Clean energy Trump Slump beckons opportunistic investors

Clean energy stocks are down following the US presidential election. Given long-term structural tailwinds, this could be an attractive entry point for investors.

The day after Donald Trump’s election victory, global clean energy stocks fell 6.82%, as represented by the S&P Global Clean Energy Select Index, driven by companies in and outside of the US. US solar experienced the largest hit, falling 12.7%, as represented by the UBS Solar Energy Basket Index. This loss extended in the following days: from 5-18 November, global clean energy stocks fell 8.3% and US solar 21%.

The President Elect’s position on climate and environmental policy has been clear, and consistent. As well as referring to climate change as a ‘hoax’ on several occasions, his first term of office saw him scrap countless environmental protection rules and withdraw the US from the Paris Agreement – the most significant global emission reduction initiative to date. It is highly likely history will repeat itself when Trump returns to the Whitehouse in January.

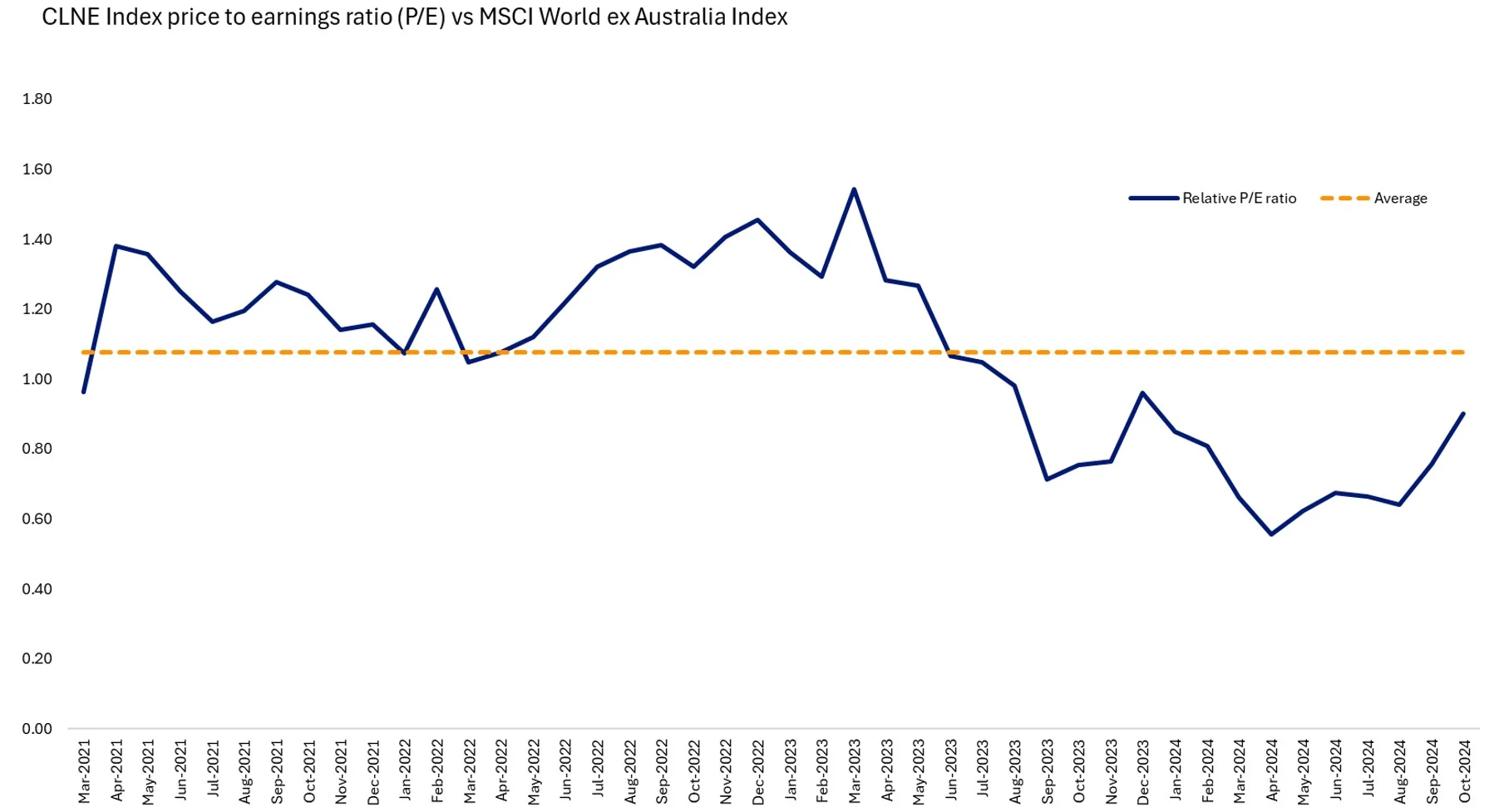

However, while the world’s largest economy is expected to make a U-turn on its clean energy policies and subsidies, it doesn’t stop the global transition to clean, renewable energy. It’s not a question of if the world will continue to move away from finite fossil fuels, but how fast. With clean energy companies currently trading at a 19% discount compared to MSCI World ex Australia on a P/E basis, this may present a buying opportunity for contrarian investors and those with a long-term horizon.

Chart 1: Clean energy valuations are relatively low

Source: FactSet, as at 31 October 2024

To quote Benjamin Graham, the father of ‘value investing’: “Never buy a stock because it has gone up or sell one because it has gone down.”

