Aerospace: The latest wide moat frontier

Morningstar® last week announced it had discovered a star in the aerospace industry in a company called Transdigm, the latest addition to its wide moat constellation. ‘Economic Moat™’ is a term Morningstar adapted from Warren Buffett to describe sustainable competitive advantages that keep competitors at bay. Transdigm has been awarded a ‘wide’ Economic Moat rating considering its advantages will allow it to earn excess returns over 20+ years. Wide moats are rare and are highly sought after by investors but identifying them is easier said than done.

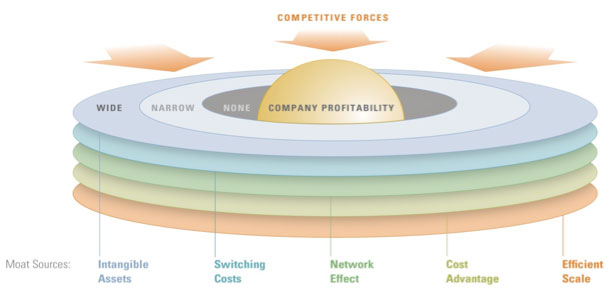

In days of old, a castle was protected by the moat that encircled it. The wider the moat, the more easily a castle could be defended. A narrow moat would not offer much protection and would allow enemies easy access to the castle. When Warren Buffett pronounced that, “In business, I look for economic castles protected by unbreachable moats.” The moats he referred to are the sustainable competitive advantages that allow companies to protect their value and to generate excess returns.

It is one thing for a company to be successful at the moment. The question is whether the business has characteristics that make it difficult for competitors to attack those earnings.

Building on Buffett’s moat analogy, Morningstar® has taken the economic moat™ concept a step further and developed a comprehensive moat-based analytic framework. A company may have great management, size, market share, technology, efficiencies or hot products but what Morningstar identifies is whether the company has a structural advantage that can sustain the high returns over a long period in the future. Morningstar has identified five potential sources of an economic moat: network effect; intangible assets; cost advantage; switching costs; and efficient scale. Each company with a moat rating has at least one, if not two of these moats.

Source: Morningstar

Of the thousands of companies globally, Morningstar analysts have only assigned a wide moat rating to 243 of these indicating they consider that only these companies can sustain their high returns for 20+ years. In Australia, there are only seven companies that are classified as wide moat. In the US just 143 have the classification. One of these classifications was awarded last week to Transdigm (NYSE: TDG).

Transdigm manufactures specialist electronic, fluid, power and mechanical motion control products for aircrafts. Its customers include aircraft manufacturers like Boeing and Airbus as well as defence customers from around the world.

Transdigm’s wide moat has been built up over many years by meeting FAA certification requirements and passing separate aircraft qualification processes. Transdigm's competitive advantages stem from its intangible assets and high switching costs on its products. Switching costs are high because of the high cost and risks of aircraft failures as well as the costs and time of recertifying aircrafts if new parts are introduced. Transdigm’s IP is an intangible asset which competitors cannot copy. Only Transdigm can service its own products because they do not allow competitors access to the technical data. Due to these wide economic moats Transdigm enjoys pricing power through the entire business cycle and captures relatively high margins. According to Morningstar’s report “we expect excess returns to invested capital to continue for at least the next two decades.” Since its IPO in 2006, investors have been rewarded because Transdigm’s price has grown over 1000%.

Morningstar’s analysis does not stop with its Moat rating. Morningstar’s equity analysts also assign a fair value to each company in its coverage universe. Fair value is a per-share measure of what the business is worth. A three-stage discounted cash flow model is combined with a variety of supplementary fundamental methods such as sum-of-the-parts, multiples and yields in order to triangulate a company's worth.

Using a combination of the qualitative moat data and the quantitative fair value data, Morningstar constructs its Moat Index series. Morningstar targets companies whose stock is trading below its estimate of the fair value when it constructs its Wide Moat Index.

The Morningstar Wide Moat Focus Index - a rules-based, equal-weighted index reviewed on a quarterly basis - includes only the most compelling valuations from US companies that have wide economic moats. So while Transdigm has just been assigned a wide moat, there is no guarantee it will be in the Morningstar Wide Moat Focus Index.

The long term returns achieved by applying this process to US equities, as represented by Morningstar’s Wide Moat Focus Index, demonstrates a portfolio of companies with wide economic moats outperforms the broad market through the cycle

Source: VanEck, Morningstar Direct. Date as at 30 September 2016, 2007-2008 returns calculated for 1 January 2007 – 31 December 2008 and 2009 returns calculated for 1 January 2009 – 31 December 2009. All data is in Australian dollars. The above chart represents past performance which is no guarantee of future results and which maybe higher or lower than current performance. Index performance is not illustrative of the Fund’s performance. An index is unmanaged and cannot be invested in directly. Index returns assume that dividends have been immediately reinvested and do not reflect the Fund’s management costs and any fees or expenses incurred when trading on exchange.

Australian investors can invest in this portfolio of wide moat companies in a single trade on ASX through the VanEck Vectors Morningstar Wide Moat ETF under the code ‘MOAT’. MOAT is a high conviction US equity portfolio of at least 40 attractively priced wide moat companies as determined by Morningstar.

For more information on MOAT click here.

To speak to a VanEck ETF specialist please call us on 02 8038 3300 or send an email to info@vaneck.com.au.

Important Notice: Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’). VanEck is a wholly owned subsidiary of Van Eck Associates Corporation based in New York, United States. VanEck Vectors ETF Trust ARBN 604 339 808 (the ‘Trust’) is the issuer of shares in the VanEck Vectors Morningstar Wide Moat ETF (‘US Fund’). The Trust and the US Fund are regulated by US laws which differ from Australian laws. Trading in the US Fund’s shares on ASX will be settled by CHESS Depositary Interests (‘CDIs’) which are also issued by the Trust. The Trust is organised in the State of Delaware, US. Liability of investors is limited. VanEck Associates serves as the investment adviser to the US Fund. VanEck, on behalf of the Trust, is the authorised intermediary for the offering of CDIs over the US Fund’s shares and issuer in respect of the CDIs and corresponding Fund’s shares traded on ASX.

This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Investing in international markets has specific risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign regulatory and tax regulations. Before making an investment decision in relation to the US Fund you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37.

Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies or the Trust gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance or any particular rate of return from the US Fund.

Investment in the US Fund may be subject to risks that include, among others, fluctuations in value due to market and economic conditions or factors relating to specific issuers. Medium capitalisation companies may be subject to elevated risks. The US Fund’s assets may be concentrated in a particular sector and may be subject to more risk than investments in a diverse group of sectors.

The Morningstar® Wide Moat Focus Index™ was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the US Fund and bears no liability with respect to the US Fund or any security. Morningstar®, Morningstar Wide Moat Focus Index™ and Economic Moat™ are trademarks of Morningstar, Inc. and have been licensed for use by VanEck. Transdigm is used by way of example only and this does not constitute a recommendation to invest in Transdigm.

Published: 09 August 2018