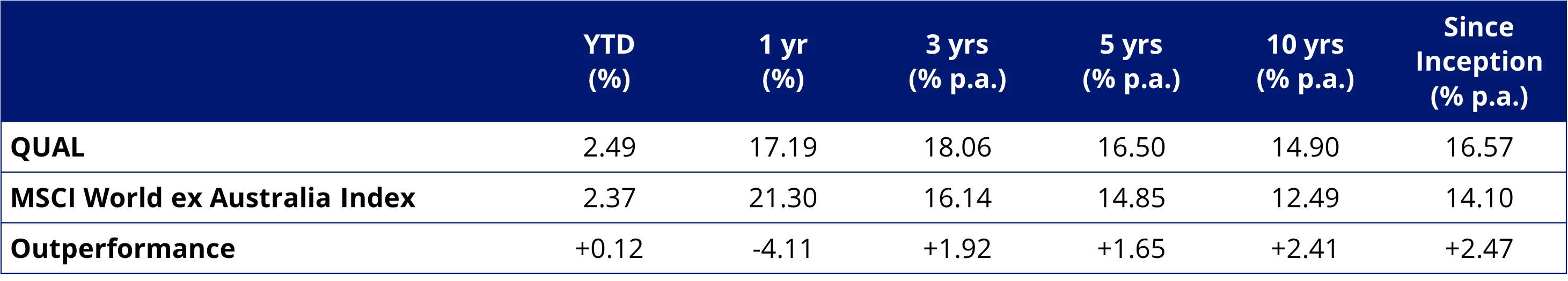

Difference #3: Top holdings

Below you can see the top 10 companies of QUAL and of the International Equity Index. In each, the top 10 holdings are household-name companies that investors tend to be familiar with. However QUAL excludes some of the companies that are included in the top 10 of the International Equity Index such as JP Morgan Chase and Tesla. To see all holdings in QUAL and their weightings, click here.

Table 3 & 4: Top 10 holdings of QUAL and MSCI World ex Australia Index

Source: FactSet, VanEck, MSCI, as at 28 February 2025. Not a recommendation to act.