Expectation vs reality

While the market has concluded the Trump Presidency is bad for clean energy companies, we don’t know what his real impact will be on the US or global clean energy sectors. But we do know that market overreactions can often present buying opportunities.

The first time the world learned Trump was announced as the next President in 2016, global clean energy stocks dropped 4.06% the next day. A year later, the sector was up 12%. Conversely, in the four years since the announcement of Joe Biden’s Presidency on 6 November 2024, the global clean energy sector was down 39.24%. This is despite a hallmark of the Biden Presidency being the Inflation Reduction Act, which at its core benefits the clean energy industry.

What was the reason for this performance differential? It could be interest rates. As central banks around the world wrangled with inflation, the majority of the developed world fell into an environment of rapidly rising rates. A high-interest rate environment is the foe of most ‘long duration’ assets, like global clean energy companies. Conversely, a low rate environment bodes better for these assets.

Aside from Australia and Japan, the developed world has already started cutting rates. The US cut 75 bps already, with another 25bps forecast for Q1 2025. While the President doesn’t control the Fed (at this point) it’s worth noting another of Trump’s election promises: to cut rates further.

Global spending set to continue

The International Energy Agency reported mid-year that global spending on clean energy technologies and infrastructure was on track to hit $2 trillion in 2024. China is set to account for the largest share of investment at $675 billion due to strong domestic demand across solar, lithium batteries and electric vehicles, followed by Europe at $370 billion.

