A simple strategy for current volatility

Markets have tumbled around the globe and the re-emergence of volatility will be prompting some investors to run for the exits. But for others this presents an opportunity. To paraphrase Warren Buffett, “Be... greedy when others are fearful.” By using some of Buffett’s simple philosophies, principles he learnt from his mentor Benjamin Graham, your portfolio should be able to weather downturns.

The recent drop in markets highlights the need for investors to have an investment strategy that is resilient when times are tough. While markets go up and down, for many investors negative outcomes or the potential for losses are the true ‘risk’ they consider. Astute investors know they can’t time the market, so they make long term investments.

Focus on quality

In markets unpredictability is the only constant. Successful long-term investors survive short-term falls by sticking to investment principles that have withstood the tests of time. Investing in profitable companies with strong balance sheets and stable earnings has historically given resilience to portfolios.

In ‘The Intelligent Investor’ Benjamin Graham defined a quality company as having “a sufficiently strong financial position and the potential that its earnings will at least be maintained over the years.” Quality investing is for the long term. History has persistently shown that because quality investing avoids leverage and focuses on earnings, it provides defence. In times of volatility, quality companies have outperformed. When markets fall, they lose less and recover faster.

Putting Graham’s theory into practice

Almost 80 years after Graham wrote the book that Warren Buffet calls, “By far the best book on investing ever written”, MSCI, the world’s largest index provider, created a quality index based on Graham’s principles. The MSCI World ex Australia Quality Index (QUAL Index) includes only the highest scoring stocks based on three easily identifiable financial characteristics which identify resilient companies:

- High return on equity;

- Low earnings variability; and

- Low debt-to-equity ratio.

Quality in volatility

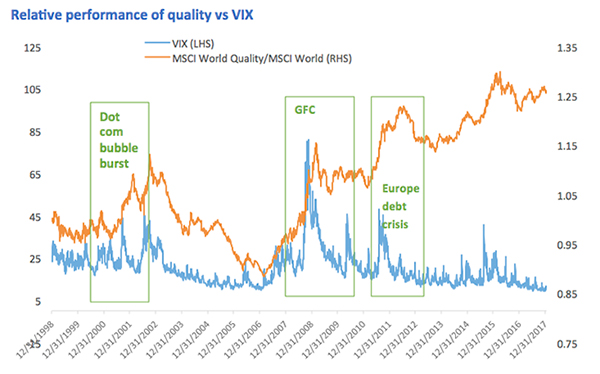

In the chart below, when the orange line is rising, quality is outperforming. In the three most recent periods of increased volatility, quality has outperformed the market benchmark.

Source: MSCI Data/Calculations, Bloomberg, December 1998 to December 2017.

Chart shows performance of MSCI World Quality relative to MSCI World compared to CBOE VIX Index (VIX) which is a real time index calculated to assess investor sentiment and expected levels of volatility. Results include the reinvestment of all dividends, but exclude fees and other costs associated with an investment in QUAL. You cannot invest in an index. Past performance is not a reliable indicator of future performance of the index or QUAL.

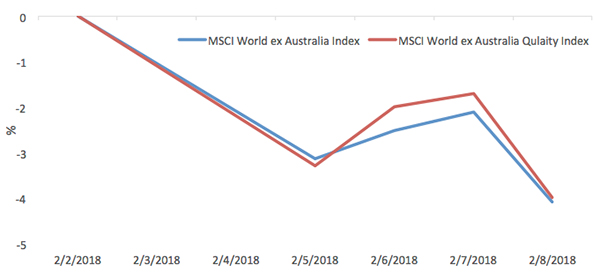

In the past week quality has again outperformed.

Source: Bloomberg, VanEck COB 2 Feb 2018 to 8 Feb 2018, Chart shows performance of MSCI World ex Australia Quality compared to MSCI World ex Australia Index. You cannot invest in an index. Past performance is not a reliable indicator of future performance of the index or QUAL.

Losing less and recovering faster: Drawdown

No investor wants to lose money and timing the top or bottom of a market cycle is nothing short of miraculous. To understand how a strategy could perform in the current environment a risk measure called ‘drawdown’ demonstrates both the depth of a fall from a historical peak and the pace of the recovery to a new peak. The maximum drawdown is the distance from the highest peak to the deepest valley. Investments that fall less and recover faster are more desirable.

The chart below shows the drawdown of QUAL Index versus the broader benchmark MSCI World ex Australia Index for the past 15 years capturing the GFC. In summary:

- The maximum drawdown of the QUAL Index was -24.28% versus the benchmark -38.41%

- The pace of recovery of the QUAL Index was eight months faster.

Source: Morningstar Direct. The calculations for the above include the reinvestment of all dividends but do not include fees and other costs with an investment in QUAL. You cannot invest in an index. Past performance is not a reliable indicator of future performance of the index or QUAL.

Accessing quality

Australians can easily invest in a quality international portfolio that has historically demonstrated resilience. Via a simple, single trade on ASX, VanEck Vectors MSCI World ex Australia Quality ETF (ASX: QUAL) provides investors with a cost effective portfolio of ~300 quality international companies identified by MSCI.

IMPORTANT NOTICE: This email is not to be circulated or distributed and is solely for the information of financial services professionals, such as a financial adviser. This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors MSCI World ex Australia Quality ETF (‘Fund’). This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

QUAL invests in international markets. An investment in QUAL has specific and heightened risks that are in addition to the typical risks associated with investing in the Australian market. These include currency risks from foreign exchange fluctuations, ASX trading time differences and changes in foreign laws and regulations including taxation.

QUAL is indexed to a MSCI index. QUAL is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to QUAL or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QUAL.

Published: 09 August 2018