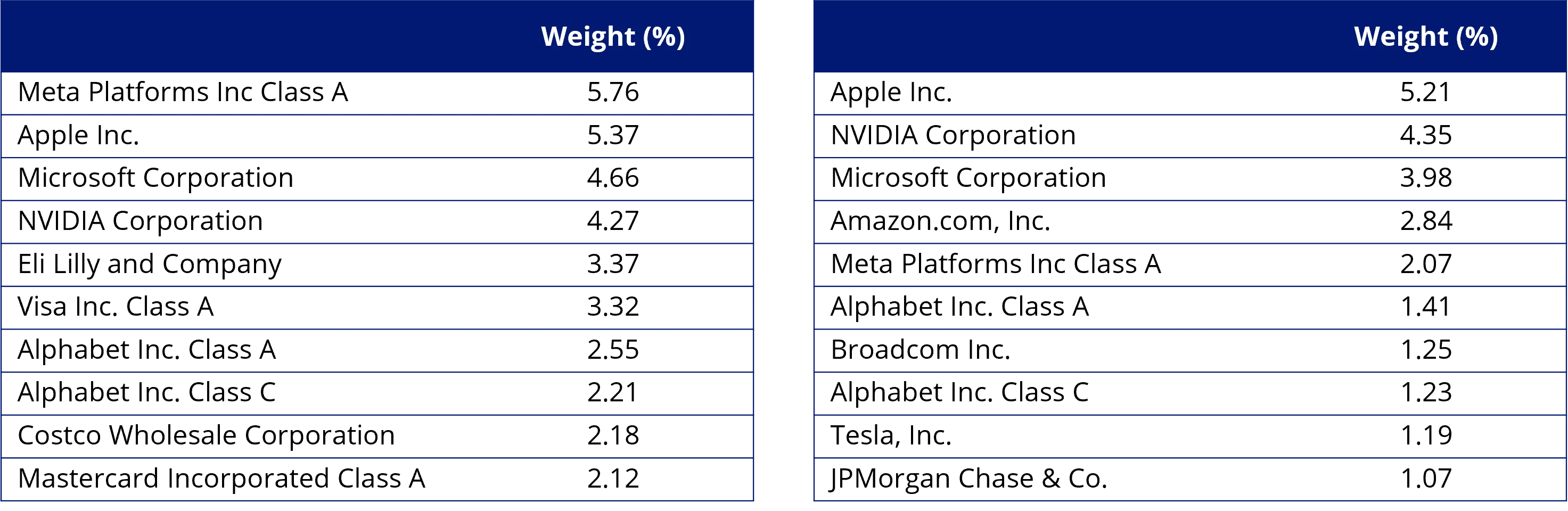

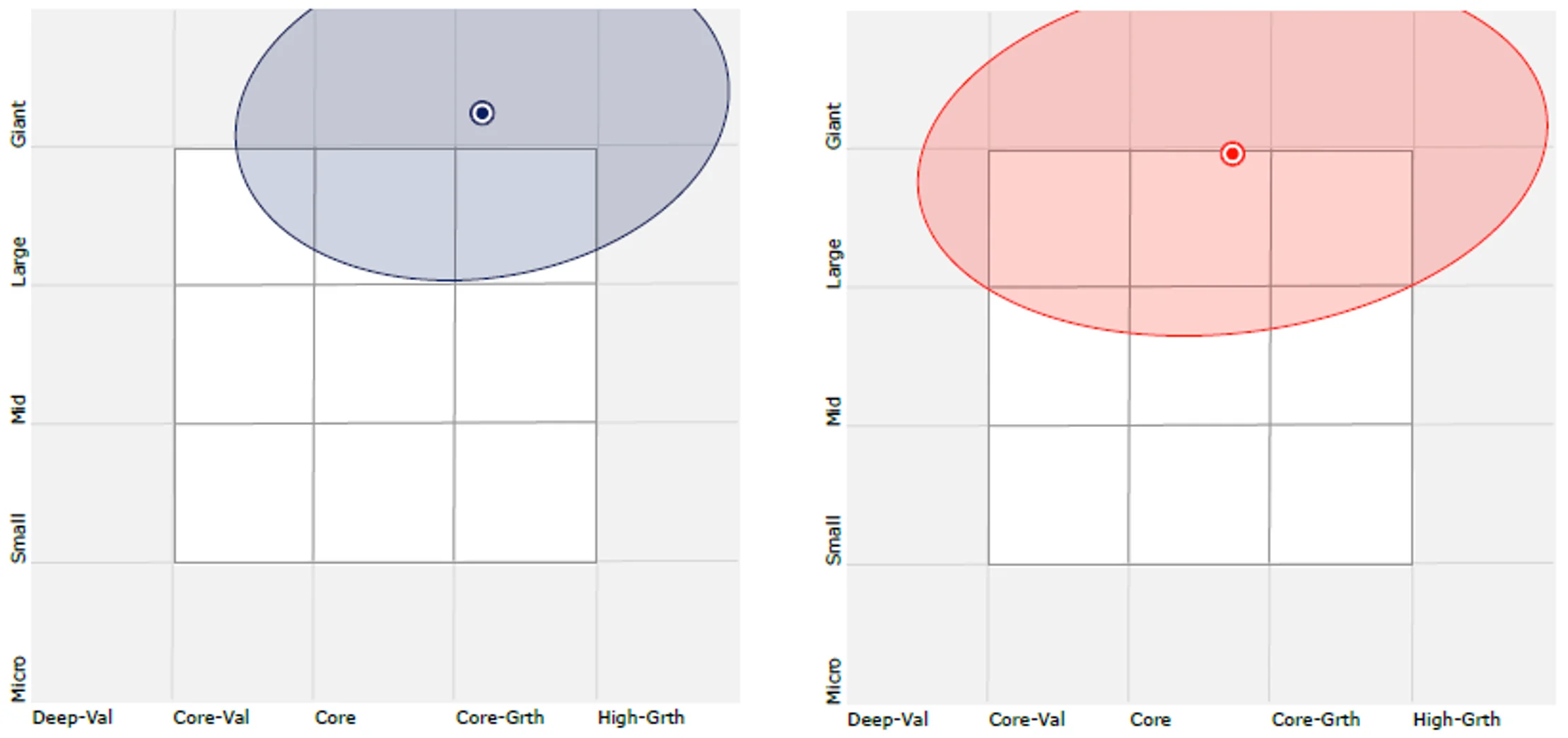

Difference #4: Style and size

When evaluating a portfolio, it is important to consider both investment style (value or growth) and what size bias a portfolio holds (giant, large, mid or small-cap companies). Below we can see this information for QUAL. Importantly QUAL holds giant companies with more of a core-growth orientation relative to the International Equity Index.

Chart 2 & 3: QUAL holdings and MSCI World ex Australia Index holdings based style map

Source: Morningstar Direct, as at 28 February 2025

You can read the new research we’ve talked about and past research - here.

While each International Equity ETF has its merit for portfolio inclusion, you should assess all the risks and consider your investment objectives.

Hedged versions of both of the exposures noted exist too.

Past performance is no guarantee of future performance. The above is not a recommendation. Please speak to your financial adviser or stock broker.

For further information you can contact us at +61 2 8038 3300.

Key risks

An investment QUAL carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

Published: 06 March 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

QUAL is indexed to a MSCI index. QUAL is not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to QUAL or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QUAL.