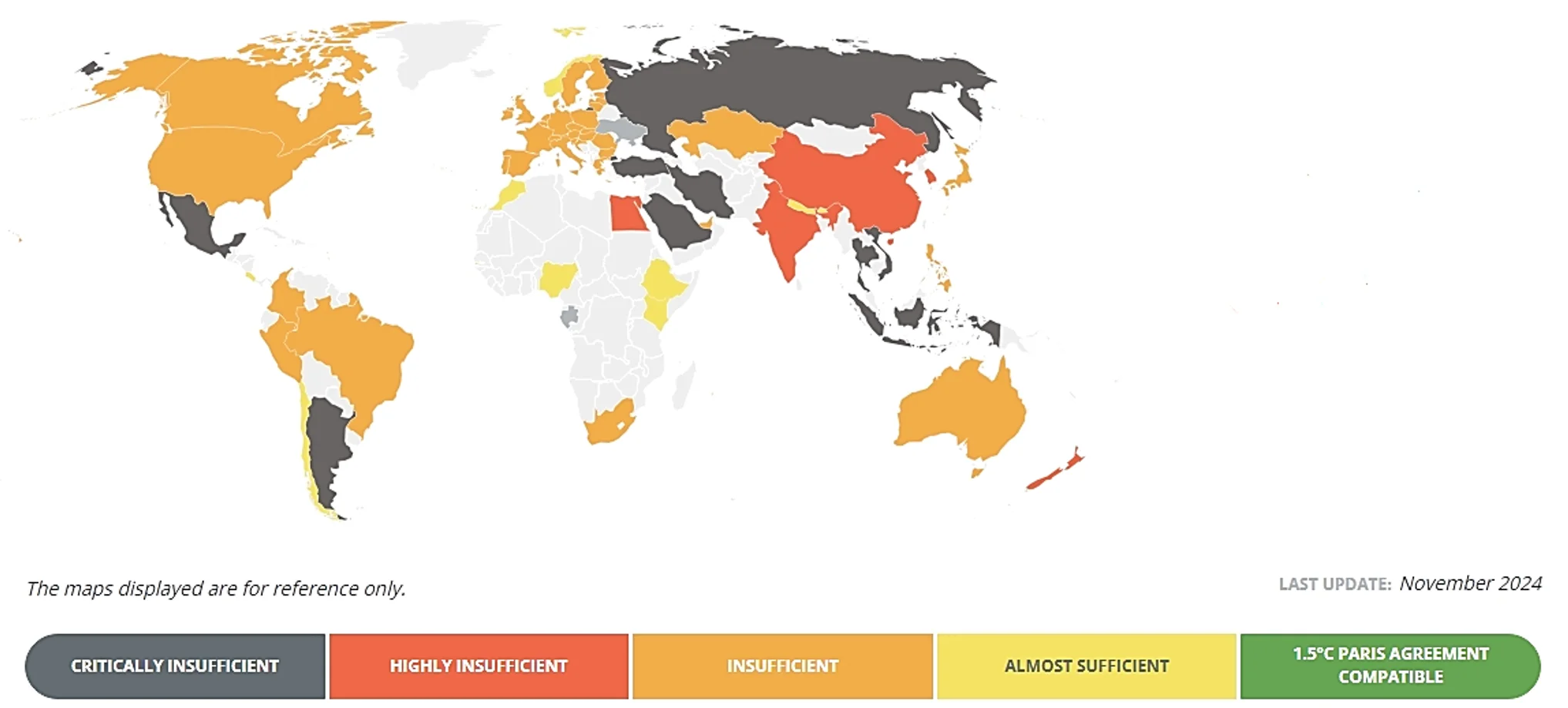

This spending looks set for a sharp increase over the next couple of decades. A recent release from the United Nations Environment Programme called out G20 countries, responsible for the bulk of total emissions, for not tracking to their existing Nationally Determined Contributions (NDCs) towards carbon reduction. A report from the United Nations Framework Convention on Climate Change (UNFCC) stated that global climate plans are falling 40% short of the requirements within the Paris Agreement.

At the 2024 United Nations Climate Change Conference (COP29) last week, new research was published showing countries had to invest an additional US$6 trillion annually through to 2030 to decarbonise the global economy at the pace required by the Paris Agreement.

Chart 2: Climate Action Tracker for Paris Agreement goals

Source: Climate Action Tracker, as at 19 November 2024.

