The next esports boom

While most of the world’s attention is on the Paris Olympics, there’s another high-stakes global competition unfolding roughly 4,867 kilometres away. This year’s inaugural Esports World Cup (EWC) kicked off in Riyadh earlier this month, bringing together 1,700 players from more than 80 countries to compete for a slice of the record $60 million prize pool.

Saudi Arabia’s multibillion-dollar esports spending spree has seen it become one of the industry’s biggest benefactors. Not content with launching the world’s biggest esports tournament this month, it struck a 12-year deal earlier this week with the International Olympic Committee (IOC) to host the first-ever Olympic Esports Games in 2025.

Over the last few years, Saudi’s $700 billion Public Investment Fund (PIF) has also acquired and invested in several high-profile video game companies, including an 8.3% stake in Nintendo, 9.1% in Activision Blizzard, 6.8% in Take-Two Interactive, and 9% in Electronic Arts. It also has a $267 million stake in Chinese company Tencent Holdings.

Focusing on the glitzy world of gaming may seem odd for a country known for conservativism, but it makes sense by the numbers. Saudi has a young, affluent and tech savvy population, with 63% of its population under the age of 30, according to its 2022 Census, 67% of the population gaming enthusiasts (according to research by the Boston Consulting Group). Its ‘National Gaming and Esports Strategy’ aims to diversify the Arab country’s economy away from oil, and predicts gaming will create 39,000 jobs and boost the GDP by $13.3 billion by 2030.

