Active ETFs: reality versus perception

Marcus Aurelius said “Everything we hear is an opinion, not a fact. Everything we see is a perspective, not the truth”.

The life lesson of perception not being reality can apply to investors and their financial advisers building portfolios today.

Appearances can be deceiving, and this is evident in the world of financial services. Active ETFs could be one of these false realities.

Understanding active ETFs requires a bit of background. Consider the very first ETFs. These were launched more than 30 years ago to provide investors with a liquid tool for accessing the market, tracking broad market indices. Relative to active funds, these ETFs were a lower-cost fund option that was more accessible, had greater transparency and could be traded with the same ease as individual shares.

The second generation of ETFs, smart beta, employed the same passive index tracking method as their predecessors, but by using active investment strategies in a passive rules-based portfolio, these ETFs were able to provide a specific investment outcome. Importantly, smart beta ETFs retained the low-cost fund structure while adding the potential to outperform the market beta.

Active ETFs are different. Rather than track an index, these products construct their portfolios the same way as unlisted actively managed funds, where investment managers actively trade securities to meet a particular investment objective – which is usually to outperform a benchmark.

A key difference between active ETFs and traditional actively managed funds is that the former is listed on a stock exchange.

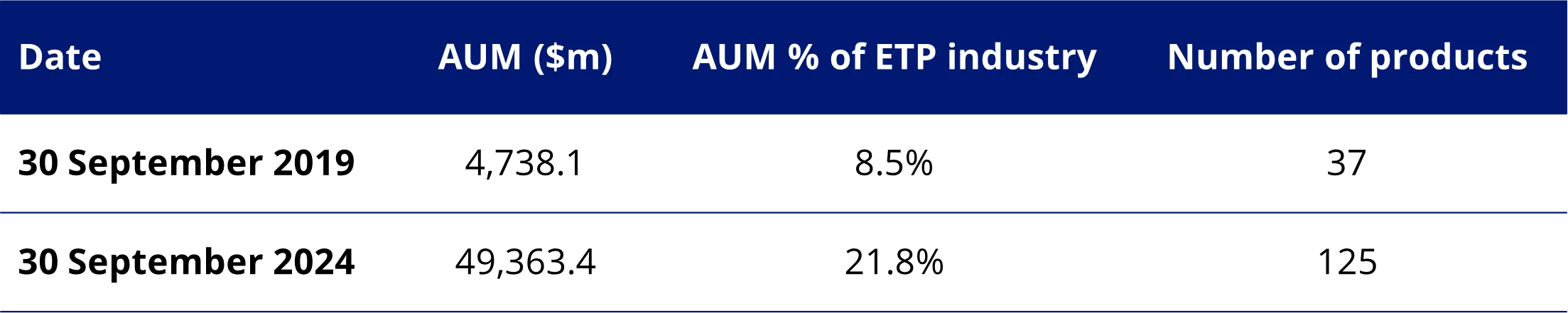

In the last five years (to 30 September 2024), active ETFs have flooded the Australian market, growing from 37 funds to 125 funds. The fast-growing assets under management for active ETFs would imply that this new product has been successful in Australia, increasing 10-fold over the last five years to $49.4 billion.

Table 1: Five years of Active ETFs in Australia

Source: ASX, VanEck

But are investors as enamoured with these funds as the numbers suggest? And are all of these active ETFs really new products?

The reality is that many of the active ETFs in the market are essentially the same active funds that have been around for years, just offered through a new channel. Transitioning from an unlisted fund to a listed active ETF doesn’t change the way it performs. A poorly performing unlisted active fund will therefore behave the same way when it is an active ETF, and likewise will a strong-performing active fund.

How to spot an active ETF

The first clue is in the fund’s name or description. Any reference to ‘active ETF’, ‘actively managed exchange-traded fund’ or similar is a signal to dig deeper.

Note, that fund managers are not currently required to follow specific naming conventions for active ETFs, but this is changing. ASIC has introduced new naming conventions for ETPs (Exchange Traded Products) that apply to new products launched from 15 April 2024 and all products by 15 April 2025.

Under ASIC’s updated guidelines, any ETP that mentions ‘active’ in the name means it is an actively managed funds. Further, any ETPs that mention ‘complex’ in the name could be an active ETF, but could also be a passive ETF that is complex in another way, such as making use of leverage within the fund. The word ‘complex’ in the product name, is intended to flag to investors that the investment strategy is more difficult to understand.

These rules aim to make it easier for investors to differentiate between products. Australia has led the world in ETF product innovation and the ASX was among the first exchanges globally to list active ETFs.

The next clue to look for is in the fees. If you recall, one of the original attributes of an ETF was the lower cost compared to active funds. Investors should tread carefully with any ETFs that don’t meet that description.

Morningstar’s research shows the difference between management fees for active and passive Australian equities funds.

Chart 1: Fees of active vs passive funds – Australian large blend category

Source: Morningstar Direct: Data as at 31 December 2023; Data is based on the open-end and exchange traded funds universes including master trusts where administration fees are included. Data excludes the superannuation and pension universes.