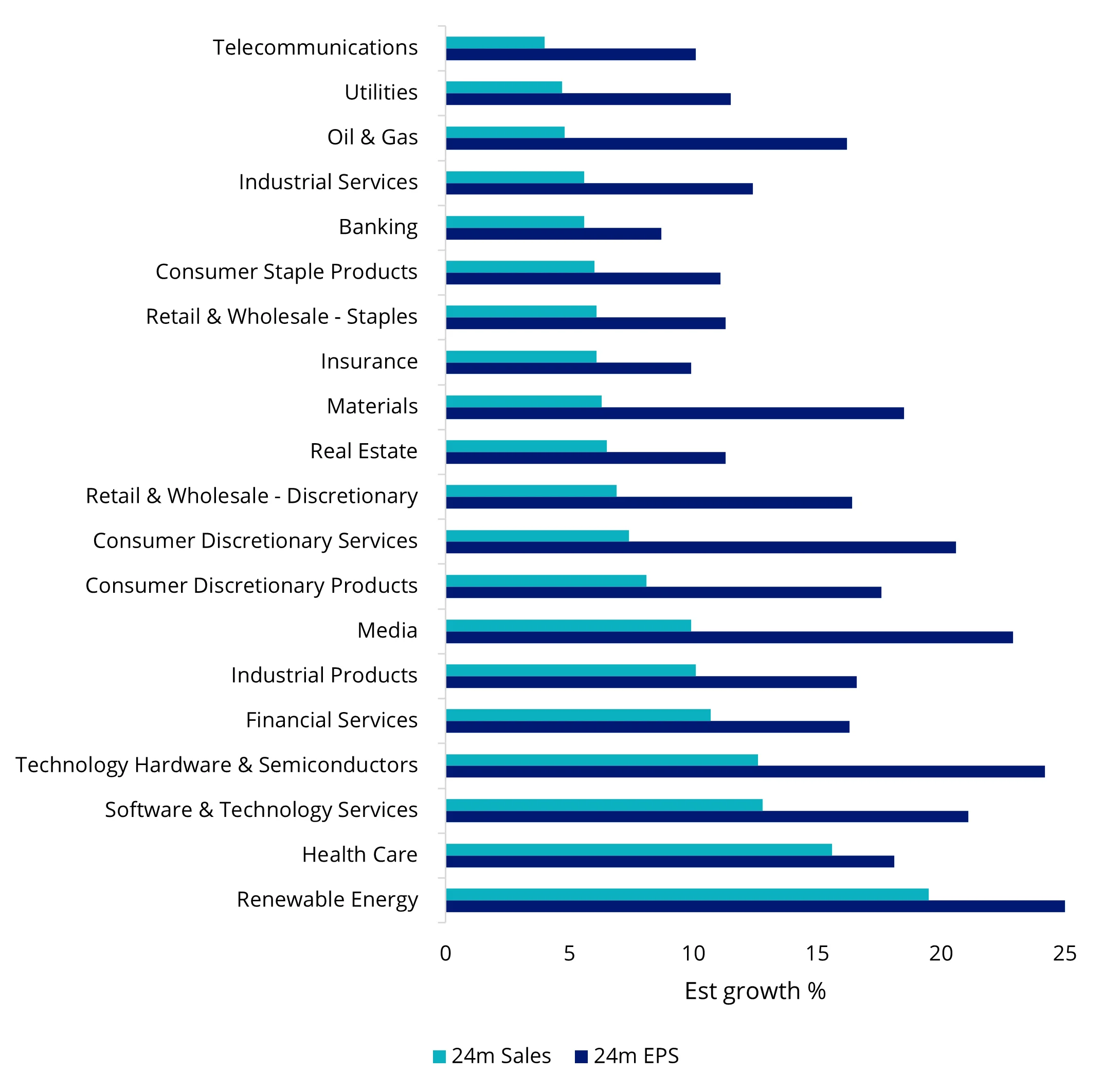

We believe this could be an attractive entry point for clean energy stocks. Notwithstanding the recent downturn, Bloomberg forecasts that renewable energy will enjoy the highest sales and EPS growth over the next two years among 20 sectors globally.