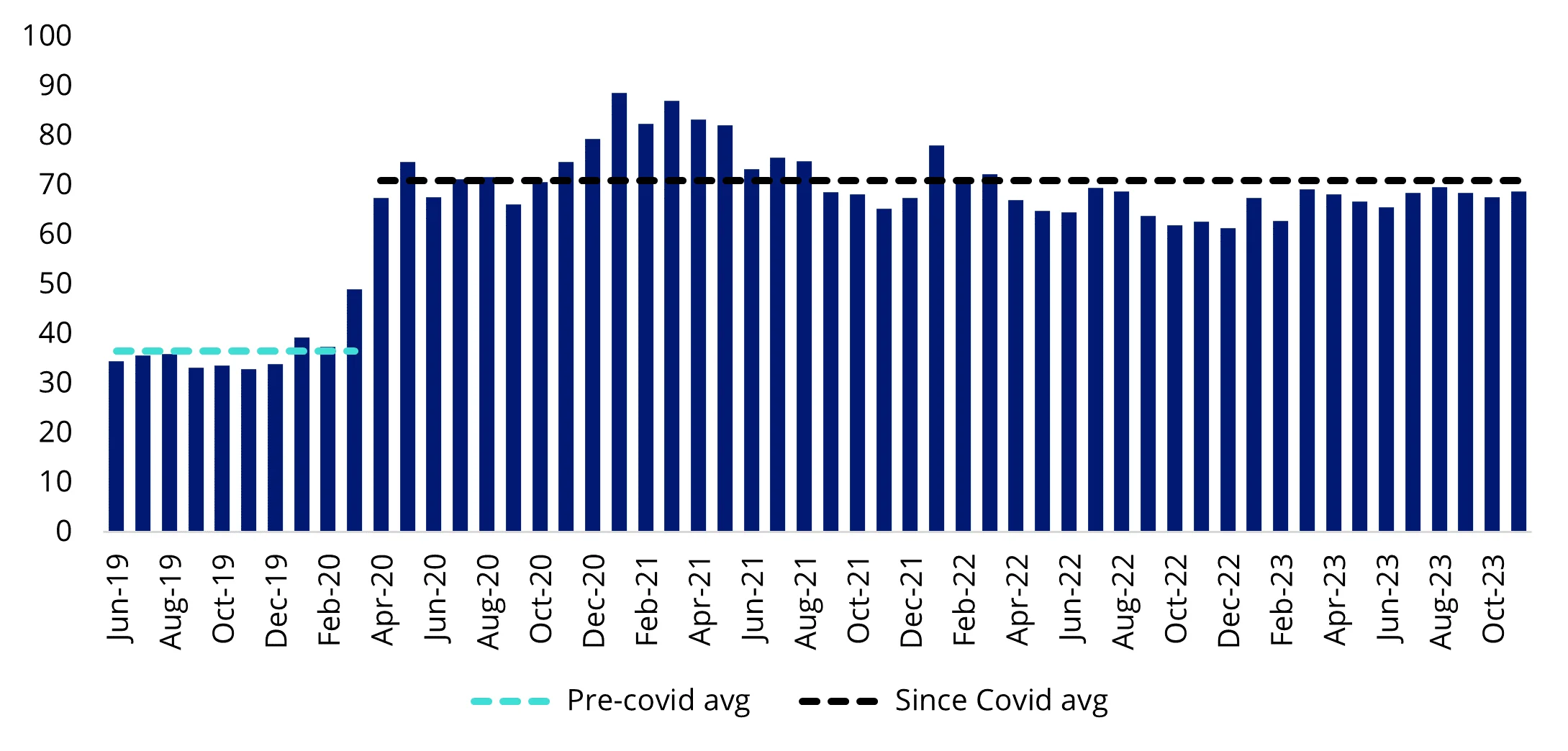

These developments come at an interesting time for esports. Despite a modicum of post-pandemic moderation, the industry continues to demonstrate robust growth. Based on data from the videogaming streaming platform Twitch, it’s clear that the surge of interest that came about during COVID has not dropped off in subsequent years.

Chart 1: Average concurrent Twitch viewers per month

Source: TwitchTracker as at Jun 2024

Chart 2: Total hours streamed on Twitch per month

Source: TwitchTracker as at Jun 2024

Interest is also spreading around the world, with the whirlwind of gaming activity in Saudi Arabia growing the Middle East & Africa (ME & A) region’s piece of the pie.

According to Newzoo, a leading market research firm specialising in the sector, the ME & A market accounted for only 4% of total revenues globally in 2023, but the region also witnessed the highest annual growth (+4.6% YoY). Asia-Pacific (namely China and South Korea) continues to be the market leader with the lion’s share of the market, but given recent developments, it may not hold that title for much longer.

Chart 3: global games market revenues in 2023 by region

Source: Newzoo, May 2024

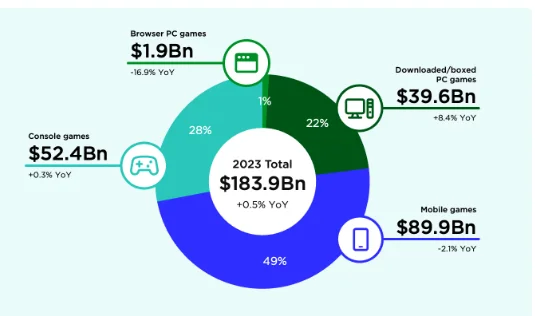

By segment, browser PC games experienced the biggest slowdown (-16.9% YoY), but this was partially offset by the growth in downloaded/boxed PC games (+8.4 YoY). The latter segment is where the majority of the pro-gaming/esports activity takes place, however mobile gaming was still the largest segment by far in 2023, responsible for nearly half of the $183.9 billion annual gaming revenue.

Chart 4: global games market revenues in 2023 by segment

Source: Newzoo, Jan 2024

Newzoo expects the esports market to grow by 6% YoY in 2025, highlighting the expanding influence the industry has on global entertainment and sports. This may be a conservative forecast, given it pre-dated the more recent developments in Saudi Arabia.

The backing of Saudi billionaires paired with the country’s sovereign wealth fund suggest the video gaming and esports industry is on track for significant growth over the coming years. The VanEck Video Gaming and Esports ETF (ASX: ESPO) offers investors a way to gain exposure to the gaming and esports sector, with many of the beneficiaries of Saudi’s investments also represented in the portfolio.

ESPO gives investors access to a diversified portfolio of the largest and most liquid companies involved in video game development, esports, and related hardware and software globally.

Key risks

An investment in our video gaming and esports ETF carries risks associated with: ASX trading time differences, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck Video Gaming and Esports ETF PDS and TMD for more details.

Published: 29 July 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.