Get ready to fortify: DFND

Find out about our new upcoming ETF, the VanEck Global Defence ETF (ASX: DFND).

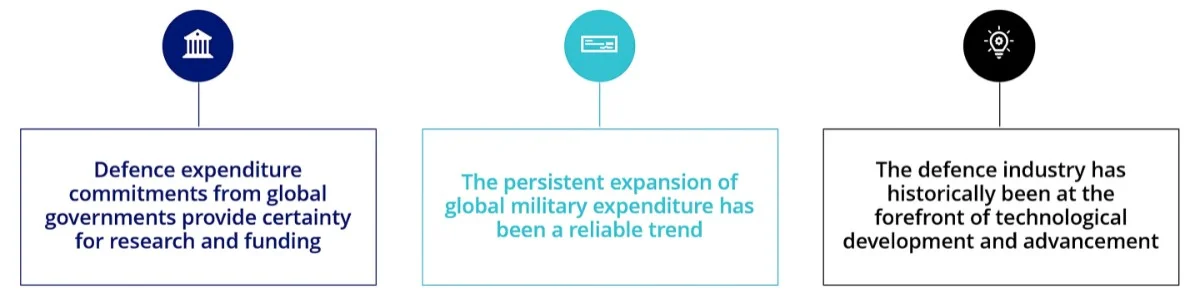

Maintaining security and defence is an enduring focus for governments globally. Defence expenditures are typically mandated and ongoing geopolitics has created an environment of increased spending. For example, NATO allies have committed to allocating 2% of their national Gross Domestic Product (GDP) to defence spending, since 2014 and more recently they agreed that at least 20% of defence expenditure should be devoted to major new equipment.

We will be hosting a live CPD webinar on 10 September 11am AEST – register and find out more here.

The multi-billion-dollar global defence industry is multifaceted and diverse.

The defence sector offers investors the opportunity to access the current leaders in military, cyber security and safety technologies

In an Australian first, investors will be able to invest in an ETF of global defence companies from around the world.

The DFND opportunity:

Focused portfolio

Exposure to the largest global companies involved in aerospace & defence, research & consulting, application software and electronic equipment & instruments, that are typically under-represented in benchmarks.

Differentiated exposure

An investment in opportunities beyond our borders, with revenues that are not necessarily correlated to general economic cycles, but rather government spending.

Advancing innovation

The defence industry is at the forefront of innovation and development as governments require specialised hardware and software creating demand for new technologies including AI and cyber security capabilities.

For those who would like to learn more, we invite you to attend our expert webinar on 10 September 11am AEST - you can register here.

Key risks: An investment in our defence ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. Once available, see the PDS and TMD for more details.

Published: 01 September 2024

This information is prepared in good faith by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of units in VanEck ETFs traded on the ASX. Units in VanEck Global Defence ETF (DFND) are not currently available. DFND has been registered by ASIC and is subject to ASX and final regulatory approval. The PDS will be available at vaneck.com.au. The Target Market Determination will be available at vaneck.com.au. You should consider whether or not any VanEck fund is appropriate for you. Investing in ETFs has risks, including possible loss of capital invested. See the PDS for details. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.