Chart 3: Bloomberg 24-month sector forecasts

Source: Bloomberg as at 19 November 2024

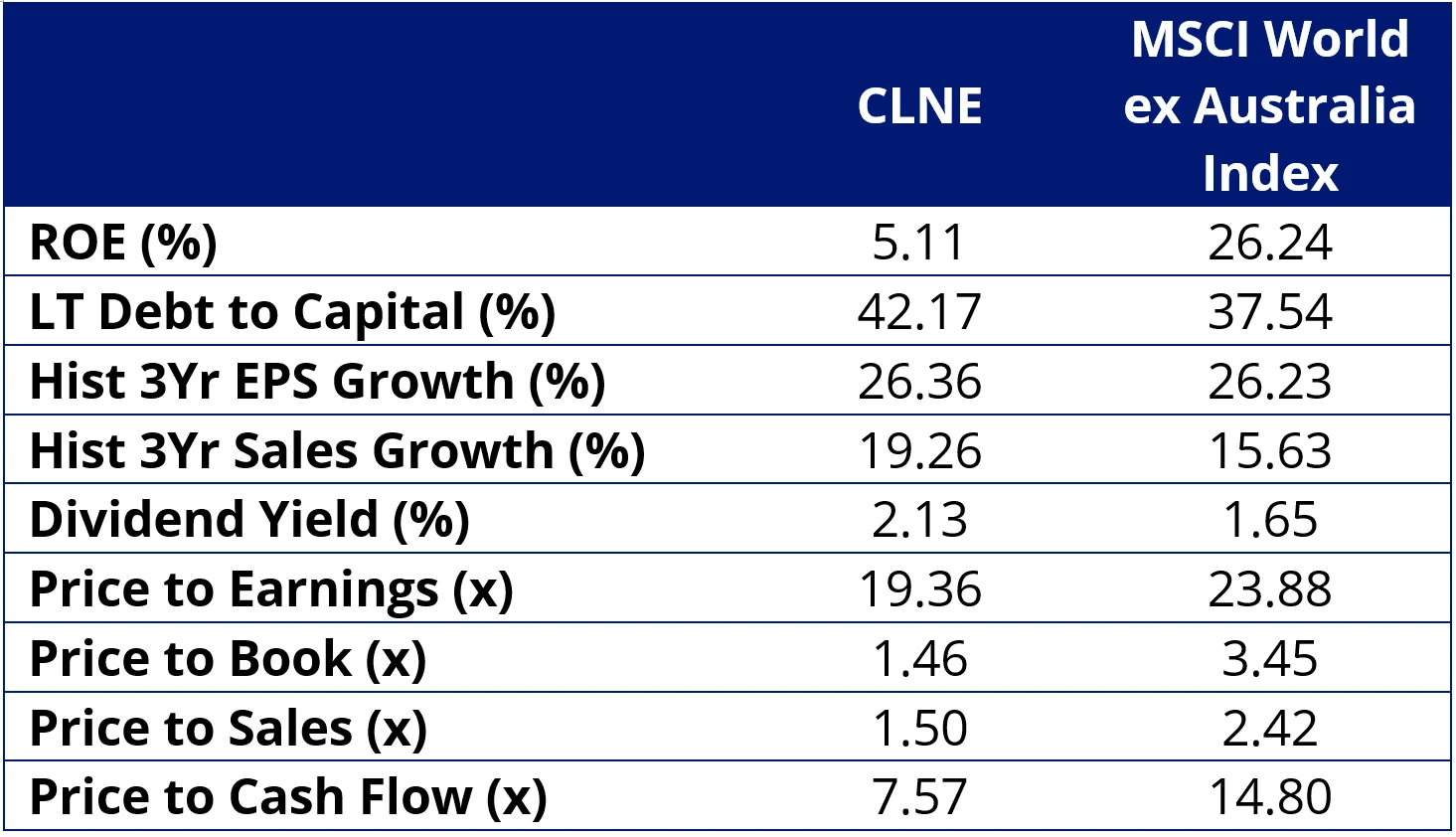

Valuations for clean energy stocks are also compelling relative to the MSCI World ex Australia when looking at price-to-earnings, price-to-book and price-to-cash-flow. Historical EPS and sales growth have also been stronger compared to the MSCI World ex Australia.

Table 1: CLNE fundamentals vs MSCI World ex Australia Index

Source: FactSet as at 20 November 2024. This is not indicative of future performance.

Accessing global clean energy companies

The steep drop for US solar stocks following the election emphasises the importance of geographical and subsector diversification.

The VanEck Global Clean Energy ETF (ASX: CLNE) includes global companies at the forefront of renewables technology, allowing investors to participate in this structural, long-term trend in one easy trade.

It has diversified exposure to 30 of the largest and most liquid companies involved in clean energy production across:

- biofuel & biomass energy production, technology & equipment;

- ethanol & fuel alcohol production;

- fuel cells technology & equipment;

- geothermal energy production;

- hydro electricity production, turbines & other equipment;

- solar energy production, photo voltaic cells & equipment; and

- wind energy production, turbines & other equipment.

Further information about CLNE and the screening criteria employed by its index can be found on our website.

Key risks

An investment in our clean energy ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, emerging markets, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck Global Clean Energy ETF PDS and TMD for more details.

Published: 21 November 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.