An ETF that charges fees that are the same or similar to an active fund doesn’t really meet the original blueprint, however, there is nothing inherently wrong with charging a premium for a product when it is warranted. A tell-tale giveaway of an active ETF is when the fund does not outperform the index and/or meet its target outcome over the long-term, yet charges fees that are higher than the equivalent passive ETFs. This is the same old story of the broken active fund model.

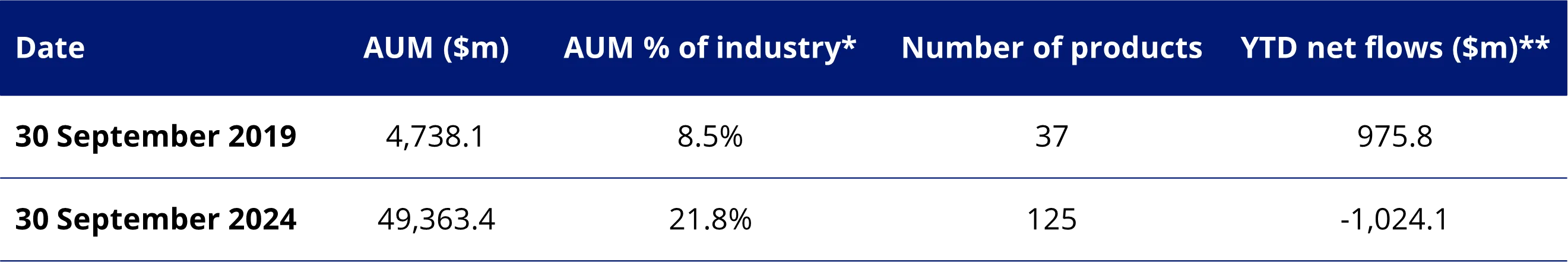

Coming back to the industry numbers published by ASX every month, it’s worth noting that most of the YTD net flows for active strategy ETFs have been driven by the restructuring of unlisted funds. Excluding unlisted monies shows active strategy ETFs are in the red, with the ‘real’ number showing outflows of $1 billion.

Table 2: The hidden numbers: YTD net flows excluding unlisted restructured monies

Source: ASX, VanEck. *includes restructured unlisted monies. **excludes restructured unlisted monies.

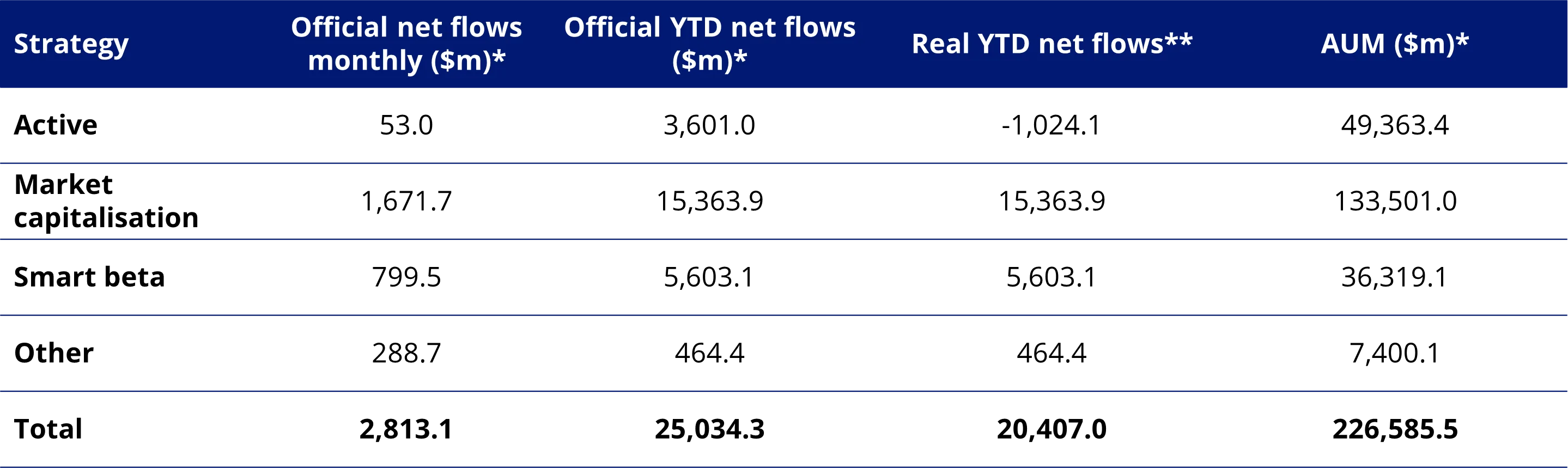

Table 3: ETF net flows by strategy type as at September 2024

Source: ASX, VanEck. *includes restructured unlisted monies. **excludes restructured unlisted monies.

The red flags are obvious when you know where to look. Some time well spent doing your homework will help ascertain whether an ETF has something more to investigate under its label.

Published: 01 November 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.